UK equity futures point to a flat open whilst Eurex futures close for the Christmas holidays - Newsquawk EU Market Open

- APAC stocks traded mixed and within narrow ranges following a largely positive lead from Wall Street. APAC lacked conviction amid light newsflow and anaemic volumes as markets wound down ahead of the holidays.

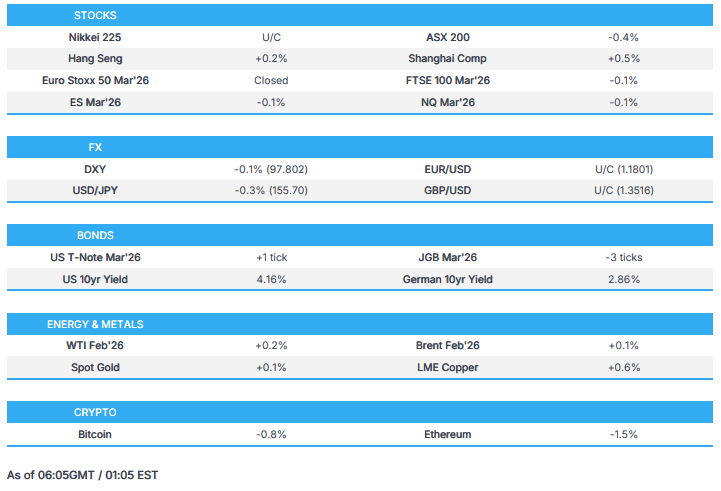

- DXY was choppy, and JPY strengthened before trimming some gains. G10 FX largely moved with the USD.

- Spot gold and silver both hit fresh all-time highs at above USD 4,500/oz and USD 72.70/bbl.

- European equity futures are closed as Eurex observes the Christmas Eve holiday. UK equity futures point to a flat open, with FTSE 100 futures U/C after the cash market closed 0.2% higher on Tuesday.

- Looking ahead, highlights include US Jobless Claims (w/e 20 Dec), Supply from the US.

- Note: The Newsquawk desk will run until 18:05GMT/13:05EST on Wednesday, 24th December. FOMC Minutes on 30th December 2025 will be covered. Normal service will resume at 0700GMT/02:00EST on Friday 2nd of January 2026 for the beginning of the European Session.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks largely closed higher after early losses triggered by a heavy slate of US data were gradually pared back through the session. Overall, newsflow was quiet heading into the close.

- SPX +0.46% at 6,910, NDX +0.50% at 25,588, DJI +0.16% at 48, 442, RUT -0.69% at 2,541

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Trump posted "Growth is up and Inflation is down in President Trump’s first year".

- US NEC Director Hassett said President Trump has "a bunch of great Fed chair candidates", via Fox Business; Precious metals are skyrocketing for good reason.

- US Treasury Secretary Bessent said large paychecks will accompany hiring in the months ahead.

- US President Trump posted on Truth said "The Financial News today was great — GDP up 4.2% as opposed to the predicted 2.5%"; "...Want my new Fed Chairman to lower Interest Rates if the Market is doing well, not destroy the Market for no reason whatsoever..

NOTABLE US EQUITY HEADLINES

- Snowflake (SNOW) is reportedly in talks to purchase Observe for around USD 1bln, according to The Information.

- Apple (AAPL) CEO reportedly bought some USD 3mln of Nike (NKE) stock, according to Barrons.

- Lockheed Martin (LMT) awarded USD 10bln modification to previously awarded US Air Force contract, according to Pentagon.

- Boeing (BA) awarded USD 2bln contract by US Air Force, according to Pentagon.

TRADE/TARIFFS

- Japan and US agree to expedite the USD 550bln investment project, according to Bloomberg, citing a statement.

- USTR Greer said he is happy to have trade with China in non-sensitive areas.

- France demands EU action to counter Chinese duties on dairy, via Bloomberg News.

