Stocks firmer into a quiet session going into Friday's US CPI - Newsquawk EU Market Open

- APAC stocks were ultimately mixed with a slightly positive bias amongst the major indices as the region reflected on earnings releases and the better-than-expected US jobs data, while Japan's benchmark hit a fresh record high on return from holiday, before fading the gains.

- US Treasury Secretary Bessent said US growth might have come to 3% for 2025, while he expects a continued pickup in construction jobs and sees a pickup in manufacturing jobs in the coming months.

- RBA Governor Bullock said the Bank will monitor data and act if inflation becomes entrenched, warning that further rate hikes may be needed.

- Japan's top currency diplomat Mimura said he won't comment on FX levels, but they are closely watching markets with a high sense of urgency.

- European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up 0.8% after the cash market closed with losses of 0.2% on Wednesday.

- Looking ahead, highlights include UK GDP Prelim. (Q4), GDP (Dec), US Weekly/Continuing Claims, Existing Home Sales (Jan), IEA OMR, EU Informal Leaders Retreat, Speakers including ECBʼs Cipollone, Lane & Nagel, BoCʼs Rogers, Supply from Italy & US, Earnings from Applied Materials, Arista Networks, Vertex Pharmaceuticals, Howmet Aerospace, Coinbase, American Electric Power, Hermes & L'Oreal.

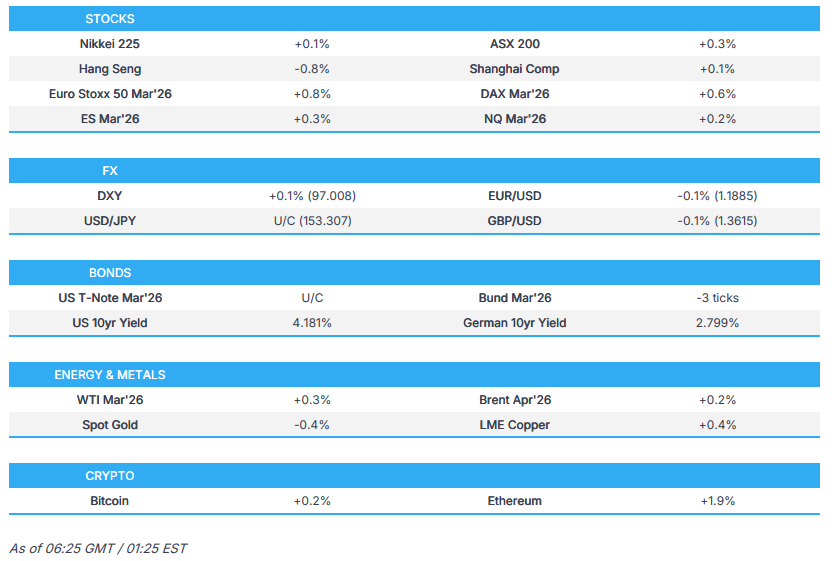

SNAPSHOT

US TRADE

EQUITIES

- US stocks saw two-way trade on Wednesday, with the major indices finishing slightly lower, as focus centred on the January NFP report, which was very strong overall: the headline smashed expectations, the unemployment rate ticked down, and wages were firmer than expected. The initial reaction was upside in equity futures and the dollar, as well as downside pressure in T-notes and gold, although the initial move gradually faded throughout the rest of the session. Alongside the report, we saw the annual BLS benchmark revisions in which the total nonfarm payrolls were revised down in the year to March 2025 by 862k, deeper than the expected downward revisions of 825k but revised up from the preliminary estimate of 911k. The downward revisions signalled the labour market may not be as robust as it appears, which may have contributed to the fading of the initial moves, while analysts were also cautious that the strength seen in January would not be sustained and that job growth was concentrated in certain sectors.

- SPX -0.01% at 6,941, NDX +0.29% at 25,201, DJI -0.13% at 50,121, RUT -0.38% at 2,669.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump and Chinese President Xi are poised to extend the trade truce by up to a year during their expected April meeting in Beijing, according to SCMP citing people familiar with discussions.

- US President Trump posted that any Republican, in the House or the Senate, who votes against tariffs will seriously suffer the consequences come election time, including the primaries. Trump stated that tariffs have given them great national security because the mere mention of the word has countries agreeing to their strongest wishes, while he added that no Republican should be responsible for destroying this privilege.

- US President Trump posted that Canada has taken advantage of the US on trade for many years, and is among the worst in the world to deal with, especially as it relates to the northern border, while he stated tariffs make a win for the US.

- US House voted 219 to 211 to pass a resolution to eliminate Trump's tariffs on Canada.

- US and Taiwan are reportedly to sign a reciprocal trade agreement on February 13th.

