Stellantis Shares Crash On 22 Billion Euro Charge Tied To Miscalculating EV Demand

Stellantis NV shares crashed the most on record in European trading after the automaker disclosed a 22-billion-euro (about $25 billion) charge tied to its failed EV strategy.

Management framed the charge as the cost of misreading the slope of EV adoption, effectively building a product and investment plan around an "energy transition" timeline that outpaced customers' budgets.

"The reset we have announced today is part of the decisive process we started in 2025, to once again make our customers and their preferences our guiding star," Stellantis CEO Antonio Filosa wrote in a statement.

Filosa said, "The charges announced today largely reflect the cost of over-estimating the pace of the energy transition that distanced us from many car buyers' real-world needs, means and desires. They also reflect the impact of previous poor operational execution, the effects of which are being progressively addressed by our new Team."

The writedowns include roughly 6.5 billion euros in payments, mainly for supplier compensation, as the struggling maker of Jeep and Fiat cars cancels multiple EV models and significantly reduces its battery footprint amid weaker demand.

Stellantis is revising earlier targets for EV sales in Europe and for 50% EVs in the US by 2030, while also seeking to offset rising tariff costs.

Part of Filosa's "reset" includes $13 billion in US investment, delaying some EV plans, bringing back V8s to refresh the Ram lineup, and multiple Jeep launches and refreshes this year. He also scrapped investments tied to a planned hydrogen joint venture.

Stellantis is also exiting its Canadian battery joint venture with LG Energy Solution (LG is buying Stellantis's stake in the Windsor, Ontario, plant project).

The move by Stellantis mirrors moves by industry peers, including Ford Motor, General Motors, and others. On Thursday, Volvo Cars shares fell the most on record after earnings missed, with the company citing "a challenging external environment."

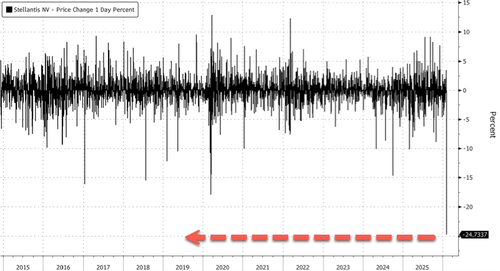

Stellantis shares in Milan fell as much as 24%, the most on record in Bloomberg data dating back to 2015.

Shares return to Covid-era lows.

Here's institutional commentary from UBS analyst Patrick Hummel:

Stellantis: 'Kitchen Sinking'; Shares Plunge 19%

Shares in Stellantis plunge 19% after the carmaker accompanied news of EV-related charges with soft 2026 guidance (in line on top-line, below on AOI and FCF). Stellantis announced €22 bn one-off charges in H2 2025, including €6.5 bn cash charges spread over four years. The latter is important, said UBS analyst Patrick Hummel, who thinks about €1.6 bn per annum cash outflows can be digested from a balance sheet perspective (€46 bn gross liquidity, €5 bn hybrid bond issue and no dividend for FY 2025 announced).

While Patrick thinks the one-offs are much larger than consensus expectations (€5-10 bn), the important aspect is the cash portion that is more in line. "Negative today, but it could be the clearing event we've been waiting for," he said, repeating his 'buy' rating on the shares.

The EV push by Western automakers has become an epic disaster, just as China is flooding Europe with low-priced EV models and eyeing the same playbook for Canada. In the US, Tesla remains the dominant outlier, continuing vehicle production while moving full steam ahead with robotaxi ambitions, AI stack, and robotics.