Stocks boosted by PM Takaichi's landslide election victory; JGBs slipped while JPY strengthens - Newsquawk EU Market Open

- APAC stocks began the week higher after last Friday's rally on Wall St, where the DJIA topped the 50k level for the first time.

- The Nikkei 225 also hit a fresh record high after PM Takaichi's landslide election victory and supermajority.

- China is reportedly urging banks to curb US Treasuries exposure amid market risk, Bloomberg reports, citing sources; guidance does not apply to China's state holdings of US Treasuries.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.4% after the cash market closed higher by 1.2% on Friday.

- Highlights include Swiss Consumer Confidence (Jan), Norwegian GDP (Q4), Mexican Inflation (Jan), US Consumer Inflation Expectations (Jan), BoC Market Participants Survey. Speakers include ECB’s Lane & Lagarde, Fed’s Waller & Bostic, Earnings from Apollo, Becton Dickinson, Loews, On Semiconductor & Cleveland-Cliffs.

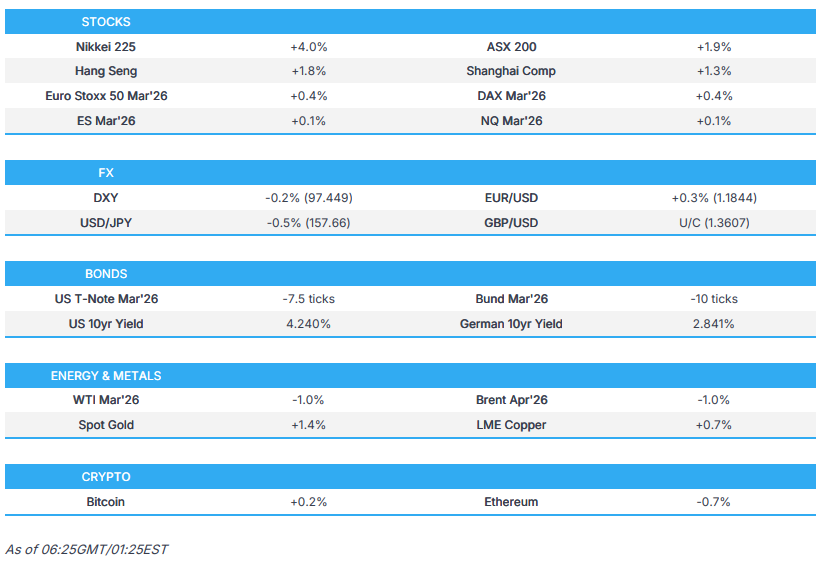

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks surged on Friday to recoup some of the recent losses with gains led by Tech and Industrials, while semiconductors surged, which were largely seen as a beneficiary of the hikes in CapEx plans from tech behemoths. However, it was the Russell that outperformed, followed by the Dow, which crossed 50k for the first time. Conversely, mega caps Google, Meta and Amazon underperformed on Friday, which weighed on the Communication and Consumer Discretionary sector.

- SPX +1.90% at 6,927, NDX +2.15% at 25,076, DJI +2.52% at 50,140, RUT +3.53% at 2,669.

- Click here for a detailed summary.

TARIFFS/TRADE

- US and India announced on Friday that they reached a framework for an interim agreement regarding reciprocal and mutually beneficial trade, in which India will eliminate or reduce tariffs on all US industrial goods and a wide range of US food and agricultural products, while the US will apply a reciprocal tariff rate of 18% and will remove tariffs on certain aircraft and aircraft parts. India and the US will significantly increase trade in technology products, and India intends to purchase USD 500bln of US energy products, aircraft and aircraft parts, precious metals, technology products and coking coal over the next five years. Furthermore, India agreed to eliminate restrictive import licencing procedures that delay market access for, or impose quantitative restrictions on, US ICT goods.

- US President Trump said he had a very important meeting with the President of Honduras, while they discussed many other issues, including investment and trade between the two countries.

- China warned a US arms deal for Taiwan could jeopardise US President Trump's state visit to China in April.

