Potential MoF activity boosts JPY post-BoJ; ahead is the tri-lateral meeting between US, Ukraine and Russia - Newsquawk US Opening News

- BoJ maintained its short-term interest rate at 0.75%, as expected, with an 8-1 vote split as Takata voted for a 25bp hike.

- BoJ Outlook Report revised its 2025 and 2026 GDP forecast higher, while shifting its 2027 forecast lower; 2026 inflation was revised higher to 1.9% (prev. 1.8%).

- USD/JPY saw two-way action on the announcement, gained during Ueda’s presser before tumbling on potential MoF activity.

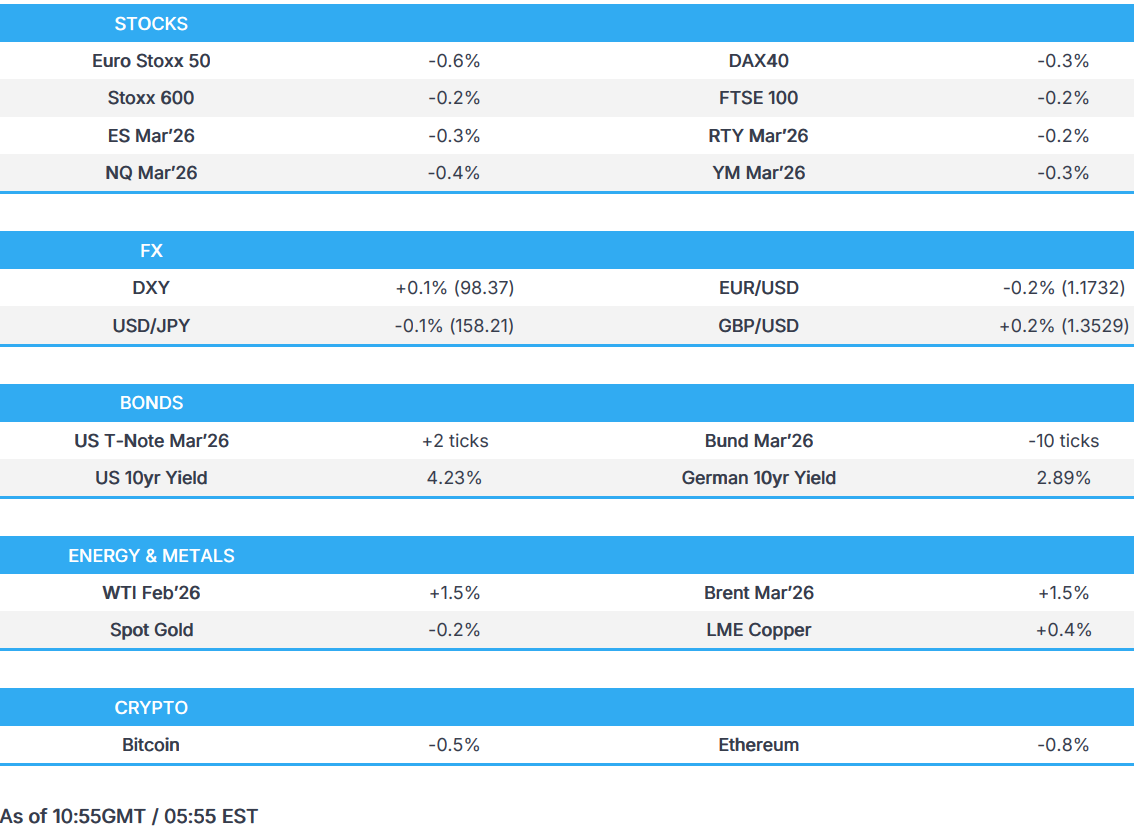

- European bourses and US equity futures are trading lower; NQ -0.4%.

- USTs & Bunds near-enough flat, Gilts led before turning around, JGBs lag.

- Commodities count down to the trilateral summit, XAU made another ATH overnight, but now off best levels.

- Looking ahead, Global Flash PMIs (Jan), Canadian Retail Sales (Nov), US UoM Consumer Expectations Final (Jan), Tri-lateral meeting between the US, Ukraine and Russia.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses are trading largely on the backfoot, in contrast to the broadly positive action seen overnight.

