NQ continues to underperform, weighed by weak AMD earnings; XAU reclaims USD 5k/oz - Newsquawk US Market Open

- NVIDIA (NVDA) AI chip sales to China are reportedly stalled by a US security review, and Chinese customers are, meanwhile, not placing H200 chip orders.

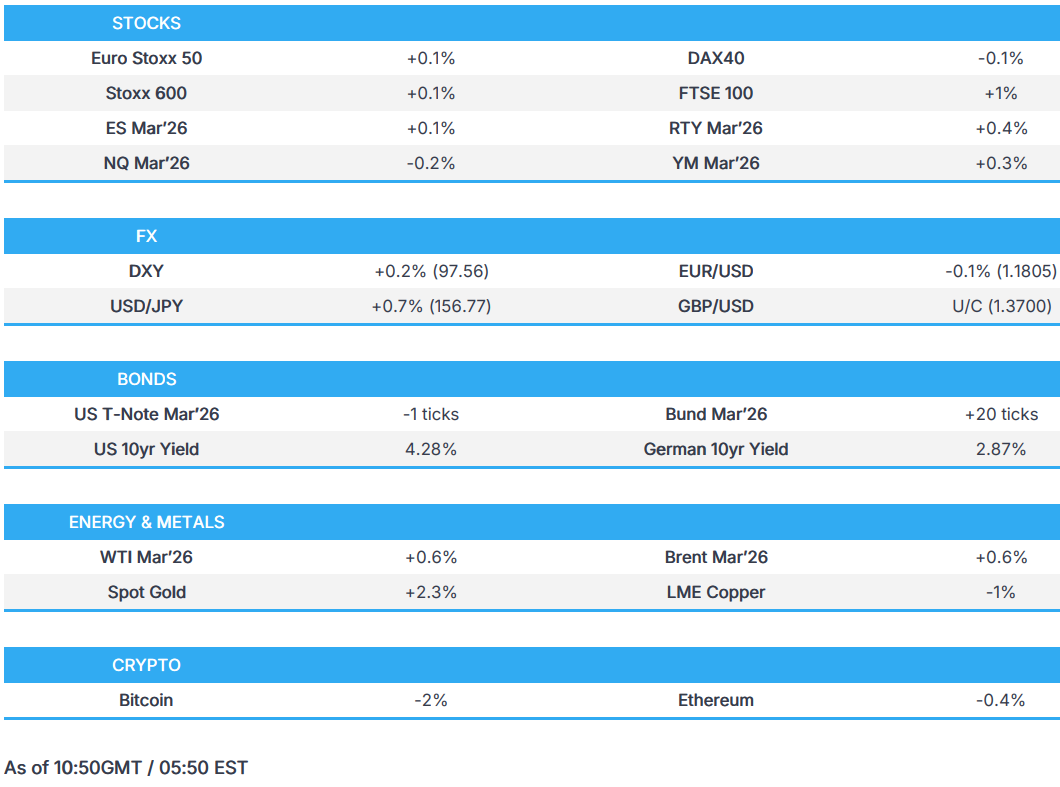

- European bourses are broadly firmer, US equity futures are mixed with mild underperformance in the NQ.

- DXY trades flat ahead of US data, JPY underperforms as focus turns to a landslide LDP victory.

- Fixed income benchmarks are mixed; USTs are flat whilst Bunds are firmer.

- Crude-specific newsflow remains light, benchmarks retrace bid following US-Iranian tensions; Precious metals continue to rebound with spot XAU returning above USD 5k/oz.

- Looking ahead, highlights include US Final Composite/Services PMIs (Jan), US ADP (Jan), ISM Services (Jan), Treasury Refunding Announcement, NBP Policy Announcement, Comments from Fed's Cook, Supply from the US.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (+0.1%) are broadly firmer across the board, though the DAX 40 (-0.1%) has been pressured by post-earnings losses in Infineon (-2.3%).