- Australia imposed 10% tariffs on China's steel ceiling frames, following an antidumping investigation.

- China is reportedly urging banks to curb US Treasuries exposure amid market risk, Bloomberg reports; guidance does not apply to China's state holdings of US Treasuries.

NOTABLE HEADLINES

- US President Trump posted "Record Stock Market, and National Security, driven by our Great TARIFFS. I am predicting 100,000 on the DOW by the end of my Term. REMEMBER, TRUMP WAS RIGHT ABOUT EVERYTHING! I hope the United States Supreme Court is watching".

- Fed Vice Chair Jefferson (voter) said on Friday that current monetary policy is well-positioned to deal with what likely lies ahead, and future Fed moves will be driven by data and views on the outlook. Jefferson also said that policy is roughly in a neutral stance and that the stance allows 'leeway' for the supply side of the economy to develop, while he also commented that he does not want to see any more weakening in the labour market.

- Fed's Daly (2027 voter) said on Friday that she keeps a 'very open mind' on interest rates and leans towards more rate cuts in 2026, but added it is hard to note if that's one cut or two. Daly stated that she supported the Fed's decision last week to hold rates steady, but thought that a case could have been made for a cut, while she added that to cut, you'd need to be more confident on inflation, or see the labour market as more challenged than the data currently shows.

- US House Minority Leader Jeffries said Democrats won’t pass the remaining government funding for the Department of Homeland Security without ICE reforms.

APAC TRADE

EQUITIES

- APAC stocks began the week higher after last Friday's rally on Wall St, where the DJIA topped the 50k level for the first time, while the Nikkei 225 also hit a fresh record high after PM Takaichi's landslide election victory and supermajority.

- ASX 200 rallied with all sectors in the green and the advances being led by broad strength in tech, real estate, miners, materials and resources.

- Nikkei 225 rose to fresh record highs above the 57,000 level after the Japanese PM Takaichi's LDP won a supermajority in the lower house election, which would allow it to override the upper house in legislation, while the decisive win paves the way for the government to proceed with further stimulus and a sales tax cut.

- Hang Seng and Shanghai Comp conformed to the widespread upbeat mood across the region, while it was also reported late last week that China's Cabinet studied measures to promote effective investment and pledged to boost support for private investment.

- US equity futures kept afloat after rallying on Friday amid a recovery in tech and risk assets.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.4% after the cash market closed higher by 1.2% on Friday.

FX

- DXY marginally softened in rangebound trade amid light pertinent catalysts from over the weekend and with key releases from the US scheduled later this week, including the NFP and CPI data. Nonetheless, there were some comments from Fed officials on Friday, including from Vice Chair Jefferson, who said current monetary policy is well-positioned to deal with what likely lies ahead, and future Fed moves will be driven by data and views on the outlook.

- EUR/USD eked slight gains after returning to the 1.1800 handle late last week, but with further upside capped by a lack of drivers from the bloc, while comments over the weekend from ECB’s Cipollone did little to spur price action.

- GBP/USD struggled for direction with price action stuck around the 1.3600 level amid further political headwinds for UK PM Starmer's premiership after his chief of staff, Morgan McSweeney, resigned due to the Mandelson scandal.

- USD/JPY swung between gains and losses with initial advances seen after Japanese PM Takaichi's landslide election victory, with the LDP seen winning a supermajority. However, the pair then wiped out its gains, given that the election win was highly anticipated, and as JGB yields climbed on the likelihood of future stimulus.

- Antipodeans kept afloat amid the constructive mood, but with upside limited in the absence of tier-1 data.

- PBoC set USD/CNY mid-point at 6.9523 vs exp. 6.9334 (Prev. 6.9590)

FIXED INCOME

- 10yr UST futures remained lacklustre after trickling lower on Friday and with little fresh drivers for the US, while participants await this week's key releases, including the delayed January NFP report and US CPI data.

- Bund futures lacked demand in the absence of any major catalysts from the bloc and with ECB speakers ahead.

