NQ underperforming following ORCL earnings; DXY steady after FOMC selloff - Newsquawk US Market Open

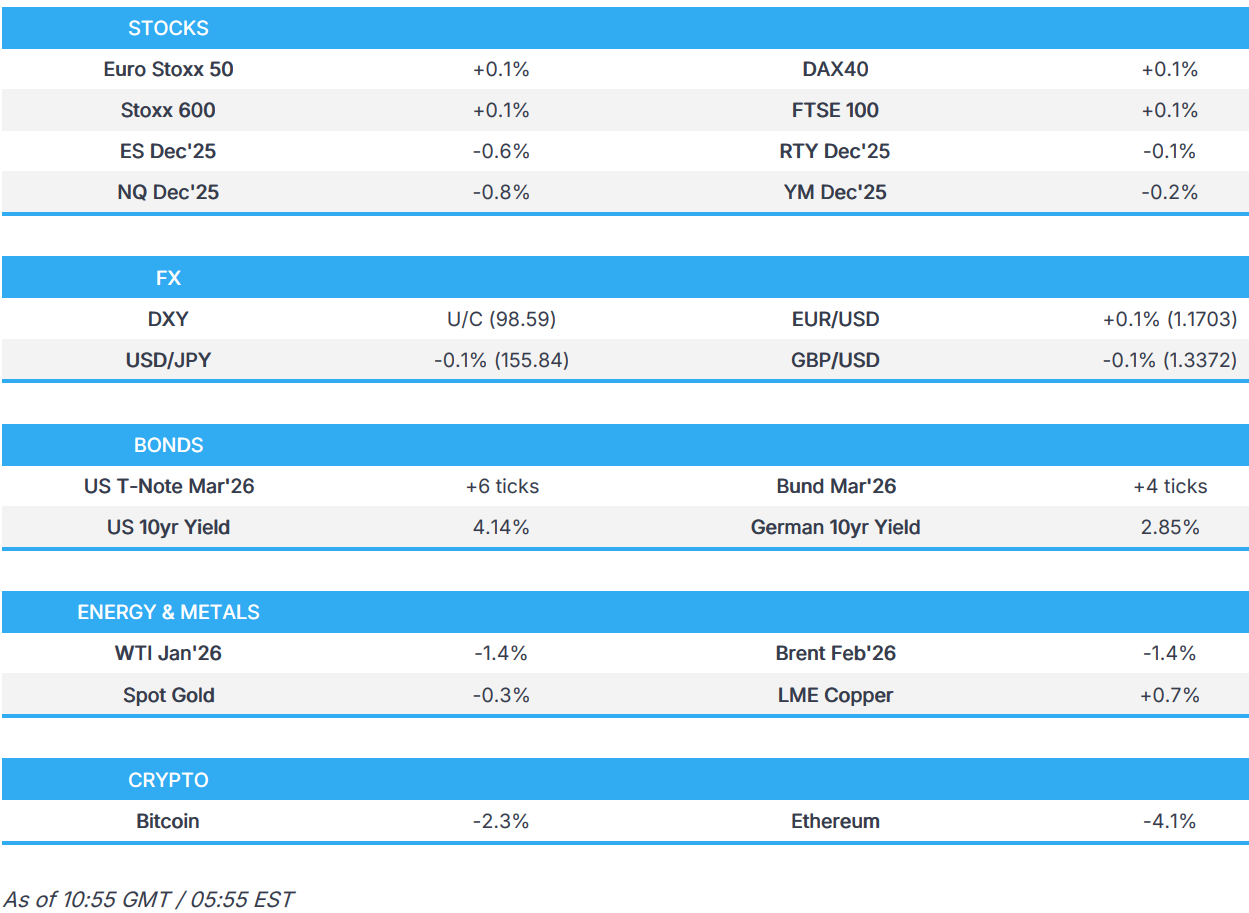

- European bourses opened lower but now marginally firmer, US equity futures are in the red, with underperformance in the NQ following Oracle (-11%) earnings.

- DXY initially attempted to pare post-FOMC pressure, but now flat, CHF little moved to the SNB announcement, but gained on the presser, the Aussie is pressured post-jobs data.

- USTs continue to strengthen in the aftermath of the FOMC, whilst Bunds pull back from highs.

- Crude benchmarks are selling off despite a bullish IEA report; XAU pares back FOMC gains; Copper pulls back from ATHs.

