Stocks Head For First Drop Of 2026 As Focus Turns To Geopolitics, Macro

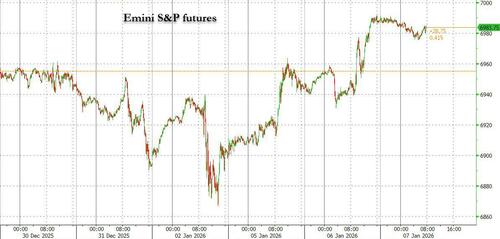

US equity futures are weaker but off session lows, as markets pause ahead of a series of US labor and economic data. As of 8:00am ET, S&P futures are down 0.1% as global equity markets have run into some resistance after a strong start to 2026; Nasdaq futures dip 0.2% with TMT underperforming premarket, with most Mag7 and Semis names lower while Energy, Healthcare and Staples rallying pre-mkt. Bonds are bid with yields down 2-4bp as the curve flattens; the USD is unchanged. n commodities, Ags are the bright spot as we see some profit-taking in Metals and oil fell after Trump said Venezuela would turn over as many as 50 million barrels of crude to the US with sales proceeds are expected to be split between the two countries. Today's US economic calendar includes December ADP employment change (8:15am), December ISM services index, November JOLTS job openings and October factors orders (10am). Scheduled Fed speakers include Bowman on banking supervision and regulation at 4:10pm

In premarket trading, Mag 7 stocks are mostly lower (Nvidia +0.6%, Tesla +0.2%, Apple -0.2%, Alphabet -0.3%, Microsoft -0.1%, Amazon -0.2%, Meta Platforms -0.4%)

- Miners and royalty companies are down as gold and silver pull back with broader markets as traders look to upcoming US economic data later this week.

- AST SpaceMobile Inc. (ASTS) falls 6% after Scotiabank cut the recommendation on the satellite broadband company to sector underperform, saying it faces an “uphill battle” given the leadership position of Elon Musk’s Starlink.

- First Solar Inc. (FSLR) falls 4% after Jefferies cut its recommendation to hold from buy on concerns over tariffs and its valuation.

- Mobileye Global Inc. (MBLY) climbs 10% with the company to acquire Israeli startup Mentee Robotics in a cash-and-stock deal valued at $900 million, as the self-driving car system company expands its robotics capabilities.

- Monte Rosa Therapeutics (GLUE) rises 38% after the biotech announced positive interim data from an ongoing Phase 1 clinical study.

- Strategy (MSTR) climbs 4% after MSCI decided for now to keep digital asset treasury companies in its stock market indexes.

- StoneCo (STNE) falls 5% after after the Brazilian digital payments company said CEO Pedro Zinner will resign for personal reasons effective March 2026.

- Ventyx Biosciences Inc. (VTYX) is up 56% after the Wall Street Journal reported that Eli Lilly & Co. is in advanced talks to acquire the company for more than $1 billion to expand its work in immunology.

In corporate news, MSCI decided against excluding digital-asset treasury companies from its MSCI Global Investable Market Indexes in its February review, sending Strategy higher in extended trading. And an Amazon AI tool offered merchants’ products without their consent.

Stocks have been on a tear on optimism over solid earnings growth and inflation remaining sufficiently contained for the Federal Reserve to keep cutting interest rates. That optimism has persisted despite a worsening geopolitical backdrop, including US actions in Venezuela, its threats of intervention elsewhere and rising tensions between China and Japan. But on Wednesday, the global rally stalled with geopolitical strains dampening the mood. Three big days of data are kicking off, with JOLTS job openings and ADP numbers due later. Memory chip shortages are in focus for AI bulls.

“Shifting trends create uncertainties that need to be priced into assets,” said Florian Ielpo, head of macro and multi-asset at Lombard Odier. “We are talking about a breathing period, with investors taking time to rethink how to deploy their concentrated equity investments in a deconcentrating world.”

Mining stocks were among the biggest decliners in premarket trading, with Newmont Corp., Freeport-McMoRan Inc. and Barrick Mining Corp. all down 1% or more. Precious metals joined the broader pullback, with silver falling below $80 an ounce and gold breaking a three-day winning streak. Copper retreated from an all-time high.

For AI bulls, memory chips are in focus after comments from Nvidia’s Jensen Huang about the need for memory and storage at CES on Tuesday. Stocks including Sandisk and Western Digital have surged in the past few days, and the rally is likely to continue: Samsung expects shortages to drive price hikes and DRAM specialist Nanya posted 445% year-on-year sales growth for December.

