Trump imposes tariffs on eight European countries over Greenland - Newsquawk European Opening News

- US President Trump imposed a 10% tariff on eight European countries, effective February 1st, over Greenland. The tariff will be increased to 25% on June 1st, unless a deal is reached for the purchase of Greenland.

- The EU is preparing EUR 93bln of tariffs on the US or restrict American companies from the European market, in retaliation to the latest threat by US President Trump, as European leaders meet for an emergency meeting on Thursday, the FT reports.

- Iranian President Pezeshkian warned that any attack on Supreme Leader Khamenei would result in an all-out war, and any military aggression would be met with a harsh and regrettable response.

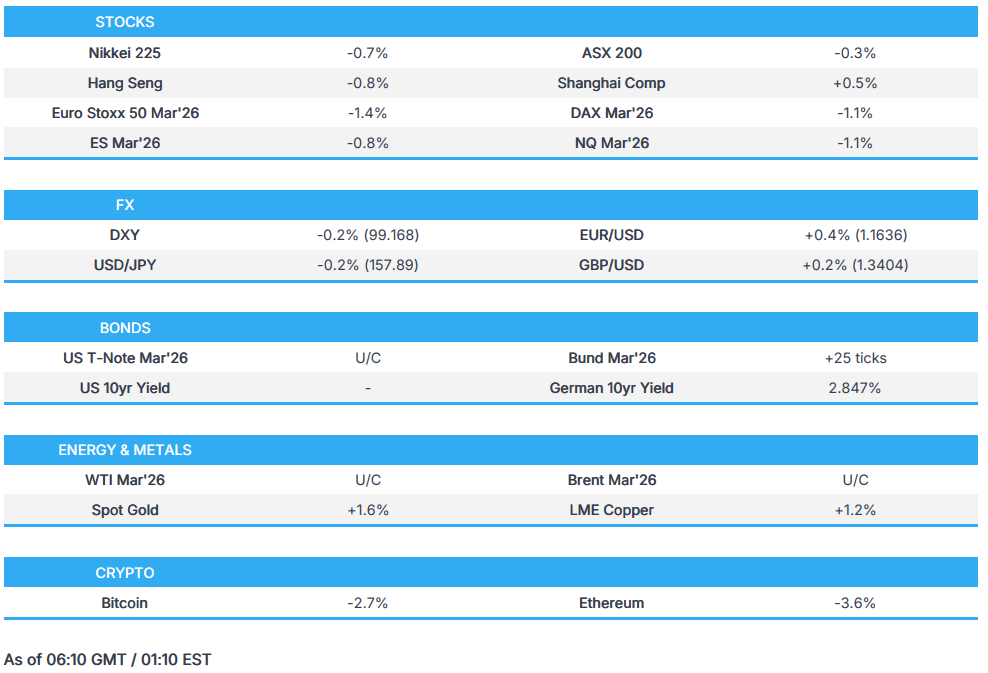

- DXY weakened as haven currencies (CHF, JPY) caught a bid following re-emerging trade tensions; XAU and XAG formed new ATHs.

- Looking ahead, highlights include EZ Final HICP (Dec), Canadian CPI (Dec), BoC SCE. Holiday: MKL Day (US market holiday).

- Desk Schedule: the desk will shut at 18:00 GMT/13:00 EST and re-open on the same day for the beginning of APAC coverage at 22:00 GMT/17:00 EST.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks ended the day very range-bound on Friday, ahead of the long US weekend due to MLK Day on Monday. Sectors were mixed, with Real Estate sitting atop the pile and Health lagging, amid a lack of tier-1 US data. While data and Fed's speak was fairly light, the Dollar saw upside and USTs sold after Trump suggested he would keep Hassett as NEC Director, and will not be his choice for Fed Chair.

- SPX -0.06% at 6,940, NDX -0.07% at 25,529, DJI -0.17% at 49,359, RUT +0.12% at 2,678

- Click here for a detailed summary.

TRADE/TARIFFS

- US President Trump hit 8 European countries with a 10% tariff, effective February 1st, over Greenland. The 8 countries include Denmark, Norway, Sweden, France, Germany, Finland, the Netherlands and the UK. The tariff will be increased to 25% on June 1st, unless a deal is reached for the purchase of Greenland.

- The EU is preparing EUR 93bln of tariffs on the US or restrict American companies' from the European market, in retaliation to the latest threat by US President Trump as European leaders meet for an emergency meeting on Thursday, the FT reports.

- French President Macron plans to urge the EU to use the ACI to retaliate against US President Trump's new 10% tariff on European countries, the AFP reports.

