Stocks mostly rebounded following Monday's record selloff; US data postponed due to partial shutdown - Newsquawk EU Market Open

- APAC stocks were mostly higher with several bourses firmly recovering from the prior day's sell-off, as the region took impetus from the positive handover from Wall Street.

- US President Trump announced that India will stop buying Russian oil, while the US will be lowering tariffs on India to 18% from 25%.

- RBA hiked the Cash Rate by 25bps as expected in a unanimous decision, marking the first hike in over two years; RBA's SoMP noted that underlying inflation is higher than expected and GDP growth has continued to pick up.

- US BLS will not release the January jobs report on Friday due to the partial US Government shutdown, while December JOLTS (due 3rd Feb) has also been postponed.

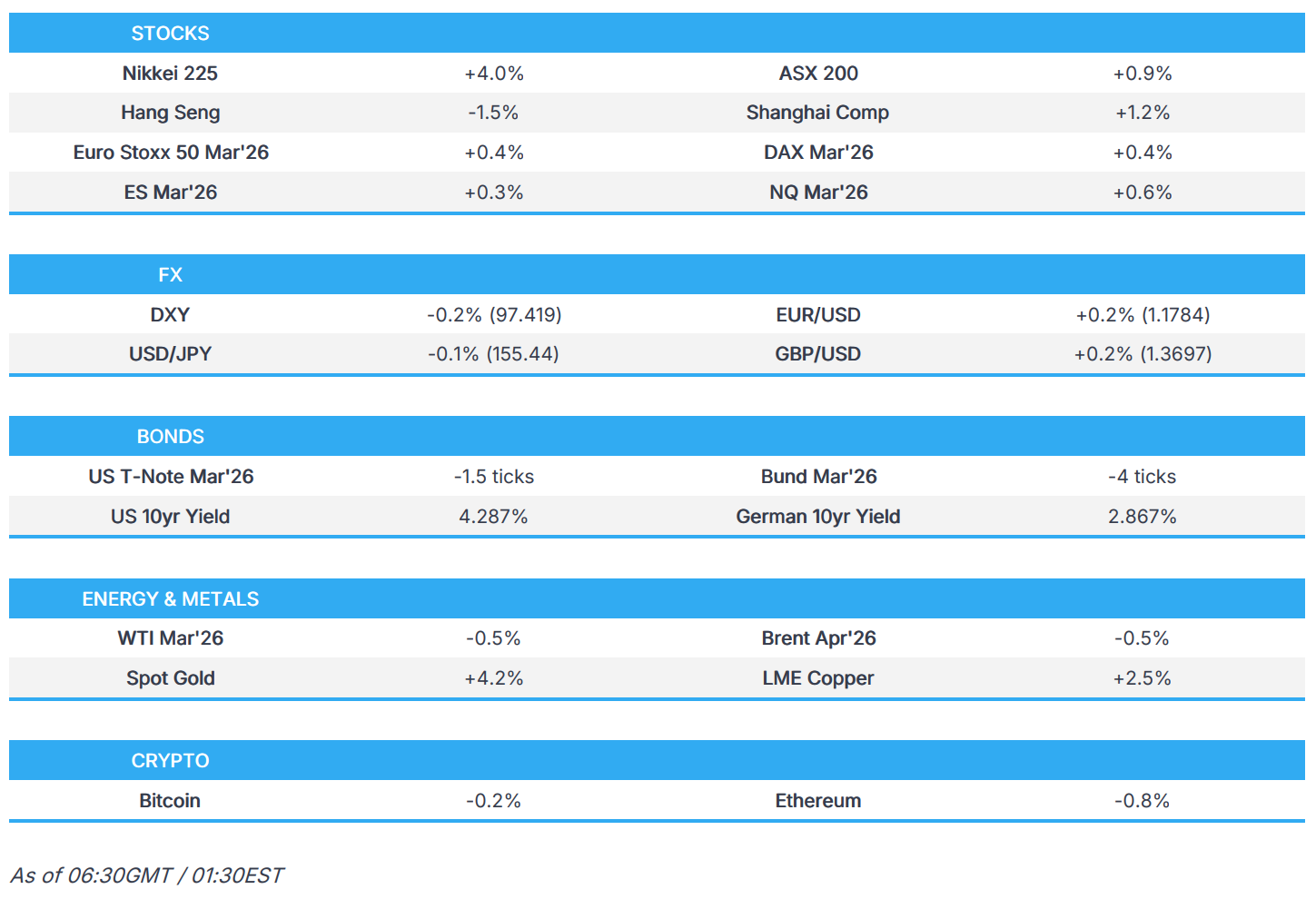

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.4% after the cash market closed with gains of 1.0% on Monday.