- European sectors hold a positive bias. Telecoms and Chemicals leads whilst Healthcare is the clear laggard, hampered by post-earning losses in Novo Nordisk (-17.6%) and Novartis (-1%). The former reported strong headline metrics, though its 2026 guidance disappointed.

- US equity futures (ES +0.1% NQ -0.2% RTY +0.3%) are trading mixed, ahead of key US data, which includes ADP Employment, ISM Services and Final PMIs.

- Infineon (IFX GY) Q1 2026 (EUR) Revenue 3.66bln (exp. 3.62bln), EPS 0.19 (exp. 0.23); Q2 Revenue Outlook 3.8bln (exp. 3.81bln).

- UBS (UBSG SW) Q4 (USD) Net Income 1.2bln (exp. 967mln), Pre-tax Profit 1.7bln (exp. 1.46bln), Investment Bank Pretax 640mln (exp. 468.7mln), Co. is to buyback USD 3bln of its own shares this year and aims to do more.

- Advanced Micro Devices Inc. (AMD) Q4 2025 (USD): Adj. EPS 1.53 (exp. 1.32), Revenue 10.3bln (exp. 9.67bln). Adj. net income 2.519bln (exp. 2.174bln). Said Q4 benefited from about USD 360mln release of previously reserved AMD instinct mi308 inventory and related charges. OutlookQ1 revenue 9.8bln (exp. 9.42bln).

- NVIDIA (NVDA) AI chip sales to China were reportedly stalled by US security review, according to FT. Chinese customers are meanwhile not placing H200 chip orders with NVIDIA.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY resides within a narrow range within Tuesday’s 97.298-97.692 range after seeing weakness yesterday against most major peers, giving back some of the post-ISM spoils, while JOLTS data was delayed, and there were several comments from Fed speakers, but failed to move the dial. Overnight, US President Trump signed the USD 1.2tln spending bill to end the government shutdown, as expected, and thus NFP will likely be released next week (TBC). Today, however, desks are eyeing the private ADP and ISM Services PMIs.

- JPY is the underperformer vs the USD, EUR, and GBP, as the Japanese currency continued to lag amid the ongoing expectations for a landslide victory by Japanese PM Takaichi's ruling LDP at the snap election on Sunday. USD/JPY topped yesterday's 156.08 peak to print a current high of 156.59, but is still some way off the 23rd Jan high of 159.23.

- EUR/USD trades flat with little notable action seen on the Final Services and Composite PMIs. Little move also seen on the EZ HICP metrics, which were broadly in-line / cooler-than-expected. A report which will have little impact on policymakers at the ECB, who are set to meet on Thursday – as a reminder, the Bank is expected to keep its deposit rate steady at 2.00%.

- GBP/USD sees modest gains and narrowly gains despite the revisions lower in Final PMIs, but likely lifted by the GBP/JPY pair testing highs from 23rd Jan as the cross looks to test 215 to the upside, residing at levels last seen in 2008.

- Antipodeans are mixed with the Aussie buoyed by rebound in gold prices, whilst the NZD posts losses following ultimately mixed employment and labour cost data from New Zealand.

FIXED INCOME

- USTs are essentially flat in quiet trade and currently trading in a narrow 111-17 to 111-21+ range. Focus overnight was on the end of the US shutdown after the House voted (217-214) to pass the USD 1.2tln spending package to fund the government. Following this, the Department of Labor announced that all agencies will fully resume normal operations from the 4th of February 2026; there are currently no further details or guidance on whether the NFP due on Friday will be released.

- Nonetheless, focus turns to US data later; the monthly ADP national employment data will be released, where analysts expect 48k from the prior 41k. The ISM services PMI headline is expected to ease to 53.5 from 54.4, where employment is seen nudging up a little, but prices and new orders are seen easing a touch. From the supply front, the QRA is also due today.

