Trump set to announce his Fed pick, with reports pointing to Warsh; DXY strengthens, UST curve steepenens - Newsquawk EU Market Open

- US President Trump says he will announce his Fed pick on Friday. Reports suggest the administration is leaning towards Warsh.

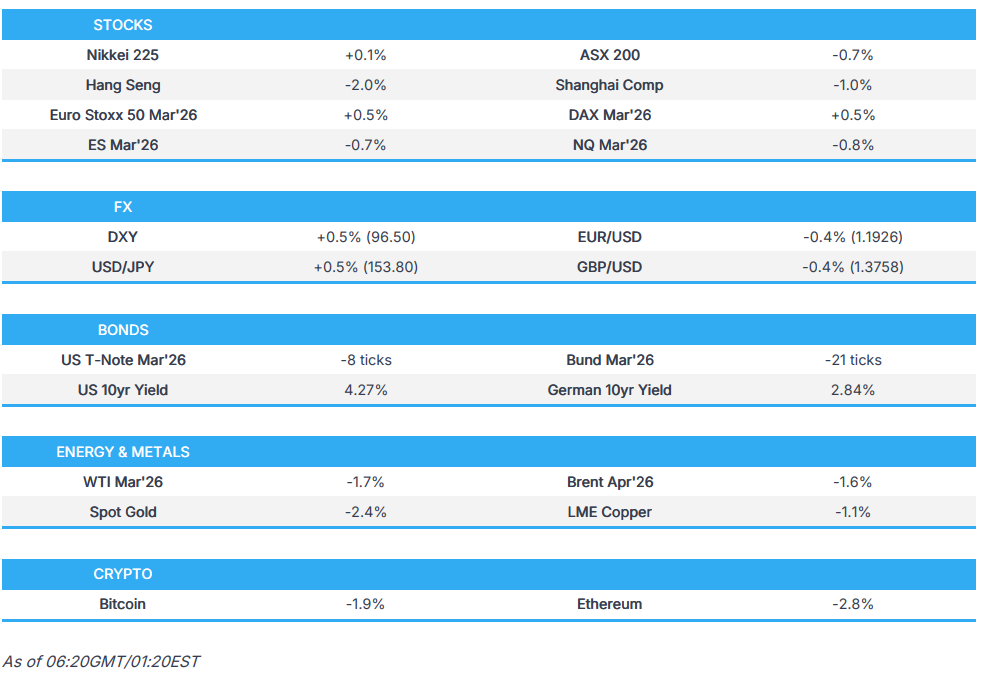

- DXY gained amid the Warsh speculation, to the detriment of G10 peers. USTs under pressure following this.

- Apple shares ended the extended US session flat, having initially risen after profit and revenue beat, driven by exceptionally strong iPhone demand.

- European futures point to a firmer open, US futures hit by the potential Warsh appointment.

- Crude benchmarks gave back some of Thursday's strength, precious metals were also on the backfoot.

- Looking ahead, highlights include Spanish/German/Italian GDP Flash (Q4), Unemployment (Jan), Prelim. HICP (Jan), Spanish Prelim. CPI (Jan), EZ GDP Flash Prelim. (Q4), Canadian GDP (Dec), US PPI (Dec), Speakers including Fed's Musalem, Bowman, Miran & Riksbank's Jansson. Earnings from SoFi, American Express, Verizon, Chevron, Exxon & Colgate.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished mixed with early weakness seen, and the tech-heavy Nasdaq 100 was the laggard as Microsoft (MSFT, -10%) plunged post-earnings due to Azure growth and next quarter guidance disappointed the lofty Wall St. expectations. As such, Technology was the clear sectoral underperformer, while Communications was at the other end of the spectrum and was buoyed by stellar Meta (+10.4%) earnings. Tesla (-3.5%) was the other Mag-7 name to report, and eventually saw weakness amid MSFT and broad risk-off sentiment, despite initially seeing gains pre-market amid an earnings beat, but attention was on the path ahead given CapEx hike.

- SPX -0.13% at 6,969, NDX -0.53% at 25,884, DJI +0.11% at 49,072, RUT +0.05% at 2,655.

- Apple Inc. (AAPL) Q1 2026 (USD): EPS 2.84 (exp. 2.67), Revenue 143.8bln (exp. 138.36bln), iPhone net sales 85.27bln (exp. 78.65bln), iPad net sales 8.60bln (exp. 8.13bln), Mac net sales 8.39bln (exp. 8.95bln), Wearables, Home and Accessories net sales 11.49bln (exp. 12.04bln). -0.1%

- Visa Inc. (V) Q1 2026 (USD) Adj. EPS 3.17 (exp. 3.14), Revenue 10.90bln (exp. 10.68bln). -1.7%

- Western Digital Corporation (WDC) Q2 2026 (USD) Adj. EPS 2.13 (exp. 1.92), Revenue 3.02bln (exp. 2.93bln). -2.7%

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said tariffs could be steeper, and that they are being very nice about it.