Three key days of economic data kick off on Wednesday as investors track the Fed’s likely path for rates, with November jobs openings and ADP Research’s private-sector payrolls figures due. The Institute for Supply Management’s index of services is expected to show a slight moderation in December activity.

“Further declines in the JOLTS hiring and quit rates would add to signs of worsening labor demand,” wrote Elias Haddad, global head of markets strategy at Brown Brothers Harriman. “If so, it would validate the 50 basis points of cuts priced into Fed funds futures over 2026 and weigh on the dollar.”

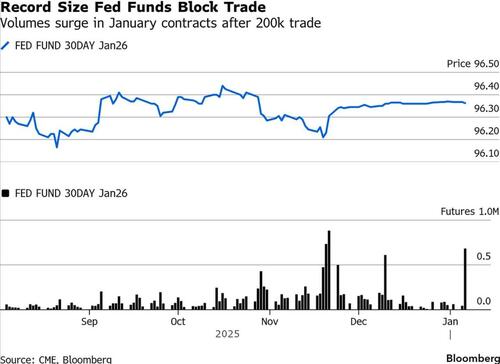

Ahead of a slate of data in the next few days, a record-sized block trade was placed in the federal funds futures market. The trade was struck in the January contracts for a size of 200,000, the largest ever as confirmed by CME Group. The motive behind the transaction is unclear. It could be related to an unwinding of existing bets or a wager that could benefit from a potential shift in market pricing for the Fed’s next rate decision.

Other developments rattling sentiment include comments from the White House that Trump is considering many ways of acquiring Greenland, and won’t rule out the use of military force. In Asia, China escalated a feud with Japan by announcing a probe on chipmaking material, while rare earth stocks surged on the back of new China-Japan export curbs.

In Europe, the Stoxx 600 is little changed with energy stocks a drag as oil prices slide. Energy stocks lag after President Donald Trump said Venezuela would send oil worth up to $2.8 billion to the US, while utilities outperform.

Here are some of the biggest movers on Wednesday:

- Italgas shares rise as much as 10% to hit a new record high after gas distribution operator Snam announced an offer of green bonds due 2031 in an aggregate notional amount of €500m, exchangeable for existing ordinary shares of Italgas.

- Thyssenkrupp shares gain as much as 5.3%, leading defense stocks higher after the Trump administration and Ukraine’s allies moved toward an agreement to offer security guarantees long sought by Kyiv.

- ArcelorMittal shares climb as much as 3.5% to the highest level in nearly 14 years after Morgan Stanley installed the stock as top pick in Europe’s steel sector.

- Atlas Copco shares rise as much as 9% to the highest level since February after Bernstein upgrades on expectations that earnings have bottomed.

- InPost shares retreat as much as 8.3%, ceding some of the previous day’s 28% gain triggered by the parcel locker operator’s announcement of a takeover proposal.

- Fresnillo shares drop as much as 4.1%, leading precious metal miners lower as gold prices decline.

- NatWest shares fall as much as 3% after they are downgraded to equal-weight from overweight at Barclays.

- Equinor shares slip as much as 3.8% as European oil stocks track crude prices downwards after Trump said Venezuela would relinquish as much as 50 million barrels of oil to the US.

- Kingspan shares drop as much as 5.4% after the company said it won’t pursue an IPO of Advnsys and will continue to report the data center materials unit as a wholly owned and broadly distinct reporting segment.

- Redcare Pharmacy shares plunge as much as 9.7%, the most since August, after the company posted fourth-quarter sales that came in below expectations due to weakness in over-the-counter products.

Earlier in the session, Asian equities declined, as escalating trade tensions between China and Japan damped investor sentiment following the recent rally. The MSCI Asia Pacific Index dropped as much as 0.7%, poised to snap a four-day advance. Technology megacaps including TSMC and Tencent were among the biggest drags, while Alibaba dropped on fresh concerns over Beijing regulations. A key gauge of Chinese stocks listed in Hong Kong led losses, while benchmarks in Japan and Taiwan also fell. China imposed controls on exports to Japan with potential military uses, intensifying a standoff between Asia’s top economies in a dispute related to Taiwan. Automakers were the biggest contributor to losses in Japan on the news. The Japan-China squabble is causing some jitters after a strong start to the year for the region’s stocks. The rally had also started to show signs of overheating. The 14-day relative strength index for the MSCI Asia Pacific Index climbed above 70 this week, entering technical overbought territory for the first time since early October.

