Santa Vs The Grinch, Diets, & QE

By Peter Tchir of Academy Securities

Santa vs The Grinch, Diets, & qe

The week ended with a bang.

At Academy’s Holiday Party, the Marines pulled out all the stops to win the annual “service song” contest (they actually brought out instruments, with Dakota leading the charge on the trumpet).

We rolled (like the Army’s rolling along song), straight into Bloomberg TV Friday morning, where Academy was the guest host for the entire 6am hour. Had some interesting guests on the Geopolitical/European side, a bond portfolio PM, and an analyst who covers Disney (I abstained from asking him a question as I just didn’t think I could contribute usefully to the Disney-OpenAI deal discussion).

Santa vs The Grinch

Post-FOMC, markets rallied making it appear like the Santa rally was well underway. We will be circling back on a couple of things mentioned in our Quick Take on the FOMC. Starting with the final line from that report – the Oracle earnings call could be market moving.

Oracle struggled the next day, but markets fought back from their lows, with some serious “rotation” occurring. But more “questionable” news from the chip and data center/AI space weighed on markets again on Friday, this time, without a late-day stick save.

We use the word “questionable” because on the one hand, we heard phrases like:

- Slight miss, overall solid, decent guidance, new clients added, backlogs, etc.

All phrases that you would not normally associate with individual stocks down double digits or even the Nasdaq 100 down 2%. Clearly expectations are high and valuations still require very strong numbers/guidance for bullishness on data centers/AI to remain intact.

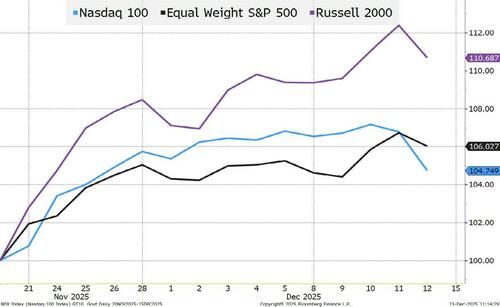

Since November 20th, we’ve seen the Nasdaq 100 lag (still up, but lagging) while the Russell 2000 has been the star of the show.

We pick that date because that was the day we started to see the Fed hawks capitulate – the Santa Rally Recipe.

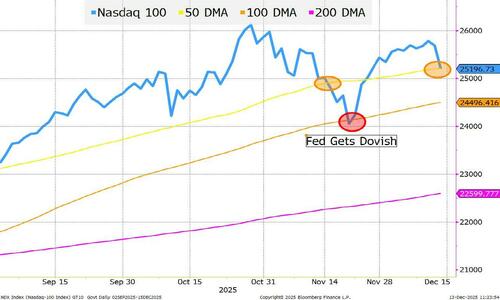

We argued that breaking the 100-Day Moving Average (DMA) made the Fed “see the light” and turn noticeably dovish (the probability of a rate cut jumped from the 30s to 90s in a matter of days).

We are trading right around the 50-DMA right now on the Nasdaq 100. It could still act as resistance, which we should see Sunday night/Monday morning. But if it breaks through there, the 100-DMA is clearly in play. What is concerning is that it was quite clear to many that the Fed played a crucial role in defending the 100-DMA. Will they do it again if we get there? Possibly, but how? The next meeting is quite far off, by market standards.

We will be watching some of these technical levels closely as it seems that not only is the “free money” gone, but the hurdle to creating further market cap gains has ratcheted higher. We define “free” money as things like announcing $X in spending on AI/data centers and being rewarded with a market cap increase far in excess of $X.

So far, the Grinch hasn’t caught up to the people in Weeville (Russell 2000), but it seems impossible to believe that further weakness here won’t bring down all the markets:

The stocks just make up such a large portion of the big indices, and it will be difficult for even the Russell 2000, with little actual overlap, to fight the trend. The outperformance can continue, but would likely all be negative.

The industry makes up such a huge part of the economic story including spending and the wealth effect (more than jobs but there are jobs too). It is difficult to see how markets can do well (though rate cut expectations, which I think are too low, will increase with more cuts coming sooner than is currently being priced in).

More “technical” than usual, but since we “survived” the Fed and the Santa rally seemed back in play, positioning (which goes hand in hand with technicals) may be offsides again coming into a period of low levels of true liquidity.

