President Trump raises tariffs on South Korea; US equity futures point to a positive open with a heavy earnings docket ahead - Newsquawk US Market Open

- US President Trump's announced he is to raise tariffs on South Korean autos, lumber, pharma, and all other reciprocal tariffs to 25% from 15% due to Korea not yet enacting the trade deal.

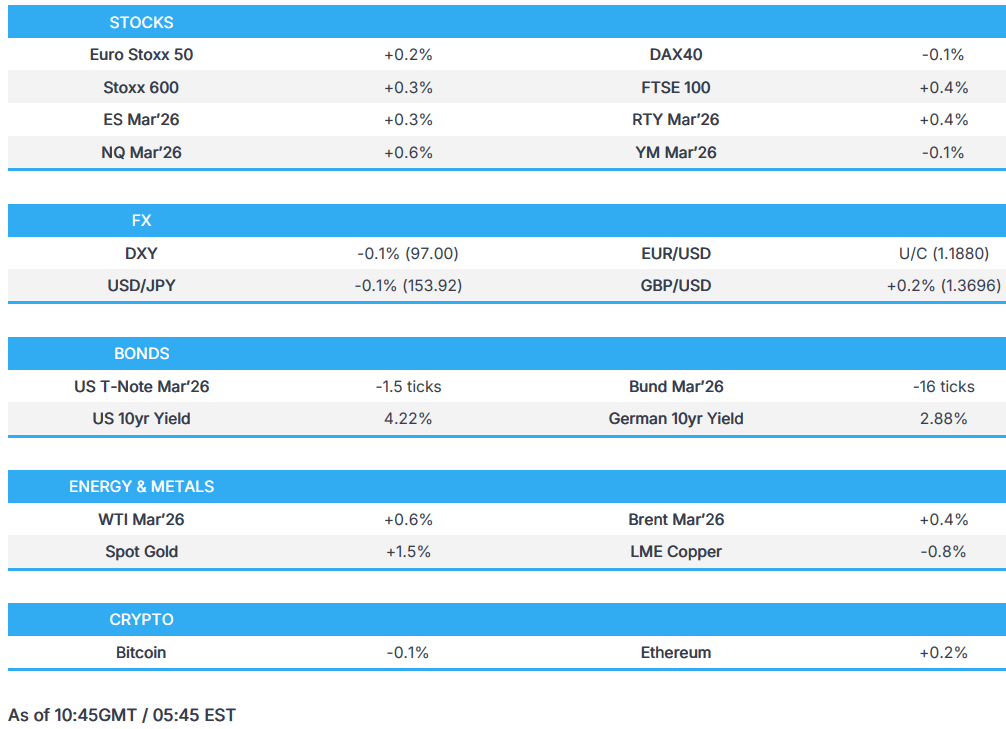

- USD/JPY fell sharply below 154.00 without a clear catalyst, in a move similar to Friday’s post-Ueda drop, DXY is slightly lower.

- European and US equity futures are broadly in the green; a slew of US earnings are on the docket.

- Fixed benchmarks hold a bearish bias, Bunds little moved to a robust auction.

- Crude prices slightly firmer, whilst Nat Gas prices remain elevated; precious metals rebound following Monday's selloff.

- Looking ahead, US Richmond Fed (Jan), Consumer Confidence (Jan), ADP Employment Change Weekly, NBH Policy Announcement. Speakers include ECB President Lagarde & ECBʼs Nagel, US President Trump. Supply from the US. Earnings from Texas Instruments, Boeing, General Motors, RTX, American Airlines, Logitech & LVMH.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.3%) are broadly in the green this morning, following a similar theme seen in the APAC session. The DAX 40 (-0.2%) is mildly pressured whilst the FTSE 100 (+0.4%) outperforms slightly, benefitting from strength in Banking names.

- European sectors are mixed; Banks lead followed closely by Insurance names whilst Basic Resources lags given the broader losses seen in underlying metal prices. In terms of key movers, Puma (+4%) opened higher by 20%, but has since pared much of that move - Jefferies highlighted that ANTA may find it hard to boost Puma's brand in China, given it already has high presence in the region.

- US equity futures (ES +0.2%, NQ +0.4%, RTY +0.2%) are firmer across the board, with very mild outperformance in the NQ. The US docket is somewhat sparse, a handful of earnings due before ADP and supply.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- G10s were initially broadly lower against the USD, but following recent JPY strength, G10s are now broadly higher. JPY leads the pile (vs initially underperforming), whilst the NZD and CAD hold around the unchanged mark. EUR/USD is mildly lower, and ultimately within a narrow 1.1850-1.1899 range. Earlier, the EU and India announced an FTA, which cut circa EUR 4bln of tariffs on the bloc’s exports.

