TSMC earnings lifts sentiment for Europe and US; ahead are a slew of Fed speakers and weekly claims - Newsquawk US Opening News

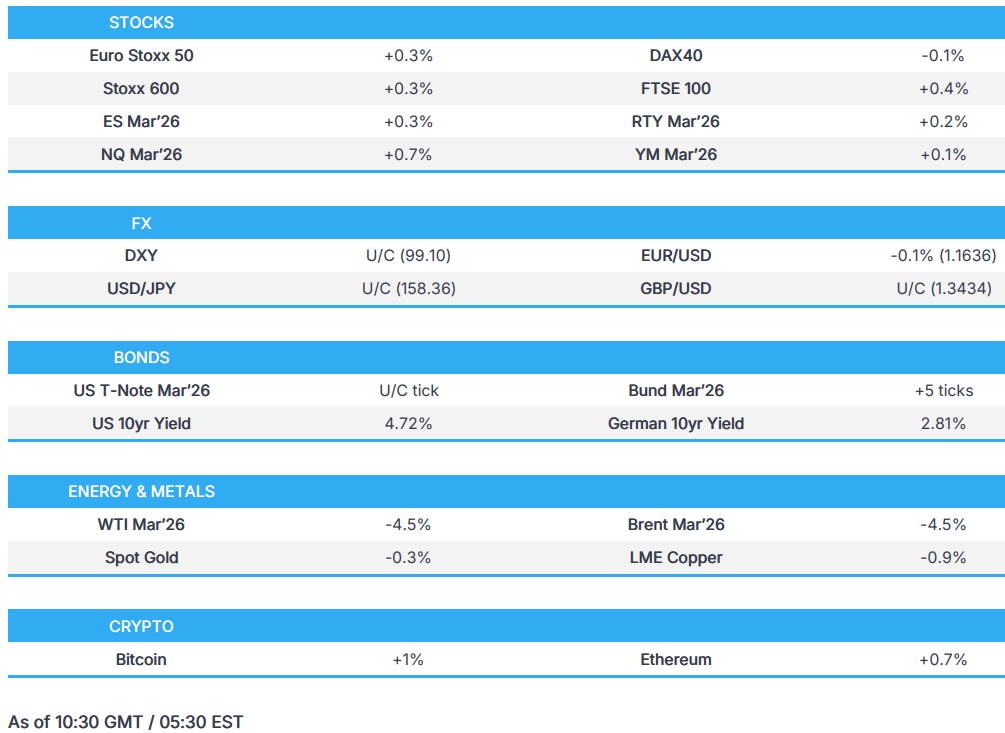

- European bourses are broadly firmer, with US equity futures also in the green; NQ outperforms after strong earnings from TSMC (+5.7% pre-market).

- China is said to be drafting purchase rules for NVIDIA's (NVDA) H200 chips, Nikkei reported, as it seeks to balance support for domestic chip development with the needs of Chinese technology firms.

- DXY is flat; USD/JPY briefly slipped on reports that the BoJ is to keep rates steady in January.

- USTs are steady awaiting data & Fed speak, Gilts opened lower after a GDP beat.

- Crude remains near Wednesday's lows after Trump said Iran has "no plan" to kill protestors, XAU also moves lower.

- Looking ahead, highlights include US Export/Import Prices (Dec; Nov-cancelled), NY Fed (Jan), Weekly Claims (w/e 3rd Jan). Speakers include, Fed's Bostic, Barr, Barkin, Schmid. Earnings from Morgan Stanley, Goldman Sachs, BlackRock.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 +0.4%) opened mixed to higher. AEX (+1%) outperforms, lifted by strong gains in ASML (+5.5%) following robust TSMC earnings & guidance, which showed a 35% jump in Q4 profit.

- European sectors are mixed. Tech (+1.7%) leads, driven by strength in ASML (+5.5%), while Financial Services (+1.2%) are boosted by post-earning strength in Partners (+6.2%). Consumer Products initially boosted by gains in Richemont (-2.2%), but the Co. has since slipped into negative territory. Q3 earnings were strong, but Richemont did highlight that rising material costs continuing to weigh on margins.