- Bunds initially held a downward bias but then gradually picked up as the morning progressed; currently at the upper end of a 127.72-127.88 range. There have been a number of Final PMI metrics this morning, with the EZ figure revised a touch lower; the accompanying report suggested that the ECB may highlight growing services inflation in its policy decision this week. EZ HICP printed in line with expectations, and cooled from the prior; core metrics were a touch short of expectations. Overall, a report which will not shift much ahead of the ECB confab on Thursday. As a reminder, the Bank is expected to keep its deposit rate steady at 2.00% and largely reiterate that rates are at a good place. Next up, a 2032 Bund auction.

- Gilts are essentially flat and trade within a 90.88-91.06 range. Action has been fairly choppy this morning, but has moved off its best levels in recent trade. Aside from the UK’s PMI (revised a touch lower), catalysts for the benchmark are incredibly light. Focus now on the BoE on Thursday, where rates are expected to be kept unchanged.

- UK DMO plans to hold a programmatic gilt tender for a long conventional gilt on February 11th.

- Australia sold AUD 1.1bln 4.25% 2036 bonds, b/c 3.73, avg. yield 4.9012%.

COMMODITIES

- Crude benchmarks initially held onto the gains seen in the latter end of Tuesday's session, which came from reports that the US shot down an Iranian surveillance drone approaching the USS Abraham Lincoln. WTI and Brent peaked at USD 64.16/bbl and USD 68.25/bbl, respectively, early in the APAC session, just shy of Tuesday's high, before steadily paring back and retracing to the key USD 63/bbl and USD 67/bbl handle.

- Spot XAU continues to rebound, with the yellow metal returning above the USD 5k/oz handle after hovering just shy of the level throughout Tuesday's session. Gold rose throughout the APAC session, peaking at USD 5092/oz, before oscillating in tight c. USD 40 range. Similarly, spot silver has gradually bid higher and briefly held above USD 90/oz before falling back below the level as European trade continues.

- 3M LME Copper has thus far traded on both sides of the unchanged mark, fluctuating in a USD 13.29k-13.52k/t band, as risk tone overnight was mixed. Heightened concerns over AI weighed on the tech-heavy NQ during Tuesday's trading day, and this followed through into Asia-Pacific equities.

- Morgan Stanley raises near-term Brent forecasts as geopolitical risk premium is likely to persist, but expects prices to fall below USD 60/bbl later this year.

- Ukraine's Naftogaz said Ukraine has received a delivery of 100MCM batch of US LNG, making it the first delivery expected in 2026.

- Venezuela's top Economic Advisor Ortega said he wants Venezuela to be known as a country with one of the highest oil production levels.

- China expands subsidies for energy storage industry as it seeks to support the country’s green transition and ensure reliable electricity supplies.

TRADE/TARIFFS

- US Senators push for USD 70bln funding deal to support US President Trump's critical minerals agenda, FT reported.

- Indian Trade Minister said the US trade deal will offer a competitive advantage to Indian exporters and our priority is to energy security for our citizens. Need to bolster capabilities in many sectors including nuclear energy and data centres. India will raise trade with the US.

NOTABLE EUROPEAN HEADLINES

- Germany sold EUR 3.197bln vs exp. EUR 4.0bln 2.50% 2032 Bund: b/c 1.51x (prev. 1.2x), average yield 2.60% (prev. 2.33%), retention 20.1 (prev. 23.87%).

- Germany's VDA announces that 2025 EV production comes out at 1.67mln vehicles, +23% Y/Y.

- Europe's safest corporate bond spreads drop to its lowest level since 2007.

NOTABLE EUROPEAN DATA RECAP

- Italian Inflation Rate MoM Prel (Jan) M/M 0.4% vs. Exp. 0.4% (Prev. 0.2%).

- Italian Inflation Rate YoY Prel (Jan) Y/Y 1.0% vs. Exp. 1% (Prev. 1.2%).

- Italian HCOB Services PMI (Jan) 52.9 vs. Exp. 51.4 (Prev. 51.5).

