Tension eases after Trump withdrew tariff plans on Europe; European equity futures firmer - Newsquawk European Opening News

- US President Trump said he had a very productive meeting with NATO's Rutte, and they have formed a framework of a future deal; will not be imposing the tariffs that were scheduled to go into effect on February 1st.

- The proposal by NATO's Rutte does not include the transfer of overall sovereignty, Axios reported citing sources; the plan includes the increase of security in Greenland and NATO activity in the Arctic.

- US President Trump said he likes keeping NEC Director Hassett where he is; down to two or three for Fed Chair; "probably down to one in my mind."

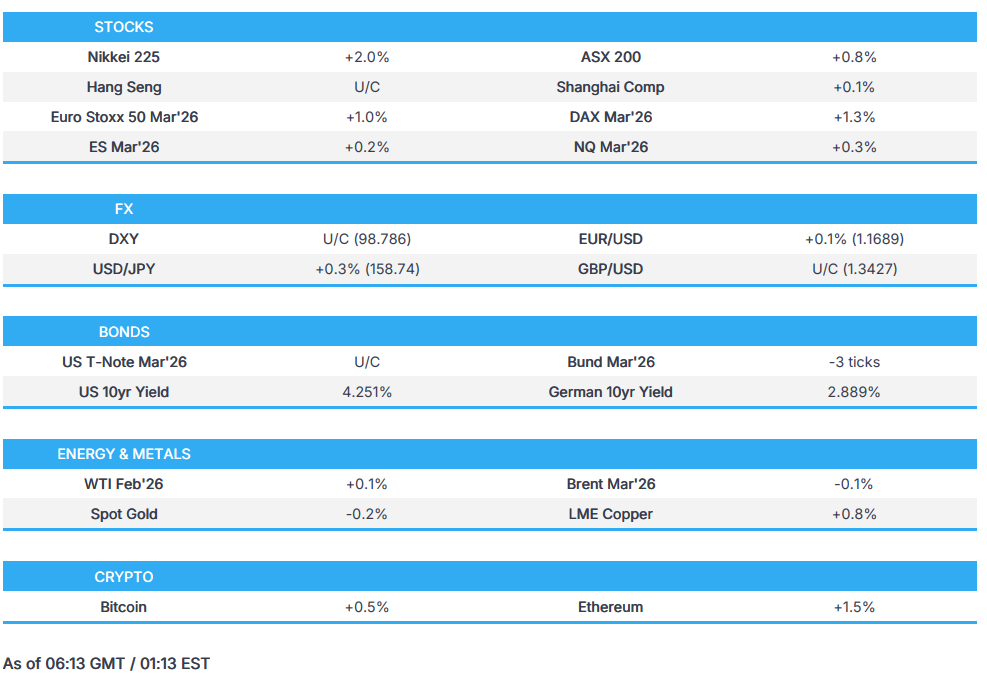

- DXY consolidated after Wednesday’s gains; AUD outperformed following a hot jobs report.

- European equity futures point to a strong open, with the Euro Stoxx 50 future up 1% after Wednesday’s cash close of -0.4%.

- Highlights include UK PSNB (Dec), US GDP/PCE Final (Q3), Jobless Claims (w/e 17th Jan), New Zealand CPI (Q4), Japanese CPI (Dec), EZ Consumer Confidence Flash (Jan), ECB Minutes (Dec), Norges Bank Policy Announcement, CBRT Policy Announcement, Norges Bank's Bache, US President Trump, Supply from France, US.

- Earnings: Intel, Procter & Gamble, Freeport McMoRan, Ge Aerospace, Abbott, LVMH

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks rose on Wednesday after President Trump ruled out military action to acquire Greenland, easing market fears, though gains were capped after Denmark rejected Trump’s demand to negotiate a US takeover of the island.

- Later, Trump said that after meeting NATO Secretary General Rutte, a framework for a future deal on Greenland had been formed and that he would therefore not impose tariffs scheduled to take effect on 1st February.

