Plaza Accord Lite? Japan, Korea Get Green Light From Yellen For FX Intervention

One week ago, when Japan's PM Kishida visited the White House and unwittingly sparked the latest Beltway fashion scandal, when Jeff Bezos' current wife appeared dressed as a middle-aged stripper to the dinner honoring the Japanese delegation, sparking online outrage among the commentariat who said Sánchez’s state dinner look was “totally inappropriate,” “embarrassing” and “the trashiest thing” to ever be seen at the black tie White House gala...

Jeff Bezos and Lauren Sanchez arrive hand-in-hand at the state dinner for Japan at the White House. Bezos didn’t answer when asked if he’d be donating to Biden’s campaign. pic.twitter.com/Vw7sTF2Bse

— Judy Kurtz (@JudyKurtz) April 10, 2024

... we said that even though the yen was plunging, it would be virtually impossible for Japan's Ministry of Finance to step in and prop up the imploding currency amid all the official celebrations, as an FX intervention during an official state dinner would look rather impolite and thus, highly un-Japanese.

Luminaries including Clinton, Bezos, Cook, Dimon arriving at White House for black-tie state dinner with Japan's PM Kishida

— zerohedge (@zerohedge) April 10, 2024

Poor Japanese MOF can't intervene in FX while this is taking place or it will get really awkward

However, now that the Japanese state visit is long over, the probability that Tokyo will step in and prop up the collapsing currency any given moment is soaring, especially since overnight the G-7 appears to have reached a tacit "Plaza Accord" lite, one where the US has given a quiet agreement to Japan and Korea to step in and intervene in the FX market to prop up their currencies.

According to Reuters, the United States, Japan and South Korea agreed to "consult closely" on foreign exchange markets in their first trilateral finance dialogue on Wednesday, acknowledging concerns from Tokyo and Seoul over their currencies' recent sharp declines.

The trilateral gathering, attended by Treasury Secretary Janet Yellen, Japanese Finance Minister Shunichi Suzuki and South Korean Finance Minister Choi Sang-mok, was held on the sidelines of the International Monetary Fund and Group of 20 (G20) finance leaders' meetings this week in Washington. Suzuki told reporters he also met Yellen bilaterally on Wednesday and explained Tokyo's readiness to take appropriate action against excessive yen moves, without elaborating.

Japan's top currency diplomat Masato Kanda, who is also in Washington, said authorities would not rule out any options in dealing with excessive yen moves. He declined to comment, when asked about the possibility of coordinated intervention to slow the dollar's ascent against other currencies, including the yen.

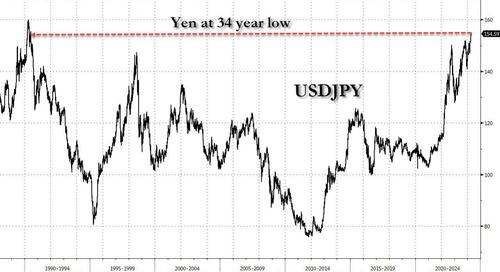

The rare warning from the three countries' finance chiefs came as receding expectations of a near-term U.S. interest rate cut pushed the yen to 34-year lows, keeping markets on alert on the chance of an intervention by Japan to prop up the currency.

"We will continue to cooperate to promote sustainable economic growth, financial stability, as well as orderly and well-functioning financial markets," according to a joint statement released after the trilateral meeting.

"We will also continue to consult closely on foreign exchange market developments in line with our existing G20 commitments, while acknowledging serious concerns of Japan and the Republic of Korea about the recent sharp depreciation of the Japanese yen and the Korean won," it said.

The dollar quickly slid to an intraday low of 154.18 yen after the statement, off the 34-year high of 154.79 yen hit on Tuesday, but it has since regained virtually all of the drop as markets continue to make a mockery of Japan, and even this latest green light by the G7 to step in and intervene to keep the dollar weaker, an outcome which is now in the benefit of not only the rest of the world but the US as well.

And indeed, Washington's acknowledgement of the currency concerns from Tokyo and Seoul may lay the groundwork for intervention, analysts said.

"While I don't see a statement like this being enough to boost the yen and avoid an intervention, the language used there is pretty strong and I wouldn't be surprised to see some concrete moves come out of Japan before the week is out," said Helen Given, a currency trader at Monex USA.

"In the last few intervention cycles, American authorities - most notably Janet Yellen - issued statements acknowledging Japan's motivations and providing verbal support," said Karl Schamotta, chief market strategist at Corpay.

"From a strategic perspective, currency intervention is far more likely to succeed when delivered through a coordinated international effort. Unilateral moves are helpful in mitigating volatility, but aren't up to the task of reversing the yen's long rate differential-driven slide," Schamotta added.

Hitting the nail on the head, Keiichi Iguchi, senior strategist at Resona Holdings, said that "the US has effectively given the nod to Japan to intervene on the yen if needed," adding that the market had assumed before heading to the G-20 that any intervention would be alone, but now there is speculation that a coordinated intervention is a possibility. That would be more effective and larger than a single intervention. Such intervention would be by Japan and South Korea intervening to buy their respective currencies at similar times.

