Stocks mixed following NQ-led selloff; Crude firmer amid US-Iran tensions - Newsquawk EU Market Open

- APAC stocks were ultimately mixed as the region partially shrugged off the downbeat handover from Wall Street.

- NVIDIA (NVDA) AI chip sales to China are reportedly stalled by a US security review, and Chinese customers are, meanwhile, not placing H200 chip orders.

- US House voted (217-214) to pass the USD 1.2tln spending package to fund the government, which was sent to US President Trump, who then signed the bill to end a partial government shutdown, as expected.

- US President Trump said they are still negotiating with Iran and that there is more than one meeting with Iran; US military shot down an Iranian surveillance drone that approached a US Navy aircraft carrier in the Arabian Sea.

- European equity futures indicate a softer cash market open with Euro Stoxx 50 futures down 0.1% after the cash market finished with losses of 0.2% on Tuesday.

- Looking ahead, highlights include Global Final Composite/Services PMIs (Jan), EZ Flash HICP (Jan), Italian CPI Prelim. (Jan), US ADP (Jan), ISM Services (Jan), Riksbank Minutes (Jan), Treasury Refunding Announcement, NBP Policy Announcement, Comments from Fed's Cook, Supply from Germany & US, Earnings from Alphabet, Arm, Qualcomm, ELF, Snap, Uber, Eli Lilly, AbbVie, CME & Bunge.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were pressured as weakness in mega-cap names (NVDA, AVGO, META, MSFT, AMZN) weighed on the tech-heavy Nasdaq 100, which unsurprisingly saw Tech as the clear sectoral laggard. Communications and Discretionary were the next worst hit, while Energy, Materials, Consumer Staples, and Utilities all saw gains in excess of 1%, with Energy underpinned by gains in oil prices due to heightened US/Iran rhetoric after a report that Iranian gunboats approached a US oil tanker in the Strait of Hormuz early Tuesday and ordered it to stop, while the US military shot down an Iranian drone that approached a US Navy aircraft carrier in the Arabian Sea.