- US equity futures (ES +0.2% NQ +0.7% RTY +0.2%) are trading firmer across the board, with outperformance in the tech-heavy NQ, following the post-earnings strength in TSMC (+5.5% pre-market).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

EARNINGS

- TSMC (2330 TT) Q4 2025 (TWD): Net Profit 505.7bln (exp. 467bln), Revenue 1.046tln (exp. 868.46bln), CapEx USD 40.9bln (exp. USD 40-42bln). Q4 gross margin 62.3% (exp. 60.6%), +3.3ppts Y/Y. Q4 revenue from high performance computing +4% Q/Q. Q4 revenue from smartphones +11% Q/Q. Q4 revenue from IoT +14% Q/Q.

- TSMC (2330 TT) guides Q1 Revenue between USD 34.6-35.8bln (exp. 33.2bln), guides Gross Margin between 63-65% (exp. 59.6%), sees Operating Margin between 54-56% (exp. 50%), 2026 CapEx to come in between 52-56bln (prev. 40.9bln in 2025). Capex is to be higher in the next three years. Cost of tools are becoming more expensive. Long term gross margins of 56% and higher is achievable. In 2026 there are uncertainties from tariffs. Will be prudent in business planning. Robust AI-related demand. Increasing AI model adoption. 2026 sales to grow by close to 30% in USD terms. Preparing to increase capacity to support customers. Customers are providing strong signals and reaching out directly to request capacity. Firms have been showing TSMC that AI is a significant help to their businesses. Announces plans to expand its fabrication facilities in Arizona. Co. is worried about electricity in Taiwan. Co. informed that Silicon from TSMC is a bottleneck with the Co. aiming to deal with the bottle neck first and foremost. Reduced their 6 and 8 inch wafer capacity to optimise resources.

- Richemont (CFR SW) Q3 2025 (EUR): Sales at constant FX +11% (exp. 7.5%); Revenue 6.4bln (exp. 6.25bln).

FX

- DXY is flat and trades within a very thin 99.08-23 range; currently just above its 50 DMA at 99.02. Focus overnight has been on geopols, whereby President Trump said Iran has “no plan” to execute protestors. Back in the US, Trump said he has no plans to remove Fed Chair Powell, whilst also speaking highly of the prospective new Fed Chairs Hassett and Warsh.

- GBP currently trades flat, within a 1.3423-1.3446 range; the peak for today is a handful of pips short of its 21 DMA at 1.3452. Some strength was seen in Cable following the region’s GDP series, which topped expectations and has Q4 GDP on track to surpass the BoE's forecast of no growth. Pantheon Macroeconomics said it expects UK growth to improve to 0.4% Q/Q in Q1 as Budget uncertainty fades, seasonality lifts the New Year, and September’s cyber-attack volatility limits spare capacity, keeping the MPC cautious.

- JPY is flat this morning, but subject to volatility, after Bloomberg reported that the BoJ is likely to keep rates steady in January; some officials are said to be concerned over the economic impact of a weak JPY. The piece added that if the JPY continues to weaken, then the pace of future rate hikes could be accelerated. But, policy will remain on hold in January. This spurred immediate pressure in USD/JPY, falling from 158.68 to 158.33.

- China's FX regulator will formulate a basket of policy measures to promote cross-border financing.

FIXED INCOME

- A contained start for fixed benchmarks. Haven allure that was helping on Wednesday has been removed by the updates around Iran (see Commodities for details).

- That aside, newsflow has been a little light and largely focused on nation-specifics rather than broader macro drivers; though, TSMC earnings are the exception, again, see the feed for details.

- USTs have spent the morning in a narrow 112-11 to 112-17+ band, Bunds in equally slim 128.23 to 128.46 confines with both benchmarks flat overall. However, a modest bullish bias is beginning to emerge, more so for EGBs than USTs, potentially as the morning's supply from Spain has now passed and was well received, digestion of the Ukraine-Russia-US situation and/or the pulling back of crude benchmarks weighing on yields. Though, the latter narrative is clouded by the gains in European gas.

- Gilts opened marginally softer and then slipped a few ticks further to a 92.67 base despite the firmer lead from EGBs. UK debt weighed on by strong GDP data for November, a series that has the Q4 trend tracking above the BoE's estimate of no growth for the period. However, this pressure proved shortlived with Gilts grinding higher and the marginal outperformer, posting upside of just over 10 ticks.

- Spain sold EUR 5.86bln vs exp. EUR 5-6bln 2.35% 2029 Bono & 3.50% 2041, 1.45% 2071 Bonds.

COMMODITIES

- Crude benchmarks are on the back foot and remain near lows of USD 58.99/bbl and USD 63.46/bbl for WTI and Brent after some of the pressure was let out of the US-Iran situation. A move driven in late US hours by President Trump saying he had been told that the killing within Iran was stopping. However, we then saw some reports of explosions in Tehran, an update that sparked a short-lived spike of c. USD 0.50/bbl, before paring amid some uncertainty around the validity of that report.