- SPX +1.16% at 6,876, NDX +1.36% at 25,327, DJI +1.21% at 49,077, RUT +2.00% at 2,698.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US House GOP leaders are struggling to strike a deal with Republican hard-liners tonight that would allow the final government funding package to advance, Politico reported. "The Rules Committee recessed Wednesday evening without a solution. Senior Rs hope to reconvene the panel by 9 pm".

- Supreme Court appears wary of Trump bid to fire Fed's Cook.

NOTABLE US EQUITY HEADLINES

- Apple (AAPL) China is to launch a Lunar New Year promotion, offering up to CNY 1,000 off select products, excluding the iPhone 17 series.

- Paramount Skydance (PKSY) is reportedly extending the January 21st deadline for shareholders of Warner Bros (WBD) to accept the offer, but is not raising the USD 30/shr price, NYT reported citing sources.

TRADE/TARIFFS

- US President Trump said he had a very productive meeting with NATO's Rutte, we have formed the framework of a future deal; will not be imposing the tariffs that were scheduled to go into effect on February 1st.

- Denmark Foreign Minister said the day ends better than it started, positive that US President Trump said he will end his trade war; If what is happening today means we can return to more normal channels than Truth Social, then that is good.

- European Council said it will hold an informal meeting on Thursday; EU leaders to discuss developments in Transatlantic relations.

APAC TRADE

EQUITIES

- APAC stocks traded entirely in the green, tracking the rebound on Wall Street after President Trump withdrew plans for additional tariffs on EU countries.

- ASX 200 opened around +0.8%, lifted by the improved global tone after US tariff removal, though the index later dipped following a hotter-than-expected Australian jobs report.

- Nikkei 225 posted firm gains of nearly 2%, snapping a five-day losing streak as chipmakers and financials advanced and JGBs stabilised.

- Hang Seng and Shanghai Comp the laggards, despite a brief recovery tech and easing trade-tension concerns after the US rollback of tariffs.

- US equity futures extended their rebound from Wednesday.

- European equity futures point to a strong open, with the Euro Stoxx 50 future up 1.1% after Wednesday’s cash close at -0.4%.

FX

- DXY consolidated after Wednesday’s gains, oscillating around 98.75 as concerns mounted that a Greenland agreement remained far off, with NATO’s Rutte warning that “a lot of work” still needs to be done.

- EUR/USD edged toward the 1.1700 handle after bouncing from a 1.1670 early-session low, supported by the softer dollar tone.

- GBP/USD hovered around 1.3430 as markets navigated another heavy UK data week, with PSNB due later today and retail sales on Friday.

- USD/JPY traded within a narrow 158.18–158.50 band before extending beyond 158.70, in line with the pullback in JGB yields. The JPY initially softened after December exports and the trade balance missed forecasts, though losses were later pared.

- Antipodeans outperformed the G7 complex, led by AUD strength after a robust jobs report showed unemployment falling to 4.1% (exp. 4.4%). AUD/USD traded beyond the 0.68 handle, marking a 15-month high.

- PBoC set USD/CNY mid-point at 7.0019 vs exp. 6.9697 (prev. 7.0014).

FIXED INCOME

- 10yr UST futures edged slightly lower from Wednesday’s highs but hovered near unchanged ahead of weekly claims and the Core PCE index, the Fed’s preferred inflation gauge.

- Bund futures traded muted amid a lack of fresh European catalysts, following Wednesday’s underperformance as German paper diverged from USTs with the re-emergence of the “buy America” trade after EU-US trade tensions eased.

- 10yr JGB futures continued to rebound from the early-week selloff and outperformed both Bunds and USTs ahead of Friday’s BoJ decision, where markets expect the Bank to leave policy on hold.

- US sold USD 13bln of 20yr bonds; stops through 1bps. WI 4.856%. High Yield: 4.846% (prev. 4.798%, six-auction avg. 4.739%). Tail: -1bps (prev. -0.1bps, six-auction avg. -0.5bps). Bid-to-Cover: 2.86x (prev. 2.67x, six-auction avg. 2.65x). Dealers: 6.2% (prev. 12.6%, six-auction avg. 10.9%). Directs: 29.1% (prev. 22.2%, six-auction avg. 25.7%). Indirects: 64.7% (prev. 65.2%, six-auction avg. 63.5%).