- US President Trump said it is ‘very dangerous’ for the UK to get into business with China and even more dangerous for Canada to get into business with China.

- US President Trump threatened to charge Canada a 50% tariff on any and all aircraft sold to the US.

- White House announced that US President Trump signed an executive order declaring a national emergency and establishing a process to impose tariffs on goods from countries that sell or otherwise provide oil to Cuba.

NOTABLE HEADLINES

- US President Trump said he will announce the Fed pick on Friday morning, and he has chosen a very good person to lead the Fed, while Trump added that the pick is someone who won't be too surprising and could have been there a few years ago, and is well-known to the financial world.

- US President Trump's administration is said to be preparing a Warsh Fed nomination, according to Bloomberg. In relevant news, former Fed Governor Warsh had met with US President Trump at the White House on Thursday, while US journalist Rachael Bade had posted on X that Trump met with two finalists for Fed Reserve chair and was leaning towards Kevin Warsh to replace Jerome Powell.

- US President Trump posted "America is setting Records in every way, and our Growth Numbers are among the best ever. The only thing that can slow our Country down is another long and damaging Government Shutdown", while he added that "Hopefully, both Republicans and Democrats will give a very much needed Bipartisan “YES” Vote."

- US President Trump said regarding a shutdown, that they hopefully won't have one and will work in a bipartisan way to avoid a shutdown, while he added that Democrats don't want a shutdown either, and he thinks they will have an amazing, incredible year.

- US President Trump and Democrats said a deal was reached to avert a shutdown in which the Senate would move quickly to pass five of the six spending bills that have cleared the House, according to WSJ.

- US House Speaker Johnson said he is not confident that a government shutdown will be avoided.

- US Senator Graham said the Senate would not vote on Thursday night on the spending deal, while it was earlier reported that the US House-backed funding package failed to pass the Senate procedural vote

- US President Trump said he doesn't want home values to go down and noted that when it is too easy and cheap to build houses, prices come down, and they do not want to do that. It was separately reported that Trump signed a historic executive order to combat the scourge of addiction and substance abuse, while he is suing the IRS and Treasury for USD 10bln over tax return leaks

APAC TRADE

EQUITIES

- APAC stocks were pressured heading into month-end, as the Apple-related euphoria following record iPhone sales, was dampened as yields gained and the dollar strengthened on reports that the Trump administration is preparing for the nomination of Kevin Warsh as the next Fed Chair.

- ASX 200 was dragged lower by underperformance in miners and resources stocks as metal prices took a hit.

- Nikkei 225 swung between gains and losses following a slew of data releases, including softer-than-expected Tokyo CPI, better-than-expected Industrial Production and weak Retail Sales, but with the downside in the index cushioned by a weaker currency.

- Hang Seng and Shanghai Comp underperformed with little fresh drivers and indirect pressure from US President Trump, who warned of dangers for the UK and Canada regarding getting into business with China, while CK Hutchison shares were hit after reports that the Panama Supreme Court ruled the Co.'s ports contract is unconstitutional.

- US equity futures declined with headwinds seen following speculation of the potential nomination of Kevin Warsh for the Fed Chair, who is seen as less dovish than other candidates.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.6% after the cash market closed with losses of 0.7% on Thursday.

FX

- DXY gained following reports that the Trump administration is said to be preparing for the nomination of Kevin Warsh for the Fed Chair role, with US President Trump to announce his decision on Friday morning. Nonetheless, the risk of a partial government shutdown still looms after a House-backed funding package failed to pass the Senate procedural vote and despite reports that a deal was reached to avert a shutdown in which the Senate would move quickly to pass five of the six spending bills that have cleared the House.

- EUR/USD gradually softened and tested the 1.1900 level to the downside amid a firmer buck owing to the potential Warsh Fed nomination, while participants look ahead to a deluge of data releases from the bloc, including flash GDP figures.

- GBP/USD failed to sustain the 1.3800 status, but with further downside limited by a lack of major UK-specific catalysts, while there was little reaction seen from warnings by US President Trump that it is ‘very dangerous’ for the UK to get into business with China and even more dangerous for Canada to get into business with China.

- USD/JPY climbed higher with the upside facilitated by softer-than-expected Tokyo inflation data and after the dollar strengthened on speculation that Trump is to pick Warsh as the next Fed chair.

- Antipodeans were pressured amid broad-based gains in the dollar, commodity weakness and the downbeat risk appetite.

