TACO Tuesday? Everything Crashing As Trump Arrives In Davos Amid Japan Bond Meltdown

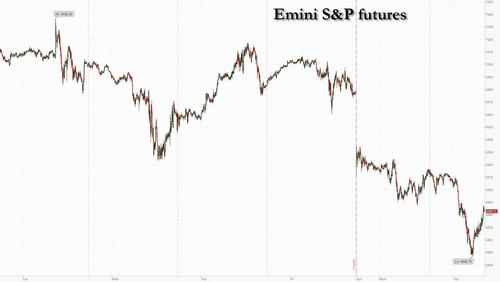

US equity futures are sharply lower, on pace for their biggest drop of the year, with Beta underperforming. And while geopolitics are the catalyst - as attention remains glued to see what Trump will say next on his Truth Social feed ahead of this week's Davos meetings - after Trump reignited his trade war with Europe, the moves are exacerbated by a meltdown in JGBs (in a historic move, 30Y JGB are +27bp, a 6-sigma move) which has triggered a global bond selloff. As of 8:00am ET, S&P futures are down 1.4%, but off their worst levels of the morning; Nasdaq futures slide 1.7%. Pre-market, all of Mag7 are lower alongside higher beta plays. Energy, Materials, Staples, and Utils are outperforming on the move lower. In the latest geopolitical news, the EU suggests a proportional response to Trump’s Greenland demands but that the previous trade deal still holds as Trump threatens additional tariffs on France; at the same time, Bessent says that EU is not looking to exit their Treasury holdings after a report from Deutsche suggested Europe - which holds a record $8 trillion in US assets - could do just that. The yield curve is twisting steeper with belly to backend of the yield curve +3 – 9bp as DXY falls the most since late Aug. Commodities are today's safe haven led by nat gas (ahead of freezing polar blasts in both Europe and the US) and precious metals (gold and silver both at new record highs, gold rising above $4700 and silver fast approaching $100). Today’s macro focus is the weekly ADP print and any updates from Davos as the market wants to see if today will be another TACO Tuesday.

In premarket trading, Magnificent Seven stocks decline alongside other growth names (Amazon -2.4%, Alphabet -2.3%, Tesla -2.1%, Nvidia -2%, Meta Platforms -2.1%, Microsoft -1.5%, Apple -1.3%)

- Gold and silver miners, including Newmont (NEM) and Agnico Eagle (AEM), rise as investors to look for safe-haven assets after US President Donald Trump announced a new 10% levy on eight European countries opposed to his plans to seize Greenland. Newmont +3%, Agnico Eagle +3.6%

- And as traders flee risk, decliners include crypto-linked stocks such as Coinbase (COIN), which is down 4%.

- 3M Co. (MMM) declines 4% after providing a 2026 adjusted earnings forecast range with a midpoint that fell slightly short of estimates. Adjusted earnings will be $8.50 to $8.70 a share in 2026, the maker of Post-it notes said. Analysts had expected $8.64 on average, according to the average of estimates compiled by Bloomberg.

- AppLovin (APP) falls 7% after a negative research report by CapitalWatch. The stock was also weighed down by a broader tech selloff amid rising geopolitical tension.

- Ciena Corp. (CIEN) drops 6% after BofA Global Research cut its recommendation to neutral from buy, citing valuation and future backlog.

- ImmunityBio (IBRX) rises 23% after the drug developer said it held a Type B End-of-Phase meeting with the US FDA regarding its supplemental application for its drug to treat bladder cancer.

- Netflix Inc. (NFLX) inches about 1% higher after reaching an amended, all-cash agreement to buy Warner Bros. Discovery Inc.’s studio and streaming business as it battles Paramount Skydance Corp. to acquire one of Hollywood’s most iconic entertainment companies.

In corporate news, Apple retook the top spot in China after iPhone shipments jumped 28% during the holiday quarter, according to Counterpoint Research. Bain Capital is said to be working with Citigroup and JPMorgan on a review of Singapore-based Bridge Data Centres that may lead to a stake sale.

While traders have been able to get past a whirlwind of other unexpected developments this year, the standoff over Greenland is giving even the biggest bulls a jolt, with no off-ramp yet and forcing the biggest overnight selloff in US futures this year. Trump’s push to take control of Greenland, and renewed trade war with Europe, has injected fresh volatility into markets, reviving fears of a trade confrontation between traditional allies with little sign of compromise. Adding to tensions, Trump overnight threatened to impose steep tariffs on champagne after French President Emmanuel Macron ruled out joining a US-led peace initiative.

