Stocks gain after rebounding stateside; Kiwi underperforms after RBNZ holds rates - Newsquawk EU Market Open

- APAC stocks traded higher in continued thin conditions as many regional bourses remained closed for holidays.

- RBNZ kept the OCR at 2.25%, as expected, and the central bank refrained from any hawkish surprises; NZD heavily underperforms.

- US VP Vance said in some ways Iran talks went well, while he added that Iranians are not yet willing to acknowledge some of President Trump's red lines.

- US Special Envoy Witkoff said the US facilitated the trilateral meeting between Ukraine and Russia, while he added that Ukraine and Russia agreed to update leaders and pursue an agreement.

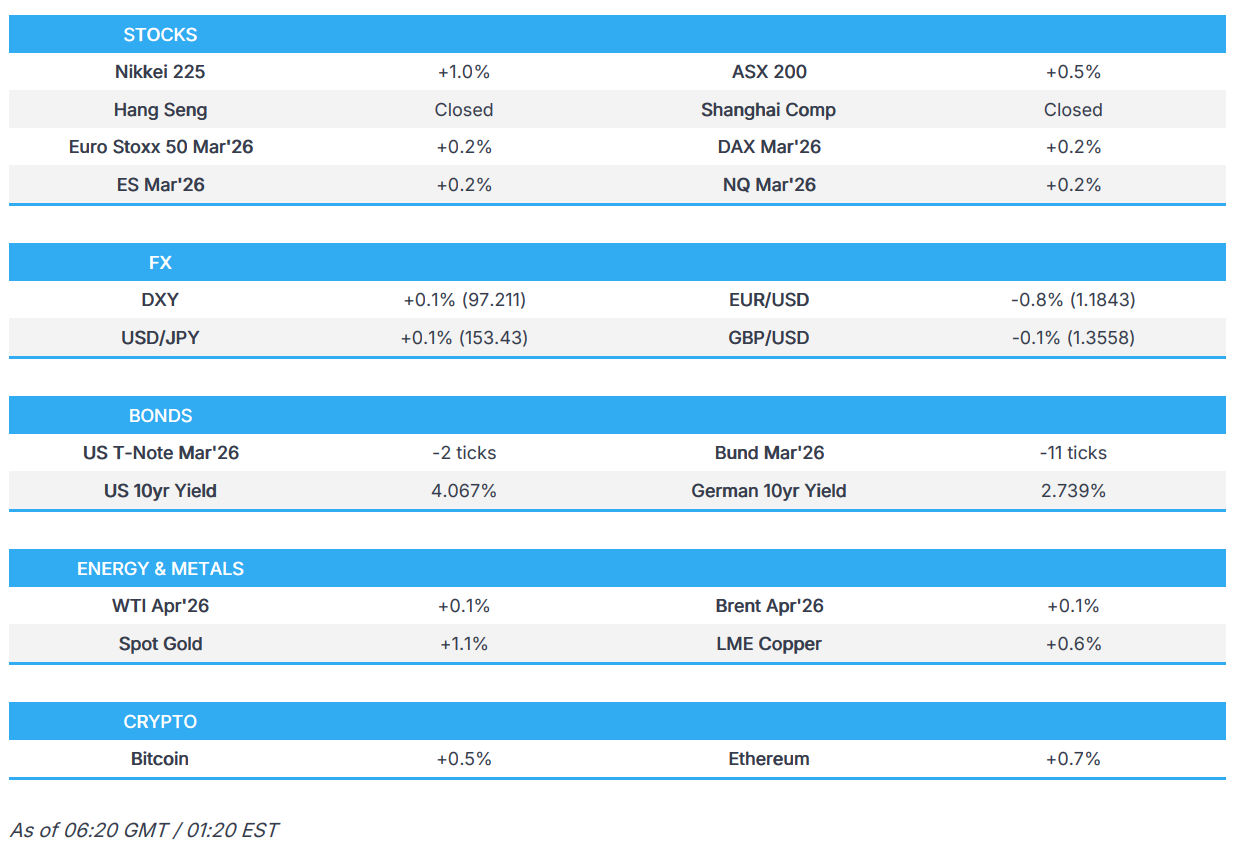

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.2% after the cash market finished with gains of 0.7% on Tuesday.

- Looking ahead, highlights include UK CPI (Jan), US Durable Goods, Industrial Production (Jan), Housing Starts (Nov/Dec), Atlanta Fed GDP, FOMC Minutes (Jan), US-Ukraine-Russia talks to take place (17-18 Feb). Speakers include ECB’s Cipollone, Schnabel & Fed's Bowman. Supply from Germany & US. Earnings from Analog, Carvana, DoorDash, Booking Holdings, Moody's, Garmin, Glencore & Orange.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were choppy on Tuesday, as US players returned from the holiday, but ultimately settled with mild gains. After the US cash equity open, indices saw a notable sell-off with the Mag-7 leading the decline, ex-Apple, although losses were swiftly pared through the afternoon. For Apple, Wedbush wrote that the recent selloff in the tech behemoth is unwarranted, and that 2026 will be the year Apple gets into the AI game.