- PBoC set USD/CNY mid-point at 6.9678 vs exp. 6.9459 (Prev. 6.9771)

- US Treasury semi-annual currency report concluded that no major US trading partners manipulated their currency to gain an unfair trade advantage during the four quarters through to June 2025, while it kept China, Japan, South Korea, Singapore, Taiwan, Vietnam, Germany, Ireland and Switzerland on the currency monitoring list. Furthermore, it stated that China is not labelled a currency manipulator amid yuan depreciation pressure but stands out among trading partners for the lack of transparency on exchange rate practices and policies.

FIXED INCOME

- 10yr UST futures retreated overnight and yields gained as markets awaited the Fed Chair pick, which President Trump said will be announced on Friday morning and with the White House said to be preparing for a Warsh nomination, who is viewed as more hawkish than other candidates.

- Bund futures continued the gradual pullback from this week's peak, but with further price moves contained ahead of a slew of releases from Germany, including Flash GDP, Import Prices, Unemployment and HICP data.

- 10yr JGB futures edged higher following a slew of data, including softer-than-expected Tokyo CPI data and with increased demand seen at the latest 2yr JGB auction.

COMMODITIES

- Crude futures gave back some of the prior day's gains, which were spurred by ongoing geopolitical risks regarding potential US military action against Iran, although the latest from US President on Iran was that he plans to have talks with Tehran and noted there are big, powerful ships going to Iran, which he hopes that they don't have to use.

- White House clarified that US sanctions relief for Venezuela covers refining and other downstream activities, but not upstream production, while an official said more announcements on Venezuela sanctions easing are expected.

- Spot gold slipped to around the USD 5,200/oz level with the precious metal pressured by a firmer buck ahead of President Trump's announcement of his Fed Chair pick and with the Trump administration said to be preparing for Kevin Warsh's nomination to succeed Powell.

- Copper futures were pressured amid the mostly downbeat risk appetite, and with demand not helped by the delay in LME trading due to technical issues, which have since been resolved.

CRYPTO

- Bitcoin was pressured overnight and briefly dipped beneath USD 82,000 before recouping some of the losses.

NOTABLE ASIA-PAC HEADLINES

- UK and China weigh a cross-border asset management scheme to deepen market ties, according to SCMP.

- China and the UK agreed to resume high-level security dialogue, with a new strategic and economic dialogue planned in 2026, according to Xinhua.

DATA RECAP

- Japanese Industrial Production MM (Dec P) -0.1% vs. Exp. -0.4% (Prev. -2.7%)

- Japanese Retail Sales YY (Dec) -0.9% vs Exp. 0.7% (Prev. 1.0%, Rev. 1.1%)

- Tokyo CPY YY (Jan) 1.5% vs Exp. 1.8% (Prev. 2.0%)

- Tokyo CPY Ex. Fresh Food YY (Jan) 2.0% vs Exp. 2.2% (Prev. 2.3%)

- Tokyo CPY Ex. Fresh Food & Energy YY (Jan) 2.4% vs Exp. 2.6% (Prev. 2.6%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said he plans to have talks with Tehran and noted there are big, powerful ships going to Iran, although he hopes they don't have to use them, while he told the Iranians 'no' to nuclear weapons, stop killing protesters, and that they have to do something.

- US Secretary of War Hegseth said they are to provide any option that the President chooses regarding Iran.

- Iran’s President discussed the region with the Emir of Qatar and Pakistan’s PM, while they called for diplomacy to ease tensions.

- Iran's Foreign Ministry condemned "illegal and unjustified" designation of the Revolutionary Guards by the EU as a 'terrorist organisation', in the strongest terms.

RUSSIA-UKRAINE

- US President Trump said regarding the Ukraine war, that Russian President Putin agreed not to fire on Kyiv for a week, given the record cold.

- US envoy Witkoff said regarding the war in Ukraine that he thinks they made a lot of progress and talks are to continue in about a week, while he added that security and prosperity agreements are largely finished and parties are discussing the land deal.

- Kremlin aide Usahkov disagreed with a statement by US Secretary of State Rubio that everything has been agreed upon regarding Ukraine, except for the territorial issue.

- Russian Foreign Minister Lavrov shot down a proposal for a US-Ukraine security deal, according to the Washington Post. Lavrov rejected a key part of the deal to end the war with Ukraine and dismissed security guarantees demanded by Ukraine for any deal, while he reiterated that the current regime in Kyiv should end.

OTHER

- US President Trump said they are getting along really well with Venezuelan leadership and major oil companies are going to scout out locations, while he said they will open all commercial airspace over Venezuela.

- US President Trump confirmed they will begin attacks on drugs coming in on land, and said you'll see that happen.

- Canadian PM Carney said regarding reports that US officials met Alberta separatists, that he expects the US administration to respect Canadian sovereignty.

EU/UK

DATA RECAP

- UK Lloyds Business Barometer (Jan) 44 (Prev. 47)