In rates, treasury futures hold gains accumulated during London morning amid bigger rallies in European bond markets spurred in part by weak German retail sales data for November. US yields richer by 1bp-4bp across a flatter yield curve, with 2s10s and 5s30s spreads respectively 3bp and 2bp tighter; 10-year near 4.145% is about 3bp richer by 3bp on the day with bunds and gilts in the sector outperforming by 1.5bp and 4.5bp. European government bonds advance for a third day, with buying more pronounced at the longer end of the curve. German 10-year yields fall 4 bps to a one-month low after weak economic data prompted traders to increase their bets on interest-rate cuts by the European Central Bank. Gilts outperform, with UK 10-year borrowing costs sliding 7 bps. European borrowers brought a record number of tranches to the market on Wednesday and are set to raise at least €38.1 billion ($44.5 billion), a number that’s likely to increase over the course of the day. Issuance in the US investment-grade bond market topped $72 billion in the first two days of the week, according to data compiled by Bloomberg. Focal points of US session include December ADP employment change and ISM services gauge and November JOLTs job openings.

In commodities, WTI crude futures fall 0.5% to $56.80 a barrel after Washington moved to exert greater control over Venezuela’s industry, with President Donald Trump saying the country would turn over millions of barrels to the US. West Texas Intermediate traded near $57 a barrel. Investors were also keeping tabs on the primary bond market as the first week of 2026 saw a surge in global issuance, signaling strong confidence despite heightened geopolitical risks. Spot silver falls 2% and back below $80/oz. Gold also drops. Bitcoin is down 1.3% near $92,000.

Today's US economic calendar includes December ADP employment change (8:15am), December ISM services index, November JOLTS job openings and October factors orders (10am). Scheduled Fed speakers include Bowman on banking supervision and regulation at 4:10pm. Albertsons is scheduled to report results before the market open. Earnings from Jefferies and Costco December sales are due later in the day.

Market Snapshot

- S&P 500 mini -0.2%

- Nasdaq 100 mini -0.3%

- Russell 2000 mini little changed

- Stoxx Europe 600 little changed, DAX +0.6%

- CAC 40 -0.2%

- 10-year Treasury yield -3 basis points at 4.14%

- VIX +0.4 points at 15.15

- Bloomberg Dollar Index little changed at 1205.69

- euro little changed at $1.1692

- WTI crude -0.9% at $56.59/barrel

Top Overnight News

- Marco Rubio has told lawmakers that President Trump plans to buy Greenland rather than invade it, while Trump has asked aids to give him an updated plan for acquiring the territory. NYT

- Trump will meet with oil company chief executives Friday at the White House to discuss plans for them to enter Venezuela and drill. Trump announced that Venezuela would relinquish 30 to 50 million barrels of oil to the US, worth roughly $2.8 billion at the current market price. BBG

- China's Foreign Ministry said China's legitimate rights and interest in Venezuela must be protected, in regards to US President Trump's statement on Venezuela oil.

- The US for the first time on Tuesday backed a broad coalition of Ukraine's allies in vowing to provide security guarantees that leaders said would include binding commitments to support the country if Russia attacks again. RTRS

- Chevron and private equity firm Quantum Capital Group are teaming up on a bid to buy the international assets of sanctioned Russian oil company Lukoil. FT

- China launched an anti-dumping probe into Japan’s chipmaking material dichlorosilane, deepening trade tensions after Beijing imposed export curbs — potentially affecting over 40% of its shipments to the country. Tokyo called the measures unacceptable. BBG

- AI “fatigue” is driving cash into shares of S&P 500 companies that aren’t the Magnificent 7, especially those that would benefit most if an expected uptick in economic growth materializes. BBG

- old is neck and neck with Treasuries to become the biggest reserve asset for foreign governments, driven by a year of explosive price gains and aggressive central bank buying. Barron’s

- Eurozone CPI for Dec was inline on the headline at +2% (down from +2.1% in Nov) while core cooled to +2.3% (vs. the Street +2.4% and down from +2.4% in Nov). BBG

- Waner Bros. Discovery Board of Directors unanimously recommended shareholders reject amended Paramount tender offer, saying the offer remains ‘Inadequate.’ BBG

- Goldman forecast MSCI China and CSI300 to appreciate 20% and 12% in 2026, after key benchmarks gained 20%-30% in the past year mainly on multiple expansion.

