'SaaSpocalypse' Strikes As Private Credit-Software Stock Vicious Cycle Accelerates

Yesterday, in a must read report for everyone, we highlighted the shocking reality of the circular firing squad evolving between private credit providers (BDCs) and software companies as the latter suffers from artificial intelligence's domination and the former's pain grows from the massive exposure it faces to those very same software entities.

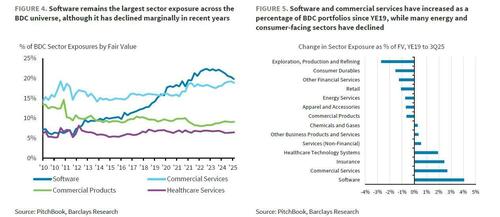

“Software is the largest sector exposure for BDCs, at around 20% of portfolios, making the industry particularly sensitive to the recent decline in software equity and credit valuations,” Barclays analysts including Peter Troisi wrote in a note available to pro subs.

The total exposure was about $100 billion in the third quarter of last year, the analysts said, citing PitchBook data.

Today the vicious cycle is accelerating as the details of the report hit the mainstream with Bloomberg reporting that sentiment has gone from bearish to doomsday lately with traders dumping shares of companies across the industry as fears about the destruction to be wrought by artificial intelligence pile up.

“We call it the ‘SaaSpocalypse,’ an apocalypse for software-as-a-service stocks,” said Jeffrey Favuzza, who works on the equity trading desk at Jefferies.

“Trading is very much ‘get me out’ style selling.”

The anxiety was underscored Tuesday after AI startup Anthropic released a productivity tool for in-house lawyers, sending shares of legal software and publishing firms tumbling.

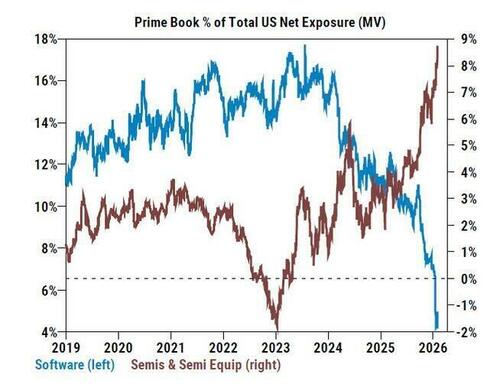

Hedge funds have already been exiting the 'software' building en masse, as noted over the weekend, Goldman's Prime Brokerage showed a stunning chart: the divergence between hedge fund exposure in semiconductor companies (broadly seen as beneficiaries of the AI supercycle) and software companies (increasingly seen as the biggest losers of AI), has never been greater.

It appears that the rest of the market is now waking up to that pain trade.

Goldman Sachs Software stock basket is collapsing, now back near Liberation Day lows from last year...

Perceived risks to the software industry have been simmering for months, with the January release of the Claude Cowork tool from Anthropic supercharging disruption fears.

“I ask clients, ‘what’s your hold-your-nose level?’ and even with all the capitulation, I haven’t heard any conviction on where that is,” Favuzza said.

“People are just selling everything and don’t care about the price.”

All told, the S&P North American software index is on a three-week losing streak that pushed it to a 15% drop in January, its biggest monthly decline since October 2008.

Simply put, fears of an AI-induced wave of obsolescence have left investors wondering which industries will be left behind.

“The draconian view is that software will be the next print media or department stores, in terms of their prospects,” said Favuzza at Jefferies.

“That the pendulum has swung so far to the sell-everything side suggests there will be super-attractive opportunities that come out of this. However, we’re all waiting for an acceleration, and when I look out to 2026 or 2027 numbers, it is hard to see the upside. If Microsoft is struggling, imagine how bad it could be for companies more in the path of disruption, or without its dominant position.”

FactSet notes that 75% of companies have beat on EPS and 65% beat on revenue. That’s not great by hit-rate standards.

Instead, as Bloomberg reports, the lift is coming from magnitude - fewer companies are clearing the bar, but the ones that do are clearing it by enough to keep the aggregate results looking healthy.

But, as we noted in detail previously, and briefly at the start of this note, the pain in software is not staying there as BDCs are suffering significantly.

Private credit could see default rates surge to as high as 13% in the US if artificial intelligence triggers an “aggressive” disruption among corporate borrowers, UBS Group AG strategists wrote in a separate note on Monday.

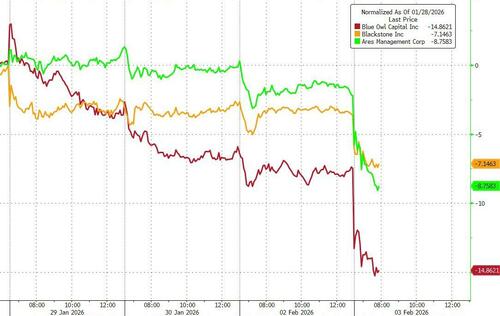

And today we see that fear contagiously accelerate in the BDCs, including Blue Owl, Blackstone, and Ares...

The central issue facing investors who want to buy software stocks is separating the AI winners from the losers. Clearly, some of these companies are going to thrive, meaning their stocks are effectively on sale after the recent rout. But it may be too early to determine who they are.

“The fear with AI is that there’s more competition, more pricing pressure, and that their competitive moats have gotten shallower, meaning they could be easier to replace with AI,” said Thomas Shipp, head of equity research at LPL Financial, which has $2.4 trillion in brokerage and advisory assets.

“The range of outcomes for their growth has gotten wider, which means it’s harder to assign fair valuations or see what looks cheap.”

For now, traders are selling first as the threat of falling software equity prices prompts painful balance sheet reflection at private credit shops (which don't report until late Fed/early March), triggering less availability of credit (or pulling existing lines), feeding back into lower growth potential for software companies (which already face existential threats from AI).

Much more on this whole fiasco in the full Barclays note available to pro subs.