- The US is seeking a rare-earth deal with Brazil as Washington is looking for alternative sources away from China, the FT reports citing sources.

- The EU is proposing to phase out Chinese-made equipment from critical infrastructure in a move to revamp its security and tech policy, the FT reports.

- South Korea's Trade Ministry said South Korea and China are to hold a new round of free-trade negotiations on services and investment.

- US President Trump, on Carney in China, said it's OK for him to get a deal with China and if he can get a deal with China, he should do that.

- Brazilian President Lula said he wants to build new partnerships with Mexico, Canada, Vietnam, Japan, and China.

CENTRAL BANKS

- White House NEC Director and Fed Chair candidate Hassett said President Trump may well keep him at his current job and remove him from contention for the role of Fed Chair.

- US President Trump said he has someone in mind for Fed Chair.

- US Treasury Secretary Bessent said for Fed Governor Bowman, the best use is her existing role; Rieder was in with Trump yesterday, via Fox Business interview. Miran can continue at Fed past January 31st. When asked if Warsh is the odds-on favourite, said we'll see. Adds that it will be Powell's decision to stay or leave post-May.

- Fed's Jefferson (voter) said he does not want to prejudge January rate-setting decision. Some upside risks remain, but expect inflation to return to a path back to 2%. Inflation somewhat elevated, climb in core goods prices inconsistent with return to 2% inflation. Cautiously optimistic for 2026, though faces risks to both employment, price stability goals. Pleased to see increased use of standing repo operations when economically sensible. Expect 2% economic growth in near-term, unemployment rate to hold steady this year. Fed rate cuts since 2024 have brought policy rate into range consistent with neutral. Current policy stance leaves US well positioned to determine how much and when to adjust policy rate.

APAC TRADE

EQUITIES

- APAC stocks opened mostly in the red as markets reacted to the increased trade tensions between the US and Europe, but pared back some losses amid quiet newsflow overnight ahead of the US market holiday.

- ASX 200 started the week with modest losses, with IT and Financials weighing on the index. Gold and Utilities helped limit the downside in the index as spot XAU hit new ATHs.

- Nikkei 225 was hit the hardest, with losses as much as 1.5%. This came amid a strengthening JPY as a safe-haven bid spread throughout markets.

- KOSPI outperformed its global peers, extending on ATHs, as South Korea and China prepare for a new round of free-trade negotiations.

- Hang Seng and Shanghai Comp started on the back foot but diverged as the session continued, with the Shanghai Comp. shifting into the green while the Hang Seng extended on earlier losses. China released its GDP figures, with the Q4 figure beating expectations and 2025 growth hitting China’s target. However, equities did not react to the data.

- US equity futures gapped lower and held onto losses following the re-emergence of US-EU trade tensions.

- European equity futures are indicative of a negative open with the Euro Stoxx 50 future down 1.1% after cash closed -0.3% on Friday.

FX

- DXY saw initial weakness from the start of Asia-Pac trading and fell just shy of 99.00 as US President Trump threatened an additional initial 10% tariff on 8 EU countries which could then rise to 25%.

- EUR/USD gained as traders shifted away from the dollar amid rising trade tensions. The pair lifted above 1.16 and held. Flows were seen into traditional havens such as the CHF and JPY.

- GBP/USD benefited the least among its G7 peers, as cable chopped around 1.34, with the UK also in Trump's sights.

- USD/JPY saw pressure at the start of the APAC session, as a combination of haven flows and renewed fiscal concerns in Japan weighed on the pair. Reports in Japanese press said that Takaichi’s LDP and the new opposition party, the Centrist Reform Alliance, are planning to cut/suspend the sales tax. This lifted bond yields and added to the JPY strength. The pair gave back the majority of its losses but remained below 158.

- Antipodeans have risen against the buck, with the Kiwi outperforming its Aussie counterpart, despite a lack of a clear catalyst behind the gains in NZD/USD, although New Zealand PM Luxon delivered his state of the nation address.

- The PBoC set USD/CNY mid-point at 7.0051 vs exp. 6.9689 (prev. 7.0078).

FIXED INCOME

- 10yr UST futures initially gapped higher as risk-off flows dominated the open following the rising trade tensions over Greenland. However, USTs fell amid the absence of volume into MLK Day.

- Bund futures outperformed their US and Japanese counterparts as US markets close for a holiday and JGBs remain under pressure as fiscal concerns arise. This makes German paper a clear market for investors to seek safety amid the rising US-EU trade tensions.