- European sectors are trading mostly in the red. Leading sectors are Telecommunications (+1.1%), Energy (+1.2%) and Healthcare (+0.4%). Telecommunication has been given a boost by Ericsson (+8.3%) after the Co. reported strong Q4 earnings, whilst stronger crude prices has underpinned the Energy sector. On the flip side, Construction (-0.9%), Travel (-1.0%) and Financial Services (-0.5%) lag - no fresh newsflow driving the move.

- US equity futures are broadly lower, following the subdued risk tone seen in Europe. Focus ahead will be on US Flash PMIs, with attention also on the trilateral meeting between US-Russia-Ukraine.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is incrementally firmer this morning and trades within a 98.25-98.48 range, which is towards the lower end of the prior day’s confines. Newsflow for the index is lacking this morning, with all attention on the upcoming trilateral meeting between US-Russia-Ukraine; Trump reminded that “anytime we meet, it is good".

- JPY currently the top G10 performer this morning. Earlier, the BoJ kept rates steady (subject to dissent) and upwardly revised their 2026 inflation forecasts – spurring upside in the JPY at the time, but gradually waned into the Ueda meeting. The Governor avoided any overt hike signal, but noted that they are wary of a “rapid” rise in yields, also adding that they "must pay attention to even small FX moves" (strengthening JPY).

- Thereafter, a significant bout of pressure was seen in USD/JPY, soon after Ueda concluded its presser. In more detail, USD/JPY fell from 159.10 to 157.32 in an immediate reaction, before gradually scaling back to around 158.00 mark where the pair currently resides. Some had touted intervention, though Bloomberg's Cudmore suggested the move is a rate check (i.e. the MOF calling round to see where banks think the JPY should be). In response, Finance Minister Katayama declined to comment if they intervened in the FX market, instead reiterating that they are watching FX moves with a high sense of urgency.

- G10s are mixed against the Dollar. GBP is towards the top of the pile, with upside facilitated by a hotter-than-expected Retail Sales report (which also included upward revisions to the prior); PMI figures this morning also paint a positive activity picture in the region. Thereafter, Cable took another leg higher to a session peak of 1.3532 after BoE’s Greene said, “forward indicators for wage growth are even more concerning than inflation expectations”, with other commentary generally striking a typical hawkish tone.

- Elsewhere, EUR is mildly lower; earlier slipped to session lows on the subdued French PMI metrics (Services surprisingly contracted), but then jumped on the upbeat German figures.

FIXED INCOME

- JGBs are lower by c. 40 ticks at the moment, with downside of just under 50 at most at a 131.32 session low. Action that comes after the BoJ and Ueda's presser where, in short, the narrative is that April is the earliest point for a hike, as Ueda specifically referenced seeing price behaviour for that period as a "factor to mull a hike". Though, JGBs remain markedly clear of their WTD 130.66 trough and by extension yields are off WTD highs. Nonetheless, the week's action, driven by fiscal commentary and the BoJ, has sparked a modest shift in market pricing; with 21bps of tightening currently implied by June vs c. 18bps last week; for April, its 14bps currently vs 11bps last week.

- USTs a tick or two higher in a very thin 111-19 to 112-23 band, awaiting the trilateral summit re. Ukraine (timing TBC), flash PMIs and the potentially imminent Fed Chair announcement.

- Bunds, in contrast, are a tick or two lower. But, also in a narrow 127.64-84 band. Modest two-way action on but no real move to the January Flash PMIs, as political uncertainty re. France and the latest geopolitical/tariff gyrations potentially making some of the responses redundant.

- OATs are broadly in-line with core benchmarks. Towards the mid-point of 121.10 to 121.27 parameters. Earlier, the French parliament found confidence in PM Lecornu (as expected), though he is still subject to another no-confidence motion. Into this, the OAT-Bund 10yr yield spread has widened a touch, out to 63bps, but within comfortable and familiar territory.

- Gilts outperform. Gains of 32 ticks at best to a 91.68 high, currently holding around 10 ticks off that. Upside despite the strong December Retail Sales release and upward revisions to the November Y/Y components. Data that appears to have been overshadowed by a reassessment of the political risk after Thursday's Burnham-induced sell-off; as more commentators pick up on the detail that Burnham's path to becoming an MP is tricky, and largely dependent on the pro-Starmer Labour NEC.

