Nikkei at fresh record highs; Docket ahead focused on US data - Newsquawk EU Market Open

- APAC stocks were mostly higher as the region took impetus from the gains on Wall Street, where the S&P 500 approached closer towards its record levels, and the Nasdaq outperformed as the tech rebound persisted.

- US President Trump and Chinese President Xi’s summit is reportedly set for the first week of April, POLITICO reported, but the White House later clarified that the Trump-Xi meeting has not been finalised.

- The EU is reportedly readying options to give Ukraine gradual membership rights and is preparing a series of options to embed Ukraine’s membership in a future peace deal.

- UK PM Starmer told Labour MPs that he is "not prepared to walk away" from power or "plunge us into chaos" as previous prime ministers have done.

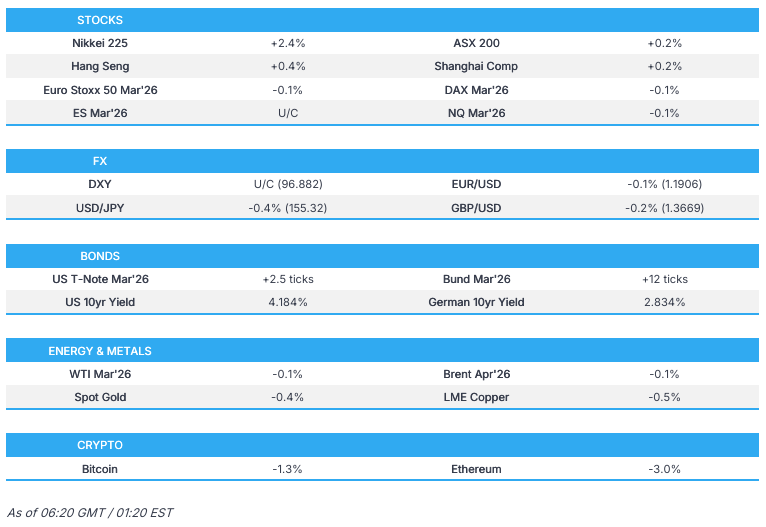

- European equity futures indicate a slightly lower cash market open with Euro Stoxx 50 futures down 0.1% after the cash market closed with gains of 1.0% on Monday.

- Looking ahead, highlights include Norwegian CPI (Jan), US NFIB (Jan), Weekly ADP, ECI (Q4), Retail Sales (Dec) & EIA STEO. Speakers include Fed’s Hammack & Logan, Supply from the Netherlands, UK, Germany & US. Earnings from Coca-Cola, S&P, Gilead, Robinhood, Welltower, Duke Energy, Datadog, Ford, AIG, Xylem, Spotify, AstraZeneca, BP, Barclays, Ferrari, Mediobanca & Kering.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks continued to gain on Monday, with tech leading the moves once again as semis largely outperformed and Nvidia (NVDA) shares rallied, seemingly continuing to benefit from the hiked CapEx plans announced alongside recent earnings from AMZN, META and GOOGL. As such, the Nasdaq led the advances, but the Dow lagged, while the sectors were predominantly firmer, although Consumer Staples and Healthcare underperformed.

- SPX +0.42% at 6,961, NDX +0.77% at 25,268, DJI +0.04% at 50,136, RUT +0.68% at 2,689.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump and Chinese President Xi’s summit is reportedly set for the first week of April, and could be the first of four meetings this year between the two leaders, according to POLITICO. However, the White House said shortly after that the Trump-Xi meeting has not been finalised.

- US President Trump posted that Canada is building a massive bridge between Ontario and Michigan, which Canada will own and have built it with virtually no US content, while he added "The Tariffs Canada charges us for our Dairy products have, for many years, been unacceptable, putting our Farmers at great financial risk. I will not allow this bridge to open until the United States is fully compensated for everything we have given them, and also, importantly, Canada treats the United States with the Fairness and Respect that we deserve. We will start negotiations, IMMEDIATELY. With all that we have given them, we should own, perhaps, at least one half of this asset. The revenues generated because of the U.S. Market will be astronomical."

- US House Democrats may move to overturn Canada tariffs and may force a vote on Canada tariffs on Wednesday.