- As discussed earlier in the week, gas benchmarks remain bid with gains of nearly a EUR/Mwh at a EUR 33/MWh peak for Dutch TTF. Drivers for the space include any potential impact to Iranian flows to Turkey, the above Ukraine situation escalating and the continued cold spell in Europe.

- Precious metals are broadly in the red this morning, following on from the subdued action seen overnight. Negative action this morning due to some unwinding of recent geopolitical risk premia after US President Trump said that he had been told the killing in Iran is stopping and that there is no plan for executions. As a reminder, the President had repeatedly threatened action against the Iranian regime, if they killed protestors. As it stands spot gold trades at the lower end of a USD 4,580.98-4,632.45/oz range.

- Base metals are also following precious peers lower; 3M LME Copper trades just above the USD 13k/t mark, in a USD 12,914-13,216.35/t range – downside which also follows the negative sentiment seen across the Chinese equities space.

- US Ambassador announces plan to work with Belgium on a USD 50bln LNG deal.

- The US is said to be considering private contractors to safeguard oil in Venezuela, CNN reported citing sources.

- US President Trump said it would be better for Venezuela to remain in OPEC but is unsure if this would be beneficial to the US.

TRADE/TARIFFS

- Japanese Finance Minister aims to make progress in selecting projects as part of Japan and US bound investment package if PM Takaichi meets with US President Trump. Fiscal reform is impossible with economic growth. said next years financial budgets reliance on debt is at a sustainable pace.

- Canada and China sign a trade cooperation MOU. Both sides committed to resolving outstanding agricultural trade issues by maintaining open channels of communication.

- Indian Trade Secretary on the India-EU trade deal negotiation said some agricultural items remain off the table.

- Indian Trade Secretary said a deal with the EU is very close but there's still room for further negotiations to solve various issues.

- China's Foreign Minister said they are ready to strengthen cooperation and trust with Canada.

- China is said to be drafting purchase rules for NVIDIA's (NVDA) H200 chips, Nikkei reported, as an attempt to balance its desire to foster domestic chip development with Chinese tech firms.

- Taiwan’s government said Taiwan and the US have previously held multiple discussions and reached consensus on preferential tariff treatment for semiconductors and related products under Section 232. Taiwan’s government said Taiwan will subsequently schedule a separate meeting with the Office of the U.S. Trade Representative to sign the Taiwan–US trade agreement documents.

- The White House said President Trump imposed a 25% tariff on certain advanced computing chips, such as NVIDIA (NVDA) H200 and AMD (AMD) MI325X chips. Depending on the outcome of negotiations, President Trump may consider alternative remedies in the future, including minimum import prices for specific types of critical minerals. The Secretary and the trade representative should consider price floors for trade in critical minerals and other trade-restricting measures. The US chip tariff will not apply to chips imported for US technology supply.

- The White House said that in the near future, US President Trump may impose broader tariffs on semiconductor imports and their derivative products.

- US President Trump ordered the Commerce Dept. and USTR to negotiate agreements with foreign suppliers to reduce US reliance on imported processed critical minerals, citing national security risks. Negotiators have 180 days to secure binding or enforceable agreements.

NOTABLE EUROPEAN HEADLINES

- BoE Credit Conditions Survey: Demand for secured lending for remortgaging was unchanged in Q4, and was expected to increase in Q1. Within the overall figure, demand for credit card lending increased in Q4, and was expected to be unchanged in Q1. Demand for corporate lending in Q1 was expected to be unchanged for small, medium-sized, and large businesses.

- ECB's de Guindos said "it is very important for all of us that the principle of central bank independence is also applied to the Federal Reserve.".

NOTABLE EUROPEAN DATA RECAP

- UK GDP MoM (Nov) M/M 0.3% vs. Exp. 0.1% (Prev. -0.1%).

- UK GDP 3-Month Avg (Nov) 0.1% vs. Exp. -0.2% (Prev. 0.0%, Rev. -0.1%).

- UK GDP YoY (Nov) Y/Y 1.4% vs. Exp. 1.1% (Prev. 1.1%).

- UK Industrial Production YoY (Nov) Y/Y 2.3% vs. Exp. -0.4% (Prev. 0.4%, Rev. -0.8%).

