NQ continues to be pressured, dragging global equities lower; Markets await US jobs reports and global flash PMIs - Newsquawk EU Market Open

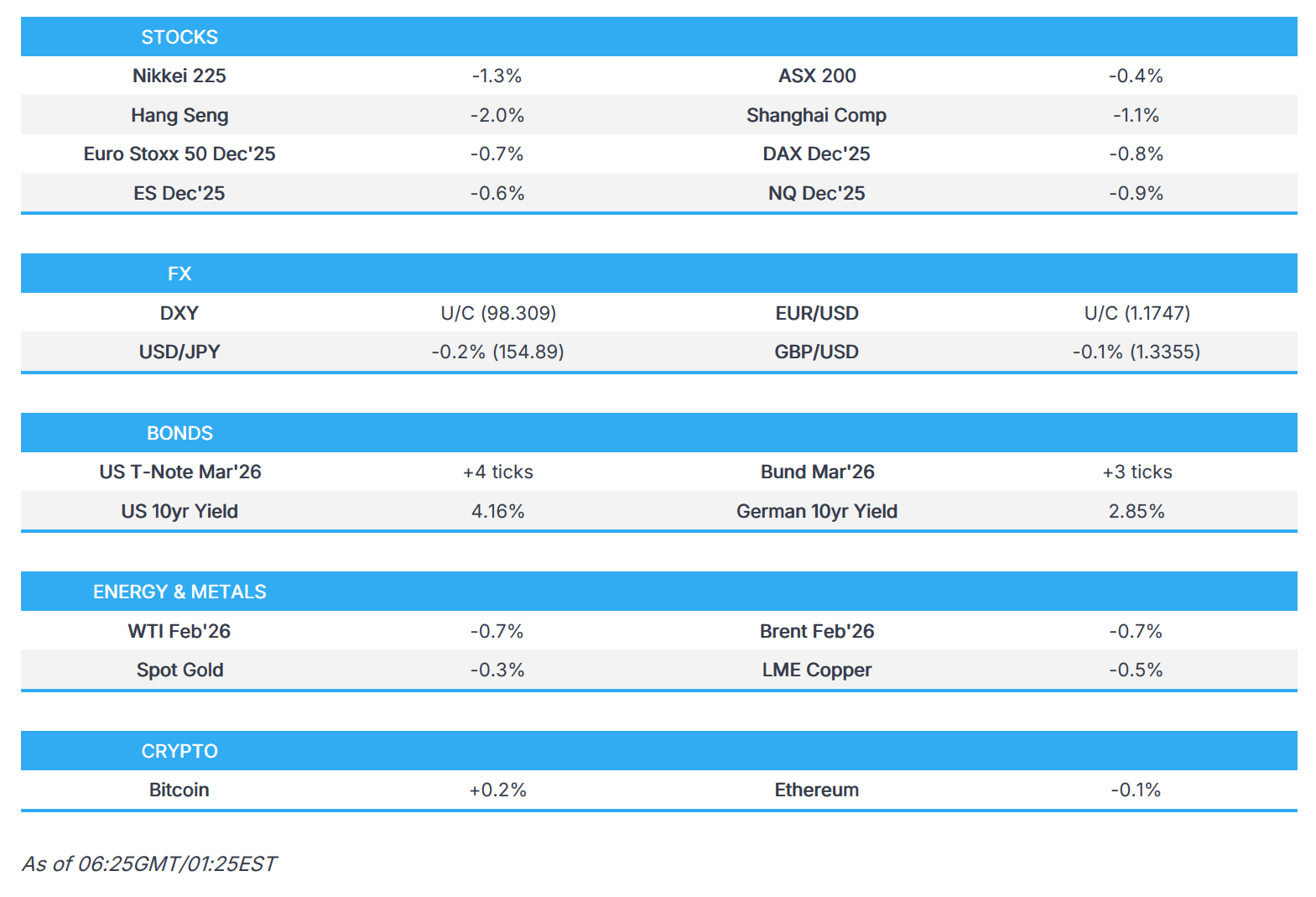

- APAC stocks were mostly lower after the weak lead from Wall Street, as the tech-related pressure rolled over into the region; Nikkei 225 fell beneath the 50,000 level amid a firmer currency.

- China Securities Times commentary noted that China should set a positive yet 'pragmatic' 2026 GDP growth target with leeway, while researchers are said to be divided between an around 5% or 4.5%-5.0% growth target for 2026.