COMMODITIES

- Crude futures oscillated in tight ranges, with the early APAC bid fading as geopolitical tensions cooled. Broader supply dynamics remained the dominant longer-term driver, keeping WTI and Brent steady but directionless.

- Spot gold stayed weak amid the risk-on, “buy America” tone following President Trump’s retreat from tariff escalation on the EU and his dismissal of military action over Greenland. XAU briefly slipped below USD 4,800/oz before rebounding, while spot silver chopped around USD 92/oz.

- Copper futures posted modest gains as global risk sentiment improved, with 3M LME copper reclaiming levels above USD 12.8k/t as concerns over market tightness resurfaced.

- Goldman Sachs raised its year-end gold price target to USD 5400/oz (prev. USD 4900/oz).

- US Private Inventory Data (bbls): Crude +3.0mln (exp. +1.8mln), Distillate -0.03mln (exp. -0.2mln), Gasoline +6.2mln (exp. +2.5mln), Cushing +1.2mln.

CRYPTO

- Bitcoin posted modest gains in line with the broader risk tone, trading on either side of the USD 90k mark.

- US Senate Agriculture Chair John Boozman (R-Ark.) is preparing to release a new draft of landmark cryptocurrency legislation on Wednesday that does not currently have sign-off from Democrats on the committee, Politico reported.

- US crypto market bill is likely to be delayed by at least several weeks as key lawmakers shift their focus to potential housing legislation in support of President Trump’s affordability push, Bloomberg reported citing sources.

CENTRAL BANKS

- US President Trump said he likes keeping NEC Director Hassett where he is; down to two or three for Fed Chair; probably down to one in my mind. Wants a Fed chief like Greenspan in the 1990s. Treasury Secretary Bessent wants to stay where he is. Will see how it all works out about Chair Powell staying at the Fed after his term as Chair ends. Reider and Warsh all good for the next Fed chair.

- Fed's Cook (voter) said as long as she is at the Fed, she will uphold the independence of the central bank.

- Atlanta Fed GDPNow (Q4) GDP: 5.4% (prev. 5.3%).

NOTABLE ASIA-PAC HEADLINES

- Australia's Nationals Leader said coalition can no longer continue.

- 6.1 magnitude earthquake strikes Volcano Islands, Japan region, USGS reported.

- NEC Director Hassett does not think they are pushing allies closer to China - Bloomberg TV.

DATA RECAP

- Australian Employment Change (Dec) 65.2K vs. Exp. 30K (Prev. -21.3K).

- Australian Unemployment Rate (Dec) 4.1% vs. Exp. 4.4% (Prev. 4.3%).

- Australian Full Time Employment Change (Dec) 54.8K (Prev. -56.5K).

- Australian Part Time Employment Chg (Dec) 10.4K (Prev. 35.2K).

- Australian Participation Rate (Dec) 66.7% vs. Exp. 66.8% (Prev. 66.7%).

- Japanese Imports YoY (Dec) Y/Y 5.3% vs. Exp. 3.6% (Prev. 1.3%).

- Japanese Exports YoY (Dec) Y/Y 5.1% vs. Exp. 6.1% (Prev. 6.1%).

- Japanese Balance of Trade (Dec) 105.7B vs. Exp. 357B (Prev. 316.7B).

- Japanese Stock Investment by Foreigners (Jan/17) 874.0B (Prev. 1141.6B).

- Japanese Foreign Bond Investment (Jan/17) -361.4B (Prev. 91.2B).

- South Korean GDP Growth Rate QoQ Adv (Q4) Q/Q -0.3% vs. Exp. 0.1% (Prev. 1.3%).

- South Korean GDP Growth Rate YoY Adv (Q4) Y/Y 1.5% vs. Exp. 1.9% (Prev. 1.8%).

- New Zealand Electronic Retail Card Spending MoM (Dec) M/M -0.1% (Prev. 1.2%).

- New Zealand Electronic Retail Card Spending YoY (Dec) Y/Y -1% (Prev. 1.6%).

- New Zealand Visitor Arrivals YoY (Nov) Y/Y 8.20% (Prev. 9.40%, Rev. From 9.4%).