- Delving into USD/JPY, the pair fell from 154.49 to a session low of 153.16 within a few minutes, but has since pared back towards 153.90. This drove the pair below the prior day’s low, and also below its 100 DMA at 153.61. A move that also weighed on the Dollar index, which fell from 97.10 to a session low of 96.90. Nothing fresh behind that move, with participants ultimately mindful of potential intervention risks, or further rate checks being carried out by the US and/or Japan. Note, the JPY move occurred alongside reports of an explosion near Iran's Parchin site, a development that potentially influenced the JPY; however, the lack of follow-through to other assets, particularly crude, diminishes this narrative.

- DXY is flat this morning and trades within a 96.90 to 97.28 range, and currently holding within the prior day’s ranges. On the trade front, US President Trump said South Korea had delayed its trade agreement with the US and imposed a 25% tariffs on various Korean sectors – the Korean Industry Minister is to visit the US, and aims to pass a special act on the deal by end-February. The Korean Won was initially pressured at the reopen of trading, but has pared about half of the move. Back to the US, markets await ADP Weekly Average figures, Richmond Fed and Consumer Confidence. Participants also count down to the FOMC tomorrow. Barring any surprises in the data, the DXY may find itself relatively rangebound into the confab.

- Click for NY OpEx Details

FIXED INCOME

- A modestly bearish start for fixed income. Action driven by the mostly constructive risk tone, though there are some pockets of weakness in Equities.

- USTs a tick or two softer in a 111-23 to 111-26+ band, within Monday's 111-22+ to 111-30 parameters. Aside from supply, which follows a solid 2yr auction last night, the US docket is headlined by ADP.

- Bunds are also lower, with magnitudes slightly larger to losses of 15 ticks at most. No follow through to Bunds or EGBs generally from the morning's German and Italian supply, taps that were unremarkable but robust enough.

- Gilts gapped lower by 15 ticks, acknowledging the pressure seen in peers overnight from the constructive risk tone. Since, the benchmark has stabilised slightly off lows and trades broadly in line with European benchmarks. The morning's 2033 UK auction was well received, with a b/c above the 3x mark, though this did not spur any move in Gilts.

- Italy sold EUR 3bln vs exp. EUR 2.5–3bln 2.20% 2028 BTP & EUR 2bln vs exp. EUR 1.5–2bln 1.10% 2031, 2.55% 2056 BTPei.

- UK sold GBP 3.25bln 4.125% 2033 Gilt: b/c 3.18x (prev. 3.04x), average yield 4.296% (prev. 4.191%), tail 0.2bps (prev. 0.3bps).

- Germany sells EUR 4.633bln vs exp. EUR 6bln 2.10% 2028 Schatz: b/c 2.1x, average yield 2.14%, retention 22.8%.

- Germany opens books to sell EUR-denominated 20-year Bund via syndicate; guidance seen +3bps to DBR.

- EIB to sell EUR-denominated 5-year bonds, guidance seen +9bps vs mid-swaps.

- Australia sold AUD 1bln 1.50% June 2031 bonds, b/c 3.46, avg. yield 4.4382%.

COMMODITIES

- Crude benchmarks softened in the earlier hours of the Asia-Pac session. WTI futures fell from USD 60.85/bbl to a trough of USD 60.17/bbl following the report, but have since rebounded slightly as the European session gets underway, but remains just shy of the USD 61/bbl figure. It was recently reported that explosions were heard near Iran's Parchin nuclear site, but no damage was reported. Some reports suggest it could have been a routine missile test – no move in crude benchmarks on the initial or subsequent reports.

- Nat Gas prices remain elevated, Dutch TTF holds above EUR 40/MWh while Henry Hub futures hover near USD 7/MMBtu, as the Arctic storm provides a short-term shock to gas production.

- Precious metals continue to rise, despite selling off late in the US session, which was seemingly led by profit-taking in silver. Spot XAU found support at USD 5,000/oz and is currently trading just shy of USD 5,100/oz. Spot silver returns above USD 112/oz after a USD 15/oz selloff from its ATH of USD 117.70/oz on Monday.

- 3M LME Copper re-opened lower, as it reacted from the selloff in the precious metals space, but found support at USD 13k/t before oscillating in a USD 13k-13.15k/t band.

- Explosions have reportedly been heard near Iran's Parchin nuclear site, no damage has been reported - details light, awaiting verification.

- Largest US power grid PJM Interconnection has issued alerts amid storm bolstering energy demand.

- Deutsche Bank expects a quarterly peak of USD 13k/t in Q2, with price moderation onwards as production recovers at several major mines. Threat of US tariffs on refined copper should lead to continued metal flows to the US in H1'26. On aluminium, they assume some moderation from current levels in H2 (2026 Avg. of USD 2.9k/t, peak of USD 3.1k/t in Q2).