- 10yr JGB futures retreated following Japanese PM Takaichi's landslide election victory, which paves the way for additional stimulus, while she also stated that they will speed up consideration for sales tax cuts.

COMMODITIES

- Crude futures declined at the open following last week's US-Iran talks, which Iran's Foreign Minister described as a 'good beginning' and with talks set to continue early this week.

- Spot gold resumed last Friday's rebound and briefly returned to above the USD 5,000/oz level amid a softer dollar, while recent data showed the PBoC increased its gold reserves for a 15th consecutive month.

- PBoC increased its gold holdings for a 15th consecutive month in January, with China's gold holdings climbing to 74.19mln fine troy ounces (prev. 74.15mln M/M).

- Copper futures were indecisive and wiped out most of the initial gains despite the heightened risk appetite.

- US Treasury Secretary Bessent said Chinese traders were the cause of the wild swings in the gold market last week and that China are having to tighten margin requirements.

- Australia shut major iron ore ports as Tropical Cyclone Mitchell approached.

CRYPTO

- Bitcoin gradually climbed higher overnight and briefly returned to above the USD 71,000 level.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi’s LDP party won a landslide victory at the snap election on Sunday as NHK exit polls showed the party alone was set for a majority with 274-328 seats and the coalition (LDP + Ishin) could win 302-366 seats in the 465-seat lower house, while a super majority of at least 310 seats would allow them to bypass or override the upper house on legislation. It was later reported that results showed the LDP had won 316 seats and, with its coalition partner Ishin, had won a total of 352 seats.

- Japanese PM Takaichi said they will speed up consideration for sales tax cuts and will submit the bill if the government council approves the sales tax cut, while she reiterated that a weak yen has both merits and demerits, and noted her goal is to build a resilient country against forex swings. Furthermore, she said they will continue with responsible, proactive fiscal policy and reiterated to place importance on fiscal sustainability, as well as noted that she is thinking of making major changes to the current cabinet.

- Thailand’s incumbent PM Anutin’s Bhumjaithai Party is ahead in the preliminary counts after the election with 194 seats out of the 550 seats in the House of Representatives, while the People’s Party is in second place with currently around 116 seats and the Pheu Thai Party is in third place with about 76 seats, while no party is likely to achieve a majority in the three-way battle.

DATA RECAP

- Japanese Average Cash Earnings YoY (Dec) Y/Y 2.4% vs. Exp. 3.0% (Prev. 0.5%)

- Japanese Real Cash Earnings YY (Jan) -0.1% vs Exp. 0.8% (Prev. -1.6%, Rev. from -2.8%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said a deal can be reached with Iran and that they have plenty of time, while he stated that a deal on just the nuclear issue would be acceptable, and that the US is going to meet with Iran again early next week.

- Israeli PM Netanyahu is to meet with US President Trump on February 11th and discuss Iran.

RUSSIA-UKRAINE

- US President Trump said something could be happening with Ukraine and Russia.

- US President Trump signed executive orders on Friday titled “Modifying Duties to Address Threats to the United States by the Government of the Russian Federation”, and “Addressing Threats to the United States by the Government of Iran”, while he also signed an executive order for “Establishing an America First Arms Transfer Strategy”

- Ukrainian President Zelensky said the US is seeking a deal to end Russia’s war by June, while he added the next round of trilateral talks will be in about a week and that the idea of a trilateral leaders’ summit to discuss difficult issues was raised.

- Ukraine conducted emergency power cuts for much of the country following Russian drone and missile attacks on major energy facilities.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer is battling to stay in post as pressure mounts for him to resign, following the departure of his chief of staff Morgan McSweeney amid the Peter Mandelson scandal.

- ECB’s Cipollone said the central bank will assess the effect of the euro strength on consumer inflation in the quarterly forecasts due next month.

- Portugal elected Socialist Party’s Antonio Jose Seguro as president in a run-off vote.

- S&P affirmed Denmark at 'AAA'; outlook stable.