The VIX broke above 20 points for the first time since November. Trump’s threat to impose tariffs unless a deal is reached for the purchase of Greenland has sparked speculation that European countries could dump US assets (easier said than done), while a spat with France’s Macron left Trump considering a 200% tariff on wine and champagne.

“The only hope really is that Republican senators and congressmen put a stop to this,” said Laurent Lamagnere, deputy chief executive officer at AlphaValue in Paris. “Investors have taken advantage of these volatility moments to buy the dip but for myself, I am not comfortable. There is no guarantee it will work this time.”

Adding to the pain, long-term treasury yields spiked after a meltdown in Japanese bonds, sending the 30-year US rate up nine basis points to 4.93%. Investors balked at Prime Minister Sanae Takaichi’s election pitch to cut taxes on food, pushing Japan’s 40-year rate to a fresh high.

8 hours later, 6-sigma collapse https://t.co/taZruAyYX8 pic.twitter.com/pbUB3QpMh3

— zerohedge (@zerohedge) January 20, 2026

The latest market drama comes in a backdrop of extreme bullishness. Investors are the most bullish in nearly five years, while protection against an equity correction is at the lowest since 2018, according to Bank of America’s latest fund manager survey. With BofA’s indicator showing the market at a “hyper-bull level,” it’s time to increase risk hedges and havens, strategist Michael Hartnett said. Still, investors caught between FOMO and growing geopolitical risks can take a cue from derivatives strategists: Hot trades for 2026 range from vanilla tail hedges to bespoke dispersion baskets.

Adding to the deluge of headlines, the annual World Economic Forum in Davos is on this week. Bessent urged calm over Greenland at a press conference, while Trump said he will use the event to meet with various parties over his ambition to take control of Greenland. Bessent also said in his remarks that the next Fed chair could be announced next week.

Barclays’ strategist Emmanuel Cau said “erratic” US policies may reinforce “sell America” bias among global allocators. Allianz Global Investors sees the risk of an escalating trade war between the world’s largest economies as “significantly higher” compared to the aftermath of Liberation Day, and expects precious metals to benefit.

Stocks in Europe have extended yesterday’s declines, Stoxx 600 is lower by 1.3% with industrial good and construction stocks leading declines, while media and food beverage shares outperformed. Here are the biggest movers Tuesday:

- Wise shares jump as much as 14.3%, marking their best day since mid-2023, after the financial technology company surpassed results expectations and raised its margin goal for the full year

- Renault shares rise as much as 3.2% as the French carmaker’s brand vehicle sales increased 3.2% last year and the firm said it will work with Turgis Gaillard on a drone project

- Inficon shares rise as much as 6.6% to the highest in nearly a year, after Deutsche Bank upgrades the Swiss vacuum instruments maker to buy from hold and raises the price target by almost 50%

- LVMH falls as much as 2.4% in Paris, on track for a seventh straight session of losses, the longest streak since March, after US President Donald Trump signaled he could impose a 200% tariff on French wines and champagne

- BKW shares fall as much as 12%, the most since June 2023, after the Swiss energy firm cut its Ebit guidance for the full year following a value adjustment of its Wilhelmshaven coal power plant

- Acciona Energias Renovables declines as much as 5.5% as RBC double-downgrades to underperform, saying the renewables firm’s weak balance sheet is a key driver of earnings risk. Parent company Acciona SA drops 5%

- Fresenius Medical Care shares slip as much as 3.5% after Goldman Sachs downgraded its recommendation on the stock to neutral from buy, citing several headwinds for 2026

- Carl Zeiss Meditec shares drop as much as 6.3%, to the lowest since February 2017, after Goldman Sachs cut its rating on the German medical optics company to neutral from buy, citing further challenges this fiscal year

- Valneva shares drop as much as 14%, after the French vaccine maker said it had decided to voluntarily withdraw the biologics license application and investigational new drug application for its chikungunya shot, Ixchiq, in the US

Asian stocks fell, as equities in Japan extended their decline amid growing political uncertainty. The MSCI Asia Pacific Index fell 0.5%, and earlier dropped as much as 0.8%, the most in more than a week. Tech names including Samsung Electronics, Tencent and SK Hynix were among the biggest drags on the gauge. Along with Japan’s shares, gauges in China and South Korea fell, and Indian stocks touched a two-month low. Japan’s Topix index fell the most in a month as political uncertainty grew following Prime Minister Sanae Takaichi’s snap election announcement. Simmering geopolitical tensions around US President Donald Trump’s threats to Greenland’s sovereignty also hurt risk appetite. Chinese equities fell following a raft of measures by Beijing to cool a market rally. Regulators have tightened requirements for margin financing and clamped down on high-speed traders to rein in potential froth.

