Stellar 20Y Auction Stops Through With Near Record Bid To Cover, Record Directs

In a week when global yields have exploded higher following the historic rout in Japan's bond market, many were nervous about the outcome of today's 20Y Treasury auction. In retrospect, they had no reason to be worried: the auction closed with flying colors amid solid demand.

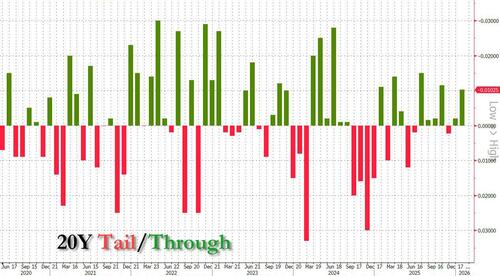

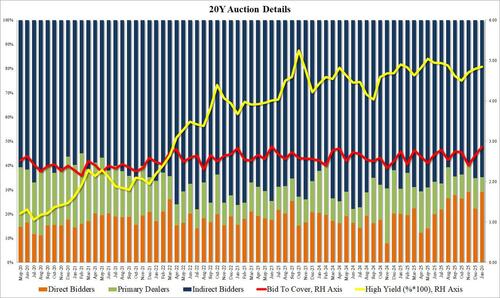

The high yield of today's sale of $13BN in 20Y paper was 4.846%, up from 4.798% a month ago and the highest since August; it also stopped through the When Issued 4.856% by 1bps , the biggest stop through since October, and also the 6th stop in the past 7 auctions.

More impressive still, the bid to cover was 2.86, up from 2.67 in December and the second highest on record (only June 2023 was higher).

The internals were a touch softer with Indirects awarded 64.72%, down from 65.19%, but above the six auction average of 63.5%. And with Directs taking 29.1%, tied for the highest on record, Dealers were left with just 6.2%, one of the six year history of the auction.

Overall, this was a stellar 20Y auction, and one which pushed yields in the secondary market slightly lower after news of the break, although with many other factors determining yields (Japan, Greenland, earnings), don't expect the auction's impact on the broader market to last.