Stocks softer as US set to return; Oil in focus ahead of meetings in Geneva - Newsquawk EU Market Open

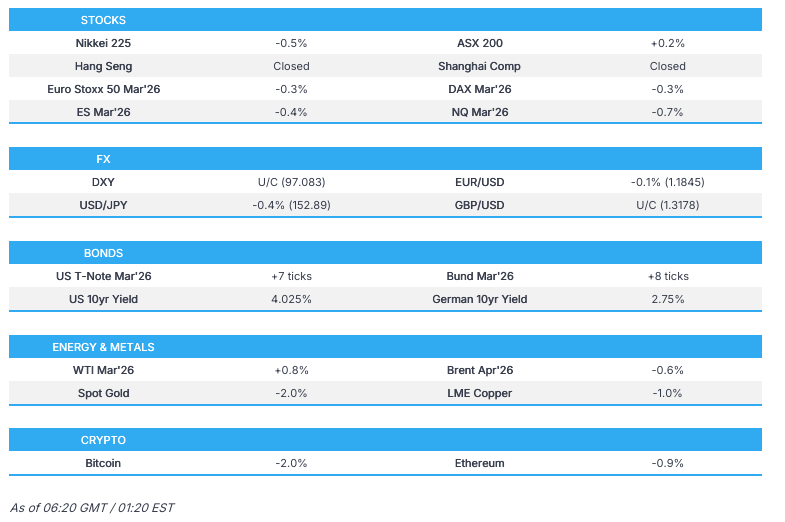

- APAC stocks traded mixed amid the extremely thinned conditions due to the Lunar New Year holiday and in the absence of a lead from the US, where markets were closed for Washington's Birthday/Presidents Day.

- Nikkei 225 retreated shortly after the open with SoftBank and heavy industry stocks leading the declines, as the post-election euphoria petered out following the recent underwhelming GDP data. USD/JPY pulled back with pressure seen as risk sentiment in Japan deteriorated shortly after the open.

- US President Trump said he will be involved in the Iran talks indirectly and that Iran wants to make a deal, while he also stated that Iran "are bad negotiators" and he hopes they will be more reasonable in talks.

- European equity futures indicate a subdued cash market open with Euro Stoxx 50 futures down 0.3% after the cash market closed with losses of 0.1% on Monday.

- Looking ahead, highlights include UK Unemployment/Wages (Dec), German/EZ ZEW (Feb), US ADP Weekly, NY Fed (Feb), Canadian CPI (Jan), Japanese Balance of Trade (Jan), US-Iran talks, US-Ukraine-Russia talks (Feb. 17th-18th). Speakers include Fed’s Barr & Daly, Supply from Germany. Earnings from Medtronic, Leidos, Palo Alto, Cadence Design Systems, Republic Services, Vulcan Materials, Kenvue, Antofagasta. Holiday: Chinese Spring Festival Golden Week (17-24 Feb).

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US markets were closed for Washington's Birthday (Presidents' Day).

TARIFFS/TRADE

- Canadian PM Carney announced that Janice Charette has been appointed as the next Chief Trade Negotiator to the US, while she will be working closely with Canada’s Ambassador to the US, Mark Wiseman, and will act as a senior adviser to Carney and LeBlanc on the upcoming CUSMA trade review.

- Mexico's Economy Minister said Mexico and Canada will present an action plan on minerals, infrastructure and supply chains in H2 2026.

- Japan announced that it will set up a simplified safety screening system for US-made cars in a boost to Toyota (7203 JT) and other Japanese automakers that are planning to reverse-import vehicles made in the US.

APAC TRADE

EQUITIES

- APAC stocks traded mixed amid the extremely thinned conditions due to the Lunar New Year holiday and in the absence of a lead from the US, where markets were closed for Washington's Birthday/Presidents' Day.

- ASX 200 was led higher by outperformance in miners as BHP shares surged after the mining giant reported a 28% jump in H1 net, although gains in the broader market were capped by weakness in tech and real estate.

- Nikkei 225 retreated shortly after the open with SoftBank and heavy industry stocks leading the declines, as the post-election euphoria petered out following the recent underwhelming GDP data.

- US equity futures mildly retreated overnight amid the humdrum environment and lack of macro catalysts.

- European equity futures indicate a subdued cash market open with Euro Stoxx 50 futures down 0.3% after the cash market closed with losses of 0.1% on Monday.

FX

- DXY traded little changed in the absence of any fresh macro catalysts and following the holiday closure stateside, while participants look ahead to weekly ADP Employment and NY Fed Manufacturing data, as well as the latest Fed commentary from Barr and Daly.