Trade/Tariffs

- China's Commerce Ministry announces an anti-dumping probe into Japan Dichlorosilane imports; investigation begins on Jan 7 and will end a year later, but can be extended by 6 months if needed.

- Japanese Chief Cabinet Secretary Kihara said China curbs targeting only Japan are regrettable, adds we'll consider necessary response as we assess China's export curb details.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded somewhat mixed as momentum began to wane despite the fresh record levels on Wall Street. ASX 200 marginally gained amid strength in tech and defensives, while participants also digested monthly inflation data, which printed softer-than-expected but remained sticky. Nikkei 225 lagged amid Japan's frictions with China after the latter imposed export controls on dual-use items to Japan. Hang Seng and Shanghai Comp retreated with the Hong Kong benchmark pressured by losses in energy names and tech stocks following a decline in oil prices, and with platform names pressured by China announcing management measures for online platforms. Meanwhile, the mainland bourses kept afloat for most of the session but eventually faltered as the mood deteriorated and were also not helped by a substantial net liquidity drain of around CNY 500bln in the PBoC's open market operations.

Top Asian News

- Maersk (MAERSKB DC) said Asia-Pacific ocean freight markets enter 2026 with cautious optimism; intra-Asia volumes are gaining momentum, and supply chain planning is increasingly focused on agility, regional connectivity, and early Chinese NY preparations.

- South Korea's President Lee said had a serious talk with China regarding supply chains and peace on the Korean Peninsula.

- Baidu's (9888 HK) AI chip arm Kunlunxin aims to raise up to USD 2bln in Hong Kong IPO, according to Bloomberg citing sources. - Co. has picked China International Capital Corp., Citic Securities Co. and Huatai Securities, while China Securities International is also working on the potential offering.

- UMC (2303 TT) Dec (TWD): Revenue 19.3bln (prev. 19.0bln Y/Y).

- China's market regulator and cyberspace authorities unveiled two separate documents on Wednesday to further regulate the country's livestreaming e-commerce sector and online trading platforms, Xinhua reported.

- China announces management measures for online platforms and China's market regulator said online platforms must not sell below cost or disrupt market competition. Online platforms must not sell below cost or disrupt market competition.

European bourses are mixed. The FTSE 100 (-0.6%) is under pressure, hit by losses across underlying commodity prices whilst the DAX 40 (+0.6%) posts gains by around half a percent. European sectors hold a very slight negative bias. Utilities holds towards the top of the pile, joined closely by Construction & Materials, and Real Estate. To the downside, Energy is the laggard, in-fitting with pressure seen across crude benchmarks whilst Luxury downside weighs on Consumer Products & Services.

Top European News

- Italian PM Meloni plans overhaul of Italy's voting system to aid re-election bid, according to FT.

FX

- DXY is flat intraday but resides in a current 98.497-98.690 parameter as traders await key US labour market data due ahead of Friday's official employment situation report; ADP's gauge of nonfarm employment is expected to print 49K in December vs -32K in November. JOLTS job openings are expected to fall to 7.61mln in November (prev. 7.67mln in October); in the October report, the quits rate fell to 1.8% from 2.0%, while the vacancy rate was unchanged at 4.6%. Elsewhere, the ISM Services PMI is seen inching down a little in December. Currently, the index is well within Monday’s 98.25-98.86 range, and on either side of its 100 DMA (98.59).

- EUR/USD was initially pressured, continuing the downside seen in the prior session. Though the downside did reverse following the EZ HICP release, which printed in-line with expectations, seemingly as bets for a cooler-than-expected print following the German series unwind. Currently just shy of the 1.1700 mark, after making a peak of 1.1702 overnight.

- AUD/USD is choppy following overnight outperformance given softer-than-expected monthly inflation, but as the headline figure and the core reading remain sticky and above the RBA’s 2-3% target.

- USD/JPY found resistance at yesterday’s high and remains within that session's 156.30-156.80 parameter. Other G10s are largely uneventful and follow the choppy price action.

- PBoC set USD/CNY mid-point at 7.0187 vs exp. 6.9896 (Prev. 7.0173).

Fixed Income

- A firmer start for fixed income. Initial gains were a familiar ~ 5 and ~ 20 ticks for USTs and Bunds, respectively.