APAC TRADE

EQUITIES

- APAC stocks traded mixed and within narrow ranges following a largely positive lead from Wall Street. APAC lacked conviction amid light newsflow and anaemic volumes as markets wound down ahead of the holidays.

- ASX 200 edged lower, with weakness in Tech and Healthcare outweighing strength across the mining complex.

- Nikkei 225 held onto modest gains, oscillating around the 50.5k level despite JPY strength, supported by a calmer domestic bond market.

- Hang Seng and Shanghai Comp varied, with little in the way of fresh domestic catalysts. Price action broadly reflected the indecisive regional risk tone.

- US equity futures hovered on either side of the flatline, trading in tight ranges amid quiet overnight newsflow and holiday-thinned liquidity.

- European equity futures are closed as Eurex observes the Christmas Eve holiday. UK equity futures point to a flat open, with FTSE 100 futures U/C after the cash market closed 0.2% higher on Tuesday.

FX

- DXY was choppy and initially traded on a softer footing, extending the weakness seen through the week amid holiday-thinned liquidity ahead of Christmas. DXY slipped to 97.75, revisiting levels last seen in early October, before trimming losses back to flat levels. G10s as a result, reversed earlier gains.

- EUR/USD benefited from the weaker dollar backdrop for most of the session, briefly pushing back above 1.1800 as G10 FX moved largely in tandem with the USD in quiet market conditions.

- GBP/USD initially advanced alongside its G10 peers, with GBP/USD eventually breaking through resistance near 1.3520 before reversing towards 1.3500. Price action was primarily driven by the USD rather than idiosyncratic drivers.

- USD/JPY underperformed amid JPY strength, driving USD/JPY below the prior day’s 155.65 low after starting the week near 157.71. The move followed renewed attention to Finance Minister Katayama’s earlier comments, alongside modest support from reports of Japan’s FY26 bond issuance plans and spillover effects from sudden KRW strength linked to South Korean pension FX hedging.

- Antipodeans initially strengthened, led by AUD, which pushed above 0.6700. The move was underpinned by a rally in metals, with spot gold and LME copper both reaching fresh all-time highs, reinforcing AUD support in thin holiday trade.

- PBoC set USD/CNY mid-point at 7.0471 vs exp. 7.0240 (Prev. 7.0523).

- South Korea's pension fund said to implement strategic foreign exchange hedging measures, according to Reuters sources.

- Brazilian Central Bank to offer USD 2bln in Dollar auction with repurchase agreements on 26th December.

FIXED INCOME

- 10yr UST futures consolidated after the prior session’s whipsaw that saw yields initially rise on GDP data before gradually retracing. Subsequent macro newsflow remained light, keeping price action subdued.

- 10yr JGB futures held a modest upward bias for most of the session after PM Takaichi signalled a continued focus on Japan’s debt sustainability, explicitly rejecting what she described as irresponsible bond issuance and tax cuts.

- Bund futures are closed as Eurex observes the Christmas Eve holiday.

- US sold USD 28bln of 2-year FRNs; high-discount margin 0.139%. High Discount Margin: 0.139% (prev. 0.17%, six-auction average 0.18%). B/C: 3.75x (prev. 3.03x, six-auction average 3.11x). Dealer: 30.0% (prev. 33.75%, six-auction average 35.31%). Direct: 0.7% (prev. 0.71%, six-auction average 0.93%). Indirect: 69.3% (prev. 65.54%, six-auction average 63.77%).

- US sold USD 70bln of 5-year notes; tails 0.1bps. Tail: 0.1bps (prev. 0.5bps, six-auction average 0.4bps); WI: 3.746%. High Yield: 3.747% (prev. 3.562%, six-auction average 3.747%). B/C: 2.35x (prev. 2.41x, six-auction average 2.36x). Dealer: 8.8% (prev. 11.0%, six-auction average 10.7%). Direct: 31.7% (prev. 27.6%, six-auction average 27.5%). Indirect: 59.5% (prev. 61.4%, six-auction average 61.8%).