“Asia markets are largely shrugging off the US-Europe drama,” said Derek Tay, head of investments at Kamet Capital Partners. “Trump seems to like to dramatize everything and talk big before walking back his threats.”

As earnings season kicks into gear, the bar is high for companies to deliver. Analysts predict fourth-quarter S&P 500 earnings growth of 8%, according to data compiled by Bloomberg Intelligence. Key themes include AI spending, oil and tariff jitters and the defense boom. Morgan Stanley strategists, meanwhile, expect an above-average EPS beat rate as the bar was low coming into the quarter.

In FX, the dollar is weaker versus all major peers, with the Bloomberg Dollar Index down 0.3%. The Swiss franc remains the haven of choice with CHF/JPY hitting the 200 level for the first time on record. Gains in the yen are limited by fiscal angst in the run-up to the Feb. 8 election.

In rates, an overnight surge in long-dated Japanese yields, which soared by much as 27bps, has set the tone for fixed income markets. US 10- and 30-year yields are up 7bps and 9bps respectively, with the curve bear-steepening. The German 10-year yield is up 5bps and its UK counterpart higher by 7bps.

In commodities, it’s been another day of record highs for spot gold and silver, which are posting respective gains of 1.2% and 1.0%. Crude futures are showing marginal gains with little follow-through from Libya’s oil crescent halting operations amid adverse weather conditions. Bitcoin is down 1.9%.

The US economic calendar includes weekly ADP employment change (8:15am) and January Philadelphia Fed non-manufacturing activity (8:30am). Fed officials are in a self-imposed communications blackout ahead of the Jan. 28 policy decision, with no action on rates priced into short-term interest-rate products

Market Wrap

- S&P 500 mini -1.7%

- Nasdaq 100 mini -2%

- Russell 2000 mini -2% (*)

- Stoxx Europe 600 -1.2%

- DAX -1.4%

- CAC 40 -1.2%

- 10-year Treasury yield +7 basis points at 4.29%

- VIX +1.4 points at 20.25

- Bloomberg Dollar Index -0.3% at 1204.7

- euro +0.6% at $1.1718

- WTI crude +0.3% at $59.6/barrel

Top Overnight News

- Japan’s bond rout intensified as investors gave a thumbs down to Sanae Takaichi’s election pitch to cut taxes on food. The 40-year yield rocketed past 4%, a first for any maturity of the nation’s sovereign debt in more than three decades. BBG

- Trump’s big Davos speech tomorrow is set to focus on affordability. He’s expected to outline a proposal to allow 401(k) savings to fund home down-payments and elaborate on plans to ban institutional investors from buying single-family homes, cap credit card rates and intervene in the market for MBS. BBG

- Scott Bessent urged calm over Greenland, calling for Europe to honor trade agreements and telling the World Economic Forum in Davos that the idea that Europeans might dump US assets “defies any logic.” BBG

- Federal Reserve Chair Jerome Powell plans to attend Wednesday’s Supreme Court hearing over the attempted dismissal of Fed Governor Lisa Cook by President Donald Trump, according to a person familiar with the situation. BBG

- US Treasury Secretary Scott Bessent said President Donald Trump could announce his pick for the next Federal Reserve chair as soon as next week. BBG

- Trump: "I know who I want to be Fed Chair, will announce sometime".

- Senior state planners in China are formulating a five-year plan to lift domestic demand, acknowledging that the world’s second-largest economy currently faces an imbalance between “strong supply and weak demand.” WSJ

- China bought about 12 million tons of US soybeans over the past three months, traders said, meeting a key pledge in its trade talks with the US. BBG

- President Donald Trump threatened to hit French wines and champagnes with 200% tariffs in an apparent effort to cajole French President Emmanuel Macron into joining his Board of Peace initiative aimed at resolving global conflicts. RTRS

- Netflix reached an amended, all-cash agreement to buy Warner Bros. Discovery Inc’s studio and streaming business as it battles Paramount Skydance Corp. to acquire one of Hollywood’s most iconic entertainment companies. BBG

Trade/Tariffs

- US President Trump: "I will impose 200% tariff on French wines and champagne, and President Macron will join the Board of Peace".