- During the early European morning, the benchmarks picked up further, to highs of 112-17+ and 128.19, firmer by 7+ and 51 ticks at most, respectively. A move that occurred in relatively limited newsflow, but as the European risk tone soured. A deterioration that extended on the mixed/downbeat APAC performance, as the region failed to sustain record Wall St. levels.

- EZ HICP Flash figures for December printed in-line with expectations (though the core figures were a touch short of expectations). Some pressure was seen in Bunds following the release, as participants unwound bets for a cooler print after the prelim. German inflation series. Also, no move to Construction PMIs this morning or a dire set of German retail data. However, on the latter, the implications have perhaps been limited given the marked upward revision to the prior (October) series.

- Finally for Bunds, around five ticks of pressure were seen following the tepid results for the new 2036 Bund line. Currently trading at 128.20.

- Gilts acknowledged the bullish action in peers and opened higher by 29 ticks at 92.54 before extending to a 91.84 peak and are currently leading the fixed space. Thereafter an above 3x b/c to a 5yr Gilt auction spurred some very modest upside in Gilts, taking UK paper above the 92.00 mark.

- UK sold GBP 4.25bln 4.125% 2031 Gilt; b/c 3.50x (prev. 3.23x), average yield 3.980% (prev. 4.093%), tail 0.2bps (prev. 0.2bps).

- Germany sells EUR 4.542bln vs exp. EUR 6bln 2036 Bund; b/c 1.29x, average yield 2.83%, retention 24.3%

Commodities

- WTI and Brent futures fell after Washington moved to tighten control over Venezuela’s oil industry, with President Trump saying Venezuela would hand over up to 30-50mln bbls of crude to the US to be sold at market prices, with proceeds managed by the President for the benefit of both countries. Nat Gas on the other hand rebounds following yesterday's slump cited by some to a warmer-than-expected winter.

- Gold eased as focus shifted away from geopolitical risk toward upcoming US data releases, with bullion finding resistance at USD 4,500/oz and now trading near the bottom end of a USD 4,441.44-4,500/oz after a more than 4% rally across the prior three sessions. Meanwhile, Chinese gold reserves data this morning showed rising reserves for a 14th consecutive month. Spot silver fell back under USD 80/oz after peaking at USD 82.77/oz earlier.

- 3M LME copper prices are choppy but holding above the USD 13k/t mark and not far off record highs, with Friday also in focus amid a potential SCOTUS ruling on the Trump tariffs.

- Chevron (CVX) , ConocoPhillips (COP) and Exxon Mobil (XOM) will meet with US President Trump on Friday, according to WSJ.

- US President Trump posted "I am pleased to announce that the Interim Authorities in Venezuela will be turning over between 30 and 50 MILLION Barrels of High Quality, Sanctioned Oil, to the United States of America". Full post "I am pleased to announce that the Interim Authorities in Venezuela will be turning over between 30 and 50 MILLION Barrels of High Quality, Sanctioned Oil, to the United States of America. This Oil will be sold at its Market Price, and that money will be controlled by me, as President of the United States of America, to ensure it is used to benefit the people of Venezuela and the United States! I have asked Energy Secretary Chris Wright to execute this plan, immediately. It will be taken by storage ships, and brought directly to unloading docks in the United States. Thank you for your attention to this matter!".

- US Private Inventory Data (bbls): Crude -2.8mln (exp. +0.5mln), Distillate +4.9mln (exp. +2.1mln), Gasoline +4.4mln (exp. +3.2mln), Cushing +0.7mln.

- Several oil storage tanks are on fire in Russia's Belgorod region after a Ukrainian drone attack, according to the regional governor.

Geopolitics: Ukraine

- Ukrainian drone hits apartment building in Tver, Russia, according to Sky News Arabia.

- Russia sends a submarine to escort tanker the US tried to seize off Venezuela, according to WSJ.

- Several oil storage tanks are on fire in Russia's Belgorod region after a Ukrainian drone attack, according to the regional governor.

Geopolitics: Middle East

- "Iran's president called on law enforcement agencies not to attack protesters", Sky News Arabia reported.

- "Iran's army chief: Trump's and Netanyahu's statements on the demonstrations represent a threat to which Tehran will respond", Sky News Arabia reported.

- US President Trump presses Venezuela to dismiss agents from China, Russia, Iran and Cuba, according to Axios.

Geopolitics: Others

- "Iran's president called on law enforcement agencies not to attack protesters", Sky News Arabia reported.