- 10yr JGB futures slumped as fiscal concerns lift yields to record highs. This came following reports that both the LDP and the newly formed Centrist Reform Alliance plan to suspend or cut the sales tax, which increases the risk of fiscal expansion.

- Venezuela reportedly plans to sell USD in the local market.

- US Treasury reportedly considering quarterly 7-year note auctions with reopenings.

COMMODITIES

- Crude futures gapped lower at the start of the APAC session, with WTI Mar’ and Brent Mar’ dipping below USD 59/bbl and USD 64/bbl respectively, before paring back losses and moving into the green as Iranian President threatened an all-out war if the Supreme Leader is attacked.

- Spot gold extended on ATHs, peaking at a record of USD 4691/oz, as the need for safe assets rose as trade tensions re-emerge between Europe and the US.

- Copper futures partially rebounded from Friday's losses, nearing USD 13k/t, despite the risk-off tone.

- US President Trump said he didn't have to consult with anyone on taking Venezuelan oil; Venezuela's oil now travelling to the US.

- US Energy Secretary Wright seeks to secure oil and minerals deals with Venezuela, Axios reported.

- Shell (SHEL LN) and Mitsubishi (8058 JT) are exploring the potential sale of stakes in LNG assets. Mitsubishi has hired RBC Capital markets to study a possible sale involving its stake later this year. Shell has marketed as much as 75% of its LNG Canada holding to buyers in recent weeks.

- Baker Hughes Rig Count: Oil +1 at 410, Nat Gas -2 at 122, Total -1 at 543.

- Sanctioned tanker Jamaica carrying Venezuelan oil cargo docked at the Curacao terminal, TankerTrackers reported.

- US reportedly explores plan to swap heavy Venezuelan oil for US medium crude to fill SPR, according to reports.

CRYPTO

- Bitcoin fell below USD 93,000 amid the global risk-off tone.

NOTABLE ASIA-PAC HEADLINES

- China's financial regulators are cracking down on excessive speculation in the stock market and are pushing for long-term investments to deliver market stability, China Securities Journal reports citing analysts.

- Fitch said China's stimulus stabilises markets but is unlikely to revive property demand.

- China's NBS said the contradiction between supply and demand remains prominent. They will implement more proactive macroeconomic policies and expand domestic demand. On the economy, they said showed steady growth amid multiple pressures in 2025 and that the economy faces problems and challenges, including strong supply and weak demand. The NBS sees multiple risks and potential dangers in key sectors but adds that China is able to maintain stable, sound growth momentum in 2026. Production, prices and expectations show positive changes since year start. Net exports accounted for 31.1% of Q4 GDP growth. Expects China's consumption to grow steadily in 2026 as policies support gains traction.

- Japan's new Centrist Reform Alliance announced its new policy that it will seek to achieve sustained wage growth and distribution of benefits from economic growth.

- Japan's Chief Cabinet Secretary confirms that the LDP are considering food and drink consumption tax exemption.

- Japanese PM Takaichi is to host a press conference from 18:00JST / 09:00GMT about the snap election.

APAC DATA RECAP

- Chinese Unemployment Rate (Dec) 5.1% vs. Exp. 5.2% (Prev. 5.1%).

- Chinese GDP Growth Rate YTD (Q4) Y/Y 5.0% (target: "around 5%", prev. 5.2%).

- Chinese Industrial Capacity Utilization (Q4) 74.9% vs. Exp. 74.4% (Prev. 74.6%).

- Chinese Fixed Asset Investment (YTD) YoY (Dec) Y/Y -3.8% vs. Exp. -3% (Prev. -2.6%).

- Chinese Industrial Production YoY (Dec) Y/Y 5.2% vs. Exp. 5% (Prev. 4.8%).

- Chinese GDP Growth Rate YoY (Q4) Y/Y 4.5% vs. Exp. 4.4% (Prev. 4.8%).

- Chinese Retail Sales YoY (Dec) Y/Y 0.9% vs. Exp. 1.2% (Prev. 1.3%).

- Chinese GDP Growth Rate QoQ (Q4) Q/Q 1.2% vs. Exp. 1% (Prev. 1.1%).

- Chinese New Home Prices M/M (Dec) -0.4% (prev. -0.4%).

- Chinese Used Home Prices M/M (Dec) -0.7% (prev. -0.7%).

- Chinese House Price Index YoY (Dec) Y/Y -2.7% vs. Exp. -2.6% (Prev. -2.4%).

- Japanese Machinery Orders MoM (Nov) M/M -11% vs. Exp. -5.1% (Prev. 7%).