- China said they hit its US soy purchase target of 12mln tonnes, Bloomberg reported citing traders.

- Taiwan's Vice President said we will balance the trade deficit between Taiwan and the US.

- South Korea is reportedly to hold off on USD 20bln worth of US trade investment, due to KRW impact.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly in the red, except the KOSPI, as the tech sector led the declines. ASX 200 continued to fall away from its 2026 peak of 8915, despite the positivity seen in the metals space as BHP upgraded its FY26 copper production guidance. Nikkei 225 neared 53,000, falling from its ATH of 54,522, as traders assess the policies put forward by the LDP and Centrist Reform Alliance going into the February 8th elections. KOSPI was set to snap its 5-day winning streak, falling from its ATH at 4924, as the tech sector weighs on sentiment. Samsung Electronics and SK Hynix briefly led losses, with shares down as much as 3% each before price gradually rebounded but remained in the red. Hang Seng and Shanghai Comp traded with modest losses, and little follow-through from the PBoC unsurprisingly holding LPRs steady. Global equities continue to price in the re-escalation of tariffs between the US and EU.

Top Asian News

- Citi sees the potential of 3 rate hikes in 2026 by the BoJ if JPY weakness continues.

European equities (STOXX 600 -1.3%) are trading on the back foot, with sentiment remaining under pressure as trade tensions between the US and Europe continue to escalate. The latest development came overnight, when US President Trump threatened to impose a 200% tariff on French wine and champagne. However, Treasury Secretary Bessent spoke on EU-US relations, saying that he is confident that leaders will not escalate and things will work out. European sectors are largely trading in the red; Media leads whilst Industrials and Utilities underperform.

Top European News

- US Treasury Secretary Bessent said the US is experiencing a capex boom, which always leads to an employment boom. The narrative of EU nations discussing selling USTs is false; there is no talk of this, it is mis-reporting. On trade:. said the worst thing countries can do is heighten trade tension with the US. The narrative of EU nations discussing selling USTs is false. There is no talk of this, it is mis-reporting. Swiss-US agreement is well along the road. On EU-US relations, said there is no need to jump to the worst case scenario at this point. Reminds that trade ties have been strained before, and it worked out. Is confident that leaders will not escalate and that it will work out. On Economy:. Expects economic growth to be strong this year, at around 4-5% real GDP growth. They will see substantial refunds of up to USD 1000 per worker in Q1.

- Citi downgrades Continental Europe to Neutral from Overweight; rising tensions and tariff uncertainties undermine the short-term outlook for European equities.

FX

- DXY is on a weak footing this morning, and currently trades at the bottom end of a 98.46-99.13 range. To recap, overnight, President Trump threatened a 200% tariff on French wines/champagne after French President Macron rejected his invitation to join his latest peace initiative. Thereafter, Trump said the UK is acting with “great stupidity”, following the Chagos deal.

- The largest bout of pressure for the Dollar was after Treasury Secretary Bessent called for calm and reminded markets that US-EU relations have been strained before, but eventually worked out. This seemingly poured some cooler water on the situation, and the index fell from around 98.85 to a current session low of 98.46.

- The recent pressure in the USD has helped to push G10s higher across the board; CHF tops the leaderboard, the EUR resides near highs beyond the 1.1700 mark, whilst USD/JPY has slipped below the 158.00 mark to make a trough at 157.58. Overnight, the JPY was shunned, alongside aggressive selling in JGBs, spurred by increased bets of unsustainable fiscal policy after PM Takaichi called snap elections and the fiscal commentary from parties since.

- Elsewhere, Cable sits towards session highs and within a 1.3410-1.3491 range. Earlier, the November jobs report showed a tick higher in the unemployment rate, whilst the wage components remained elevated. A knee-jerk lower was seen in the Pound, but this pared almost immediately, given the narrative around a summer-cut has not really shifted for the BoE.

Fixed Income

- Fixed on the backfoot as yields climb in catch-up to Monday's US holiday and with Japan at record levels.

- JGBs down to a 130.66 base, c. 80 ticks below the close on Monday. Pressure driven by the Takaichi trade being in force into the formal election announcement on Friday, and then the polls on 8th February. Pressure that appears to be driven by scrutiny of the fiscal plans of both the government and the combined opposition, as they outline plans to postpone/remove various tax measures.

