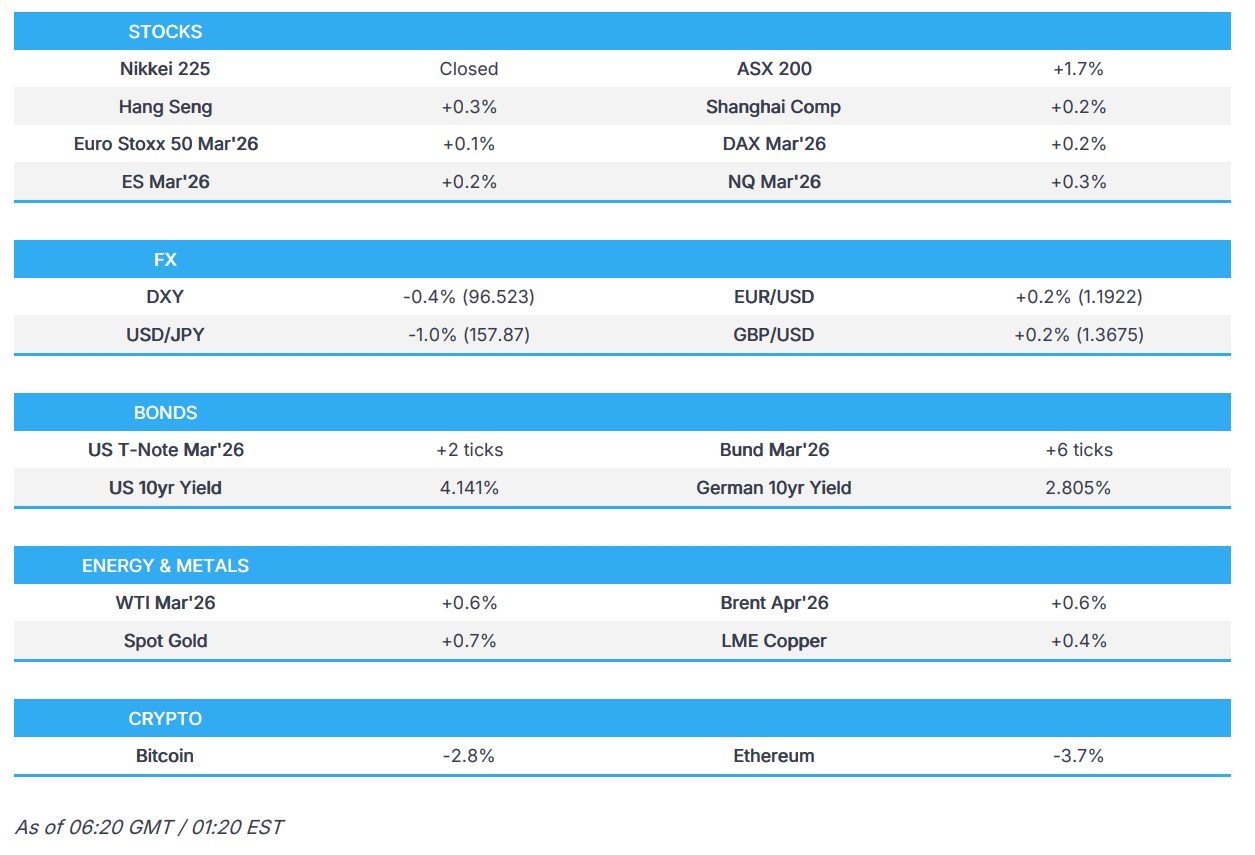

Stocks mostly firmer ahead of US NFP; Crude higher amid further Trump threats - Newsquawk EU Market Open

- APAC stocks traded higher but with some of the gains in the region capped after the weak handover from the US and with the NFP report on the horizon, while participants also digested earnings and data in thinned conditions, with Japanese markets shut for a holiday.

- Ukrainian President Zelensky plans spring elections alongside a referendum on the peace deal after a US push.

- US President Trump said he might send a second carrier to strike Iran if talks fail and stated that "Either we will make a deal or we will have to do something very tough like last time".

- European equity futures indicate a quiet cash market open with Euro Stoxx 50 futures +0.1% after the cash market finished with losses of 0.2% on Tuesday.

- Looking ahead, highlights include ECB Wage Tracker, US NFP (Jan), Japanese PPI (Jan), BoC Minutes (Jan), OPEC MOMR. Speakers include ECB’s Cipollone & Schnabel, Fed's Schmid, Bowman & Hammack. Supply from Germany & US. Earnings from T-Mobile, McDonalds, AppLovin, Equinix, Motorola Solutions, Hilton, Kraft Heinz, TotalEnergies, Michelin.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were broadly lower on Tuesday, albeit in contained ranges, as participants await the US jobs report on Wednesday, followed by CPI on Friday. Data on Tuesday was largely subdued, as retail sales disappointed, and the weekly ADP only saw 6.5k jobs added per week for the last four weeks. Import/export prices saw the former come in as expected, while the latter was slightly lower, in addition to soft employment costs.