- Japanese Machinery Orders YoY (Nov) Y/Y -6.4% vs. Exp. 4.9% (Prev. 12.5%).

- Japanese Tertiary Industry Index MoM (Nov) M/M -0.2% vs. Exp. 0% (Prev. 0.9%)

- Japanese Industrial Production YoY Final (Nov) Y/Y -2.2% vs. Exp. -2.1% (Prev. 1.6%)

- Japanese Capacity Utilization MoM (Nov) M/M -5.3% vs. Exp. 0.8% (Prev. 3.3%)

- Japanese Industrial Production MoM Final (Nov) M/M -2.7% vs. Exp. -2.6% (Prev. 1.5%)

NOTABLE APAC EQUITY HEADLINES

- Baidu (9888 HK) rolls out their fully driverless robotaxi services in Abu Dhabi via the AutoGo app.

- Tokyo Electric Power (9501 JT) is to delay the restart of its Kashiwazaki-Kariwa nuclear power plant, NHK reported.

GEOPOLITICS

RUSSIA-UKRAINE

- Ukraine holds off on new Helsing drone orders following setbacks, Bloomberg reports.

- Ukraine's Security of National Security Umerov said that the US and Ukraine will hold additional talks in Davos after the two sides discussed security guarantees for Ukraine over the weekend in Florida.

- IAEA said it secured an agreement between Russia and Ukraine to implement ceasefire for repairs to begin on last remaining backup power line to Zaporizhzhya plant.

- Ukrainian President Zelensky said air defences supplies are insufficient and warns of new Russian massive strikes.

MIDDLE EAST

- Iranian President Pezeshkian warned that any attack on Supreme Leader Khamenei would result in an all-out war and any military aggression will be met with a harsh and regrettable response. This comes following comments by US President Trump, in an interview with Politico, calling for the end of Khamenei's reign and called him "a sick man who should run his country properly and stop killing people."

- Iranian Supreme Leader Khamenei said those linked to Israel and the US have caused massive damage and have killed thousands during the protest, blaming US President Trump for inflicting casualties, damage and slander on Iranians.

- The attack on Iran is only a matter of time and Washington is preparing to act, Israel's Channel 12 reports citing US officials.

- US President Trump on Truth said "I greatly respect the fact that all scheduled hangings, which were to take place yesterday (Over 800 of them), have been cancelled by the leadership of Iran. Thank you!".

- US President Trump and Netanyahu discussed Iran in a 2nd phone call, according to Axios. The White House and the prime minister's office declined to comment. During their first call on Wednesday, Netanyahu asked Trump to hold off on military action against Iran to give Israel more time to prepare for potential Iranian retaliation. It was one of the reasons Trump decided to delay orders for the U.S. military to move forward with a strike against Iran. U.S. officials say military action is still on the table if Iran resumes killing protesters. Israeli officials think that despite the delay, a US military strike could take place in the coming days.

OTHERS

- US President posted about NATO: "NATO has been telling Denmark, for 20 years, that “you have to get the Russian threat away from Greenland.” Unfortunately, Denmark has been unable to do anything about it. Now it is time, and it will be done!!!"

- European officials would rather negotiate with the Trump administration than retaliate, the NYT reported citing diplomats; however, hitting back is possible if Washington continues to escalate its efforts.

- Canadian PM Carney is considering sending troops to Greenland for military exercises with NATO, CBC reported.

- UK PM Starmer is to hold an emergency press conference on January 19th following US President Trump's Greenland tariff threats (time TBC; guided to be in the morning).

- EU Commission President von der Leyen said the EU and UK stand firm in upholding Greenland and Denmark's sovereignty.

- Danish Arctic Commander said they have been invited by the US to join military exercise in Greenland, and awaiting reply; there are no Chinese or Russian ships observed near Greenland.

- Venezuelan opposition leader Machado will not reveal details of conversation with Trump and insisted on returning to Venezuela as soon as possible. Trump and Rubio's goal is to help Venezuela have self-determination. Not putting date on further progress, have already taken huge step.

- Chinese surveillance drone entered Taiwanese airspace for the first time over the weekend, FT reported.

EU/UK

NOTABLE HEADLINES

- Hedge funds have placed a GBP 100bln bet on gilts that the BoE believes has left Britain dangerously exposed to a bond market meltdown, Telegraph reports.

- Morningstar confirms Switzerland at AAA; stable.

DATA RECAP

- UK Rightmove House Prices MM (Jan) 2.8% (Prev. -1.8%); YY (Jan) 0.5% (Prev. -0.6%)