- German's Economic Minister said they will move forward with the wind power tenders to expand capacity.

- Deutsche Bank thinks USD 6,000/oz for spot gold is achievable this year due to a weaker dollar; in alternative scenarios, USD 6,900/oz would be in line with the past 2-year outperformance. An eventual moderation of XAU/XAG ratio may result in higher absolute silver prices.

- ADNOC Gas (ADNOC) CEO said they're investing more than USD 20bln to increase processing capacity by approximately 30% by 2029.

- DTEK Power Company said the Russian attack damaged an energy facility in Ukraine's Odesa region.

- UAE’s ADNOC chief revises forecast and sees oil demand above 100mln barrels per day until 2040.

- US President Trump is said to be mulling a cap on California state fuel tax and vowed to drive down the state's gas prices, according to NY Post.

TRADE/TARIFFS

- US President Trump announces he is "increasing South Korean TARIFFS on Autos, Lumber, Pharma, and all other Reciprocal TARIFFS, from 15% to 25%".

- South Korea Legislature Trade Committee head said that passages of such trade bills usually take six to seven months.

- South Korea's ruling party said it aims to pass special act on US trade deal by end of February, according to Yonhap Infomax.

- South Korean ruling party official said bills to enact US investment have been introduced and will soon be reviewed.

- South Korean Industry Ministry said Minister is to visit the US soon and meet with Commerce Secretary Lutnick.

- EU Commission begins 2 set of proceeding on Google under the DMA; Google is designated as a core platform service, requiring interoperability with third-party services.

- China reportedly signs deals to buy at least 8 cargoes or approximately 520k tonnes of Canadian Canola following PM Carney's visit, according to sources.

- Chinese Foreign Minister said UK PM Starmer will visit China between January 28-31st.

- European Commission President von der Leyen said EU and India finalised a trade deal, and called it "the mother of all deals".

- Japan and the US are reportedly to announce several projects in a first batch under the USD 550bln scheme.

NOTABLE EUROPEAN HEADLINES

- China's Industry Ministry announces that they have renewed the cooperation MOU regarding green maritime tech and shipbuilding with Denmark.

- India to sign a security and defence partnership with EU today in addition to advancing the free trade agreement at the 16th India-EU Summit, according to The Print.

- UK government plans to tighten scrutiny of Chinese influence in the UK, with PM Starmer seeking to bolster the registration scheme while still deepening Sino-British ties, according to FT.

NOTABLE EUROPEAN DATA RECAP

- Spanish Unemployment Rate (Q4) 9.93% vs. Exp. 10.6% (Prev. 10.45%).

- French Consumer Confidence (Jan) 90 vs. Exp. 90 (Prev. 90, Low. 89, High. 91).

- Swedish PPI YoY (Dec) Y/Y -2.7% (Prev. -1.4%).

- Swedish PPI MoM (Dec) M/M -1.1% (Prev. 1.2%).

- UK BRC Shop Price Inflation (Jan) 1.5% vs. Exp. 0.7% (Prev. 0.6%, Rev. From 0.7%).

CENTRAL BANKS

- ECB's Kocher in a Bloomberg interview said that a lot has happened since the last ECB meeting in December; said "of course exchange rate matters". said uncertainty remains high. Important to keep full optionality. Need to act quickly and decisively. noted downside risk remains at large. Modest Eurozone growth forecasts, supported by German stimulus and savings rate. ECB is fine as long as deviations from 2% CPI are modest. Euro appreciation was substantial over the past year. Can't exclude anything on rates. At the moment, doing fine on rates.

- ECB amends monetary policy implementation guidelines. New provisions allow conditional reinstatement of access to Eurosystem monetary policy operations for entities subject to an open bank resolution scheme. Updates are a further step in gradually phasing out temporary collateral easing measures.

- ECB paves way for acceptance of DLT-based assets as eligible Eurosystem collateral. Eurosystem to accept marketable assets issued in central securities depositories (CSDs) using distributed ledger technology (DLT) as eligible collateral for Eurosystem credit operations as of 30 March 2026. Further work is exploring ways to expand eligibility to assets issued and settled entirely on DLT networks. Decision reflects Eurosystem’s commitment to innovation and fosters technological progress in European financial markets.

- BoE Governor Bailey said in an article in The Banker that banks’ present stability is hard won and banks are now better equipped to absorb losses in crises, adds urgent need to boost resilience in market based finance.

NOTABLE US HEADLINES

- Philippines said they conducted joint military exercises with the US in the South China Sea, according to Al Arabiya.

- US ambassador to China Perdue said in Bloomberg TV interview that China and the US completed most agreements made in Busan, South Korea.

- Top Border Patrol official Bovino has been removed from his role as US Border Patrol commander at large, according to The Atlantic.