- US Democratic senators urge the Trump admin. to use North American free trade talks to crack down on Chinese vehicles.

- China's chief trade negotiator Li Chenggang met with Mexico's Deputy Economy Minister in Beijing, while it was also reported that China's top trade negotiator had met with the Westinghouse Electric Company CEO on Tuesday.

NOTABLE HEADLINES

- Fed's Miran (voter) said the recent NFP report does not mean the Fed can't lower rates and suggested that if supply increases, then there will be a decline in inflation. Miran also stated that supply chain failures are blamed for higher inflation; it stands to reason that pushing supply out lowers inflation, while he added that deregulation opens up an output gap.

- Fed's Hammack (2026 voter) said the unemployment rate looks like it's stabilising and the labour market is broadly in balance, but noted inflation is still too high. Hammack stated it is important for the Fed to get inflation back to 2% and that the current Fed Funds Rate is right around neutral, while she also noted it is good for the Fed to stay on hold right now and doesn't need to fine-tune rate policy.

- US President Trump directed the Department of Energy to issue funds to coal plants in states including West Virginia and Ohio, while he stated that he is 'not a big fan of those crazy, China-made windmills' and coal is the most dependable form of energy they have. Trump also signed an order directing the Pentagon to buy electricity from coal-fired power plants in a move to boost the sector.

- US Treasury Secretary Bessent said US growth might have come to 3% for 2025, while he expects a continued pickup in construction jobs and sees a pickup in manufacturing jobs in the coming months. Furthermore, he stated that President Trump is laser-focused on the housing market.

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed with a slightly positive bias amongst the major indices as the region reflected on earnings releases and the better-than-expected US jobs data, while Japan's benchmark hit a fresh record high on return from holiday, before fading the gains.

- ASX 200 was led higher by strength in utilities and financials after shares in Origin Energy and ANZ Group rallied post-earnings, but with upside in the broader market capped by hawkish rhetoric from RBA Governor Bullock.

- Nikkei 225 swung between gains and losses, in which the index initially climbed to above the 58,000 level for the first time, but then briefly wiped out all of its gains as currency strength persisted.

- Hang Seng and Shanghai Comp were mixed with the Hong Kong benchmark dragged lower by underperformance in the likes of Budweiser and NetEase following their earnings releases, with the latter also weighed by tech/AI-related headwinds, which dragged other large tech names lower such as Tencent, Baidu and Meituan, while AI startup Zhipu shares surged around 36% after the release of its new model. Conversely, the mainland treaded water following another firm liquidity operation by the PBoC and after China's State Council held a session on boosting AI use, with Premier Li urging to promote the use of AI in various sectors, while there are also expectations for the US and China to extend the trade truce by up to a year during the expected Trump-Xi meeting in April.

- US equity futures gradually edged higher in range-bound trade after their choppy post-NFP performances.

- European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up 0.8% after the cash market closed with losses of 0.2% on Wednesday.

FX

- DXY remained lacklustre after yesterday's mixed and ultimately flat performance despite the stronger-than-expected data from January, which pushed market pricing for the next Fed rate cut back to July from June. Nonetheless, there was some concern about the sustainability given that private employment was behind most of the growth driving the headline increases in Non-Farm Payrolls, while the final annual BLS benchmark payroll revisions through to March 2025, saw total jobs revised down by 862k. Furthermore, the greenback was also not helped by trade uncertainty after a report that US President Trump is privately considering exiting the North American trade pact.

- EUR/USD lacked conviction after its recent return to sub-1.1900 territory, and with officials calling for additional EU debt.

- GBP/USD struggled for direction after recent whipsawing and as participants await UK GDP data.

- USD/JPY continued its recent downward trend and returned below the 153.00 level, with the pair not helped by in-line PPI data from Japan and jawboning by top currency diplomat Mimura.

- Antipodeans were rangebound amid the mixed risk sentiment in Asia-Pac and with some hawkish comments from RBA Governor Bullock, who stated the Bank will monitor data and act if inflation becomes entrenched, warning that further rate hikes may be needed.

- PBoC set USD/CNY mid-point at 6.9457 vs exp. 6.9153 (Prev. 6.9438)

- BoC Minutes stated that Governing Council members agreed that the policy interest rate was on the stimulative side and agreed they would need to maintain optionality in setting monetary policy.

FIXED INCOME

- 10yr UST futures traded little changed but were off the prior day's worst levels after slumping in reaction to the stronger-than-expected NFP report, and although some of the downside was faded, a further rebound was thwarted by a weak auction and with more issuances scheduled later, including a 30yr note offering stateside.

- Bund futures took a breather following yesterday's whipsawing and central bank rhetoric, in which ECB's Nagel called for more EU debt, while Schnabel noted numerous headwinds for the German economy, with potential growth weighed on by demographic change.

