President Trump to allow NVIDIA to ship H200 chips to China; Quiet APAC session to continue into Europe - Newsquawk EU Market Open

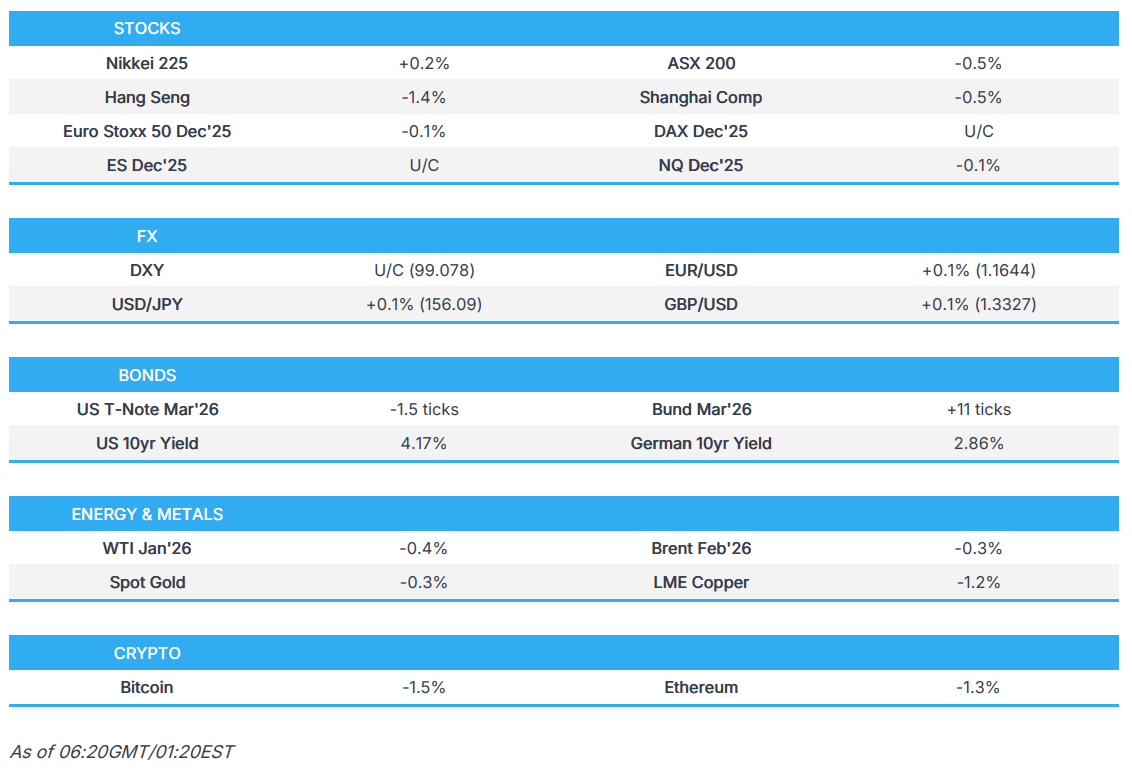

- APAC stocks were subdued following the lacklustre lead from Wall Street, with markets cautious ahead of the FOMC policy announcement on Wednesday.

- US President Trump announced that he informed Chinese President Xi that the US will allow NVIDIA (NVDA) to ship its H200 products to approved customers.

- RBA unsurprisingly kept the Cash Rate unchanged at 3.60%, although comments from RBA Governor Bullock at the press conference leaned hawkish.

- Ukrainian President Zelensky said talks in London were productive and there is small progress towards peace.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 futures -0.1% after the cash market closed flat on Monday.

- Looking ahead, highlights include German Trade Balance (Oct), US Average Weekly Prelim Estimate ADP (4-week, w/e 22 Nov), JOLTS (Sep), EIA STEO, Speakers including ECB's Nagel, BoJ's Ueda, BoE's Ramsden, Lombardelli, Mann, Dhingra & RBNZ's Breman, Supply from UK & US, Earnings from GameStop.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were mostly lower to start the week with all sectors but Technology in the red, while Communications and Consumer Discretionary were the worst performers, with the former weighed by downside in Alphabet (GOOGL, -2.3%) and Netflix (NFLX, -3.4%) due to an attractive all-cash Paramount (PSKY, +9.0%) bid for Warner Bros (WBD, +4.4%). Tesla (TSLA, -3.4%) was weighed on Consumer Discretionary after receiving a downgrade at Morgan Stanley due to its high valuation, a more cautious EV outlook, and non-auto growth being priced in.

- A blip of reprieve was seen for US indices following a Semafor report that the US is to allow NVIDIA (NVDA, +1.7%) H200 chip exports to China, although the move swiftly pared for US indices, and mostly did for NVIDIA as well.