NOTABLE APAC EQUITY HEADLINES

- Baidu (9888 HK / BIDU) releases its official Ernie 5.0 large language model.

- CK Hutchison (0001 HK) said they are aware of the media reported related to possible separate listing of health and beauty units, adds there is no certainty any transactions will happen.

- Samsung SDS (018260 KS) - Q4 2025 (KRW): Revenue 3.54tln (exp. 3.64tln), Operating Profit 226.1bln (exp. 240.1bln), Net Income 182.3bln (exp. 203.1bln).

GEOPOLITICS

RUSSIA-UKRAINE

- Ukraine's top negotiator Umerov said he met with US envoys Witkoff and Kushner, discussed security guarantees and post-war reconstruction.

- Russia President Putin said he is willing to provide USD 1bln for the Board of Peace from frozen Russian assets.

- Russia's President Putin said he plans contact with US Envoys Witkoff and Kushner on Thursday; will discuss issue of possible use of frozen Russian assets with US envoys with Palestinian Authority President Abbas.

- US President Trump said we're getting close on the Ukraine War.

MIDDLE EAST

- US ambassador said all options are on the table [on Iran] and President Trump will keep his promise.

- Israeli military source quoted by local press: "The US military is mobilizing large capabilities in the region in preparation for the possibility of a large-scale confrontation with Iran", Sky News Arabia reports. Concern in Tel Aviv that Washington will strike Iran hard at first and then withdraw its forces quickly and leave Israel facing a new reality on the ground. Tel Aviv doubts the ability of the United States to find a real alternative to the Iranian regime in the event of its overthrow.

- US President Trump said he hopes there will be no further action on Iran.

- Israeli army raises its readiness for a possible US attack on Iran, according to local media.

GREENLAND

- US President Trump said it looks like we have concept of a deal; great deal for everybody; outlines of Greenland deal are everything we wanted. It's a deal that everyone is happy with. said the framework is a long-term deal.

- The proposal by NATO's Rutte does not include the transfer of overall sovereignty, Axios reported citing sources; the plan includes the increase of security in Greenland and NATO activity in the Arctic.

- US President Trump said military is not on the table in Greenland; that will not be necessary; people will use their best judgement on Greenland.

- NATO's Secretary General Rutte said the issue of Greenland remaining with Denmark did not come up in his conversation with President Trump.

- NATO's Rutte said there is still a lot of work to be done for the Greenland deal, AFP reported.

- US President Trump’s deal for Greenland is said to involve small pockets of land, according to NYT.

- German Finance Minister, on US President Trump's Greenland deal, said have to wait and not get hopes up too soon.

- NATO's Spokesperson said NATO's Rutte had a very productive meeting with President Trump focusing on the importance of Arctic region security for allies. Talks among NATO allies will focus on ensuring Arctic security through the collective efforts of allies, especially the seven Arctic allies. Denmark, Greenland and the US will go forward,aiming to ensure that Russia and China will never gain a foothold in Greenland.

- Denmark Foreign Minister said US President Trump saying he won't use force is a good signal, but is still unclear that Trump has an ambition we can't accommodate. Hopes to open talks with the Trump team, seeking to address US concerns.

- US President Trump on Greenland said we will explain deal down the line; deal will last forever; assume Denmark has weighed in possible deal involving Greenland. Putin has accepted to join the peace board. The US will be involved in Greenland mineral rights.

- Emergency EU leaders summit will go ahead as planned on Thursday.

- US President Trump said Denmark must tell me "to my face" on Greenland; I don’t like getting it secondhand”.

- US President Trump on Greenland, said could see price that could be reasonable; NATO's Rutte statement was nice, but the US still needs Greenland.

- Denmark rejects US President Trump's demand to negotiate takeover of Greenland.

LATAM

- The Trump administration is actively seeking regime change in Cuba by the end of 2026, the WSJ reported citing sources; the administration assess Cuba's economy as weak following the capture of Venezuela's Maduro.

- Valero (VLO) is reportedly buying Venezuelan oil as part of the US deal with Venezuela, Reuters report citing sources.

- US President Trump said they will sell Venezuelan oil at market prices and keep some.