- UK GDP 3-Month Avg (Nov) 0.1% vs. Exp. -0.2% (Prev. 0.0%, Rev. -0.1%).

- UK Balance of Trade (Nov) -6.116B vs. Exp. -3.5B (Prev. -6.531B, Rev. -4.824B).

- UK Goods Trade Balance (Nov) -23.71B vs. Exp. -20.4B (Prev. -24.17B, Rev. -22.54B).

- UK Goods Trade Balance Non-EU (Nov) -11.46B vs. Exp. -9.1B (Prev. -11.81B, Rev. -10.26B).

- UK Industrial Production MoM (Nov) M/M 1.1% vs. Exp. 0.1% (Prev. 1.3%, Rev. 1.1%).

- UK Manufacturing Production MoM (Nov) M/M 2.1% vs. Exp. 0.5% (Prev. 0.4%, Rev. 0.5%).

- UK Manufacturing Production YoY (Nov) Y/Y 2.1% vs. Exp. -0.3% (Prev. -0.2%, Rev. -0.8%).

- UK Construction Output YoY (Nov) Y/Y -1.1% vs. Exp. 0.1% (Prev. 0.9%).

- UK RICS House Price Balance (Dec) -14% vs. Exp. -16% (Prev. -14% , Rev. -16% ).

- Italian Industrial Production MoM (Nov) M/M 1.5% vs. Exp. 0.5% (Prev. -1.0%, Rev. -1%).

- Italian Industrial Production YoY (Nov) Y/Y 1.4% vs. Exp. -0.6% (Prev. -0.2%, Rev. -0.3%).

- German Full Year GDP Growth (2025) 0.20% vs. Exp. 0.2% (Prev. -0.50%, Rev. -0.2%); Q4 0.2% Q/Q.

- German Wholesale Prices YoY (Dec) Y/Y 1.2% vs. Exp. 1.6% (Prev. 1.5%).

- German Wholesale Prices MoM (Dec) M/M -0.2% vs. Exp. 0.2% (Prev. 0.3%).

CENTRAL BANKS

- US President Trump said no plans to remove Fed Chair Powell.

- US President Trump rejects criticism from Senate Republicans of the Justice Department probe of Fed chair Jerome Powell and said “they should be loyal.”; speaks highly of Kevin Hassett and Kevin Warsh.

- BoJ is reportedly likely to keep rates steady in January; some officials are said to be concerned over the economic impact of a weak JPY, Bloomberg reported. If the JPY continues to weaken, then the pace of future rate hikes could be accelerated. But, policy will remain on hold in January. Possible that the negative aspects such as a further JPY depreciation and the impact on personal consumption, will become a point of concern.

- BoJ Governor Ueda said mechanism under which wages and prices rise moderately in tandem likely to be sustained. BoJ is expected to keep raising interest rates if targets are met.

- ECB's Kazaks said policy rates are optimally positioned as inflation trends improve. Warns that inflation and growth risks are balanced and emphasises the need for vigilance.

- PBoC cuts the one-year relending facility rate to 1.25% (prev. 1.50%), to increase tech innovation quotas by CNY 400bln to CNY 1.2tln. Central Bank to boost relending quotas to power tech innovation. Pledges continued liquidity support via open market tools. Overnight rates will be guided to hover near policy rates. Will maintain ample liquidity to support bond issuance. Will flexibly conduct government bond operation going forward. Lowers minimum down payment for commercial property loans to 30% to boost market inventory clearance. No intention to use currency depreciation for trade advantage. Will guide expectation and prevent overshooting in CNY risk.

- China's PBoC Deputy Governor announces plans to release a series of monetary and financial measures.

- Bank of Korea keeps Base Rate unchanged at 2.50%, as expected. Removes "potential rate cut" reference from the statement.

- BoK Governor Rhee said the Government is to make an announcement on the US trade deal and the FX market later in the day.

- BoK Governor Rhee said rate decision was unanimous, need to remain cautious on FX volatility. 5 members see a 'high chance' of a hold in the next 3 months, 1 sees a cut in the near-term. Addressing FX volatility requires immediate steps as well as structural reforms. A weak KRW is not likely to trigger any financial crisis and have ample amounts of USDs.

NOTABLE US HEADLINES

- BofA card spending, week to January 10th: +4.6% Y/Y (prev. 1.7%). Strong growth across most categories, partially due to favourable base effects.

- US President Trump said the party that controls the White House often loses seats in midterm elections.

