Oracle Tumbles On Disappointing Cloud Revenue; CapEx Soars: Funding Questions Remain

While the Fed's "not so hawkish" cut was certainly better than what the market expected, largely thanks to the very dovish addition of $40BN in not QE monthly Reserve Management Purchases of T-Bills, there was another key event today and, as we previewed earlier, that was Oracle's second quarter results. And unlike the Fed, this one was not nearly as good for risk assets: the company reported earnings which beat estimates, but the top line was a mess, with cloud growth missing across the board, and margins also disappointing, sending the stock lower after hours.

Here is what Oracle just reported for Q2:

- Adjusted EPS $2.26 vs. $1.47 y/y, beating estimates of $1.64

- The company clarified that GAAP and non-GAAP earnings per share "were both positively impacted by a $2.7 billion pre-tax gain in the sale of Oracle's interest in our Ampere chip company."

- Adjusted revenue $16.06 billion, +14% y/y, missing estimates of $16.21 billion

- Cloud revenue (IaaS plus SaaS) $8.0 billion, +36% y/y, missing estimate $8.04 billion

- Cloud Infrastructure revenue (IaaS) $4.1 billion, +71% y/y, beating estimates of $4.09 billion

- Cloud Application revenue (SaaS) $3.9 billion, +11% y/y, matching estimates of $3.9 billion

- Software revenue $5.88 billion, -3.1% y/y, missing estimates of $6.03 billion

- Hardware revenue $776 million, +6.6% y/y, beating estimates of $716.7 million

- Service revenue $1.43 billion, +7.4% y/y, beating estimates of $1.36 billion

- Revenue in constant currency +13%, missing estimates of +14.6%

- Cloud revenue (IaaS plus SaaS) in constant currency +33%, missing estimate +35.1%

- Cloud Infrastructure revenue (IaaS) in constant currency +66%, missing estimate +69.1%

- Cloud Application revenue (SaaS) in constant currency +11%, missing estimate +12.4%

- Adjusted operating income $6.72 billion, +10% y/y, beating estimates $6.82 billion

- Adjusted operating margin 42% vs. 43% y/y, missing estimates of 42.2%

- Remaining performance obligations $523 billion, up 15% and beating est of $519.4BN

Commenting on the quarter, Larry Ellison said that "we are now committed to a policy of chip neutrality where we work closely with all our CPU and GPU suppliers. Of course, we will continue to buy the latest GPUs from NVIDIA, but we need to be prepared and able to deploy whatever chips our customers want to buy,” said Oracle Chairman and CTO, Larry Ellison. The question, of course, is where will the money come from for the company which has spooked the stock - and especially bond market - with its CDS soaring to the highest since the GFC, as markets realized that ORCL will need to issue a lot more debt to fund its capex.

Ellison also said that “Oracle sold Ampere because we no longer think it is strategic for us to continue designing, manufacturing and using our own chips in our cloud datacenters."

There was the token AI pitch of course: "There are going to be a lot of changes in AI technology over the next few years and we must remain agile in response to those changes."

"Remaining Performance Obligations (RPO) increased by $68 billion in Q2—up 15% sequentially to $523 billion—highlighted by new commitments from Meta, NVIDIA, and others," said Oracle Principal Financial Officer, Doug Kehring.

So what to make of these results? Well, as we noted in our preview, while three months ago, Oracle’s scorching earnings outlook sent the shares soaring to their best day in three decades, today things look very different for the database software maker and the AI trade in general.

Heading into today's earnings report, ORCL shares plunged 33% since Sept. 10 (and more than 40% at the lows), when they hit an all-time high based on enthusiasm for raging growth in its cloud business. Today, Oracle and many other artificial intelligence companies are facing a wave of skepticism due to heavy capital expenditures and the circular nature of some arrangements.

Today's results were mixed at best: yes earnings beat, but Oracle posted disappointing cloud revenue, signaling it will take longer than expected for the company’s recent huge AI bookings to pay off. As noted above, Q2 cloud sales increased 34% to $7.98 billion, while revenue in the company’s closely watched infrastructure business increased 68% to $4.08 billion. Both numbers fell just short of analysts estimates.

The silver lining: Oracle's remaining performance obligation, a measure of bookings, jumped to $523 billion in the fiscal second quarter, which ended Nov. 30, the company said Wednesday in a statement. Analysts, on average, estimated $519 billion, according to data compiled by Bloomberg. Still, ORCL needs to start monetizing this backlog instead of just parading with how much it may collect at some point in the future.

Oracle has found recent success in the competitive cloud computing market. It’s engaging in a massive data center build-out to power AI work for OpenAI and also counts companies such as ByteDance’s TikTok and Meta Platforms as major cloud customers.

Still, as Bloomberg notes, Wall Street has raised doubts about the costs and time lines required to develop AI infrastructure at such a massive scale. Oracle has taken out massive sums of debt and committed to leasing multiple data center sites; its off-balance sheet debt is also emerging as a potential risk.

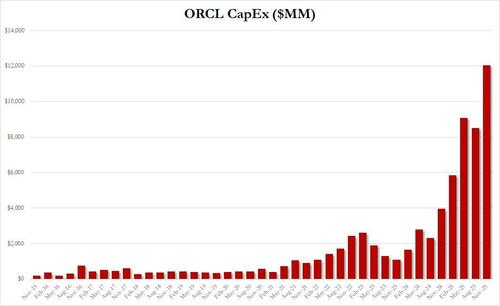

Investors want to see Oracle turn its higher spending on new data center infrastructure into revenue as quickly as it has promised. Capital expenditures, a metric of data center spending, were about $12 billion in the quarter, an increase from $8.5 billion in the preceding period. Analysts anticipated $8.25 billion in capital spending in the quarter. In September, the company projected capital expenditures of $35 billion for the fiscal year.

Part of the negative sentiment from investors in recent weeks is tied to increased skepticism about the business prospects of OpenAI, which is seeing more competition from companies like Google, wrote Kirk Materne, an analyst at Evercore ISI, in a note ahead of earnings. Investors would like to see Oracle management explain how they could adjust spending plans if demand from OpenAI changed, he added.

But the biggest question, however, is the one we flagged earlier: where/when will the money to fund all this massive capex growth come from... and it better not be all debt because in that case the Barclays bear case of zero cash in late 2026 comes into play and ORCL's CDS will go straight up. The company better have a ready answer during the earnings call

ORCL shares slumped 6% in after hours after closing at $223.27 in New York.