Stellar 30Y Auction Stops Through, Sees Solid Foreign Bidder Demand

The last coupon auction of the first full week of 2026 was also the strongest one.

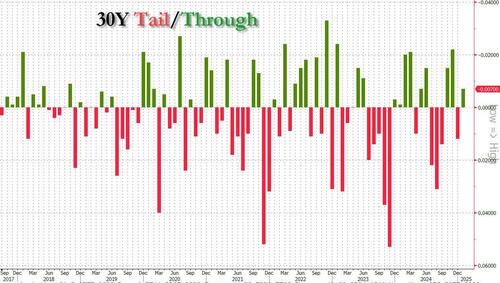

Moments ago the Treasury sold $22BN in 30Y paper in a very solid auction: the sale priced at a high yield of 4.825%, just fractionally higher than the 4.773% in December, and also stopped through the When Issued 4.833% by 0.8bps.

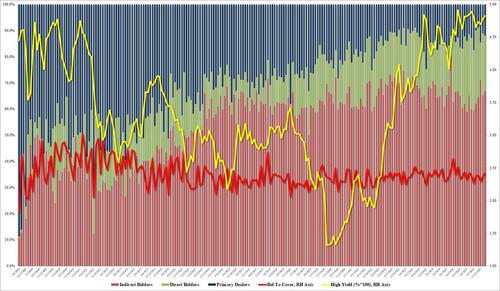

The bid to cover was a solid 2.418, up from 2.365 last month, and the highest since June.

The internals were also impressive, with foreigners buying 66.8%, up from 65.4% in December, and above the six-auction average of 63.7%. And with Direct Bidders awarded 21.3%, bit below the recent average of 23.9%, Dealers were left holding 11.95%, which was also below the recent average of 12.4%.

Bottom line: a very strong auction, which was also facilitated by today's surprisingly cool CPI report, which swung the long-end from an intraday high of 4.20% to a low of 4.15%, and was last trading at 4.165%.