- White House said the US and Bangladesh have agreed to an agreement on reciprocal trade in which the US will reduce reciprocal tariffs to 19% on goods originating in Bangladesh, while the US commits to establishing a mechanism that will allow for certain textile and apparel goods from Bangladesh to receive a zero percentage reciprocal tariff rate. It was also reported that the Bangladesh chief adviser said the US is committed to establishing a mechanism for certain textile and apparel goods from Bangladesh to receive zero reciprocal tariff in the US.

NOTABLE HEADLINES

- Fed's Miran (Voter, Dove) said there was no significant tariff-driven inflation seen so far, and interest rates should be much lower than current levels.

- Fed's Bostic (2027 voter, retiring) said choppy jobs data adds to the case for Fed caution, and he is starting to see questions about confidence in the US dollar.

- US President Trump said in a Fox Business taped interview that the US economy can grow at 15% if Fed nominee Warsh does a job that he's capable of. It was also reported that Trump said he doesn't know if the Powell probe is worth holding up Warsh, while he added that Powell is incompetent, but the question is if he's corrupt.

- US plans a Big Tech carve-out from next wave of chip tariffs, with the Trump admin intending to spare companies including Amazon (AMZN), Google (GOOG) and Microsoft (MSFT) from forthcoming tariffs on chips, while tariff carve-outs to hyperscalers would be tied to investment commitments made by TSMC (2330 TT), according to FT.

- White House eyes data centre agreements amid energy price spikes, while a draft pact seeks to help ensure data centres do not raise household electricity prices and strain water resources or undermine grid reliability, according to POLITICO

- US Senate Majority Leader Thune said a GOP counterproposal to Democrats on DHS funding is coming soon.

- US CBO estimates January budget deficit at USD 94bln (prev. USD 143bln)

APAC TRADE

EQUITIES

- APAC stocks were mostly higher as the region took impetus from the gains on Wall Street, where the S&P 500 approached closer towards its record levels, and the Nasdaq outperformed as the tech rebound persisted.

- ASX 200 marginally gained amid continued outperformance in tech, but with advances in the index limited by underperformance in the top-weighted financial sector and weakness in some defensives.

- Nikkei 225 rallied to a fresh record high near the 58,000 level amid the Takaichi trade and expectations of incoming stimulus, while SoftBank was among the biggest gainers due to its heavy semiconductor exposure.

- Hang Seng and Shanghai Comp lagged behind their regional counterparts in somewhat mixed trade, with the Hong Kong benchmark led higher by pharmaceuticals, while the mainland was flat amid little fresh drivers.

- US equity futures took a breather following the prior day's tech-driven advances.

- European equity futures indicate a slightly lower cash market open with Euro Stoxx 50 futures down 0.1% after the cash market closed with gains of 1.0% on Monday.

FX

- DXY traded flat overnight, which provided some respite from the selling pressure seen during the prior session, where the dollar was sold alongside broad yen strength post-election, and after Bloomberg reported that China is urging banks to curb UST exposure amid market risk, while the recent weakness had also coincided with the broad risk-on sentiment.

- EUR/USD held on to most of yesterday's gains after it benefitted from the dollar's demise and reclaimed the 1.1900 status, while there were several ECB comments which continued to point to a lack of willingness to adjust policy in the near term.

- GBP/USD was contained after failing to reclaim the 1.3700 level to the upside, but retained most of yesterday's gains, which were facilitated by several cabinet ministers voicing support for UK PM Starmer.

- USD/JPY extended on post-election declines as the decisive victory by the LDP and expectations of fiscal stimulus are seen to pave the way for the BoJ to quicken the pace of tightening and have boosted April rate hike odds.

- Antipodeans conformed to the mostly uneventful mood across the FX space after gaining yesterday alongside the widespread heightened risk-appetite.

- PBoC set USD/CNY mid-point at 6.9458 vs exp. 6.9135 (Prev. 6.9523).

FIXED INCOME

- 10yr UST futures were rangebound following the recent choppy performance and reports that China is to curb UST exposure, while demand was also not helped by supply, with Alphabet conducting a USD 20bln 7-part issuance.

- Bund futures remained afloat after rebounding from the prior day's trough, but with further gains capped ahead of German auctions, including EUR 5.0bln of Bobls later and EUR 2.5bln of Bunds tomorrow.

- 10yr JGB futures reversed the post-election declines and were unfazed by a weaker 10yr inflation-indexed JGB auction.

COMMODITIES

- Crude futures took a breather after gaining yesterday alongside the broader risk sentiment and dollar weakness, while it was also reported that Qatar pushed the start of its LNG expansion to the end of 2026 and that US forces seized an oil tanker departing from Venezuela.