- Action that has driven Japanese yields to highs. The 40yr above 4.23% (+40bps), the 30yr above 3.90% (+41bps), 20y to 3.48% (+32bps), 10yr to 2.38% (+20bps). With the curve markedly steeper.

- Macquarie's Berry wrote, "if the selloff continues, and especially if it spreads globally, then we should see the BoJ dust it [bond buying tool] off and put it to work - maybe as early as tomorrow morning's daily operations".

- Evidently, we have seen the selloff spread globally. USTs are pressured down by around 9 ticks, and currently resides at the bottom end of the day's range; Gilts (-70 ticks) and Bunds (-45 ticks) also follow suit. The latter took a leg lower on the region's ZEW metrics, whereby the Expectations figure topped expectations and improved from the prior.

- Japan sold JPY 800bln 20-year JGBs; b/c 3.19x (prev. 4.10x, 12-month avg. 3.44x), average yield 3.2510% (prev. 2.916%). Tail 25bps (prev. 3bps).

Commodities

- Crude on the backfoot but only marginally so. Spent the APAC session in a narrow range with complex-specific newsflow somewhat light as the market focus remains on Greenland and the tariffs stemming from it. Early morning trade saw some mild selling in the complex, but this has since reversed to trade towards highs of USD 59.59/bbl and USD 64.27/bbl.

- Spot gold at highs, printed another ATH of USD 4737/oz given the risk tone and despite the morning's significant yield strength.

- Base peers in the red. 3M LME Copper down to USD 12.8k/T, within reach of Friday's USD 12.7k/T base and back towards opening levels from early-January.

- China announces plans to expand high-level opening of nonferrous metals future markets by steadily including eligible futures and options in foreign access.

- China raises both gas and diesel prices by CNY 85 per tonne from the 21st January.

- Venezuela's Acting President said plans to boost gold and iron output in 2026, and attract metals investment for FX.

- China's Shanghai Futures Exchange to adjust margin requirements and daily price limits for selected copper, aluminium, gold and silver futures contracts from the 22nd of January settlements.

Geopolitics: Ukraine

- Ukrainian President Zelensky might go to Davos if he has a bilateral meeting with Trump to sign "prosperity deal".

- Russia's Lavrov said they yet to receive documents following recent US and European talks on Ukraine.

- Russia's Lavrov said they are ready for contact with the US on Balkans.

Geopolitics: Others

- European Commission President von der Leyen says the bloc's response will be united, proportional and unflinching. The territorial integrity of Greenland is non-negotiable and they will be working on wider Arctic security measures.

- UK Government, in response to Trump's remarks on Diegeo Garcia, said "the deal secures the operations of the joint US-UK base on Diego Garcia..." and "It has been publicly welcomed by the US...".

- US President Trump posted "Thank you to Mark Rutte, the Secretary General of NATO!".

- US President Trump posted "the United Kingdom, is currently planning to give away the Island of Diego Garcia..." adds that this "is another in a very long line of National Security reasons why Greenland has to be acquired.".

- US President Trump, on Truth Social, said he had a good phone call with NATO Secretary General Rutte about Greenland, and have agreed to meet various parties in Davos.

- US President Trump said he will talk about Greenland in Davos, does not think the EU will push back too much on Greenland.

- US President Trump conceded in a weekend phone call with UK PM Starmer that he was given bad information regarding troop deployments from European countries to Greenland, CNN reported citing senior UK official.

US Event Calendar

- 8:15am ADP Weekly Employment Change

- 8:30am Philadelphiaa Fed Non-mfg Survey

DB's Jim Reid concludes the overnight wrap

I watched the new Game of Thrones prequel last night. When I first watched the original series 15 years ago the geopolitics of Westeros and beyond were that of pure fantasy. A decade and a half on and it sometimes feel like we're now in our own episode with all that's going on in the world.

With the US off yesterday the implications of the tariff threats over Greenland had yet to fully percolate through financial markets. This morning US cash bond trading have reopened in Asia and 10yr USTs are +3.8bps higher trading at 4.26% and 30yrs +4.8bps at 4.885%. 2yr yields are flat. The sharp sell-off in long-end bonds ultimately reversed the full effects of Liberation Day so it's worth keeping an eye on the demand for US assets as a barometer for how aggressive the US might be on this policy.

