Respect & Clarity: China Opens Door For Reengaging Trump In Trade Talks

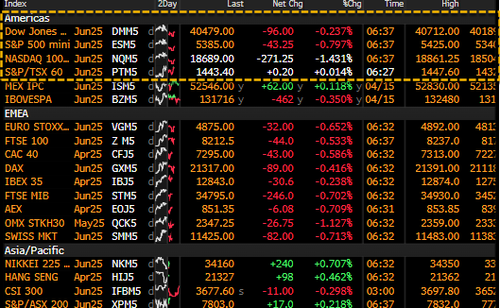

Nasdaq 100 and S&P 500 e-mini futures trimmed overnight losses after China reportedly laid out a set of preconditions for resuming trade talks with President Trump and his administration, Bloomberg reported, citing a source familiar with Beijing's internal deliberations.

According to the source:

Demand for Respect: China wants a more respectful tone from the U.S., particularly reducing disparaging remarks from U.S. cabinet members. Beijing was especially angered by Vice President JD Vance's recent "Chinese peasants" comment. Chinese Foreign Ministry spokesman called Vance's remarks "ignorant and disrespectful."

Unified U.S. Messaging: Chinese officials are confused by conflicting signals from Washington. While Trump's tone on Chinese President Xi Jinping has been moderate, hawkish comments from other high-ranking White House officials have conflicted. Without a clear and consistent U.S. position, China sees little value in engagement.

Point Person: Beijing wants the Trump administration to designate a point person to oversee trade talks.

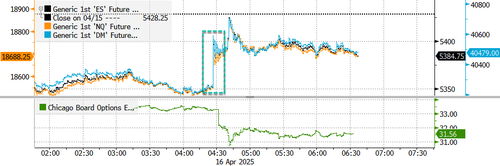

News of the preconditions crossed the Bloomberg wires at 0427 ET.

This sent the U.S. main equity index futures surging, trimming earlier losses from European and Asian sessions.

As of 0630 ET, Nasdaq futures are still down 1.5%, while S&P 500 futures are down around 1%.

Commenting on the Bloomberg report, Gary Ng, senior economist at Natixis, said these developments of potential trade talks between the U.S. and China might fuel more risk-on sentiment:

"The impact on the dollar will still be mixed for now, but there will be more inflows into equities, both in China and the US."

Ng emphasized that this is not a U-turn in strategy, noting China had already signaled its openness to talks in a white paper published on April 9. However, he cautioned that a deal remains uncertain given the wide range of unresolved issues and the deepening economic and geopolitical rivalry between the two economic superpowers.

Goldman analyst Rich Privorotsky commented on the latest trade developments and markets:

China IP and retail sales strong overnight…largely ignored as markets lower on the back of U.S. restrictions on NVDA chip exports to China. This follow's yday's announcement of China halting the import of Boeing plans. Seems like the conflict between the two countries continues to escalate without a clear off ramp.

"US President Donald Trump is willing to strike a trading deal with China, but the latter should reach out first" (RTRS) The upshot "China has appointed a new top trade negotiator amid the tariff war with the U.S."

Bar feels low for some face saving exercise to bring both sides to the table (tricky part is who makes the first move). In a sense that could be a short term positive catalyst from here but even if tariffs are reduced they are likely to persist on China at some elevated level.

The implications on U.S. consumers, global trade and growth remain impaired.

The fate of the global economy and financial markets hinges on a trade deal. The latest effective rate of 145% on Chinese goods entering the U.S. and 125% on U.S. goods entering China have already created ructions in global trade routes (read here and here) that only suggest macroeconomic headwinds are incoming in both China and the U.S.