Which Brings Us to Diets

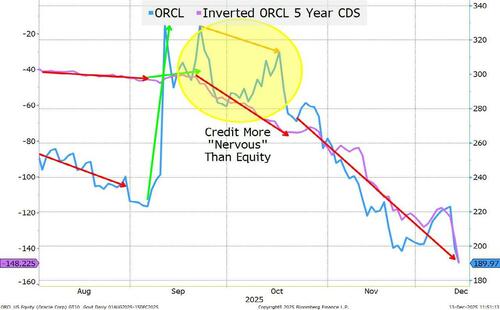

I cannot remember the last time there was this much chatter about single name CDS, with Oracle’s CDS leading the way. Not only did we end the TV interview on Friday talking about that, but we also spent some time on Friday helping Barron’s understand CDS, in relation to big tech and data centers.

We mentioned Debt Diets a few weeks ago, and want to highlight it again. It was our “Theme for 2019.” At the time, many corporations were seeing their stocks come under pressure, largely due to strains in the credit market for their names. It is “easy” for corporate leadership to ignore the debt markets when their stock price is doing really well. You can probably even give credit markets only a cursory glance if your stock is facing some pressure, but credit is just a side story. But when credit becomes a main part of the story – it is difficult to ignore. That isn’t necessarily a bad thing. It might sound bad, but it doesn’t have to be.

When Credit Leads the Way

This chart, for me, explains why a “debt diet” may be on the way (and yes, we will explain what we mean by that, and why it isn’t necessarily bad, and follows our end of “free” money narrative).

It is possible that I’m “grasping” at straws, but from the middle of September to the middle of October, the credit market and stock market were not “beating the same drum.” Yes, the stock market faced some selling pressure, but it also had a solid rebound. The credit market basically widened every day during that period.

Now they are back to moving in the same direction and it seems almost impossible to ignore the performance of the credit market when making a decision on the stock market.

Which brings us to the Debt Diet.

Companies can alter their spending plans.

Probably unnecessary here, but for the space as a whole, it might be a good time for CEOs and CFOs to explain their spending plans more clearly. To, not necessarily, pay “homage” to creditors, but make sure creditors understand their concerns are being taken into account.

Clarity, especially as to what might make them cautious on building more (maybe some rough alignment of building with profits and positive cash flow in mind, versus an almost “build it and they will come” mentality).

Companies do not need to be “afraid” of creditors, but a clearer recognition of their importance to your future might be in order.

A lot can be done without changing the plans today. I see a lot of ways that clarification and some identification of issues or trends that might change spending plans could go a long way towards improving spreads and leaving the market hungry for more issuance in 2026 and beyond!

Debt Diets are Manageable – An AI Diet Might Not Be

So far, this seems more like a “debt diet” type of situation in the data center space. The news that has come out doesn’t seem to have changed the overall narrative (backlogs, new clients, etc. all seem to argue this is more about a change in valuations than a meaningful change in trend for the industry).

However, I am nervous that we could see an AI Diet developing:

How much are companies budgeting for AI spend next year? The following year? Just like the industry itself had “free” money for a period of time, it was impossible for any corporation in America to do anything but spend more on AI. As companies have now been using AI for 2 years or more, are they all seeing the benefits they thought they paid for? Certainly, some are and they are probably rejoicing in their spending. But everyone? Especially in an economy, where away from certain industries (our little i-shaped view of the economy), we are seeing little growth. For now, I think the spending from corporate America continues, but it will be possibly “abated” as opposed to unabated.

Chips and China. The admin is comfortable selling a greater variety of chips to a greater variety of nations (China being the most important, though I’d argue that the Middle East isn’t far behind in importance). The question is whether China wants chips in the quantity that would fuel real revenue growth? Or is China willing to forego some quality today, in an effort to continue to bootstrap their own chip industry and make them more competitive with the top chips being designed/produced by U.S. companies and TSMC? I think this is more about constraining the upside rather than creating downside risk to spending on U.S. chips, but I have this nagging concern that “we” may be underestimating the resources and skills that China is devoting to this.

