No Surprises In Treasury Refunding Statement: No Auction Size Increases For "Next Several Quarters"

Ahead of today's much-anticipated quarterly refunding announcement by the US Treasury, some were hopeful that Bessent could pull an anti-Yellen and forecast a gradual decline in long-term issuance in coming quarters, sending yields lower. None of the happened, however, and instead the Treasury did not surprise markets, announcing that this quarter's refunding total would come in line with estimates, at $125BN (to refund $90.2BN in securities). And while the Treasury said that auction sizes would be unchanged for "next several quarters" as expected, the department said it would continue to rely on bills to fund the increasing amount of federal spending. That said, by late March, the Treasury anticipates incrementally reducing short-dated bill auction sizes in light of the April 15 tax date. These reductions will lead - the Treasury believes - to a cumulative $250-300 billion net decline in total bill supply by early May.

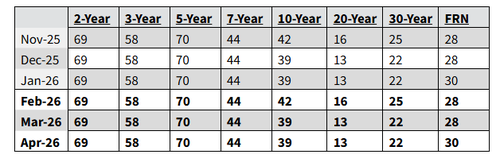

Here is a summary of what the Treasury announced:

No surprises in today's Refunding statement

- No change in net issuance: Treasury says will keep coupon, floating rate note auction sizes unchanged for "next several quarters" as expected. No ramp in issuance yet.

- Refunding size: Treasury offering $125BN in quarterly refunding, as expected. Will sell $58BN in 3Y, $42BN in 10Y and $25BN in 30Y, and will keep auctions sizes unchanged through May.

- Bills: Despite QE Lite, the Treasury expects to "maintain the offering sizes of benchmark bills at current levels into mid-March" By late March, Treasury anticipates incrementally reducing short-dated bill auction sizes in light of the April 15 tax date. These reductions will lead to a cumulative $250-300 billion net decline in total bill supply by early May

- Cash: Treasury assumes an $850BN cash balance at the end of March. However, based on current projections for the upcoming refunding quarter, Treasury estimates that the size of the Treasury General Account (TGA) could peak around $1,025 BN by late April.

- Buybacks: Treasury expects to purchase up to $38BN in off-the-run securities across buckets for "liquidity support" and up to $75 billion in the 1-month to 2-year bucket for cash management purposes in the coming quarter.

Taking a closer look at the Treasury's quarterly refunding statement published at 8:30am Wednesday, the department said it anticipated keeping auction sizes unchanged for nominal notes, bonds and floating-rate notes, “for at least the next several quarters”, a paraphrase of the same forward guidance that debt managers have used for two years now.

As for next week’s refunding auctions, they will total $125 billion, as expected, and will be made up of:

- $58 billion of 3-year notes on Feb. 10

- $42 billion of 10-year notes on Feb. 11

- $25 billion of 30-year bonds on Feb. 12

The refunding will raise new cash of approximately $34.8BN, net of the $90.2BN in maturing securities.

The Treasury also said it’s “monitoring” the Federal Reserve’s expanded purchases of bills, which mature in a year or less. The central bank in December stunned markets (if not ZH readers, who knew about the move well ahead of time), when it said it would buy $40 billion a month of Bills until April, in an effort to ensure ample reserves in the banking system. And the department is keeping an eye on “growing demand for Treasury bills from the private sector."

As a result, based on current fiscal forecasts, Treasury expects to maintain the offering sizes of benchmark bills at or near current levels into mid-March. By late March, Treasury anticipates incrementally reducing short-dated bill auction sizes in light of the April 15 tax date. These reductions will likely lead to a cumulative $250-300 billion net decline in total bill supply by early May. The Treasury "will continue to evaluate near-term borrowing needs and assess additional adjustments to bill auction sizes as appropriate."

The department has for several quarter relied on T-Bills to fund the steadily increasing amount of federal spending. Amid that focus, some market participants ahead of Wednesday’s release reported speculation of aggressive moves to outright reduce bond issuance to help pull down yields that serve as a benchmark for mortgages and other loans. That did not happen.

Separately, the Treasury also "continues to evaluate potential future increases to nominal coupon and FRN auction sizes, with a focus on trends in structural demand and potential costs and risks of various issuance profiles,” the department said. FRNs refer to floating rate notes.

“While the administration’s focus on affordability measures has brought back questions about potential efforts to lower borrowing costs via more active adjustments to the issuance mix, we do not expect Treasury to do so at this point,” Goldman Sachs strategists William Marshall and Bill Zu wrote ahead of Wednesday’s release. Goldman’s take reflected the views of many dealers. Any move to cut sales of bonds, or 10-year notes, would have run against the department’s long-standing pledge to be “regular and predictable” in its debt management. Bessent himself invoked that language in a speech in November.

“The statement itself was very much steady-as-she-goes, with the Treasury reiterating the view that nominal coupon and FRN auction sizes will hold ‘for at least the next several quarters,’” said John Canavan, lead analyst at Oxford Economics.

Meantime, the Fed’s purchases reduce “the risk of Treasury oversupplying” the market with more bills than investors are prepared to handle, Morgan Stanley strategists led by Martin Tobias wrote in their refunding preview. Beyond April, the Fed’s plans are unclear, however — all the more so given Kevin Warsh’s nomination to become the next chair in May. Warsh has in the past advocated shrinking the Fed’s securities portfolio.