- Looking ahead, highlights include US Initial Jobless Claims (6 Dec, w/e), OPEC MOMR, Supply from the US, Earnings from Broadcom, Costco & lululemon.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- UK pledges an additional GBP 1.5bln for NHS medicines as part of Trump tariff deal, according to FT.

- Britain is to reform the system to speed up investigations into unfair trade practices and is to sharpen trade defences by giving the trade secretary power to direct investigations, according to draft government guidance.

- Mexico approves wide-ranging tariffs of up to 50% on China, according to Bloomberg. China's Commerce Ministry later commented regarding Mexico's tariffs that it will closely monitor the implementation and will further evaluate the impact, while it added that the measures harm the interests of relevant trade partners, including China.

- India's CEA chief economic advisor said most trade issues with the US have been sorted out and will be surprised if there is no deal with the US by March.

- Mexico's tariffs to hurt Indian-made car exports of Volkswagen (VOW3 GY), Hyundai (5380 KS), Nissan (7201 JT) and Maruti Suzuki (7269 JT), according to Reuters Sources. It was earlier reported by Bloomberg that Mexico approved wide-ranging tariffs of up to 50% on China.

EUROPEAN TRADE

- UAE State Minister said UAE and EU free trade talks are advancing rapidly.

- China's Commerce Ministry said we welcome the EU's decision to resume talks on price commitments, with discussions to continue next week.

EQUITIES

- European bourses (STOXX 600 +0.2%) opened broadly lower, but managed to clamber off worst levels as the morning progressed, albeit marginally so.

- European sectors also held a negative bias as the open, but now display a mixed picture. Construction leads followed by Autos whilst Tech is weighed down by pressure seen in Oracle (-11% pre-market) after its earnings.

- US equity futures are broadly on the backfoot, with underperformance in the tech-heavy NQ, with Oracle lower by roughly 11% after revenue missed expectations and investors questioned its heavy AI-related spending and rising debt despite strong demand and large new commitments.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY attempted a recovery from the post-FOMC slump, which saw the index fall to a 98.592 low yesterday before extending lower to 98.537; though the index is now flat. A floor was found during APAC trade as risk began to wane. To recap, the Fed cut rates by 25bps to 3.5-3.75%, as expected, but in a dovish 9-3 vote split - Goolsbee and Schmid voted to leave rates unchanged, while Miran wanted a larger 50bps reduction. In terms of the session ahead stateside, weekly initial jobless claims (for the week of 6th December) are seen rising to 220k from 191k (last week's low reading was largely due to seasonal adjustment factors); continuing claims (for the week of 29th November) are seen ticking up to 1.947mln from 1.939mln. Wholesale sales and inventory revisions are also due today.

- High beta FX (CAD, GBP, NZD, AUD) are all softer, with state-side sentiment also lower following the Fed and Oracle earnings. AUD is the laggard following the Aussie jobs report overnight, which showed a surprise contraction in jobs that was solely due to a drop in full-time work. Little move was seen on China's Economic Work conference readout, which noted that China is to make use of RRR rate cut flexibly. EUR/USD is uneventful around the 1.1700 mark in a narrow 1.1683-1.1707 parameter.

- CHF was unmoved by the SNB rate decision, which was overall as expected with no fireworks (some expected a return to NIRP). SNB kept rates at 0.00% and reiterated its language on FX, that it “remains willing to be active in the foreign exchange market as necessary”. In terms of inflation projections, 2025 was unchanged, whilst 2026 and 2027 were revised a touch lower. The CHF, however, saw mild strength during the press conference, in which he said he cannot say whether a lower CPI outlook makes NIRP more likely. USD/CHF dipped as low as 0.7979 (vs high 0.8001).

- RBI likely selling USD to help INR avert a sharp fall, according to traders cited by Reuters

- Click for NY OpEx Details

FIXED INCOME

- USTs continue to build on the post-FOMC upside; in brief, the FOMC cut rates by 25bps to 3.50-3.75%, as expected, while the vote split was a bit more dovish than expected. For US paper specifically, the Fed also said it will start technical buying of Treasury bills to manage market liquidity, in which the initial round will total around USD 40bln in Treasury bills per month to help manage market liquidity levels. Currently trading in a 112-11 to 112-18+ range, and another leg higher would see a retest of the high from 8th December at 112-19. From a yield perspective, the FOMC sparked a bull steepening, which has continued into today. Now attention turns to a number of US data points, incl. Jobless Claims, Wholesale Sales and then a 30-year auction, which follows on from a strong 3yr and mostly positive 10yr.