Electricity. If there is one thing our Macro, Structured Products, and Sustainable Finance teams agree on – it is the importance of electricity in today’s economy and the risk that we cannot generate electrons quickly and efficiently enough to satisfy the needs of industry going forward. This “molecules to electrons” has been a theme of ours for quite some time and fits perfectly into our ProSec™ (Production for Security) framework. If you were starting to think, wonder, or even hope that we could go an entire T-Report without mentioning ProSec™, we had to disappoint you.

If you have not read Stav Gaon’s work on data centers, I highly recommend you do. You can find his work under the Securitized Products Research & Strategy tab on Academy’s website. You can scroll and pick through his various pieces on data centers.

I think the Debt Diet is real and not necessarily bad. I don’t think the AI Diet is real, but since it is very bad if it occurs, it seemed worth at least highlighting that risk in our “diet” framework.

qe

Is the $40 billion of Federal Reserve purchases QE or a non-event? Or somewhere in between?

It “depends.” Clearly the Fed had to address some issues within the front end of the yield curve. SOFR, as a secured rate, should not be more expensive than unsecured rates. That is embarrassing, and has some small economic consequences. This is NOTHING like elevated LIBOR. When we have problems on interbank lending or even in the commercial paper markets, we can worry. This is much more of an issue with regulations, regulatory capital, and return on capital. The rules have been created in such a way, that it isn’t particularly economic (or even feasible) for the banking industry to price and trade SOFR at levels where “it should trade.” So, to the extent these purchases are “temporary” and designed to get us through year end and “clean things up” (and then they can be reduced or eliminated), it isn’t really QE or even qe. Bitcoin does as good of a job as any asset class at “sniffing” out balance sheet expansion and it has been moderately happy, but not giddy, since the announcement was made.

If the Treasury decides to take advantage of this by reducing issuance of longer-dated bonds, to sell more T-Bills to the Fed, and does this month after month, it starts to look a lot more like QE.

For now, I’ll be in the “qe” camp and that this is more of a “fix,” than in the full-on QE camp, but I’m not sure why Treasury wouldn’t try to make this work a lot more like QE than maybe even Powell intended?

I continue to believe that “we ain’t seen nothing yet” in terms of how the admin and Treasury will work with the Fed to achieve 3% or lower on the front end and a 3-handle (under 4%) on 10s.

At 4.18% on 10s and 2s vs 10s at 66 (the highest since February 2022), I’m tempted to be buying 10s and putting on flatteners. But, it is probably a bit early, as the market doesn’t feel that healthy, and I think that we need Japanese yields to really stabilize and Europe to make it clear on whether they are going to spend aggressively, or seize Russia’s frozen reserves, or let the 5% defense spending fizzle, before we can get too comfortable on U.S. rates.

It does seem ”curious” that Goolsbee went from dissenting on Wednesday (wanted no cut) to highlighting that he thinks there will be more cuts next year than others! I wonder what sort of “bollocking” he got from the admin between the FOMC meeting and his speaking opportunity?

Bottom Line

I am not sure how we got to the “bottom line” without mentioning Tuesday’s jobs data. The release date is highly unusual and I certainly don’t understand how the government shutdown will affect the report. Since it is delayed, the response rate could be higher, but maybe much of the preliminary work wasn’t done?

The consensus is for 50k jobs to be created. I’d be leaning towards the under. I do think a weak jobs report would help bonds. I agree with Goolsbee that the Fed will cut sooner and more aggressively than is priced in, but it won’t help the long end much (just yet) and won’t help stocks – as the “slowdown” story (despite the Fed raising GDP expectations for next year) will weigh on stocks.

One thing I can tell you with certainty is that despite all this talk of diets, and probably because of the holidays and travel, I’m very reluctant and even a bit scared to step on a scale.

Have a great week, but expect more chop and volatility coming into year end and the start of next year, which should be a gangbuster one for debt issuance, and may well make credit markets interesting to focus on again! I’ve almost missed the fact that in the past year, where everything in credit seemed so dull (until the latter half when the financing needs started to hit home), we also saw the first signs of unexpected problems in private credit.

With all that is going on in the world, and U.S. service members at risk, it was fun to sit back and watch a great Army-Navy football game