- Spot gold mildly pulled back after advancing the prior day on the back of a weaker dollar, although the downside was limited overnight, with the precious metal holding above the USD 5,000/oz level.

- Copper futures faded some of their recent gains as markets in its largest buyer, China, lagged behind regional peers.

CRYPTO

- Bitcoin marginally declined in choppy trade with prices back beneath the USD 70,000 level.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Katayama said discussions on using the entire surplus are planned, but no position has been taken, while she indicated that a proposed cut in the food sales tax would serve as a temporary solution ahead of the implementation of a new tax credit system.

- French government advisory body issued a report on China, which recommends ways to neutralise competitiveness gaps, including implementation of a 30% general tariff, or a depreciation of the Euro by 20-30% vs the Renminbi.

- FTSE Russell postponed the March stock index review for Indonesia, according to Bloomberg TV.

DATA RECAP

- Australian Westpac Consumer Confidence Index (Feb) 90.5 (Prev. 92.9)

- Australian Westpac Consumer Confidence Change MM (Feb) -2.6% (Prev. -1.7%)

- Australian NAB Business Confidence (Jan) 3 (Prev. 3)

- Australian NAB Business Conditions (Jan) 7 (prev. 9)

GEOPOLITICS

MIDDLE EAST

- White House official said US President Trump does not support Israel annexing the West Bank, while the official added that a stable West Bank is key to Israel's security and aligns with the administration's peace goals.

RUSSIA-UKRAINE

- EU is reportedly readying options to give Ukraine gradual membership rights and is preparing a series of options to embed Ukraine’s membership in a future peace deal, according to people familiar with the matter. Options include providing Kyiv upfront with the protection that comes with EU accession, as well as immediate access to some membership rights. At the same time, the bloc would give Ukraine a clear timeframe of steps needed to advance with the formal procedure, while other options on the table would entail continuing along the existing accession path or introducing a transition period and gradual membership to the process.

- EU proposed to list eight Russian oil refineries, including Tuapse, in the 20th sanctions package against Russia, according to an EEAS document.

OTHER NEWS

- US military carried out a strike on a vessel in the eastern Pacific, killing two and leaving one survivor.

- US Interior Secretary Burgum said a Greenland deal is moving forward with progress.

- China held a 2026 work conference on Taiwan affairs, while the Chairman of the Chinese People's Political Consultative Conference, Wang Huning, said they will resolutely crack down on Taiwan independence, according to Xinhua.

- China’s embassy in London said it has consistently opposed UK interference in China’s internal affairs, including the BNO visas issue. Furthermore, it urged the British side to follow the general trend and cease political interference, while it accused Britain of resorting to tricks and described its behaviour as contemptible.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer told Labour MPs that he is "not prepared to walk away" from power or "plunge us into chaos" as previous prime ministers have done.

- UK Health Secretary Wes Streeting has been accused of orchestrating a leadership coup against UK PM Starmer, The Telegraph reports.

- BoE's Mann said import prices are contributing to UK CPI, with US tariffs driving Chinese export prices to the UK.

- ECB President Lagarde said she expects inflation to stabilise sustainably at the 2% target and noted that they are operating in a volatile global environment marked by heightened geopolitical tensions and persistent policy uncertainty. Lagarde said supply chains are becoming more fragmented, and industrial policies are reshaping global competition, but stated that despite the challenging environment, economic activity in the euro area has been resilient. Furthermore, she reiterated a data-dependent, meeting-by-meeting approach.

- ECB President Lagarde urged EU politicians to push through structural reforms, including a savings and investment union, a digital Euro and deeper market integration, while she noted that price stability alone won’t make Europe stronger without broader policy action.

- ECB's Nagel said the update of the December 2025 projection confirms the inflation outlook, and that the ECB takes action when the medium-term inflation projection deviates sustainably and noticeably from 2%. Nagel said risks to inflation are currently roughly balanced and the inflation shortfall is short-term and small, while he stated the current interest rate level is appropriate. Nagel also commented that he is prepared to adjust in either direction if needed, but is unlikely to react to a short-lived slowdown in inflation, and noted that even if the inflation rate falls slightly below our target in the coming quarters, there is no immediate need for action.

DATA RECAP

- UK BRC Retail Sales Monitor YY (Jan) 2.3% vs. Exp. 1.2% (Prev. 1.0%, Rev. From 1%)