- However, the move for Gilts unwound after strong UK PMIs and hawkish commentary from BoE's Greene, points that were enough to take the benchmark to near enough flat on the day.

COMMODITIES

- In short, the commodity space awaits the trilateral summit between Ukraine, Russia and the US today and potentially into tomorrow. Timing and details around the meeting are currently light, though we do know the attendees. From Ukraine, Umerrov, Budanov, Arakhamia and Hnatov. From Russia, Kostyukov; note, Dmitriev is also in the UAE, unclear if he will partake. From the US, Witkoff and Kushner.

- Crude is firmer by just under a USD a barrel. Towards highs of USD 60.22/bbl and USD 64.93/bbl for WTI and Brent, respectively. Upside that is more a consolidation from the downside seen on Thursday than a fundamentally-driven move higher.

- XAU pulled back in the early European morning. A move that, interestingly, occurred alongside downside in US equity futures at the time. As such, the move is perhaps profit-taking from recent gains; we also note similar action in silver at the time, though XAG remains firmer on the day. Spot gold briefly broke below USD 4.9k/oz, after hitting USD 4967/oz overnight.

- Base metals feature gains in 3M LME Copper. Upside that seemingly occurred alongside strength in China overnight. At best 3M LME to USD 12.97k/T. Note, Shanghai Futures Exchange is to adjust price limits and margin ratios for nickel, aluminium, lead, zinc, and stainless-steel futures as of the 27th January settlement.

- China’s Shanghai Futures Exchange will adjust price limits and margin ratios for nickel, aluminium, lead, zinc, and stainless-steel futures following the 27th of January closing settlement.

- China is reportedly set to offer CNY-denominated liquefied natural gas futures contracts as early as February, according to sources.

- Goldman Sachs lowers its Summer'26 Henry Hub forecast to USD 3.75/MMBtu (prev. USD 4.50/MMBtu), maintains 2027 forecast at USD 3.80/MMBtu.

- US President Trump said Venezuelan oil will be divided up.

TRADE/TARIFFS

- EU official said India and EU will announce a free trade agreement as soon as next week.

- EU Official announces that the India-EU FTA will lead to substantially lower tariffs.

- The Trump administration pushed out 2 key officials focused on countering technological threats from China, the WSJ reported citing sources; this has raised concerns among US security hawks about the softer stance towards China.

- Spanish PM Sanchez said the US is provoking tension in the Transatlantic, EU have the instruments to respond proportionally to coercion.

- The EU is moving to revive its US trade deal after President Trump backed away from his tariff threat tied to Greenland.

- US President Trump said the people who brought the tariff legislation against the US are strongly China-oriented; the US is going so well, giant growth and investment with almost no inflation.

NOTABLE EUROPEAN HEADLINES

- Germany's core budget had borrowing of EUR 66.9bln instead of the allocated EUR 81.8bln, according to sources. Sources also reported that total investment hits record level of EUR 86.8bln in 2025.

- French parliament finds confidence in PM Lecornu (i.e. the no-confidence motion failed); another motion to follow shortly.

NOTABLE EUROPEAN DATA RECAP

- UK S&P Global Composite PMI Flash (Jan) 53.9 vs. Exp. 51.5 (Prev. 51.4).

- UK S&P Global Services PMI Flash (Jan) 54.3 vs. Exp. 51.7 (Prev. 51.4).

- UK S&P Global Manufacturing PMI Flash (Jan) 51.6 vs. Exp. 50.6 (Prev. 50.6).

- UK Retail Sales MoM (Dec) M/M 0.4% vs. Exp. -0.1% (Prev. -0.1%, Low. -0.7%, High. 0.5%).

- UK Retail Sales ex Fuel YoY (Dec) Y/Y 3.1% vs. Exp. 1.4% (Prev. 2.6%, Rev. From 1.2%, Low. 0.8%, High. 2.2%).

- UK Retail Sales YoY (Dec) Y/Y 2.5% vs. Exp. 1% (Prev. 1.8%, Rev. From 0.6%, Low. 0.4%, High. 1.7%).

- UK Retail Sales ex Fuel MoM (Dec) M/M 0.3% vs. Exp. -0.2% (Prev. -0.4%, Rev. From -0.2%, Low. -0.8%, High. 0.5%).