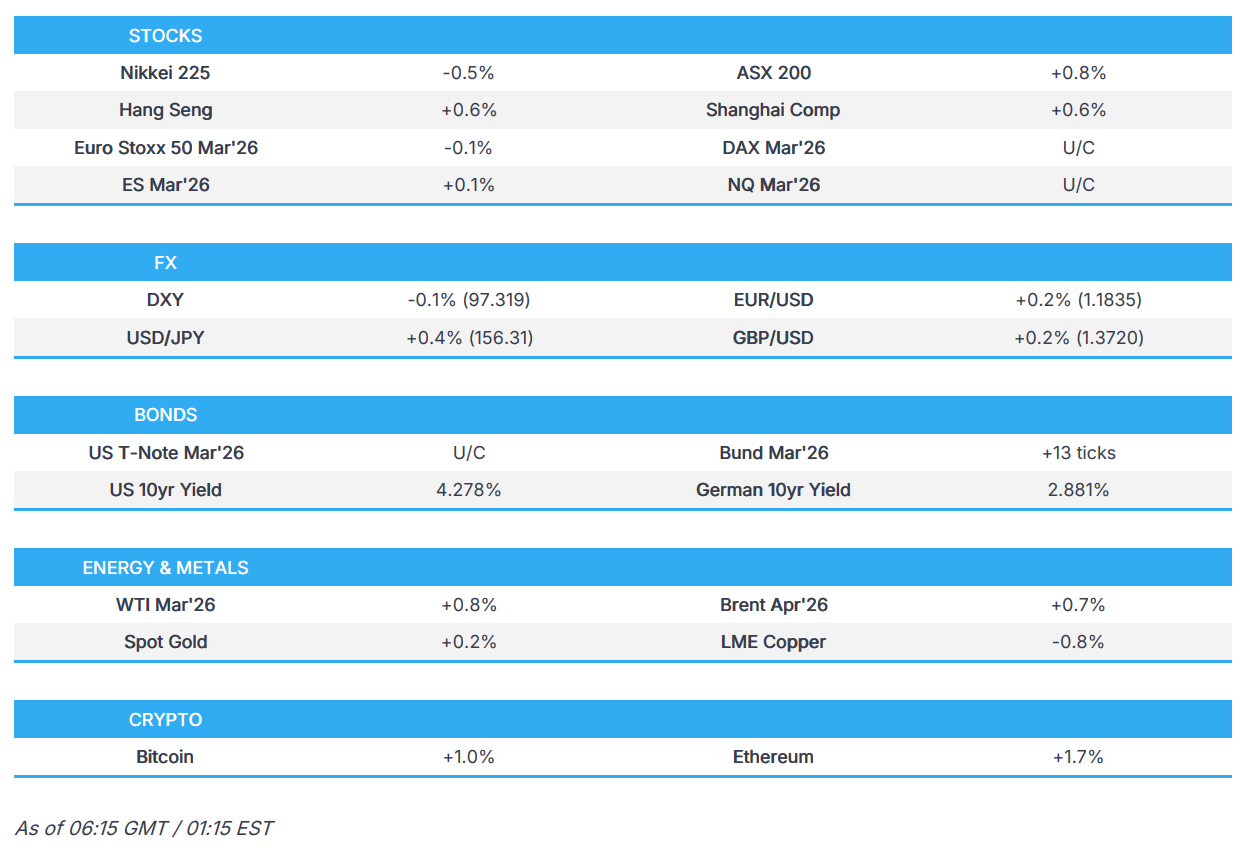

- SPX -0.84% at 6,918, NDX -1.55% at 23,339, DJI -0.34% at 49,241, RUT +0.31% at 2,648.

- Click here for a detailed summary.

TARIFFS/TRADE

- NVIDIA (NVDA) AI chip sales to China are reportedly stalled by a US security review, and Chinese customers are, meanwhile, not placing H200 chip orders with NVIDIA until there is clarity on whether they will be able to secure the licences and what conditions will be attached, according to FT.

- US government reached a water treaty agreement with Mexico.

- US Interior Secretary Burgum said the US plans to announce as many as 11 trade agreements on critical minerals this week.

NOTABLE HEADLINES

- US House voted (217-214) to pass the USD 1.2tln spending package to fund the government, which was sent to US President Trump, who then signed the bill to end a partial government shutdown, as expected.

- Fed Governor Miran resigned on Tuesday from his position as Chair of the Council of Economic Advisers, according to a White House official cited by Barron's.

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed as the region partially shrugged off the downbeat handover from Wall Street, where sentiment was mired by renewed tech-selling, while participants in the region also reflected on the latest Chinese PMI data and the end of the partial US government shutdown.

- ASX 200 climbed higher with the upside led by outperformance in miners as metal prices continued their recovery, but with gains in the index capped by heavy losses in the tech sector.

- Nikkei 225 slumped at the open but is off worst levels, while risk appetite was pressured following recent earnings, including disappointing results from Nintendo, which saw its shares suffer a double-digit percentage drop.

- Hang Seng and Shanghai Comp saw two-way price action as participants digested stronger-than-expected Chinese RatingDog Services PMI data, and after the PBoC drained liquidity, while it was also reported that NVIDIA AI chip sales to China are stalled by a US security review and that Chinese customers are meanwhile not placing H200 chip orders with the company.

- US equity futures traded little changed and got some respite from the prior day's tech-related selling.

- European equity futures indicate a softer cash market open with Euro Stoxx 50 futures down 0.1% after the cash market finished with losses of 0.2% on Tuesday.

FX

- DXY lacked direction after it weakened against most major peers yesterday and gave back some of the post-ISM spoils, while JOLTS data was delayed, and there were several comments from Fed speakers, but didn't provide anything incrementally new. More recently, US President Trump signed the USD 1.2tln spending bill to end the government shutdown.

- EUR/USD eked slight gains but with the upside limited amid a lack of catalysts from the bloc and as inflation data looms.

- GBP/USD gradually reclaimed the 1.3700 handle in uneventful trade with a very quiet calendar for the UK ahead of Thursday's BoE rate decision, while there was little reaction seen to NIESR raising its UK 2026 GDP growth forecast to 1.4% from 1.2%.

- USD/JPY extended on recent advances as the Japanese currency continued to underperform amid the ongoing expectations for a landslide victory by Japanese PM Takaichi's ruling LDP at the snap election on Sunday.

- Antipodeans were rangebound amid the mixed risk appetite in Asia, and with NZD/USD not helped by the ultimately mixed employment and labour cost data from New Zealand.