- Looking ahead, highlights include French Prelim. CPI (Jan), RCM/TIPP (Feb), New Zealand Unemployment (Q4), Australian S&P PMIs Final (Jan), Speakers including Fed’s Bowman, Barkin & ECB's Lagarde, Supply from UK & Germany, Earnings from AMD, Supermicro, Amgen, Amcor, PayPal, PepsiCo, Pfizer, Merck & Publicis.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks saw gains to start the week, with most sectors also in the green, as Consumer Staples and Industrials led the way, while Energy, Utilities, and Real Estate were the only ones in the red, with the former weighed down by losses in excess of USD 3/bbl on WTI and Brent.

- Energy was heavily sold as the US/Iran rhetoric seemingly eased, after weeks of escalating tension, while Materials names saw notable strength as Trump launches a USD 12bln mineral stockpile to counter China, and participants also digested strong ISM Manufacturing data, which returned to expansion territory for the first time in a year and printed the highest reading since 2022.

- SPX +0.54% at 6,976, NDX +0.73% at 25,739, DJI +1.05% at 49,408, RUT +1.02% at 2,640.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump posted on Truth that it was an honour to speak with Indian PM Modi, who agreed to stop buying Russian oil, and to buy much more from the US and, potentially, Venezuela. Trump added that they agreed to a trade deal between the US and India, whereby the US will charge a reduced Reciprocal Tariff, lowering it from 25% to 18%, while India will move forward to reduce tariffs and non-tariff barriers against the US to zero. Furthermore, Modi also committed to “BUY AMERICAN,” at a much higher level, in addition to over USD 500bln of US energy, tech, agricultural, coal, and many other products.

- White House official said the US is also dropping 25% additional tariff on Indian imports since India is reducing purchases of Russian oil.

NOTABLE HEADLINES

- Fed's Bostic (2026 voter, retiring) said the outlook for H1 of 2026 is for strong economic performance, inflation to stay high and a source of concern, while he stated the outlook for 2026 is a continued resilient economy and that no one is projecting a worsening of the labour market. Bostic said they will have reached an equilibrium with the economy by mid-year, as well as commented that they are not through with inflation from tariffs, and it is premature to say that the inflation job is done. Furthermore, he has no rate cuts for 2026 pencilled in and stated that one or two cuts would put them at neutral.

- Fed SLOOS for January noted that, regarding loans to businesses, survey respondents reported, on balance, tighter lending standards for commercial and industrial (C&I) loans to firms of all sizes, while banks reported stronger demand for C&I loans to large and middle-market firms and basically unchanged demand for C&I loans to small firms on net.

- US President Trump said the Fed chair nominee will do well and that the investigation into Fed Chair Powell should be taken to the end.

- US President Trump announced the creation of a US strategic critical minerals reserve, which includes USD 2bln funding from the private sector and USD 10bln funding from the US Exim Bank.

- US President Trump said they are working hard with House Speaker Johnson to get the current funding deal that passed in the Senate last week, through the House and to his desk, which he would sign into law immediately.

- US House Rules panel advanced the Senate funding package.

- US Treasury said it expects to borrow USD 109bln in Q2 and sees end cash balance of USD 900bln, while it is to borrow USD 574bln in Q1 and sees end cash balance of USD 850bln.

- Barron's reported that the BLS will not release the January jobs report on Friday due to the partial US Government shutdown, while December JOLTS (due 3rd Feb) has also been postponed.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher with several bourses firmly recovering from the prior day's sell-off, as the region took impetus from the positive handover from Wall Street, where markets rallied after a strong ISM Manufacturing report.

- ASX 200 climbed higher with tech and miners leading the advances, although further upside was capped as the focus turned to the RBA which hiked rates for the first time in over two years and sounded hawkish on inflation.

- Nikkei 225 surged following recent currency weakness and gained a firm footing above 54,000 to hit a record intraday high.

- KOSPI outperformed in a turnaround from the prior day's bloodbath with the Korea Exchange activating a sidecar earlier in the session to briefly halt program trading after a sharp rise in the local benchmark.

- Hang Seng and Shanghai Comp initially lagged with early pressure seen across tech stocks, despite no immediate obvious catalysts, and with some attributing it to VAT hike concerns, while the Hang Seng TECH Index briefly re-entered bear market territory after dropping more than 20% from its October high. However, Chinese markets then pared their losses alongside the broad rally in Asia.

- US equity futures held on to recent spoils and lingered near the prior day's best levels.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.4% after the cash market closed with gains of 1.0% on Monday.

FX

- DXY took a breather after advancing against all G10 peers yesterday as yields climbed and participants digested better-than-expected ISM Manufacturing PMI data, which printed its first expansion in 12 months and at the fastest pace since 2022. There were some recent Fed comments in which Bostic argued that one or two rate cuts would put them at neutral and said it's premature to say that the inflation job is done, while it was also announced that the BLS has delayed the December JOLTS report due today and the January NFP report that was scheduled for Friday owing to the partial government shutdown.

- EUR/USD nursed losses after having recently suffered against the firmer dollar and returned to 1.1800 territory, while it was also reported that France adopted the 2026 state budget after the government survived no-confidence votes.