- Data included weaker-than-expected NAHB and NY Fed manufacturing figures, with the latter marginally topping expectations on the headline, with internals steady; the latter sparked some gradual pressure in T-Notes, while the highlight of the day, and dominating the tape, were geopolitical updates with both the US/Iran meeting, and also the trilateral confab between the US/Russia/Ukraine.

- SPX +0.10% at 6,843, NDX -0.13% at 24,702, DJI +0.07% at 49,533, RUT +0.00% at 2,647.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump announced that the first batch of projects under the US-Japan trade deal will officially begin, which includes a gas-powered plant in Ohio, an LNG facility in the Gulf of Mexico, and a critical minerals plant in Georgia.

NOTABLE HEADLINES

- Fed's Barr (voter) said it is prudent for the Fed to take time and look at data, before changing policy again, while he added that the outlook suggests the Fed will hold rates steady for some time. Barr also said he wants to see more evidence of inflation ebbing to the 2% target and he still sees ‘significant risk’ inflation will stay over 2%, but added it is reasonable to think price pressures will further cool.

- Fed's Daly (2027 voter) said inflation is above target and people are feeling stretched, while current policy is slightly restrictive and they have 75bps to get to neutral. Daly also stated they need to get inflation down and commented that models show productivity gains are lifting the neutral rate, and the labour market is showing less churn and dynamism.

- US President Trump said tax refunds are substantially greater than ever before because of the Great Big Beautiful Bill.

- US President Trump’s administration has intensified its assault on the US Consumer Financial Protection Bureau.

APAC TRADE

EQUITIES

- APAC stocks traded higher in continued thin conditions as many regional bourses remained closed for holidays.

- ASX 200 mildly gained amid outperformance in real estate, tech and financials, with the latter helped by gains in Big 4 bank NAB post-earnings, although miners, materials and resources were at the other end of the spectrum after the prior day's commodities-related pressure.

- Nikkei 225 rallied back above the 57,000 level with sentiment in Japan underpinned by the better-than-expected trade data for January, which showed the fastest pace of increase in exports in more than three years.

- US equity futures gradually edged higher as they attempted to shrug off the recent choppy performance.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.2% after the cash market finished with gains of 0.7% on Tuesday.

FX

- DXY eked slight gains following the recent mixed performance against its major counterparts and after bets over Fed rate cuts by year-end were slightly trimmed. There were also several comments from Fed officials, including Fed Governor Barr, who signalled no urgency to resume easing and believes the outlook suggests the central bank will hold rates steady for some time, while Barr and Goolsbee both said they want to see more evidence on inflation ebbing to the 2% target before entertaining further easing. Furthermore, Fed's Daly said that current policy is slightly restrictive and that they have 75bps to get to neutral, while participants now look ahead to the FOMC Minutes due later today.

- EUR/USD lacked firm conviction after the prior day's whipsawing in which the single currency was initially pressured in the aftermath of disappointing EU and German ZEW data, but then clawed back most of its intraday losses after finding support near the 1.1800 level.

- GBP/USD remained constrained following yesterday's underperformance, owing to the soft labour market report, which showed the unemployment rate unexpectedly rose to 5.2% from 5.1%, and wage growth slowed across both key measures, while the attention now turns to incoming UK CPI data.

- USD/JPY edged higher as the positive risk appetite in Japan spurred outflows from Japan's haven currency, but with losses in the yen cushioned by the stronger-than-expected trade data.

- Antipodeans weakened with NZD underperforming following the RBNZ meeting, where the central bank kept the OCR at 2.25%, as expected, which was the first time it paused in four meetings and the first rate decision under Governor Breman's term. RBNZ refrained from any hawkish surprises, with the committee to continue assessing incoming data carefully, and stated that if the economy evolves as expected, monetary policy is likely to remain accommodative for some time.

FIXED INCOME

- 10yr UST futures mildly breached beneath the prior day's trough after the curve flattened on return from the long weekend and following the better-than-expected ADP employment and NY Fed Manufacturing data, while participants now await the FOMC Minutes due later.

- Bund futures trickled lower following the prior day's choppy performance and disappointing ZEW data, with demand constrained ahead of a EUR 5.5bln Bund issuance.

- 10yr JGB futures initially extended on its recent advances but then reversed course after hitting resistance just shy of the 133.00 level, with demand for JGBs hampered by the positive risk appetite and stronger-than-expected Japanese trade data.