S&P 500 (-1.01%) and NASDAQ 100 (-1.14%) futures are at similar levels to where they were when Europe went home last night with European equity futures flat to slightly lower. Asia equity markets are selling off a touch more with the Nikkei (-0.98%) being the largest underperformer, followed by the ASX (-0.66%). All other main Asian markets are within a tenth or two of being flat on both sides of zero. JGBs continue to see a very large sell-off, ahead of the upcoming election on February 8th, this time not helped by a soft 20yr auction. 10 and 30yr yields are +8.1bps and +21.7bps higher this morning with 40yr yields crossing 4%. Pretty dramatic moves especially as 10yr yields had already moved +7.7bps yesterday.

This morning the Euro has edged up another tenth of a percent and is now +0.55% above the pre-weekend levels with the Dollar yesterday weakening against every other G10 currency, just as long-end Treasury futures were also losing ground. Interestingly Polymarket suggest the probability of all Trump's Greenland tariffs going into effect by February 1st is currently 18%, rising to 39% for some of these being imposed. Denmark and Norway are those seen with the highest likelihood of sticking. So Polymarket participants expect compromise but not with high certainty.

So markets have reacted but there's clearly room for bigger moves if the rhetoric increases further. Trump will likely continue to be active beforehand but remember he speaks at Davos tomorrow and this would be an ideal location for him to get his full views of the world across. Yesterday he declined to rule out the use of force to take Greenland, saying “No comment” when asked by NBC News in an interview. That’s driven growing fears about some kind of retaliatory trade escalation from Europe, with increasingly strong comments from several officials. For instance, German finance minister Lars Klingbeil said that “We are constantly experiencing new provocations, we are constantly experiencing new antagonism, which President Trump is seeking, and here we Europeans must make it clear that the limit has been reached”. Nevertheless, US Treasury Secretary Bessent warned the EU against retaliatory tariffs, saying they’d be “very unwise”.

At around 530am London time just before we go to print Trump posted on social media that “I had a very good telephone call with Mark Rutte, the Secretary General of NATO, concerning Greenland. I agreed to a meeting of the various parties in Davos, Switzerland. As I expressed to everyone, very plainly, Greenland is imperative for National and World Security. There can be no going back — On that, everyone agrees." So some elements of conciliation but without changing his demands.

In terms of what it meant for equities yesterday, trade-exposed sectors were particularly affected. So the STOXX 600 (-1.19%) posted its worst performance in two months, with auto companies like BMW (-3.43%) and Porsche (-3.73%) falling back, whilst a decline in luxury stocks pushed France’s CAC 40 (-1.78%) back into negative territory for 2026. Defence stocks were the main exception however, with Rheinmetall (+0.95%) one of the few to advance on expectations this could galvanise a fresh push towards higher European defence spending. S&P 500 futures were down around -1% at the time of the European close, whilst the VIX index of volatility (+2.98pts) has jumped to 18.8pts as I type, its highest level in nearly 2 months. Elsewhere, Gold prices have risen +1.84% since the weekend.

The situation is complicated by the upcoming Supreme Court ruling on the IEEPA tariffs, which might end up further constraining Trump’s room for manoeuvre on tariffs. However, no-one knows when this will come through (apart from maybe the judges). The bid offer is somewhere between today and June. The market has been burnt before by overreacting to tariff threats. Obviously, there was Liberation Day but more recently Trump’s escalation with China in October prompted a -2.71% decline for the S&P 500 on that day, before he then met with Xi and the trade truce was extended by a year.

For sovereign bonds, the latest developments brought about a clear curve steepening, echoing what happened in previous moments of trade escalations. At the front end, the rally was driven by more dovish central bank pricing, as investors grappled with the prospect of more rate cuts to soften any trade war. So 2yr German yields (-3.1bps) saw a clear decline yesterday, but with 10yr bund yields up +0.5bps.

Otherwise yesterday, there was little data of note, although the Euro Area CPI reading for December was revised down very slightly to +1.9%, having been at +2.0% on the flash print. Elsewhere, Canada’s CPI print was higher than expected yesterday, with headline inflation picking up to +2.4% (vs. +2.2% expected). However, the two measures of core inflation tracked by the Bank of Canada both fell back, with the median core measure down to +2.5% (vs. +2.7% expected), whilst the trim core measure fell to +2.7% as expected. Finally, the IMF also released their latest growth forecasts, upgrading global growth in 2026 by two-tenths to +3.3%, with 2027 unchanged at +3.2%.

Looking at the day ahead, data releases include UK unemployment for November, along with the German ZEW survey for January. Central bank speakers include the ECB’s Nagel, along with BoE Governor Bailey and Deputy Governor Ramsden. Finally, earnings releases include Netflix and United Airlines.