GEOPOLITICS

RUSSIA-UKRAINE

- US President Trump said Ukrainian President Zelensky is to blame for the current stalemate in Russia–Ukraine negotiations, adding that Russian President Putin is “ready to make a deal.”.

MIDDLE EAST

- "Flight restrictions in Iran lift, without explanation," AP reported.

- UN Security Council plans to meet with Iran at 15:00 EST / 20:00 GMT on Thursday, AFP reported.

- Iran has extended its airspace closure NOTAM until 03:30 UTC (~2 hours from now).

- US President Trump said Iran's government could fall due to unrest but "any regime can fail".

- US President Trump has told his National Security team that any US military action in Iran to be swift and decisive, NBC News reported citing sources; adds that a sustained war is undesirable. Trump's advisors have so far not been able to guarantee a quick collapse of Iran's regime.

- NOTAM over Iran has expired, according to reported.

- Iran's Foreign Minister Araghchi said there have been many threats by US President Trump and others but we are in control, hopes tensions do not reach a high level; no plans to carry out executions against protestors. Not ready to give up our legitimate right to the peaceful use of nuclear technology.

- Iran issues NOTAM to close all airspace, according to reported; "NOTAM is valid for a little more than 2 hours"; closes airspace to all flights except international flights to Iran with prior permission.

- “All the signals are that a US attack [against Iran] is imminent, but that is also how this administration behaves to keep everyone on their toes. Unpredictability is part of the strategy,” Reuters reported, citing a Western military official.

- The X account which flagged the initial explosions in Tehran said they have deleted the post "as the source appears to be a bit flimsy, though reporting on any potential action is going to be difficult due to the ongoing internet blackout across Iran".

- US President Trump has made it clear to the National Security team his goals for any US military action in Iran, NBC news reported.

- Maersk (MAERSKB DC) MECL service returns to trans-Suez route; following improved stability in the Red Sea, enabling more efficient transit times while maintaining safety as the top priority.

OTHERS

- Colombia President Petro is to meet with US President Trump on February 3rd.

- US President Trump posted "had a very good call with the Interim President of Venezuela, Delcy Rodríguez. We are making tremendous progress, as we help Venezuela stabilize and recover.". "Many topics were discussed, including Oil, Minerals, Trade and, of course, National Security.".

- The US Senate votes 51-50 in favour to allow US President Trump to act on Venezuela military action without Congressional approval; VP Vance casting the deciding vote.

- Chinese officials have reached out to counterparts in Venezuela and the US to seek assurances regarding their loans to Venezuela, Bloomberg reported citing people familiar with the matter.

CRYPTO

- Bitcoin is a little firmer this morning and trades above USD 97k.

APAC TRADE

- APAC stocks traded mostly in the green, outperforming their US counterparts, though the Nikkei lagged the region.

- ASX 200 continued its trend higher as mining and materials names advanced, supported by fresh ATHs in metals and news that Rio Tinto and BHP are collaborating on iron ore extraction in the Pilbara.

- Nikkei 225 underperformed, slipping back below 54,000 as reports that opposition parties CDP and Komeito have begun talks to form a new party weighed on sentiment.

- KOSPI traded comfortably in the green, extending to new ATHs and nearing 4,750, whilst the BoK kept rates steady as expected in a unanimous decision.

- Hang Seng and Shanghai Comp saw mixed trade, with the Hang Seng hovering just below ATHs near 27,380 while the Shanghai Composite oscillated around the unchanged mark as Chinese markets struggled for traction.

NOTABLE ASIA-PAC HEADLINES

- Earthquake of magnitude 5.5 in the Hokkaido region in Japan, EMSC reported.

NOTABLE APAC DATA RECAP

- Chinese M2 Money Supply YoY (Dec) Y/Y 8.5% vs. Exp. 8% (Prev. 8%).

- Chinese New Yuan Loans (Dec) 910B vs. Exp. 800B (Prev. 390B).

- Chinese Outstanding Loan Growth YoY (Dec) Y/Y 8.3% vs. Exp. 6.3% (Prev. 6.4%).

- Chinese Total Social Financing (Dec) 2210B vs. Exp. 2000B (Prev. 2490B).

- Australian Consumer Inflation Expectations (Jan) 4.6% vs. Exp. 4.5% (Prev. 4.7%).

- Japanese PPI YoY (Dec) Y/Y 2.4% vs. Exp. 2.4% (Prev. 2.7%).

- Japanese PPI MoM (Dec) M/M 0.1% vs. Exp. 0.1% (Prev. 0.3%).