- Sectors were mixed, as Utilities, Real Estate, and Materials outperformed, with Financials and Communications lagging as further Alphabet weakness weighed on the latter. For Financials, weakness was led by names such as Charles Schwab and Interactive Brokers Group, which saw a sharp sell-off in the US afternoon, albeit with no clear driver, but some touted Altruist adding AI tax planning to its Hazel platform. One of the other stock-specific highlights included impressive Datadog (+11%) earnings, which helped support software names.

- SPX -0.33% at 6,942, NDX -0.56% at 25,128, DJI +0.10% at 50,188, RUT -0.34% at 2,680.

- Click here for a detailed summary.

TARIFFS/TRADE

- White House revised the Fact Sheet on the US-India trade deal in which the reference to pulses was dropped, and the wording around India's proposed USD 500bln purchase was changed from a firm "commitment" to an "intent".

- US Treasury Secretary Bessent said US-China ties are stable, but competitive and they are aiming for fair competition and de-risking, not decoupling, while he added that China must rebalance amid a persistent USD 1tln trade imbalance.

- White House said regarding the US-Canada bridge that President Trump spoke to Canadian PM Carney earlier today and made his position clear; the fact that Canada will own land on both sides is unacceptable, while Trump believes the US should have shared authority and own at least 50%.

- US House Speaker Johnson failed in an effort to block votes on measures to rescind Trump tariffs.

NOTABLE HEADLINES

- US President Trump said the US should have the lowest interest rates in the world, while he also commented that employment numbers are really good and remained good after government job cuts.

- Fed's Hammack (2026 voter) said the Fed is in a good position with policy ‘to see how things play out’ and the current Fed target rate ‘in vicinity’ of neutral, while she added that interest rates could remain on hold for an extended period while economic data is assessed, and flexibility will be maintained to raise rates if needed.

- Fed's Logan (2026 voter) said in the coming months, if inflation falls and the labour market stays stable, no further rate cuts will be needed. Logan said the current policy stance may be very close to neutral, providing little restraint, while she is cautiously optimistic that the current policy stance will get inflation down to 2% and sustain a balanced labour market.

- White House Press Secretary said President Trump will focus on energy and deregulation this week, with a "clean beautiful coal" event scheduled for Wednesday afternoon, and President Trump is to sign off on scrapping climate rules on Thursday.

APAC TRADE

EQUITIES

- APAC stocks traded higher but with some of the gains in the region capped after the weak handover from the US and with the NFP report on the horizon, while participants also digested earnings and data in thinned conditions, with Japanese markets shut for a holiday.

- ASX 200 outperformed with the index led higher by the top-weighted financial sector after shares in Australia's largest lender and company by market cap, CBA, rallied following a 5% increase in H1 profits.

- Hang Seng and Shanghai Comp were kept afloat following the PBoC's liquidity operations and recent pledge to continue implementing an appropriately loose monetary policy in its quarterly implementation report. However, the upside was limited as participants also reflected on the mixed Chinese inflation data in which CPI printed softer-than-expected, while PPI was slightly better-than-feared but remained in deep deflationary territory.

- US equity futures mildly rebounded overnight amid the brightened mood in Asia and with some repositioning ahead of the looming jobs report.

- European equity futures indicate a quiet cash market open with Euro Stoxx 50 futures +0.1% after the cash market finished with losses of 0.2% on Tuesday.

FX

- DXY weakened in Asia-Pac trade amid gains in the dollar's major counterparts and following the prior day's choppy performance, which was not helped by soft US data, including disappointing Retail Sales, while all attention now turns to the delayed January Nonfarm Payrolls report.

- EUR/USD eked slight gains and reclaimed the 1.1900 status, but with price action contained amid very few fresh catalysts from the bloc, while comments from ECB's de Guindos did little to shift the dial as he reiterated that the current level of rates is appropriate and said recent euro strength is fully consistent with the assumptions included in the ECB's projections.

- GBP/USD rebounded overnight but with the recovery lacking in strength after retreating yesterday from resistance near 1.3700, and with a very quiet calendar for the UK heading into GDP data on Thursday.

- USD/JPY continued its post-election retreat amid bets for sooner BoJ policy normalisation, while USD/JPY was also constrained amid the absence of Japanese participants due to National Founding Day.