Iguchi concludes that if what’s happened with the views of the US, Japan, and South Korea finance ministers at the G-20 spread further, this could slow the speed of dollar appreciation

Bloomberg's Vassilis Karamanis writes that "the factor that invites a fresh outlook on intervention is that it may not be unilateral anymore. Japan’s currency chief Masato Kanda said earlier that G-7 members had reaffirmed that excessive moves in the FX market were harmful for economies. In essence, this leaves the door open to members to intervene in markets under certain circumstances. This isn’t breaking news for the market as we got similar headlines Wednesday, but it’s all the more reason for us to focus on spot and volatility correlation to assess just how concerned traders are when it comes to intervention in the Japanese currency."

Finance leaders of the G7 advanced nations agreed to a Japanese proposal to reaffirm their commitment that excessive volatility and disorderly moves in the currency market were undesirable, Kanda told reporters after the G7 gathering.

In recent months, Japan and South Korea have seen their currencies slide against the dollar in recent weeks due largely to reduced bets of near-term cuts to elevated U.S. interest rates. Increasingly ineffectual verbal warnings by Japanese authorities have failed to keep traders from pushing the yen down near 155 to the dollar, a level seen as Tokyo's line-in-the-sand that heightens the chance of intervention.

Meanwhile, Bank of Korea Governor Rhee Chang-yong said on Wednesday authorities have the resources and tools to smooth out any volatile moves in the country's currency, signaling readiness to intervene in the market to shore up the won.

"Our exchange rate deviated a little bit from what could be justified by market fundamentals," Rhee said in an IMF seminar.

Finance leaders of the G20 major economies have a long-standing agreement that excessive exchange-rate volatility and disorderly currency moves are undesirable. Tokyo has argued this G20 agreement gives it freedom to intervene in the currency market to counter excessive yen moves.

Still, intervention could be costly and there is no guarantee it could reverse the current strong-dollar tide, which is driven by the big gap between U.S. and near-zero Japanese interest rates.

"I'm not sure whether Tokyo would intervene just because the dollar breaks past 155 yen," said Masafumi Yamamoto, chief FX strategist at Japan's Mizuo Securities.

"Authorities probably feel that solo intervention won't have a lasting effect when a strong U.S. economy is pushing back the timing of a Fed rate cut and driving up the dollar," he said.

Others were skeptical an intervention is imminent. Bloomberg analyst Ven Ram writes that a joint intervention along the lines we saw in 1998 when the US authorities waded into the markets, together with Japanese officials, seems unlikely for now. The statement from the Treasury letterhead had this crucial sentence:

“We will continue to cooperate to promote sustainable economic growth, financial stability, as well as orderly and well-functioning financial markets. We will also continue to consult closely on foreign exchange market developments in line with our existing G20 commitments, while acknowledging serious concerns of Japan and the Republic of Korea about the recent sharp depreciation of the Japanese yen and the Korean won.”

Here’s how Ram interpreted that language:

- There is perhaps room for the central banks of Japan and South Korea to combine efforts to draw lines in the sand for their currencies;

- The statement, though, doesn’t give a sense that the US might be keen to join any such efforts. That is especially so in light of Treasury Secretary Janet Yellen’s avowed preference for the markets to determine an appropriate exchange rate.

Back in June 1998, the US and Japan shored up the yen in coordinated intervention, sending the dollar crashing by 4.5% in just one day, so while the markets seem to be interpreting the latest joint statement to mean that there is perhaps approval for coordinated currency intervention, Ram sees it as an admission that the US isn’t interested in joining any such effort.

While Japan and Korean combining efforts to rescue their currencies would have a huge, though temporary, effect on sentiment, it won’t be nearly as dramatic if the US were involved. And since the prospect of an imminent intervention from Japan doesn’t look so compelling, that's why the dollar is just down mildly today.

Still, even Japan may have no choice but to do it alone: Morgan Stanley FX analyst Daniel Blake published an overnight note according to which potential currency intervention rises as the yen approaches a key threshold of 155 against rises as a yen weaker than that level poses risk for Japanese stocks, and also exacerbates momentum reversal in Japanese stocks.

We give the last word to Bloomberg's Paul Dobson who echoed the above sentiment and said that Janet Yellen acknowledged the “serious” concerns expressed by Japan and South Korea over sharp declines in their currencies, offering a green light for them to intervene if necessary. The reason is simple: the US also doesn't want a super-strong, rapidly-appreciating dollar, while its global peers would prefer a little bit more stability for their depreciating currencies.

True, it’s not such a bad thing for the US if it has enhanced purchasing power — for starters, it should help it conquer inflation. But nobody wants other nations to be able to undercut them with way cheaper products and manufacturing for too long.

Imagine if China let the yuan go where the market would like it to be all at once— there’d probably be some pretty hasty protests or retribution.

And it’s worth noting that most larger Asian economies have plenty of firepower if they do need to push back against the dollar, having built up currency reserves for just such an eventuality. That could come in handy, because if the Fed does stay on hold for a lot longer (or starts to hike again) they may well be called on. Perhaps it’s also not such a bad thing for the US

Bottom line, however, is that with Biden still going full debt throttle on the US economy to demonstrate just how amazing Bidenomics is, even if it costs the US $1 trillion in debt every 100 days to maintain this growth illusion and is sowing the seeds of the next financial crisis as even the IMF warned (see IMF Warns Biden's Fiscal Profligacy Poses "Significant Risks" To Global Economy 'In Great Election Year'), any truly aggressive shorting of the US Dollar will likely wait to have until Trump wins the elections at which point the deep state bureaucrats will have no choice but to admit just how ugly the US economic picture really is, and the USD craters.