- US President Trump posted "I just had a very good telephone conversation with Mayor Jacob Frey, of Minneapolis. Lots of progress is being made! Tom Homan will be meeting with him tomorrow in order to continue the discussion".

GEOPOLITICS

RUSSIA-UKRAINE

- DTEK Power Company said the Russian attack damaged an energy facility in Ukraine's Odesa region.

- Infrastructure facilities in the Lviv region of western Ukraine were hit by a Russian strike, according to the regional governor.

- US President Trump's administration has signalled to Ukraine that US security guarantees are contingent on Kyiv first agreeing a peace deal that would likely involve ceding the Donbas region to Russia, according to sources cited by FT.

MIDDLE EAST

- Intensive diplomatic efforts are currently underway between Iran and the US across multiple channels, Kann news reported; efforts aimed at reducing the level of "escalation" between parties. However, no significant breakthrough reported at this stage.

- Explosions have reportedly been heard near Iran's Parchin nuclear site, no damage has been reported - details light, awaiting verification.

- Palestinian media reported Israeli artillery shelling targeting areas in Khan Yunis in the southern Gaza Strip, according to Sky News Arabia.

- The Rafah crossing is estimated to be opened on Wednesday or Thursday, Israeli media reported.

- The explosions heard on the outskirts of Tehran are a routine missile test, Al Hadath reported citing Iranian TV.

OTHERS

- South Korea's National Security Office reportedly urges North Korea to immediately stop its launches of ballistic missiles.

- North Korea reportedly fired several ballistic missiles, according to the South Korea military.

- North Korean missile appears to have landed outside of Japan's Exclusive Economic Zone (EEZ), according to NTV.

- Japan's Coast Guard sends second notice that a possible North Korean ballistic missile has already fallen.

- Projectile believed to be North Korean-fired ballistic missile has already fallen, according to the Japanese Coast Guard.

- Japanese Coast Guard issues second notice regarding North Korean projectile.

- North Korea fires projectile towards sea, according to Yonhap; details light.

- China said US-Philippines patrol in South China Sea undermines regional peace, while China’s military vows to safeguard sovereignty and maritime rights, uphold regional peace amid US-Philippines patrol.

- US President Trump said he is pleased to report that Venezuela is releasing its political prisoners at a rapid rate, which rate will be increasing over the coming short period of time. Full post: "I am pleased to report that Venezuela is releasing its Political Prisoners at a rapid rate, which rate will be increasing over the coming short period of time. I’d like to thank the leadership of Venezuela for agreeing to this powerful humanitarian gesture! PRESIDENT DONALD J. TRUMP".

CRYPTO

- Bitcoin is essentially flat and trades around USD 88k, with Ethereum also trading steady around USD 2.9k.

APAC TRADE

- APAC stocks were mostly higher following on from the rebound on Wall Street, but with some of the gains capped ahead of key events and big tech earnings stateside, while participants also digested Trump's latest tariff salvo against South Korea.

- ASX 200 rallied on return from the long weekend, with risk appetite also facilitated by M&A-related headlines and improved business sentiment.

- Nikkei 225 gained despite the initial indecision following recent currency moves and after Services PPI cooled but remained above the BoJ's price target.

- KOSPI sold off at the open following US President Trump's announcement to raise tariffs on South Korean autos, lumber, pharma, and all other reciprocal tariffs to 25% from 15% due to its legislature not yet enacting the US-Korea trade deal. However, the index then clawed back its losses and more, with the TACO trade likely in play and with South Korean officials attempting to appease Trump.

- Hang Seng and Shanghai Comp traded somewhat mixed with firm gains in Hong Kong led by Zijin Mining, which is to buy Canada's Allied Gold for USD 4bln, while the mainland index lagged despite an acceleration in Chinese Industrial Profits and the PBoC's liquidity efforts.

NOTABLE ASIA-PAC HEADLINES

- China is to roll out policy document on boosting jobs amid AI impact, according to Xinhua. China will roll out policies to support employment amid AI shift and will boost support for employment among key groups.

NOTABLE APAC DATA RECAP

- Japanese Machine Tool Orders YY (Dec F) 10.9% (Prelim. 10.6%).

- Japanese Services PPI (Dec) 2.6% vs Exp. 2.7% (Prev. 2.7%).

- New Zealand Credit Card Spending YY (Dec) -0.3% (Prev. 4.4%).

- Chinese Industrial Profits YoY (Dec) Y/Y 5.3% (Prev. -13.1%).

- Chinese Industrial Profits (YTD) YoY (Dec) Y/Y 0.6% (Prev. 0.1%).

- Australian NAB Business Conditions (Dec) 9 (Prev. 7).

- Australian NAB Business Confidence (Dec) 3 (Prev. 1).