- Antipodeans benefitted from the softer dollar with AUD/USD reclaiming the 0.71 handle for the first time in 3 years, while support was seen following comments from RBA's Hauser that inflation is too high, which they can't let persist and will do what is needed to bring inflation back to the target band.

- PBoC set USD/CNY mid-point at 6.9438 vs exp. 6.9109 (Prev. 6.9458).

FIXED INCOME

- 10yr UST futures lingered around the prior day's best levels after climbing in the aftermath of the recent soft data releases, including disappointing Retail Sales, although price action was contained ahead of the Nonfarm Payrolls report and with overnight cash Treasuries trade shut due to the Tokyo market closure.

- Bund futures held on to recent gains after advancing in tandem with global peers, but with price action tempered ahead of today's German Bund issuances.

COMMODITIES

- Crude futures rebounded from the prior day's trough but with further upside limited after the weekly private sector inventory showed a much larger-than-expected build for crude stockpiles, while US/Iran tensions remain in focus after President Trump said he was considering sending a second aircraft carrier strike group to the Middle East to prepare for military action if negotiations with Iran fail. Furthermore, he said that they will either make a deal or will have to do something very tough like last time, and expects the second round of US-Iran talks to take place next week.

- Spot gold gradually edged higher in a somewhat choppy fashion as the key US jobs report looms.

- Copper futures were relatively rangebound heading to the major key risk event and with a lack of conviction seen in its largest buyer, China, following mixed Chinese inflation data.

- Chile Collahuasi Copper Production for December fell 12.1% Y/Y to 36.2k tonnes, while Escondida copper production fell 16.5% to 111.5k tonnes, according to Cochilco.

- US Private Energy Inventory Data (bbls): Crude +13.4mln (exp. +0.8mln), Distillates -2.0mln (exp. -1.3mln), Gasoline +3.3mln (exp. -0.4mln), Cushing +1.4mln.

- EIA STEO (Feb) sees world oil demand for 2026 at 107.8mln BPD (prev. 107.7mln BPD), and world oil demand for 2027 is seen at 106.1mln BPD (prev. 106.1mln BPD).

- US issued Venezuela-related licences which authorise certain transactions necessary to ports and airport operations, as well as certain activities involving Venezuelan-origin oil.

- Venezuela shipped its first crude cargo to Israel as oil exports reopened after Maduro's removal, according to reports.

- Syria is reportedly tapping energy majors to explore for trillions of cubic meters of gas, with the state oil chief noting that Chevron (CVX), ConocoPhillips (COP), TotalEnergies (TTE FP) and Eni (ENI IM) are interested in exploration, according to FT.

CRYPTO

- Bitcoin gradually trickled lower with prices back beneath the USD 68,000 level.

NOTABLE ASIA-PAC HEADLINES

- RBA Deputy Governor Hauser said Australia's economy is not just 'dig it and ship it', with many parts of the economy doing quite well, while he added inflation is too high, which they can't let persist, and will do what is needed to return it to the band.

DATA RECAP

- Chinese CPI MM (Jan) 0.2% vs. Exp. 0.3% (Prev. 0.2%)

- Chinese CPI YY (Jan) 0.2% vs. Exp. 0.4% (Prev. 0.8%)

- Chinese PPI YY (Jan) -1.4% vs. Exp. -1.5% (Prev. -1.9%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said Iran wants to make a deal and it would be foolish if they didn't.

- US President Trump said he might send a second carrier to strike Iran if talks fail and stated that "Either we will make a deal or we will have to do something very tough like last time", while he expects the second round of US-Iran talks to take place next week. Furthermore, he expressed optimism about the diplomatic path and said Iran "wants to make a deal very badly" and is engaging much more seriously than during previous talks due to the military threat, according to Axios.

- US reportedly weighs seizing tankers carrying Iranian oil to pressure Tehran, according to WSJ. Trump administration officials have discussed whether to seize additional tankers involved in transporting Iranian oil to pressure Tehran, but have held off, amid concerns about the regime’s near-certain retaliation and the impact on global oil markets.

- Iran made it clear to mediators in recent days that it is sticking to its position regarding missiles not being a subject of compromise, even though it might be willing to discuss the issue after the nuclear issue is resolved, according to the Jerusalem Post.

RUSSIA/UKRAINE

- Ukrainian President Zelensky plans spring elections alongside a referendum on the peace deal after a US push.

OTHER

- China Global Times former editor-in-chief Hu Xijin posted that if the US sells USD 20bln worth of weapons to Taiwan, it will trigger a very serious crisis, and it would be hard to believe that China will simply conduct another island-encircling military exercise, while he is more inclined to believe that the mainland will take some real actions.