- Italian HCOB Composite PMI (Jan) 51.4 (Prev. 50.3).

- EU Inflation Rate MoM Flash (Jan) M/M -0.5% (Prev. 0.2%).

- EU Core Inflation Rate YoY Flash (Jan) Y/Y 2.2% vs. Exp. 2.3% (Prev. 2.3%, Low. 1.9%, High. 2.3%).

- EU Inflation Rate YoY Flash (Jan) Y/Y 1.7% vs. Exp. 1.7% (Prev. 2.0%, Rev. From 1.9%, Low. 1.5%, High. 2.1%).

- EU PPI MoM (Dec) M/M -0.3% vs. Exp. -0.3% (Prev. 0.7%, Rev. From 0.5%).

- EU PPI YoY (Dec) Y/Y -2.1% vs. Exp. -2.3% (Prev. -1.4%, Rev. From -1.7%).

- EU HCOB Services PMI Final (Jan) 51.6 vs. Exp. 51.9 (Prev. 52.4).

- EU HCOB Composite PMI Final (Jan) 51.3 vs. Exp. 51.5 (Prev. 51.5).

- UK S&P Global Services PMI Final (Jan) 54.0 vs. Exp. 54.3 (Prev. 51.4).

- UK S&P Global Composite PMI Final (Jan) 53.7 vs. Exp. 53.9 (Prev. 51.4).

- German VDMA Engineering Association December orders comes at -5% Y/Y.

- German HCOB Composite PMI Final (Jan) 52.1 vs. Exp. 52.5 (Prev. 51.3).

- German HCOB Services PMI Final (Jan) 52.4 vs. Exp. 53.3 (Prev. 52.7).

- French HCOB Services PMI Final (Jan) 48.4 vs. Exp. 47.9 (Prev. 50.1).

- French HCOB Composite PMI Final (Jan) 49.1 vs. Exp. 48.6 (Prev. 50).

- Spanish HCOB Composite PMI (Jan) 52.9 (Prev. 55.6).

- Spanish HCOB Services PMI (Jan) 53.5 vs. Exp. 56.6 (Prev. 57.1).

CENTRAL BANKS

- Fed Governor Miran resigned on Tuesday from his position as Chair of Council of Economic Advisers, Barron's reported citing a White House official.

- BoJ won't come to the rescue of a Takaichi-driven bond rout, with sources stating that Japanese PM Takaichi should not count on the BoJ's help in taming sharp yield rises given the high cost of intervention including risk of igniting unwanted yen declines.

- PBoC announces plan to build a multi-level financial service system to support domestic demand, tech innovation and SMEs. To continue to support debt risk resolutions for financing platforms, back local government in market oriented reforms and guide financial institutions to provide services based on marker and legal principles.

- Riksbank Minutes: President Thedeen said "at present I assess that monetary policy is following a stable and reasonable course, and we can tolerate minor deviations in data outcomes without immediately needing to adjust the course we have set.

NOTABLE US HEADLINES

- US Labour Department said all agencies will fully resume to normal operations from the 4th of February 2026.

- US President Trump signs a bill to end a partial government shutdown, as expected.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin said it will defend its interest in the Arctic, via Sky News Arabia.

- Russia's Kremlin said it has not seen any new developments when it comes to India and Russian oil.

- Russia's Kremlin said Russia will continue its Special Military Operation until the relevant decisions are made by Ukraine.

- Ukraine's Naftogaz said Ukraine has received a delivery of 100MCM batch of US LNG, making it the first delivery expected in 2026.

- China’s President Xi is to hold a video call with Russian President Putin, CCTV reported.

MIDDLE EAST

- Iran is to announce major structural and administrative decisions in the defence sector to respond to new threats, Iran's Noor News reported.

- "Deputy Speaker of Iran's Parliament: Iran and the United States likely reached preliminary understandings before sitting down at the negotiating table", Sky News Arabia reported.