- Yemeni Saudi-backed government forces reportedly advance towards Aden.

- "Iran's army chief: Trump's and Netanyahu's statements on the demonstrations represent a threat to which Tehran will respond", Sky News Arabia reported.

- China's Foreign Ministry accused the US of bullying and using brazen force, in regards to Venezuela.

- Ukrainian drone hits apartment building in Tver, Russia, according to Sky News Arabia.

- South Korea President Lee said China may move structure in the sea between the two countries.

- US President Trump presses Venezuela to dismiss agents from China, Russia, Iran and Cuba, according to Axios.

- China's Taiwan Affairs Office named two people to be punished for Taiwan independence activities, while it stated the people as well as their relatives are banned from entering the mainland, Hong Kong and Macau.

- Russia sends a submarine to escort tanker the US tried to seize off Venezuela, according to WSJ.

- US President Trump's administration warns Venezuela's Interior Minister to cooperate or face potential targeting, according to sources.

- US said military is among 'options' to acquire Greenland and annexation of semi-autonomous territory from Denmark is ‘national security priority’, according to FT.

- US Secretary of State Rubio told lawmakers that US President Trump aims to buy Greenland, and downplayed military action, according to WSJ.

US Event Calendar

- 8:15 am: Dec ADP Employment Change, est. 50k, prior -32k

- 10:00 am: Dec ISM Services Index, est. 52.2, prior 52.6

- 10:00 am: Nov JOLTS Job Openings, est. 7647.5k, prior 7670k

- 10:00 am: Oct Factory Orders, est. -1.19%, prior 0.2%

- 10:00 am: Oct F Durable Goods Orders, est. -2.2%, prior -2.2%

- 10:00 am: Oct F Durables Ex Transportation, est. 0.2%, prior 0.2%

- 10:00 am: Oct F Cap Goods Orders Nondef Ex Air, prior 0.5%

- 10:00 am: Oct F Cap Goods Ship Nondef Ex Air, prior 0.7%

DB's Jim Reid concludes the overnight wrap

The strong risk rally of 2026 showed no sign of relenting yesterday, as markets continued to shrug off geopolitical developments. That meant both the S&P 500 (+0.62%) and Europe’s STOXX 600 (+0.58%) advanced to new record highs. Moreover in Europe, there was also a decent bond rally thanks to some soft inflation numbers, raising hopes that the ECB’s next move might still be a cut rather than a hike, particularly after the final composite PMIs were a bit weaker than expected. So it was a strong day for the most part, whilst Brent crude oil prices (-1.72%) reversed Monday’s rise as fears of disruption to oil flows from Venezuela eased. Oil is down a similar amount again overnight as Trump has announced that 30-50m barrels will be delivered to the US from Venezuela and most Asia equities have finally paused for breath this morning, trading lower.

In terms of the latest in Venezuela itself, there weren’t really any major developments in the last 24 hours. But multiple press outlets reported that the Venezuelan regime was cracking down on dissent as they sought to consolidate their power after Maduro’s removal. So with the regime still in power, it remains unclear exactly how the US would be involved with the country’s administration over the short-to-medium term, although Trump previously said on Sunday that “If they don’t behave, we will do a second strike”. In the meantime, Venezuela’s assets continued to recover yesterday, with the 2027 bond up another +2.22% to 43.5 cents on the dollar. However, several US energy companies which outperformed on Monday began to struggle again, including Chevron (-4.46%), SLB (-0.39%) and Halliburton (-3.41%), despite the broader move higher in US equities.

Those declines for the oil majors came as Brent crude (-1.72%) erased Monday’s +1.65% rise amid headlines suggesting that the US was keen to avoid disruption to Venezuela’s oil exports. Reuters reported that Venezuela was in talks to export oil to the US while Bloomberg reported that Chevron had booked extra tankers to Venezuelan ports this month, so potentially mitigating the decline in oil shipments from the country amid the recent US naval blockade. Indeed, Brent is trading another -1.65% lower this morning after Trump said last night that Venezuela would turn over “between 30 and 50 MILLION barrels” of oil to the US. There wasn't much extra detail but this sort of volume is around 30-50 days of pre-US blockade production so this could be the oil that has been sitting around and probably doesn't mark the start of a trend.