- 10yr JGB futures were choppy on return from the holiday closure with early upside as yields in Japan retreated, while the latest Japanese PPI data printed in line with expectations and provided little to influence price action.

COMMODITIES

- Crude futures remained afloat but with gains limited following the recent choppy performance alongside mixed geopolitical-related headlines, including reports that the Pentagon was preparing a second aircraft carrier to deploy to the Middle East, although officials cautioned that there has been no official order for deployment and plans could change. Furthermore, President Trump said after meeting with Israel's PM that he insisted negotiations with Iran should continue to see whether a deal can be reached, which would be his preference.

- US Energy Secretary Wright said the Venezuela oil quarantine is essentially over and called it a historic pivot, but noted that political prisoners remain an issue.

- Venezuela's interim President Rodriguez hopes the relationship with the US progresses without obstacles, and she spoke with the US Energy Secretary about deals on oil, gas, power, and mining, while she looks to proceed as fast as possible.

- Spot gold lacked direction after pulling back from resistance around the USD 5,100/oz level and following some unwinding of Fed rate cut bets in the aftermath of the recent better-than-expected US jobs data.

- Copper futures were indecisive amid a somewhat tentative mood in Asia and a lack of conviction in its largest buyer, China.

CRYPTO

- Bitcoin was somewhat choppy and ultimately faded its intraday gains to return to flat territory above the USD 67,000 level.

NOTABLE ASIA-PAC HEADLINES

- Japan's top currency diplomat Mimura said he won't comment on FX levels, but they are closely watching markets with a high sense of urgency, while he added they are not lowering their guard and continue to be in contact with US authorities.

- RBA Governor Bullock said the board decided inflation at around 3-point something was unacceptable. Bullock also commented that the economy is performing reasonably well and the labour market is a positive development, while she added the Bank will monitor data and act if inflation becomes entrenched, warning that further rate hikes may be needed.

DATA RECAP

- Japanese PPI MM (Jan) M/M 0.2% vs. Exp. 0.2% (Prev. 0.1%)

- Japanese PPI YY (Jan) Y/Y 2.3% vs. Exp. 2.3% (Prev. 2.4%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said the meeting with Israeli PM Netanyahu was very good, while Trump insisted negotiations with Iran continue to see if a deal can be made, which he would prefer, but if not, we will see what happens.

- Israeli PM office said Israeli PM Netanyahu discussed with US President Trump the negotiations with Iran, Gaza, and regional developments, while he also discussed the security needs of the State of Israel in the context of the negotiations, and the two agreed to continue their close coordination and relationship.

- US Pentagon reportedly prepares a second aircraft carrier to deploy to the Middle East, as President Trump raises pressure on Iran to make a nuclear deal, according to WSJ. However, officials cautioned that there hasn’t been an official order to deploy the second carrier and that plans could change.

- Iranian top security official said they have not received a specific proposal from the US, while the official added that Muscat was about an exchange of messages, and there is no talk of zero enrichment, which they need for energy and medicine.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said they won't agree to peace talks in Russia or Belarus, while he stated Russia is not ready for an energy truce, and there has been no answer from Russia on an energy truce. Furthermore, he said it is only possible to end the war by summer if the US increases pressure on Russia, and the US needs to pressure Russia, not simply talk.

- Explosions were reported by witnesses in Ukraine's capital of Kyiv.

OTHER

- North Korea is said to be developing a submarine that can carry 10 submarine-launched ballistic missiles, and is accelerating its program to develop and manufacture drones based on experience from the Russia-Ukraine battlefield, according to MPs citing South Korea's spy agency. Furthermore, North Korea-Russia collaboration is said to exclude modern tech and nuclear programs, while North Korea seeks to improve relations despite dissatisfaction with China, and it also appears to have entered the stage of designating leader Kim's daughter, Kim Ju-Ae, as his successor.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves sees opportunities for joint procurement with Europe and hopes for more concrete progress in EU talks very soon, while it was separately reported that Reeves will limit the deregulatory drive as she seeks closer relations with the EU, according to FT.

- ECB's Schnabel said Europe is a continent with "huge potential", while she stated regarding the German economy that headwinds are numerous and that demographic change is increasingly weighing on potential growth and thus on the sustainability of social security systems. Furthermore, she said energy costs remain elevated compared with pre-pandemic levels, and protectionism as well as global competition, especially from China, are hitting Germany particularly hard.

- Euro-area finance ministers will discuss options to promote the use of the common currency in issuance and transactions, as part of the bloc’s push to strengthen the euro’s global role and assert Europe’s financial independence.

DATA RECAP

- UK RICS House Price Balance (Jan) -10% vs. Exp. -11% (Prev. -14%)

Loading...