- SPX -0.35% at 6,847, NDX -0.25% at 25,628, DJI -0.45% at 47,739, RUT -0.02% at 2,251.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said he spoke with Chinese President Xi very recently and thinks that China will buy even more soybeans than promised. Trump separately announced that he informed Chinese President Xi that the US will allow NVIDIA (NVDA) to ship its H200 products to approved customers in China and other countries, while Trump added that President Xi responded positively, and that 25% will be paid to the US. Furthermore, Trump said the Department of Commerce is finalising the details, and that the same approach will apply to AMD (AMD), Intel (INTC) and other great US companies.

- US President Trump posted that ''Mexico continues to violate our comprehensive Water Treaty, and this violation is seriously hurting our BEAUTIFUL TEXAS CROPS AND LIVESTOCK. Mexico still owes the U.S over 800,000 acre-feet of water for failing to comply with our Treaty over the past five years." Trump added that the "U.S needs Mexico to release 200,000 acre-feet of water before December 31st, and the rest must come soon after. As of now, Mexico is not responding, and it is very unfair to our U.S. Farmers who deserve this much needed water. That is why I have authorized documentation to impose a 5% Tariff on Mexico if this water isn’t released, IMMEDIATELY."

- US President Trump said they will end up putting severe tariffs on fertiliser from Canada if they have to, while it was separately reported that the US Ambassador to Canada said President Trump doesn't want to terminate USMCA, according to the National Post.

- US lawmakers urged US President Trump to ease Japan tariffs amid Chinese economic coercion, according to Nikkei.

- US Treasury Secretary Bessent said they are working on an India trade deal.

- Chinese Premier Li said at the '1 + 10' dialogue with the heads of major international economic organisations that the global economy in 2025 is marked by turbulence and twists, creating urgent demand for reforming and improving global economic governance, while he added that tariffs have dominated global discussions on the economy this year and that mutually destructive consequences of tariffs becoming increasingly evident. Li said calls for free trade are growing louder and that AI is also becoming central to global trade discussions.

NOTABLE HEADLINES

- US President Trump said he is taking action to protect farmers and confirmed the US will provide USD 12bln aid to farmers. Trump said farming equipment has gotten too expensive, while he added that they will take those rules off and want a reduction in prices on farming equipment.

- US farmers said the Trump administration’s USD 12bln aid package brings temporary relief, but is unlikely to kickstart a lasting recovery for the American farm economy, according to Bloomberg.

APAC TRADE

EQUITIES

- APAC stocks were subdued following the lacklustre lead from Wall Street with markets cautious ahead of the FOMC policy announcement on Wednesday, where participants will also be eyeing the central bank's latest dot plot projections, while downside was stemmed in the region amid a further warming of US-China trade relations after US President Trump confirmed that the US will permit NVIDIA (NVDA) to sell its H200 chips to China.

- ASX 200 was pressured following the RBA rate decision where the central bank unsurprisingly kept the Cash Rate unchanged at 3.60%, although comments from RBA Governor Bullock at the press conference leaned hawkish as she stated that it looks like more rate cuts are not needed and she doesn't see rate cuts in the foreseeable future, while she added that the outlook is for an extended pause or hikes, but would not put a probability on it.

- Nikkei 225 lacked conviction and swung between gains and losses within a narrow range following recent currency weakness and anticipation that the BoJ will hike rates next week.

- Hang Seng and Shanghai Comp were subdued after the readout from yesterday's Politburo meeting underwhelmed, as some were hoping for more forceful measures, while chipmakers in China were pressured in early trade after US President Trump's announcement to allow NVIDIA to sell chips to approved customers in China.

- US equity futures were rangebound but off yesterday's worst levels, with the help of the further warming in US-China trade relations.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 futures -0.1% after the cash market closed flat on Monday.

FX

- DXY was little changed amid a non-committal tone ahead of Wednesday's Fed policy announcement and rate projections, while there have been some mixed US trade/tariff-related headlines as US President announced that he informed Chinese President Xi that the US will allow NVIDIA (NVDA) to ship its H200 products to approved customers in China and other countries, but then threatened Mexico with an additional 5% tariff if it does not immediately release additional water to help US farmers.

- EUR/USD traded sideways amid a lack of catalysts and with the single currency largely unaffected by the recent bout of ECB rhetoric.

- GBP/USD kept afloat but with price action confined within tight parameters amid quiet pertinent newsflow and a sparse data calendar to begin the week, although there are several BoE policymakers scheduled to appear before the Treasury Select Committee later today.

- USD/JPY took a breather after climbing yesterday in the aftermath of a magnitude 7.6 earthquake, which prompted Japan to issue a tsunami warning, although this was later downgraded to a tsunami advisory and all advisories were eventually lifted.

- Antipodeans strengthened as focus was on the RBA meeting where the central bank maintained the Cash Rate at 3.60%, as unanimously forecast, while support was seen during the post-meeting press conference where RBA Governor Bullock noted that it looks like more rate cuts are not needed.

- PBoC set USD/CNY mid-point at 7.0773 vs exp. 7.0748 (Prev. 7.0764).

