Tailing 5Y Auction Sees Record High Directs, Record Low Dealers

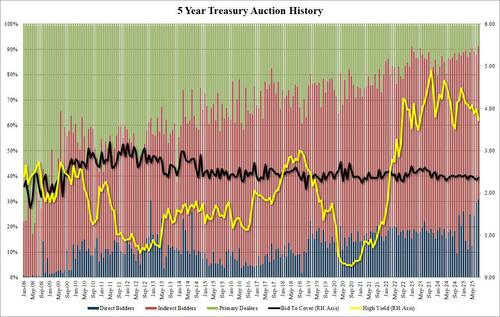

After yesterday's stellar, blowout 2Y auction, moments ago the US sold $70 billion in 5Y paper in what was a far weaker auction.

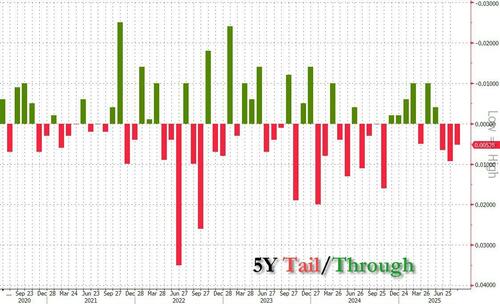

The high yield was 3.724%, down from 3.983% in July and the lowest since last September's 3.519%; it also tailed the When Issued 3.717% by 0.7bps, the 3rd tail in a row.

The Bid to Cover was 2.36, up from last month's ugly 2.31, but below the six auction average of 2.37.

The internals were also wobbly, with Indirects taking 60.5%, up from 58.3%, but also far below the recent average of 69.3%. But weakness in foreign demand was offset by a surge in domestic demand, with Directs taking a new record high of 30.7%.

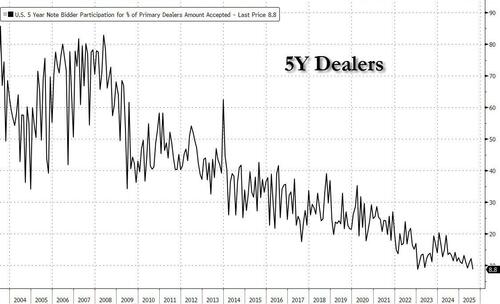

This left just 8.8% for Dealers, tied with the previous record low from Jan 2023.

And overall:

While this was generally a disappointing auction, although with some silver linings below the surface, clearly the market did not care, and 10Y yields slumped to the day's lows shortly after the auction.