- Bunds follow USTs, and are now flat to trade in a current 127.36 to 127.77 range. Newsflow is incredibly light this morning, with price action essentially a paring of some of the upside seen following the FOMC. Elsewhere, UBS analysts recommend a long 10yr Bund trade, target 2.75% yield; said term premia priced by markets are too high – for reference, current 10yr yield is at 2.85%.

- Elsewhere, Gilts remain bid, as UK paper plays catch-up to peers – price action muted and within a narrow 91.22 to 91.38 range.

- Italy sells EUR 5bln vs exp. EUR 4.0-5.0bln 2.35% 2029, 3.00% 2029, 2.70% 2030 BTP

COMMODITIES

- Crude benchmarks have sold off throughout the APAC session and into the European session as risk tone sours across equity markets despite an FOMC cut that was perceived dovish. After opening at USD 58.92/bbl and USD 62.43/bbl respectively, WTI and Brent trended c. USD 1.30/bbl lower to session lows of USD 57.57/bbl and USD 61.20/bbl as equities sold off. The selloff completely reversed Wednesday's gains following the seizure of an oil tanker off the coast of Venezuela.

- Spot XAU peaked to USD 4248/oz early in the APAC session as the metal continued its gains following the dovish FOMC announcement. As the APAC session continued, however, XAU reversed lower as the dollar began to strengthen and equities sold off. In past sessions, XAU has been moving in-tandem with equities despite its safe haven characteristics, perhaps explaining the selloff in the APAC session.

- 3M LME Copper gapped higher and drove higher to a peak of USD 11.72k/t, USD 30/t shy of ATHs, before falling back lower as global risk tone soured. The red metal stabilised at USD 11.58k/t and has since remained in a tight USD 60/t band.

- Russia's Energy Ministry expects oil refining and gas and coal production to remain at 2024 levels in 2025, via RIA.

NOTABLE DATA RECAP

- Swedish CPI MM (Nov) -0.4% (Prev. -0.4%)

- Swedish CPIF MM (Nov) -0.2% (Prev. -0.3%)

- Swedish CPI YY (Nov) 0.3% vs. Exp. 0.3% (Prev. 0.3%)

- Swedish CPIF YY (Nov) 2.3% vs. Exp. 2.3% (Prev. 2.3%)

NOTABLE EUROPEAN HEADLINES

- ECB's Makhlouf said he is confident that medium-term inflation will be at 2%.

- SNB maintains its Policy Rate at 0.00% as expected; SNB reiterates it remains willing to be active in the foreign exchange market as necessary. Inflation in recent months has been slightly lower than expected. In the medium term, however, inflationary pressure is virtually unchanged compared to the last monetary policy assessment. Sight deposits held at the SNB will be remunerated at the SNB policy rate up to a certain threshold. Although US tariffs and trade policy uncertainty weighed on the global economy, economic developments in many countries had thus far remained more resilient than had been assumed.

- SNB Chairman Schlegel said the Bank will continue to observe the situation and adjust monetary policy where necessary to keep price stability Banks' sight deposits held at the SNB will be remunerated at the SNB policy rate up to a certain threshold. The low level of interest rates in Switzerland is having an effect via the exchange rate. Mid-term inflation pressure is practically unchanged since the previous quarter. Ready to intervene in the FX market if necessary. Policy continues to be expansionary, and supports inflation and the economy. Cannot say lower CPI outlook makes NIRP more likely.

- ECB proposes expanding the existing small banks regime to include more banks for supervision purposes. Recommends merging bank capital stack into 2 elements; a releasable and a non-releasable buffer. The non-binding pillar 2 guidance would be kept separate, on top of the releasable buffer. ECB design or role of additional tier 1 instruments could be adjusted to enhance loss absorption capacity.

- BoE's Bailey said BoE should not have interest rate risk on its balance sheet, the question is how fast to remove it.

NOTABLE US HEADLINES

- NEC Director Hassett said the Fed has plenty of room to cut rates and probably will need to do some more, while he added that data could support a 50bps cut and they could definitely get to 50, or even more. Hassett also said a 25bps cut would be a small step in the right direction and that President Trump will make the Fed Chair choice in a week or two.

- US House of Representatives voted 312-112 to pass the USD 901bln defence spending bill.

GEOPOLITICS

MIDDLE EAST

- US officials discussed hitting the UN Palestinian refugee agency with terrorism-related sanctions, according to sources cited by Reuters.