- GBP/USD eked slight gains, albeit with price action contained amid quiet pertinent newsflow and a sparse calendar for the UK heading into Thursday's BoE meeting.

- USD/JPY slightly eased back from yesterday's peak after rallying alongside the recent dollar strength and the improvement in risk sentiment, while Japanese Finance Minister Katayama clarified regarding PM Takaichi's comments over the weekend and said the PM talked about FX benefits as a general fact and didn't specifically emphasise merits in a weak yen.

- Antipodeans gained amid the rebound in risk appetite and metal prices, while further upside was seen after the RBA meeting, where the central bank hiked the Cash Rate by 25bps to 3.85%, as expected, and stated inflation is likely to remain above target for some time.

- PBoC set USD/CNY mid-point at 6.9608 vs exp. 6.9598 (Prev. 6.9695)

- SNB Chairman Schlegel said interest rates are currently appropriate and that the SNB can cut rates below zero, but noted a higher threshold, while he also commented that the current situation with low inflation and 0% interest rates is not easy for monetary policy.

FIXED INCOME

- 10yr UST futures languished at the prior day's trough after the curve flattened in the aftermath of the strong ISM report.

- Bund futures remained subdued after retreating yesterday and ahead of Bund issuances scheduled for today and tomorrow.

- 10yr JGB futures retreated amid the improvement in risk sentiment and with demand not helped by a weaker 10yr JGB auction.

COMMODITIES

- Crude futures remained lacklustre after declining yesterday amid some unwinding of the geopolitical risk surrounding a potential US attack on Iran, with US envoy Witkoff and Iranian Foreign Minister Araghchi to meet on Friday in Istanbul to discuss a possible nuclear deal.

- Spot gold continued to recover from the recent historical slump and returned to above the USD 4800/oz.

- Copper futures edged higher alongside the resurgence in metal prices and risk appetite.

CRYPTO

- Bitcoin was choppy overnight and returned to flat territory after recovering from a brief dip beneath the USD 78,000 level.

NOTABLE ASIA-PAC HEADLINES

- RBA hiked the Cash Rate by 25bps to 3.85%, as expected, with the decision unanimous, while it stated that inflation is likely to remain above target for some time and that a wide range of data confirms inflation has picked up materially. RBA said broad measures of wage growth continue to be strong and job market conditions are a little tight, but also noted that private-sector demand is growing faster than expected. It also stated there are uncertainties about the outlook for domestic economic activity and inflation and the extent to which monetary policy is restrictive. RBA's Statement on Monetary Policy noted that underlying inflation is higher than expected and GDP growth has continued to pick up, with private demand growth surprisingly strong, while it projected trimmed mean inflation at 3.7% (prev. 3.2%) in June 2026, 3.2% (prev. 2.7%) in December 2026, and 2.7% (prev. 2.6%) in December 2027. It also sees annual GDP growth at 2.3% (prev. 2.0%) in December 2025, 1.8% (prev. 1.9%) in December 2026, and 1.6% (prev. 2.0%) in December 2027, while its forecasts assume a Cash Rate of 3.9% in June 2026, 4.2% in December 2026 and 4.3% in December 2027.

- RBA Governor Bullock said the pulse of inflation is too strong and that high inflation hurts all Australians, while she added the Board thinks inflation will take longer to return to the target, and they cannot allow inflation to get away from them. Bullock also said she would not give forward guidance and that the board will remain focused on data, as well as noted that they did not discuss a 50bps rate increase.

DATA RECAP

- South Korean Inflation Rate MM (Jan) 0.4% vs. Exp. 0.4% (Prev. 0.3%)

- South Korean Inflation Rate YY (Jan) 2.0% vs. Exp. 2.1% (Prev. 2.3%)

- Australian Building Permits MM (Dec P) -14.9% vs. Exp. -5.7% (Prev. 15.2%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said they are talking with Iran and will see how that goes.

- US senior official said the US-Iran meeting on Friday will focus on trying to reach a "package deal" that would prevent war with Iran, while the Trump admin hopes Iranians will come to the summit ready to make significant compromises, according to Axios.

- Israeli officials estimate that US President Trump will launch an attack on Iran, and expect negotiations with Iran to reach an impasse, according to Al Hadath.

RUSSIA-UKRAINE

- US President Trump said they are doing very well with Ukraine and Russia and thinks they will have some good news, while he stated that Russian President Putin agreed to no missiles going into Kyiv.

- Ukraine agreed a multi-tier plan for enforcing any ceasefire with Russia, according to the FT

- Loud explosions were reportedly heard in Ukraine's capital of Kyiv, according to witnesses.

OTHER

- US Interior Secretary Burgum said absolutely when asked whether the Cuban regime could fall, and stated that with a change in government, investment upside is dramatic, according to Fox News.

EU/UK

NOTABLE HEADLINES

- France's government adopted the 2026 budget after it survived two no-confidence votes in Parliament.