- US President Trump said they are looking into whether Israel violated the ceasefire by killing a Hamas leader; Ukrainian President Zelensky said there was still no ideal peace plan as of now.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.7% after the cash market closed with gains of 0.6% on Monday.

- Looking ahead, highlights include UK Jobs Report (Oct), EZ/UK/US Flash PMIs (Dec), German ZEW Survey (Dec), Japanese Trade Balance (Nov), US Average Weekly Prelim Estimate ADP (4-week, w/e 29 Nov), Non-Farm Payrolls (Oct), Jobs Report (Nov), Retail Sales (Oct), Business Inventories (Sep), NBH Announcement, Comments from BoC’s Macklem, Supply from UK.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks ultimately closed in the red with the Russell and Nasdaq lagging, although sectors were predominantly firmer with Health Care, Utilities and Consumer Discretionary outperforming, but Tech, Energy and Communication underperformed with Tech still pressured after the ORCL and AVGO reports last week. Energy stocks were hit as oil prices declined on Russia/Ukraine peace progress, as talks took place between Ukraine, the EU and the US, in which all sides were seemingly optimistic, and President Trump suggested they were closer than ever to peace.

- The pressure in crude prices gave a helping hand to T-Notes, with the curve bull steepening and T-Notes hitting a peak after a weak NY Fed Manufacturing survey, before paring off highs into the settlement. There were also several Fed speakers, including Miran who explained his dissent, while Williams remarked that Fed policy has moved toward neutral from modestly restrictive, and Collins said she wants more evidence of inflation returning to target before easing again.

- SPX -0.16% at 6,816, NDX -0.51% at 25,067, DJI -0.09% at 48,417, RUT -0.79% at 2,531.

- Click here for a detailed summary.

TARIFFS/TRADE

- US suspended implementing a technology deal it struck with the UK amid growing frustrations in Washington over progress of trade talks with London, according to FT.

- US and Mexico signed a new agreement on the Tijuana River sewage crisis.

NOTABLE HEADLINES

- Fed's Miran (voter, dove) said Fed policy is too tight, and he sees no material impact from tariffs on inflation, as well as noted that the labour market shows no signs of severe stress currently. Miran said the President is entitled to have his opinion about rates and that Trump has not talked to him about plans for the Fed seat, while Miran anticipates continuing in the current seat until someone is confirmed for it.

- Fed's Williams (voter, neutral) said he was 'very supportive' of the Fed's decision to cut interest rates last week and expects the coming jobs data will show gradual cooling, as well as noted it is too early to say what the Fed will need to do in January.

- Fed's Collins (2025 voter) said she supported the Fed rate cut amid shifting balance of risks, but it was a "close call" and she sees future inflation risks as lower than they were. Collins said scenarios with a notable further rise in inflation seem somewhat less likely, and she remains concerned about potential inflation persistence, while she stated it was important to her that the forward guidance in the Committee’s statement now echoes language in the December 2024 statement, which preceded a pause in cutting rates, but added that policy is not on a pre-set path.

- Atlanta Fed starts search to replace Atlanta Fed President Bostic, while it plans an expansive process run by an executive search firm and wants a large pool of candidates with meaningful ties to the sixth Federal Reserve district.

- US President Trump said health insurers are making billions, and he does not want to give them anything, while he wants money to go to the people to let them buy their own healthcare.

- US Treasury Secretary Bessent reiterated that Congressional stock trading must end.

- Nasdaq exchange is reportedly is planning to submit paperwork with the US SEC for 23-hour weekday trading, according to Reuters.

APAC TRADE

EQUITIES

- APAC stocks were mostly lower after the weak lead from Wall Street, as the tech-related pressure rolled over into the region.

- ASX 200 marginally declined amid underperformance in the tech, energy and resources sectors, while data showed consumer sentiment deteriorated.

- Nikkei 225 fell beneath the 50,000 level amid a firmer currency, BoJ rate hike expectations and underperformance in tech and electronics stocks.

- Hang Seng and Shanghai Comp were hit amid the tech woes, with the sector heavily represented in the list of worst-performing stocks in the Hong Kong benchmark.

- US equity futures trickled lower with pressure seen as losses in Asia were exacerbated as Chinese markets entered the fray.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.7% after the cash market closed with gains of 0.6% on Monday.

FX

- DXY traded sideways amid a lack of fresh macro catalysts and with little reaction seen following comments from Fed officials, including Collins, Williams and Miran, while the attention turns to the delayed US November payrolls report scheduled later today and with the headline October NFP number to also be released alongside it.