- UK Gfk Consumer Confidence (Jan) -16 vs. Exp. -16 (Prev. -17).

- EU HCOB Services PMI Flash (Jan) 51.9 vs. Exp. 52.6 (Prev. 52.4).

- EU HCOB Manufacturing PMI Flash (Jan) 49.4 vs. Exp. 49.1 (Prev. 48.8).

- EU HCOB Composite PMI Flash (Jan) 51.5 vs. Exp. 51.8 (Prev. 51.5). "

- German HCOB Composite PMI Flash (Jan) 52.5 vs. Exp. 51.6 (Prev. 51.3).

- German HCOB Services PMI Flash (Jan) 53.3 vs. Exp. 52.5 (Prev. 52.7).

- German HCOB Manufacturing PMI Flash (Jan) 48.7 vs. Exp. 47.8 (Prev. 47.0).

- French HCOB Composite PMI Flash (Jan) 48.6 vs. Exp. 50.1 (Prev. 50.0).

- French HCOB Manufacturing PMI Flash (Jan) 51.0 vs. Exp. 50.3 (Prev. 50.7).

- French HCOB Services PMI Flash (Jan) 47.9 vs. Exp. 50.5 (Prev. 50.1).

CENTRAL BANKS

BoJ

- BoJ maintains its short-term interest rate at 0.75%, as expected; 8-1 vote split with Takata voting for a 25bps hike.

- BoJ Governor Ueda (post-policy presser) said headline inflation soon to undershoot 2%; not yet at the stage to mull if goal achievement is coming earlier. Will conduct monetary policy in such a way as to ensure they do not fall behind the curve. Will keep raising rates if the economic outlook is realized. It will take a while before the full impact of tightening is seen across the economy, conditions remain accommodative after the December move. Will conduct nimble market operations to respond to irregular moves; will work closely with the government on long-term rates. Operations could be conducted to encourage stable yield formation. Must pay attention to even small FX moves as underlying inflation approaches 2%.

Other

- BoE's Greene said due to spillovers, there can be a case for the BoE doing the opposite of the Fed in cases of divergence. Underlying employment growth remains a sideways trend, with vacancies looking to have levelled out. No evidence of a non-linear increase in unemployment is immediate. BoE survey data suggests that the decline in wage growth has now run its course. Forward indicators for wage growth are even more concerning than inflation expectations.

- RBNZ Governor Breman reaffirms commitment to achieve inflation mid-point, core inflation remains within the target range.

- US President Trump said mortgage rates hit a 3-year low despite "Too Late" Powell; the Fed has been discredited during Chair Powell's reign.

- US President Trump, on the Fed Chair, said he is done with interviews and has someone in mind.

NOTABLE US HEADLINES

- US President Trump thanks Chinese President Xi for working with the US and ultimately approving the TikTok deal, adds that Xi could have gone the other way.

- US House passes package of FY26 funding bills in a major step towards averting government shutdown on Jan 31st; sending to Senate for final votes.

- US Government funding package is poised for House approval as voting continues.

- US House Speaker Johnson said there is no GOP consensus on whether to use tariff revenue to send USD 2k checks out.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin said discussions in Abu Dhabi will happen today and will continue tomorrow if necessary. Russia's sovereign assets frozen in the US amount to a little less than USD 5bln. Not looking to go into details on the "Anchorage Formula" for peace agreement with Ukraine.

- Ukrainian President Zelensky said he discussed with US President Trump additional air defence missiles, and provisions for PAC-3 & anti-ballistic missiles.

- Ukraine President Zelensky said he is waiting for US President Trump, a date, and a place for the signing of security guarantees.

- Russia's Kremlin said Greenland proposal and Board of Peace were discussed with US envoys; talks were constructive. Without solving the territorial issue, there is no prospect of long-term settlement in Ukraine.

- Russian envoy Dmitriev called the meeting between President Putin and US envoys important.

- Russia's Kremlin said the talks between President Putin and US envoys have concluded.

- US President Trump said Russian President Putin, alongside others, will have to make concessions to end the war in Ukraine. Putin and Zelensky want to make a deal. Ukraine war doesn't affect the US, it affects Europe.