- EUR/USD marginally trickled lower, but with price action kept within tight parameters near the 1.1850 level amid light newsflow from the bloc and the recent mixed EU Industrial Production data.

- GBP/USD price action was lacklustre ahead of UK employment and wages data, while UK PM Starmer U-turned again, whereby his government abandoned plans to delay 30 council elections following legal advice, and polling suggested that Labour majorities on 10 councils are set to be wiped out.

- USD/JPY pulled back with pressure seen as risk sentiment in Japan deteriorated shortly after the open, while there were some recent comments from former BoJ board member Adachi, who sees a likelihood that the BoJ will hike rates by 25bps in April.

- Antipodeans were rangebound amid the mixed risk appetite and with little reaction seen to the release of the RBA Minutes from the February meeting which noted that members agreed that prevailing uncertainties meant it was not possible to have a high degree of confidence in any particular path for the cash rate and the Board concluded inflation would stay stubbornly high if it had not hiked interest rates as it did this month.

FIXED INCOME

- 10yr UST futures gradually edged higher as yields continued to soften following the holiday closure on Monday for Washington's Birthday, while participants look ahead to data and Fed speak.

- Bund futures eked slight gains but with the upside limited after the prior day's choppy mood and as German ZEW data and issuances loom.

- 10yr JGB futures climbed higher amid the negative risk sentiment in Japan and as participants contemplate the ramifications of recent weak GDP data on near-term BoJ policy, while there was a mixed reaction seen following the 5yr JGB auction, which was relatively in line with the previous.

COMMODITIES

- Crude futures faded some of the prior day's gains after steadily advancing in thinned conditions, while the focus turns to US-Iran talks and trilateral negotiations between Ukraine, Russia and the US in Geneva.

- Hungary's MOL initiated the release of strategic crude oil reserves to maintain security of supply in the region with no oil delivered via Druzhba pipeline since Jan 27th, while it began supplying its refineries with seaborne crude oil to make up for the shortfall.

- Spot gold retreated after stalling around the USD 5,000/oz level with selling pressure seen alongside a drop in silver prices, which tumbled by around 5% before bouncing off its lows.

- Copper futures remained subdued with demand hampered amid the mass holiday closures across the region, including its largest buyer, China.

CRYPTO

- Bitcoin was choppy and ultimately retreated after briefly testing the USD 69,000 level to the upside.

NOTABLE ASIA-PAC HEADLINES

- RBA Minutes from the February 2nd-3rd meeting stated that members agreed that prevailing uncertainties meant it was not possible to have a high degree of confidence in any particular path for the cash rate, and the Board concluded inflation would stay stubbornly high if it had not hiked interest rates as it did this month. Members agreed that the data received since the previous meeting had strengthened their concern that, without a policy response, inflation would remain persistently above target for too long. Furthermore, it stated that longer-term bond yields in Australia had moved higher, reflecting changed expectations for the cash rate, while the strategy remains to return inflation to target over time, whilst preserving employment gains, and incoming data will be critical in assessing how risks evolve.

GEOPOLITICS

MIDDLE EAST

- US President Trump said he will be involved in the Iran talks indirectly and that Iran wants to make a deal, while he also stated that Iran "are bad negotiators" and he hopes they will be more reasonable in talks.

- US officials said they expect Iran to come to the Geneva talks today with concrete concessions regarding its nuclear program, according to Axios.

- Israeli army conducted bombing operations in deployment areas within Beit Lahiyah and the Northern Gaza Strip, according to Palestinian media cited by Al Qahera.

- UN Secretary-General Guterres condemned the Israeli government's decision to renew land registration in Judea and Samaria, while he called for a reversal of the decision and adherence to the two-state solution, according to Kan News.

RUSSIA-UKRAINE

- Ukrainian long-range drones hit the Ilsky oil refinery in the Krasnodar Krai region of Russia, and the refinery is on fire, according to Visegrad 24.

OTHER

- US President Trump said Secretary of State Rubio is talking to Cuba right now and that they want to make a deal, while Trump stated that we will see how it all turns out with Cuba and the US talking.

- Nigerian army spokesperson said 100 US forces had arrived in Nigeria as Washington scales up military operations to fight extremism.

EU/UK

NOTABLE HEADLINES

- UK Labour party majorities on 10 councils are set to be wiped out now that the cancelled elections are going ahead, according to polling for The Telegraph.

- EU Commissioner Dombrovskis said EU officials held a constructive meeting to strengthen the international role of the euro on Monday.