- EUR/USD price action was uneventful with the single currency confined to within a very tight range around the 1.1750 level.

- GBP/USD struggled for direction in the absence of pertinent newsflow and heading into UK jobs and average earnings data.

- USD/JPY retreated amid the wide expectations of the BoJ to resume its policy normalisation with a 25bps hike this week.

- Antipodeans mildly softened alongside the widespread negative mood and downside in commodity prices.

- PBoC set USD/CNY mid-point at 7.0602 vs exp. 7.0444 (Prev. 7.0656)

FIXED INCOME

- 10yr UST futures kept afloat after bull-steepening on weak NY Fed Manufacturing and ahead of the NFP report.

- Bund futures lacked direction amid light pertinent drivers, and with German ZEW data scheduled later today.

- 10yr JGB futures were little changed amid a quiet calendar, BoJ rate hike expectations and slightly softer demand at the enhanced liquidity for long-end JGBs.

COMMODITIES

- Crude futures remain subdued after declining yesterday alongside optimism regarding Ukraine peace talks.

- Spot gold returned to beneath the USD 4,300/oz level, but with the downside relatively contained in comparison to the losses in other metal prices, including silver and copper.

- Copper futures were pressured with demand hampered by the downbeat mood across the Asia-Pac region.

CRYPTO

- Bitcoin retreated overnight amid ongoing tech-related pressure, with prices back beneath the USD 86,000 level.

NOTABLE ASIA-PAC HEADLINES

- China Securities Times commentary noted that China should set a positive yet 'pragmatic' 2026 GDP growth target with leeway, while researchers are said to be divided between an around 5% or 4.5%-5.0% growth target for 2026.

DATA RECAP

- Australian Westpac Consumer Sentiment (Dec) -9.0% (Prev. 12.8%)

- Australian Westpac Consumer Sentiment Index (Dec) 94.5 (Prev. 103.8)

GEOPOLITICS

MIDDLE EAST

- US President Trump said they are looking into whether Israel violated the ceasefire by killing a Hamas leader.

- Al Jazeera correspondent reports Israeli airstrikes in areas east of Gaza City.

RUSSIA-UKRAINE

- US President Trump said there was a good conversation and long discussion with European leaders, while he added that things are seemingly going well and had a long talk with Ukrainian President Zelensky, while he said he also spoke to heads of Germany, Italy, NATO, Finland, France, UK, Poland, Norway, Denmark and the Netherlands. Furthermore, he thinks they are closer than they ever have been, and noted that he had numerous conversations with Russian President Putin.

- Ukrainian President Zelensky said Ukrainian negotiators will continue talks with the US delegation and have different positions on the territory, while he added that Ukraine is ready for fair work for a strong peace deal, and he doesn’t think the US was demanding anything on territories. Furthermore, Zelensky said the US passed on Russian demands and said Ukraine needs a clear understanding on security guarantees before taking any decisions regarding frontlines.

- Ukrainian President Zelensky later said there was still no ideal peace plan as of now, and the current draft is a working version, while he added the US wants to proceed quickly to peace and that Ukraine needs to ensure the quality of this peace. Zelensky said there is agreement that security guarantees should be put to a vote in Congress and said they are really close to strong security guarantees, while he hopes to meet with US President Trump when the final framework for peace is ready. He also stated that there will be no free economic zone in Donbas under Russian control and that Ukraine will not recognise Donbas as Russian either de jure or de facto, as well as noted that Ukraine will ask the US for more weapons if Russia rejects the peace plan. Furthermore, he said Ukraine and US negotiators could meet this weekend in the US, and that Ukraine and the US support German Chancellor Merz's idea of a Christmas ceasefire, with an energy ceasefire an option.

- German Chancellor Merz said there is a chance of a real peace process, the biggest chance since the start of the war and without US President Trump, they would not have achieved the past hours' positive dynamic. Merz said the US offered a remarkable material contribution to security guarantees, while he added that the territorial question is key and only Ukraine can decide on territorial concessions. Furthermore, he said using frozen Russian assets is the only solution the EU can reach with a qualified majority, and all alternatives need unanimity, which they don't have.

OTHER

- US military said it carried out strikes on free vessels in international waters, which killed eight people.

EU/UK

NOTABLE HEADLINES

- UK financial regulator is considering a revamp of capital requirements for specialist trading firms and sees a real opportunity to make rules more proportionate and boost UK competitiveness, while options on the table include tweaking EU-aligned rules, aligning with the US approach, or allowing trading firms to use internal models.