- US State Department condemned the Houthis' ongoing unlawful detention of current and former local staff of US missions to Yemen.

RUSSIA-UKRAINE

- Ukrainian navy drones in the Black Sea struck the "Dashan" vessel that is part of Russia's shadow fleet, while the attack led to the tanker being disabled.

- The EU is looking to reach an agreement by Friday to lengthen the freeze on Russian assets using emergency powers, according to Bloomberg citing people familiar.

- Russia's Lavrov said Russia wants a package of documents on a long term sustainable peace for Ukraine. Should be security guarantees for all sides.

- Ukrainian drones struck Lukoil's oil extraction platform in the Caspian sea, according to SBU source cited by Reuters; oil and gas production halted.

- Russia’s Lavrov said European peacekeepers in Ukraine "will Be A Target ", via Interfax.

OTHER

- US seized an oil tanker off the coast of Venezuela, while President Trump said the vessel was seized for a very good reason, and Attorney General Bondi said the oil tanker was used to transport sanctioned oil from Venezuela and Iran. Furthermore, Guyana's government said the oil tanker seized by the US was falsely flying a Guyana flag and that it will take action against the unauthorised use of the Guyanese flag.

- Russia's Kremlin said President Putin plans to meet Turkey's President Erdogan during his visit to Turkmenistan.

- Russia's Kremlin said Russia remains open to investment. It was reported by the WSJ that US companies could invest in strategic sectors from rare-earth extraction to drilling for oil in the Arctic and help restore Russian energy flows to Western Europe and rest of the world.

CRYPTO

- Bitcoin is a little lower and trades just above USD 90k, whilst Ethereum drops below USD 3.2k.

APAC TRADE

- APAC stocks were ultimately subdued after failing to sustain the early positive momentum from the dovishly perceived FOMC where the Fed lowered rates by 25bps to between 3.50-3.75%, as expected, but with a less hawkish tilt than what Wall Street had anticipated, although much of the gains were eventually wiped out as a slump in Oracle post-earnings stoked tech and AI-related concerns.

- ASX 200 eked mild gains but with upside limited by the latest jobs data, which showed a surprise contraction in jobs that was solely due to a drop in full-time work.

- Nikkei 225 reversed its opening gains and more amid pressure from a firmer currency and as AI-exposed stocks were hit, including SoftBank.

- Hang Seng and Shanghai Comp gradually retreated with the mainland not helped by another liquidity drain by the PBoC, while trade-related uncertainty lingered, with China said to have held urgent discussions with major domestic tech firms on Wednesday about whether to permit purchases of NVIDIA’s H200 processors.

NOTABLE ASIA-PAC HEADLINES

- HKMA cut its base rate by 25bps to 4.00%, as expected, and in lockstep with the Fed.

- China's Commerce Ministry said China has taken measures to grant exemptions on Nexperia chips for compliant exports intended for civilian use.

- China's Foreign Ministry on tensions with Japan said Japanese PM Takaichi's attitude makes it impossible to engage in dialogue.

- China's Commerce Ministry said non-state import quota for fuel oil in 2026 set at 20mln metric tons.

- China holds annual central economic work conference on Dec 10-11th, according to Xinhua; said China is to make use of RRR rate cut flexibly. Will continue to expand domestic demand. Will build strong domestic market. Will consolidate, stabilise economy. Will implement appropriately loose monetary policy. Will implement more proactive fiscal policy. Will maintain yuan exchange rate basically stable. Will step up counter-cyclical and cross-cyclical adjustment. Will optimise fiscal expenditure structure. Will emphasise resolving local fiscal difficulties. Will flexibly use policy tools including RRR, rate cuts. Will actively resolve local govt debt risks, prohibit new hidden debt. Will stabilise property market with city-specific measures. Encourages buying existing homes for social housing.

- Japan's Lower House passes supplementary budget bill for FY2025 to fund new economic policy package under PM Takaichi, according to Jiji.

DATA RECAP

- Australian Employment (Nov) -21.3k vs. Exp. 20.0k (Prev. 42.2k, Rev. 41.1k)

- Australian Full Time Employment (Nov) -56.5k (Prev. 55.3k)

- Australian Unemployment Rate (Nov) 4.3% vs. Exp. 4.4% (Prev. 4.3%)

- Australian Participation Rate (Nov) 66.7% vs. Exp. 67.0% (Prev. 67.0%)