FIXED INCOME

- 10yr UST futures traded flat amid sparse headline-driven newsflow, which was accentuated by the cancellation of JOLTS data due to the partial government shutdown. Nonetheless, the House has since approved the funds to end the shutdown, which President Trump signed into law, while participants await the Treasury Refunding Announcement.

- Bund futures rebounded off the prior day's trough, but with the upside limited ahead of EZ flash HICP data and Bund supply.

- 10yr JGB futures remained afloat in quiet trade amid a lack of tier-1 data releases from Japan and with risk sentiment mixed.

COMMODITIES

- Crude futures remained firmer with the energy complex supported by US-Iran tensions after reports that the US shot down an Iranian drone and Iranian gunboats approached a US oil tanker in the Strait of Hormuz early Tuesday and ordered it to stop, while the latest private sector weekly inventory data showed a surprise drawdown of over 11mln bbls.

- US Private Inventory Data (bbls): Crude -11.1mln (exp. +0.5mln), Distillates -4.8mln (exp. -2.3mln), Gasoline +4.7mln (+1.4mln), Cushing -1.4mln

- US is working to grant general licenses allowing the production of oil and gas in Venezuela.

- Spot gold continued its firm rebound and returned to above the USD 5,000/oz level.

- Copper futures pulled back overnight after the prior day's rally and with price action contained amid the mixed risk appetite in Asia.

CRYPTO

- Bitcoin gained overnight with prices returning to above the USD 76,000 level.

NOTABLE ASIA-PAC HEADLINES

- China's Vice Finance Minister said China is facing persistent headwinds and policy uncertainty.

- PBoC injected CNY 75bln via 7-day reverse repos with the rate at 1.40% for a net drain of CNY 203bln.

DATA RECAP

- Chinese RatingDog Services PMI (Jan) 52.3 vs. Exp. 51.8 (Prev. 52.0)

- Chinese RatingDog Composite PMI (Jan) 51.6 (Prev. 51.3)

- New Zealand Employment Change QQ (Q4) 0.5% vs. Exp. 0.3% (Prev. 0.0%, Rev. From 0%)

- New Zealand Unemployment Rate (Q4) 5.4% vs. Exp. 5.3% (Prev. 5.3%)

- New Zealand Participation Rate (Q4) 70.50% vs. Exp. 70.3% (Prev. 70.30%, Rev. From 70.3%)

- New Zealand Labour Costs Index QQ (Q4) 0.4% vs. Exp. 0.5% (Prev. 0.5%)

- New Zealand Labour Costs Index YY (Q4) 2.0% vs. Exp. 2% (Prev. 2.1%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said they are still negotiating with Iran and that there is more than one meeting with Iran.

- US Central Command confirmed that a US F-35C shot down an Iranian Shahed drone which flew "aggressively" and with "unclear intent" toward the USS Abraham Lincoln aircraft carrier in the Arabian Sea today, according to CBS.

- White House Press Secretary said that CENTCOM acted appropriately to shoot down an Iranian drone, and talks with Iran later this week are still scheduled, according to Fox News.

- Iran's Far News Agency said an Iranian drone completed a "surveillance mission in international waters" after the US military said it shot down an Iranian drone, while Iran's Tasnim News Agency said the connection with the drone in international waters was lost and that the reason for the lost connection was unknown.

- Iran reportedly wants to change venue and format of nuclear talks with the US, according to Axios citing sources, who noted that Iran is walking back from understandings that were reached in recent days after several countries were already invited to participate in the talks. Furthermore, Iran is said to want to move the talks from Istanbul to Oman and now want to hold them in a bilateral format, only with the US, rather than with several Arab and Muslim countries attending as observers, while a regional diplomat said Iran is also seeking to change the scope of the Friday talks to only focus on the nuclear file, and does not want the direct participation of regional countries.

- Iran told the mediators it is ready to discuss the nuclear issue and is willing to consider compromises, while it added that they can discuss the issue of ballistic missiles and the proxies afterwards, according to the Jerusalem Post.

- Israeli army announced airstrikes and tank shelling on militants after an Israeli officer was seriously injured in a shooting, while the IDF said the shooting at its forces is a violation of the ceasefire agreement in Gaza.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said Ukraine is expected to make concessions, but Russia must also make concessions, mainly stopping aggression.

EU/UK

NOTABLE HEADLINES

- NIESR raised its forecast for UK GDP growth this year to 1.4% from 1.2%.