- EU Commission President von der Leyen said Europe will continue to work on Arctic security, step up investments in Greenland and Arctic-ready equipment and deepen cooperation with partners in the region. Well-prepared with measures if tariffs are applied. Europe should use defence spending 'surge' on Arctic-ready equipment. Close to prosperity deal with the US and Ukraine.

- US President Trump said the US will work with NATO on Greenland security; there are good things for Europe within the framework. On the trilateral meeting with Ukraine and Russia, said "anytime we meet, it is good". There will be something on Greenland in 2 weeks.

- Russian defence ministry reported strategic bomber patrols conducted over Baltic Sea.

MIDDLE EAST

- Israeli officials reportedly express concern that they could be targeted in retaliation by Iran in response to a US strike, FT reported citing sources.

- US President Trump, on Iran, said they have a big force going towards Iran; watching Iran very closely and would rather not see something happen on Iran; will be doing a 25% secondary tariff on Iran.

OTHERS

- US President Trump posted that the Board of Peace withdraws its offer for Canada to join.

- US President Trump posted "Maybe we should have put NATO to the test: Invoked Article 5, and forced NATO to come here and protect our Southern Border from further Invasions of Illegal Immigrants".

- US House narrowly rejects resolution to limit President Trump's war powers in Venezuela.

- US President Trump said Chinese President Xi will come to the US towards the end of the year.

- NATO's Rutte and Denmark's PM is to meet on Friday morning.

- Russian defence ministry reported strategic bomber patrols conducted over Baltic Sea.

CRYPTO

- Bitcoin is a little lower and trades just above the USD 89k mark, whilst Ethereum holds above USD 2.9k.

APAC TRADE

- APAC stocks traded entirely in the green, though without a clear sector-led driver, as regional sentiment stayed broadly constructive.

- ASX 200 posted modest gains, supported by strength in mining and metals as gold, silver and platinum extended their bid. A strong PMI print — with both manufacturing and services pushing further into expansion — added to the positive tone.

- Nikkei 225 gapped higher at the open but later pared part of its advance, pressured by chip stocks after weak Intel earnings. Offsetting some of the drag, videogame names outperformed, with Nintendo (+5%) boosted by strong US Switch 2 sales data. Following the BoJ rate decision, the Nikkei was unreactive as rates remained unchanged.

- Hang Seng and Shanghai Comp opened higher, with the Hang Seng outperforming after Alibaba (+3.6%) was reported to be preparing the listing of its chipmaking arm. Metals strength following fresh records in gold and silver also supported both indices.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi had a phone call with Brazilian President Lula, Xinhua reported. China is willing to cooperate with Brazil in different areas.

NOTABLE APAC DATA RECAP

- Indian HSBC Composite PMI Flash (Jan) 59.5 (Prev. 57.8).

- Indian HSBC Manufacturing PMI Flash (Jan) 56.8 (Prev. 55).

- Indian HSBC Services PMI Flash (Jan) 59.3 (Prev. 58.0).

- Japanese S&P Global Services PMI Flash (Jan) 53.4 (Prev. 51.6).

- Japanese S&P Global Manufacturing PMI Flash (Jan) 51.5 (Prev. 50.0).

- Japanese Inflation Rate YoY (Dec) Y/Y 2.1% (Exp. 2.2%, Prev. 2.9%).

- Japanese Inflation Rate MoM (Dec) M/M -0.1% (Prev. 0.3%, Rev. From 0.4%).

- Japanese Inflation Rate Ex-Food and Energy YoY (Dec) Y/Y 2.9% vs. Exp. 2.8% (Prev. 3%).

- Japanese Core Inflation Rate YoY (Dec) Y/Y 2.4% vs. Exp. 2.4% (Prev. 3.0%).

- Australian S&P Global Composite PMI Flash (Jan) 55.5 (Prev. 51).

- Australian S&P Global Services PMI Flash (Jan) 56.0 (Prev. 51.1).

- New Zealand Inflation Rate QoQ (Q4) Q/Q 0.6% vs. Exp. 0.5% (Prev. 1%).

- New Zealand Inflation Rate YoY (Q4) Y/Y 3.1% vs. Exp. 3% (Prev. 3%).

NOTABLE APAC EQUITY HEADLINES

- China is considering tighter rules for firms to list in Hong Kong amid deal quality concerns, Bloomberg reported.