Two more things to note:

While the Treasury assumes an $850 billion cash balance at the end of March, based on current projections for the upcoming refunding quarter, the Treasury now estimates that the size of the Treasury General Account (TGA) could peak around $1,025 billion (plus or minus $50 billion) by late April, before declining rapidly in May after tax day (this estimate reflects significant uncertainty regarding the size of April tax receipts, as well as macroeconomic factors and the path of fiscal and monetary policy).

Additionally, as part of its quarterly Treasury buyback schedule release, the Treasury said it anticipates that, over the course of the upcoming quarter, it will purchase up to $38 billion in off-the-run securities across buckets for liquidity support and up to $75 billion in the 1-month to 2-year bucket for cash management purposes.

Digging a little deeper we find the following:

1. The minutes of the Treasury Borrowing Advisory Committee’s Feb. 3 meeting indicated the following:

Debt Manager Liang Jensen summarized primary dealers’ views on floating-rate notes indexed to the Secured Overnight Financing Rate (SOFR). Most dealers expressed support for Treasury issuing SOFR-indexed FRNs.

- Supporters argued that a Treasury SOFR FRN would diversify Treasury’s front-end issuance mix and potentially reduce funding costs, given the strong incremental demand

- Some dealers emphasized the risk of potentially cannibalizing demand for Treasury bills and for the existing 2-year Treasury FRN, while several dealers cautioned that Treasury could be exposed to spikes in SOFR during periods of funding market stress

- Most dealers pointed to a 1-year final maturity as particularly attractive in meeting demand from Money Market Funds

- Committee briefly discussed the feedback from dealers and the pros and cons of Treasury issuing a SOFR-linked FRN, and concluded that Treasury should study the idea further

Committee discussed the first charge, addressing bill purchases and the consolidated balance sheet — concept of a consolidated balance sheet between the Federal Reserve and Treasury was previously addressed in a February 2020 Committee presentation

- Committee then discussed the circumstances where Treasury should focus on the composition of privately-held Treasury debt outstanding or the composition of total debt outstanding

- Presenter reviewed how key elements of the Fed’s balance sheet alter effective interest rate risk when considered on a consolidated basis

- The presenter noted that, in the current environment, it would be reasonable for Treasury to meet some portion of the Federal Reserve’s System Open Market Account (SOMA) demand for Treasury bills through increased issuance in this sector of the curve

- Also discussed how the results of the Committee’s optimal debt issuance model might change when separating the interest-bearing and non-interest-bearing components

- Presenter advised that Fed policy inflection points are relevant times to consider the composition of privately-held Treasury securities when making issuance decisions

Committee discussed second charge, which addressed trends in demand for Treasury securities. Presenter highlighted several structural shifts shaping demand, including runoff from SOMA, growth in MMF assets, expanding bank portfolios, evolving pension plan structures, increasing Treasury holdings by foreign private investors, and potential demand associated with stablecoins

- The discussion covered key considerations—such as collateral needs, duration management, diversification benefits, and central bank reserve management—that are influencing Treasury allocations in portfolios

- Presenter concluded incremental demand for Treasuries might evolve going forward, noting that the short and intermediate sectors of the curve were likely to experience the broadest growth

2. TBAC (Treasury Borrowing Advisory Committee) said it had a “robust” discussion on the relative tradeoffs of increasing auction sizes more gradually, perhaps earlier than needed, compared to a more accelerated path of increases when the financing gap is larger. While noting the importance of keeping the mandates of the Federal Reserve and Treasury separate, the committee said there can be “cross effects.”

- The committee in a letter to Treasury Secretary Scott Bessent discussed the level of demand at various points of the curve, while noting that dynamics may continue to evolve prior to the need to raise coupon auction sizes

- “As always, the Committee felt strong communication to ensure a regular and predictable operating framework would help to facilitate any adjustment period for market participants,” TBAC wrote

- Committee also discussed the value of Treasury securities as a portfolio diversification tool, noting that in recent years it has been more volatile, with Treasury securities at times being positively correlated with equity returns

- Reduced diversification value could be a headwind for some segments of Treasury demand, though some TBAC members felt that the markets were returning to more typical countercyclical performance versus risky assets

- Committee concluded that the demand function for Treasury securities was healthy, with several members noting that the distinction between buying Treasury securities for duration and buying them on an asset swapped basis was meaningful.

- Committee noted the reduction of demand for longer-duration sovereign debt in certain jurisdictions and, in some cases, the shift to shorter issuance from those respective debt management offices

- Committee discussed how Treasury should consider the composition of privately-held Treasury securities compared to total Treasury debt outstanding, including the holdings of the Federal Reserve’s System Open Market Account (SOMA), when evaluating its issuance mix

- It was in broad agreement that the Fed policy inflection points are relevant times to consider the composition of privately held Treasury securities when making issuance decisions

- The Fed has a recent history of meaningful Quantitative Easing (QE) actions over short periods of time, the effects of which Treasury could consider in due course. QE that has run its policy course changes the composition of private holdings

- Treasury may find that it can make cost- and risk-efficient adjustments to its issuance mix due to the resulting changes in supply and demand, within its ever-important “regular and predictable” framework. Present day considerations include increased demand for Treasury bills as part of Federal Reserve MBS run-off reinvestments and RMPs

- “The separation of mandates for the Treasury and Fed is important, but it is well understood that there can be cross effects; Treasury could factor in the impact of these effects on privately-held Treasury balances when it evaluates its issuance mix,” TBAC wrote