Whilst investors were focused on Venezuela, there were also fresh headlines on Greenland, as several European leaders issued a statement defending its sovereignty. The group included the leaders of Denmark, Germany, France, the UK, Italy, Poland and Spain, who said that “It is for Denmark and Greenland, and them only, to decide on matters concerning Denmark and Greenland.” It also said that Arctic security must “be achieved collectively, in conjunction with NATO allies including the United States, by upholding the principles of the UN Charter, including sovereignty, territorial integrity and the inviolability of borders. These are universal principles, and we will not stop defending them.” On the other side of the Atlantic, the White House said in a statement to the press that Trump and his advisers were “discussing a range of options” to acquire Greenland and that use of the military “is always an option”.

For markets at least, there was no sign that all this news was having a particularly large impact, and the recent strength in European assets showed no sign of relenting. In fact, there was a fresh round of optimism after the latest European inflation numbers were weaker than expected, which dampened fears about a potential hawkish pivot from the ECB this year. That came as the German CPI reading fell to +2.0% on the EU-harmonised measure (vs. +2.2% expected), whilst the French reading was in line with expectations at +0.7%. So that cemented expectations that the Euro Area-wide print today might come in on the softer side.

Those inflation prints and the prospect of a more dovish ECB helped to bring down yields across Europe, with those on 10yr bunds (-2.8bps), OATs (-1.9bps) and BTPs (-3.5bps) all moving lower. Moreover, that trend got further momentum after the final PMI readings were on the weaker side, with the final composite PMI for the Euro Area revised down four-tenths from the flash print to 51.5. That backdrop helped to support equities too, with the STOXX 600 (+0.58%), the FTSE 100 (+1.18%) and the DAX (+0.09%) all at record highs.

Over in the US, the equity rally also proceeded, with the S&P 500 (+0.62%) exceeding the record high it posted on Christmas Eve. Interestingly, that came in spite of ongoing weakness among the tech mega caps, with the Mag 7 (-0.36%) dragging on the broader index. There were mixed moves within the Mag-7 amid headlines from the CES trade show, with Tesla (-4.14%) leading on the downside after Nvidia (-0.47%) announced plans for a self-driving AI the previous evening. But US equities saw broad gains otherwise, with three-quarters of the S&P 500 constituents higher on the day, while the small cap Russell 2000 (+1.37%) extended its YTD gain to +4.07%. An impressive performance with just three trading days behind us.

In the meantime, US Treasuries lost ground, unlike their counterparts in Europe, with the 2yr yield (+1.2bps) up to 3.46%, whilst the 10yr yield (+1.2bps) reached 4.17%. We did hear from a few Fed speakers as well, although there wasn’t much that shone light on the future policy path. For instance, Governor Miran said “I think that well over 100 basis points of cuts are going to be justified this year.” But that was in line with his previous dovishness, so markets weren’t reactive. Meanwhile, Richmond Fed President Barkin said that “policy will require finely tuned judgments balancing progress on each side of our mandate”, and that it was “a delicate balance”.

The very strong rally in Asian equities so far this year has slightly reversed this morning with the Nikkei (-0.96%) and Hang Seng (-1.21%) leading the losses. The KOSPI (-0.21%) and Shanghai Comp (-0.08%) are also lower but with the S&P/ASX 200 (+0.15%) just about defying the regional trend, following a slowdown in Australia’s core inflation in November, which supports the argument for the RBA to maintain current interest rates (details below). S&P 500 (-0.04%) and Nasdaq futures (-0.12%) are trading just below the flat line.

Returning to Australia, CPI increased by +3.4% y/y in November, down from +3.8% in October and below market expectations of +3.7%. On a m/m basis, the headline CPI remained unchanged at 0.0%. The trimmed mean CPI, which is the RBA’s preferred measure of inflation, slowed to 3.2% y/y from +3.3%, aligning broadly with expectations. On a monthly basis, trimmed mean inflation rose by +0.3%, remaining consistent with October's figures. Meanwhile, the Australian dollar (+0.33%) continues its winning streak for the fourth consecutive session, trading at 0.6760 against the US dollar, despite the easing of inflation in Australia during November. Additionally, yields on Australia’s 10-year government bonds are -2.9bps lower, currently trading at 4.76% as I write this.

Looking at the day ahead, data releases include the Euro Area flash CPI print for December, German unemployment for December, whilst in the US there’s the ISM services index for December, JOLTS job openings for November, and the ADP’s report of private payrolls for December. Otherwise, central bank speakers include the Fed’s Bowman and the ECB’s Pereira.