Rio Tinto And Glencore In Talks To Form World's Largest Mining Company With $200 Billion Valuation

Are we on the cusp of an M&A boom in metals and commodities, with prices continuing to soar? Or are deals just easier to get through under a new administration?

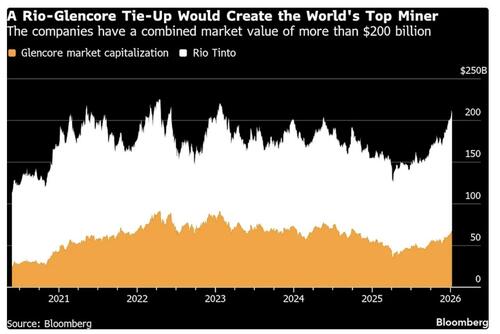

Regardless, Rio Tinto and Glencore have reopened merger talks that could create the world’s largest mining company, with a combined valuation exceeding $200 billion — more than a year after earlier negotiations collapsed, according to Yahoo.

The companies confirmed Thursday that they are discussing various deal structures, including an all-share takeover covering part or all of Glencore’s business. The market reacted swiftly: Glencore shares jumped about 10% in London, while Rio slipped more than 2%.

If completed, the transaction would eclipse any previous mining merger and create a giant capable of rivaling BHP. Copper is the central prize. With prices recently surging above $13,000 a ton amid supply disruptions and tariff fears, mining executives increasingly see copper as the industry’s most strategic asset. “It makes a lot of sense,” said Ben Cleary of Tribeca Investment Partners. “It’s the one big deliverable mining deal out there.”

Yahoo writes that for Rio, absorbing Glencore would sharply expand copper output and provide access to prized assets such as Chile’s Collahuasi mine. The move would also help reduce dependence on iron ore as China’s construction boom fades.

Although analysts have questioned whether Rio would accept Glencore’s large coal business, people familiar with the talks say Rio is now open to keeping it — at least initially — and could divest later. No final structure has been agreed.

The renewed talks follow major changes at both firms. Rio has a new chief executive, Simon Trott, who has emphasized cost discipline and simplification, while Glencore has highlighted plans to nearly double copper production over the next decade. In private, Glencore CEO Gary Nagle has described a tie-up with Rio as the most logical deal in the sector.

“This is Simon’s first test as CEO and I would expect his disciplined approach to be carried through to M&A,” said John Ayoub of Wilson Asset Management.

The discussions come amid a broader wave of consolidation after Anglo American’s deal for Teck Resources and earlier takeover interest from BHP. Under UK rules, Rio must decide by Feb. 5 whether to proceed or step back for six months.