FIXED INCOME

- 10yr UST futures remained subdued ahead of a 10-year auction and amid some pre-FOMC anxiety.

- Bund futures partially nursed some of its recent losses after retreating firmly beneath the 128.00 level yesterday amid a bond rout and following hawkish rhetoric from ECB's Schnabel, while participants now await German trade data.

- 10yr JGB futures bounced off the prior day's lows but with the recovery limited amid BoJ December rate hike expectations and following a weaker 5yr JGB auction.

COMMODITIES

- Crude futures were lacklustre after sliding throughout the prior day amid Ukraine/Russia updates including Ukrainian President Zelensky’s meeting with key European allies as he faces US pressure to reach a swift peace deal with Russia, and although little new was reported, the UK government stated that leaders all agreed it is a critical moment and that they must continue to ramp up support to Ukraine and economic pressure on Russian President Putin.

- Crude flow from Lukoil's West Qurna-2 storage tanks resumed towards major crude oil depots of Tuba, according to energy sources cited by Reuters.

- Spot gold was indecisive in rangebound trade amid an uneventful dollar and with participants cautious ahead of the FOMC.

- Copper futures trickled lower with demand hampered amid the mostly subdued overnight risk appetite.

CRYPTO

- Bitcoin was pressured overnight and returned to beneath the USD 90,000 level.

NOTABLE ASIA-PAC HEADLINES

- RBA kept the Cash Rate unchanged at 3.60%, as expected, with the decision unanimous and noted that recent data suggests the risk to inflation have tilted to the upside, but it will take a little longer to assess persistence of inflationary pressures, while it added that private demand is recovering, and labour market conditions still appear a little tight, though modest easing is expected. RBA said the board judged it appropriate to remain cautious and update its outlook as the data evolves, with the board to be attentive to the data and evolving assessment of the outlook and risks to guide its decisions. Furthermore, the board judged that some of the recent increase in underlying inflation was due to temporary factors, while it is focused on its mandate to deliver price stability and full employment, and will do what it considers necessary to achieve that.

- RBA Governor Bullock said at the post-meeting press conference that inflation and jobs data will be important for the board meeting in February, while she added that it looks like more rate cuts are not needed. Bullock stated they did not consider a rate cut and did not explicitly consider the case for a rate hike at this meeting, but discussed the circumstances in which tightening might be required. Bullock said if inflation looks persistent, it will raise questions for policy, while she would not put timing on any future move and will proceed meeting by meeting. Furthermore, she doesn't see rate cuts in the foreseeable future and noted the outlook is for an extended pause or hikes, but would not put a probability on it.

DATA RECAP

- Australian NAB Business Confidence (Nov) 1.0 (Prev. 6.0)

- Australian NAB Business Conditions (Nov) 7.0 (Prev. 9.0, Rev. 10)

GEOPOLITICS

MIDDLE EAST

- Israeli military announced it struck infrastructure belonging to Hezbollah in several areas in southern Lebanon.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said talks in London were productive and there is small progress towards peace, while he added that the Ukraine-Europe plan proposals should be ready by Tuesday to share with the US. Zelensky said Ukraine cannot give up land and that the US is trying to find a compromise on the issue, as well as noted that Ukraine lacks USD 800mln for the US weapons purchase programme this year. Furthermore, he said a Coalition of the Willing meeting is to take place this week and that China is not interested in forcing Russia to end its war in Ukraine.

- EU Commission President von der Leyen says as peace talks are ongoing, the EU remains ironclad in its support for Ukraine, while she added that the goal is a strong Ukraine, on the battlefield and at the negotiating table. Furthermore, she said Ukraine's sovereignty must be respected, and Ukraine's security must be guaranteed in the long term as a first line of defence for our union.

- UK government said leaders all agreed that now is a critical moment and must continue to ramp up support to Ukraine and economic pressure on Russian President Putin.

- The Times' Swinford said "Britain and the EU are getting closer to releasing GBP 200bln worth of frozen Russian assets to fund Ukraine's reconstruction - announcement could come within days".

EU/UK

NOTABLE HEADLINES

- BoE's Taylor said the foot is on the brake a little bit still, while he added that wage inflation and services inflation are coming down.

- European Parliament said parliament and member state negotiators reached a provisional deal to update EU rules on sustainability reporting and due diligence requirements for companies. Furthermore, it stated that companies with more than 1,000 employees and annual turnover over EUR 450mln are to report on their sustainability, while large corporations with more than 5,000 employees and annual turnover of more than EUR 1.5bln are to carry out due diligence on their adverse impacts.

DATA RECAP

- UK BRC Retail Sales YY (Nov) 1.2% (Prev. 1.5%)

- UK BRC Total Sales YY (Nov) 1.4% (Prev. 1.6%)

- Barclays UK November Consumer Spending fell 1.1% Y/Y (prev. -0.8%), the largest decline since February 2021.