Small Modular Reactor Developers Push New Partnerships And Use Cases

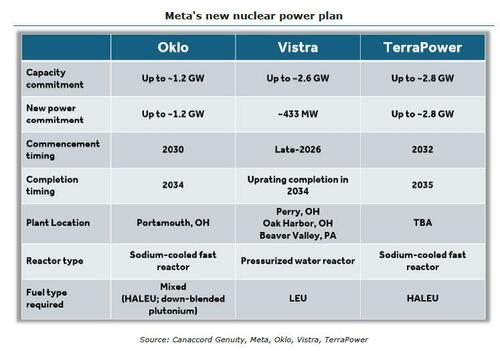

Hot on the heels of the biggest nuclear energy deal by a tech company to date, one which saw Meta validate Oklo's "proof of concept" by committing to purchase 1.2 GW of new energy ...

... peer Small Module Reactor (SMR) developers, Nano Nuclear and NuScale Power, released their own updates on new engineering partnerships and potential use cases.

Nano Nuclear, which in recent months had focused on its project at the University of Illinois (UI), had put its various other business segments - including an exciting project with its laser uranium enrichment partner LIS Technnologies - on the backburner. The UI project is a full-scale deployment of Nano’s Kronos reactor design, a 15 MW high-temperature, gas-cooled reactor (HTGR).

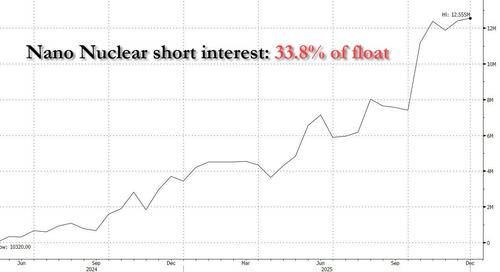

While the project may include a power purchase agreement eventually, its primary purpose is R&D of the reactor design. Nano investors are hoping that it will soon become a source of revenue as well, while shorts are pressing their skepticism, which explains why more than a third of the company's float - a record - is now shorted.

Nano had previously announced the potential for deploying a fleet of reactors, but the study itself could take months, with a Final Investment Decision likely years away. But in the company's latest news, Nano unveiled some real traction with the announcement that it has selected EPC firm Ameresco to develop and deploy all three of their reactor designs: Kronos, Zeus, and Loki. As the initial assessment advances, the companies plan to coordinate on government funding and other available incentives.

$NNE Breaking News: "NANO Nuclear Signs Memorandum of Understanding with Ameresco (NYSE: $AMRC) to Explore the Deployment of Advanced Microreactor Technologies on Federal and Commercial Sites - $AMRC is a leading energy infrastructure solutions provider https://t.co/67BhVSKDqy

— NANO Nuclear Energy (NASDAQ: NNE) (@nano_nuclear) January 12, 2026

Ameresco announced partnerships in 2025 with the two other junior public reactor developers, Terrestrial Energy and Terra Innovatum. With Terra also working on an HTGR design, and Terrestrial working on a molten salt reactor (MSR), Ameresco holds a relatively full docket for a firm that has yet to deploy any nuclear plants, big or small. Adding to the likelihood that deployment timelines are likely not going to move rapidly, executives at Ameresco said they were looking years past 2027 for reactor deployments on the recent earnings call:

“I would not say 2026 or 2027 though. That is a little early, even for a traditional power plant … I think the opportunity is very real, especially with the Army announcements that just came out a couple of weeks ago and more from the Department of Energy that we believe that it is certainly in the future. Probably a few more years than 2027.”

Meanwhile, light water SMR developer NuScale published the results of a study performed with Oak Ridge National Laboratory. The study evaluated the economics of utilizing the heat and electricity produced by NuScale’s 77 MWe Nuclear Power Module (NPM) for use by a chemical processing facility. Results indicate the arrangement would lead to profitable operations for the reactor developer famous for their licensing Odyssey with the Nuclear Regulatory Commission — only they’re less famous for gaining a Design Certification for their administrative efforts and more famous for failing miserably to ever capitalize on the achievement.

NuScale has made multiple announcements regarding potential use cases, including training facilities, desalination plants, and now industrial process heat. They currently hold a loose agreement with the Tennessee Valley Authority to construct dozens of NPMs for up to 6 GW of new generation capacity, coupled with $25 billion of support from the Japan-US trade agreement.

Expect to see more "steel in the ground" news from Nano and NuScale as they seek to convince investors they are