COMMODITIES

- Crude futures attempted to nurse some losses after retreating yesterday as geopolitics dominated the tape, with US-Iran and US-Russia-Ukraine talks conducted in Geneva. On the former, Iran's Foreign Minister said they have reached an understanding on the main principles with the US, which does not mean an agreement will be reached soon, but the path has started, while there was little new information from the trilateral meeting with talks to continue on Wednesday, although Ukrainian President Zelensky said the Ukrainian people would reject a peace deal that involves Ukraine unilaterally withdrawing from the eastern Donbas region and turning it over to Russia.

- US Energy Secretary Wright said they will restart uranium enrichment in the US, in part with partners in France. Wright also said that he thinks we will see several hundred thousand BPD of additional Venezuelan oil production by year-end.

- Spot gold gradually recovered throughout Asia-Pac trade, with the precious metal returning to above the USD 4,900/oz level, heading into today's FOMC Minutes release.

- Copper futures continued its rebound from the prior day's trough with the partial recovery facilitated after sentiment on Wall St somewhat improved, but with further upside limited overnight alongside the absence of key participants due to holiday closures.

CRYPTO

- Bitcoin was relatively rangebound and recovered from an early dip beneath the USD 67,000 level.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi affirmed she will consider a revision of the constitution and wants to pass the budget and tax reform bill quickly, while they are to consider a revision of the imperial household law.

- RBNZ kept the OCR at 2.25%, as expected, while it stated that the committee will continue to assess incoming data carefully and if the economy evolves as expected, monetary policy is likely to remain accommodative for some time. RBNZ said the economy is at an early stage in its recovery, and although residential business investment is increasing, households remain cautious in their spending. RBNZ stated the committee is confident that inflation will fall to the 2% midpoint over the next 12 months, and conditional on the central economic outlook, the OCR is projected to remain around its current level in the near term before increasing from late 2026. Furthermore, it stated that risks to the outlook are balanced and it sees the OCR at 2.26% (prev. 2.20%) by June 2026, at 2.38% (prev. 2.28%) by December 2026, at 2.62% (prev. 2.45%) by June 2027 and sees the OCR at 2.79% by December 2027 (prev. 2.65%).

- RBNZ Governor Breman said the OCR trajectory is aligned with the anticipated evolution of the economy, while she added the OCR track indicates there is a possibility of a hike towards the end of the year, but noted a Q4 hike is not fully priced into the OCR track. Breman also stated that they want to keep the OCR on hold while the economy recovers and are not planning to hike until they see a stronger economy and more inflationary pressure.

DATA RECAP

- Japanese Trade Balance (JPY)(Jan) -1152.7B vs. Exp. -2142.1B (Prev. 113.5B, Rev. From 105.7B)

- Japanese Exports YY (Jan) 16.8% vs. Exp. 12% (Prev. 5.1%)

- Japanese Imports YY (Jan) Y/Y -2.5% vs. Exp. 3% (Prev. 5.2%, Rev. From 5.3%)

GEOPOLITICS

MIDDLE EAST

- US VP Vance said in some ways Iran talks went well, while he added that Iranians are not yet willing to acknowledge some of President Trump's red lines and that Trump has multiple strategies regarding Iran. Furthermore, he said Trump wants to find a solution, whether it is diplomatic or another option.

- Iranian President Pezeshkian said Tehran will never abandon its peaceful nuclear programme.

- Russia, China, and Iran have sent ships together to practice military operations in the Strait of Hormuz.

RUSSIA-UKRAINE

- US Special Envoy Witkoff said the US facilitated the trilateral meeting between Ukraine and Russia, while he added that Ukraine and Russia agreed to update leaders and pursue an agreement.

- Ukrainian President Zelensky said the Ukrainian people would reject a peace deal that involves Ukraine unilaterally withdrawing from the eastern Donbas region and turning it over to Russia. Zelensky also commented that Russia's position is absurd and may be an indication that Moscow is not ready for real peace.

- Head of the Ukrainian negotiating delegation said the first day of trilateral negotiations focused on practical issues and the mechanics of possible decisions.

- Russia-Ukraine-US talks lasted six hours and were tense, while they are to be continued on Wednesday.

OTHER

- US State Department senior official said the US would resume nuclear tests to match 'opaque' Chinese activity and flagged new details about a 2020 test the US recently accused China of secretly conducting, according to SCMP.

EU/UK

NOTABLE HEADLINES

- ECB President Lagarde is expected to leave the ECB, before her eight-year term ends in October 2027, according to FT citing a person familiar with her thinking. However, it was reported shortly after that the ECB said Lagarde remains totally focused on her mission and has not made a decision on her term.

- UK Chancellor Reeves is said to be resisting pressure to spend more on defence, The Telegraph reports citing sources.