- Israeli artillery shelling reported in central Gaza, via Al Jazeera news.

- Israeli army announces airstrikes and tank shelling on militants after an Israeli officer was seriously injured, according to Sky News Arabia. IDF said shooting at our forces is a violation of the ceasefire agreement in Gaza, according to Al Arabiya.

- US President Trump said we are still negotiating with Iran and that there is more than one meeting with Iran.

OTHERS

- Ukrainian peace negotiators have arrived in Abu Dhabi and have started their first meetings, IFX reported.

CRYPTO

- Bitcoin is on the backfoot and trades around USD 76k whilst Ethereum is a touch lower.

APAC TRADE

- APAC stocks were ultimately mixed as the region partially shrugged off the downbeat handover from Wall Street, where sentiment was mired by renewed tech-selling, while participants in the region also reflected on the latest Chinese PMI data and the end of the partial US government shutdown.

- ASX 200 climbed higher with the upside led by outperformance in miners as metal prices continued their recovery, but with gains in the index capped by heavy losses in the tech sector.

- Nikkei 225 slumped at the open but is off worst levels, while risk appetite was pressured following recent earnings, including disappointing results from Nintendo, which saw its shares suffer a double-digit percentage drop.

- Hang Seng and Shanghai Comp saw two-way price action as participants digested stronger-than-expected Chinese RatingDog Services PMI data, and after the PBoC drained liquidity, while it was also reported that NVIDIA AI chip sales to China are stalled by a US security review and that Chinese customers are meanwhile not placing H200 chip orders with the company.

NOTABLE ASIA-PAC HEADLINES

- China's market regulator unconditionally approves CATL (3750 HK), Chery (9973 HK) and others joint venture formation.

- China's Vice Finance Minister said China is facing persistent headwinds and policy uncertainty.

- New Zealand ANZ Commodity Price Index MM (Jan) +2.0% (Prev. -2.1%).

NOTABLE APAC DATA RECAP

- Indian HSBC Composite PMI Final (Jan) 58.4 (Prev. 57.8).

- Indian HSBC Services PMI Final (Jan) 58.5 vs. Exp. 59.4 (Prev. 58.0).

- Chinese RatingDog Composite PMI (Jan) 51.6 (Prev. 51.3).

- Chinese RatingDog Services PMI (Jan) 52.3 vs. Exp. 51.8 (Prev. 52.0).

- Japanese S&P Global Services PMI Final (Jan) 53.7 (Prelim. 53.4).

- Australian Composite PMI (Jan F) 55.7 (Prelim. 55.5).

- Australian S&P Global Services PMI Final (Jan) 56.3 (Prev. 51.1).

- Australian S&P Global Composite PMI Final (Jan) 55.7 (Prev. 51).

- Australian Ai Group Manufacturing Index (Jan) -19.4 (Prev. -18.0, Rev. From -18).

- Australian Ai Group Construction Index (Jan) 5.2 (Prev. -18.7).

- Australian Services PMI (Jan F) 56.3 (Prelim. 56.0).

- New Zealand Participation Rate (Q4) 70.50% vs. Exp. 70.3% (Prev. 70.30%, Rev. From 70.3%, Low. 70.3%, High. 70.4%).

- New Zealand Labour Costs Index YoY (Q4) Y/Y 2.0% vs. Exp. 2% (Prev. 2.1%, Low. 1.9%, High. 2.1%).

- New Zealand Unemployment Rate (Q4) 5.4% vs. Exp. 5.3% (Prev. 5.3%, Low. 5.2%, High. 5.4%).

- New Zealand Employment Change QoQ (Q4) Q/Q 0.5% vs. Exp. 0.3% (Prev. 0.0%, Rev. From 0%, Low. 0.2%, High. 0.4%).

- New Zealand Labour Costs Index QoQ (Q4) Q/Q 0.4% vs. Exp. 0.5% (Prev. 0.5%, Low. 0.4%, High. 0.6%).