- US sold 6-wk bills at high rate 3.580%, B/C 2.87x; sold 1yr bills at high rate 3.380%, B/C 3.74x.

- Treasury Buyback (10- to 30-year TIPS, max USD 500mln): Accepts USD 108mln of USD 1.19bln offers, accepts 4 out of 15 eligible issues; Offer to cover 11.02x.

COMMODITIES

- Crude futures eventually tilted higher after the prior session’s gains, remaining underpinned by ongoing geopolitical tensions, supportive US GDP data and a softer dollar this week. Overnight macro newsflow for the complex was limited, keeping price action contained.

- Spot gold extended its rally to fresh all-time highs, climbing through USD 4,500/oz to peak near USD 4,526/oz, up sharply from Monday’s USD 4,340/oz low. The advance was driven by persistent geopolitical risk and continued USD weakness.

- Spot silver rose to a USD 72.70/oz peak (vs USD 67.33/oz low on Monday). From a fundamental perspective, precious metals continue to be fuelled by geopolitics and a softer dollar.

- Copper futures remained firm, extending recent momentum amid a softer dollar. Three-month LME copper held comfortably above the USD 12,000/t level throughout the session.

- US Private Inventory (bbls): Crude +2.4mln (exp. -2.4mln), Distillate +0.7mln (exp. +0.4mln), Gasoline +1.1mln (exp. +1.1mln), Cushing +0.6mln.

- Baker Hughes Rig Count: Oil +3 at 409, Nat Gas unch. at 127, Total +3 at 545.

CRYPTO

- Bitcoin traded subdued within narrow ranges and dipped back under the USD 88,000 level.

CENTRAL BANKS

- BoJ Oct 29–30 meeting minutes (two meetings ago): Members agreed the BoJ will continue to raise rates if economic and price forecasts materialise. Many members said the likelihood of economic and price forecasts materialising has heightened, but must maintain policy to confirm whether positive wage-setting behaviour will not be disrupted. One member said the timing of a rate hike is approaching, but authorities should wait a bit longer to scrutinise the direction of the new administration’s policies.

- BoC Minutes (Dec): Agreed to remain cautious in interpreting data given recent volatility; felt it was hard to predict whether the next move would be a hike or a cut. Policy Outlook; Ahead of Bank of Canada’s Dec 10 rate announcement, Governing Council felt it was hard to predict whether next move would be a hike or a cut. Prepared to respond in case of a major new shock, or data showing economy and inflation diverging materially from outlook.

NOTABLE ASIA-PAC HEADLINES

- South Korea to exempt capital gains taxes for retail investors selling overseas stocks to reinvest domestically; to increase tax benefits on corporate earnings repatriated from abroad; to offer tax benefits for retail investors hedging FX.

- South Korea said FX markets will soon see the government's strong determination, via Bloomberg.

- South Korea to extend auto sales tax cut through June; to extend fuel tax cut through February, according to the Finance Ministry.

- South Korea Presidential Policy Chief said authorities will take action to stabilise the exchange rate.

- Japan to reportedly assume 3% rate on bond expenses in FY26 budget, according to Japanese press Yomiuri.

- Japan to reportedly issue around JPY 29.6tln in new government bonds for its FY26 budget, according to NHK.

DATA RECAP

- South Korean Consumer Sentiment Ind (Dec) 109.9 (Prev. 112.4).

- Japanese Leading Index Final (Oct) 109.8 (Prelim. 110).

GEOPOLITICS

RUSSIA-UKRAINE

- Unconfirmed explosions were reported in Moscow at the site where a general was killed two days ago.

- Ukrainian drone attack sparks fire at industrial site in Russia's Tula region, according to the regional governor.

MIDDLE EAST

- Russian President Putin said Russia "reject Israel's repeated violations of Syrian territory", via Al Arabiya.

OTHERS

- US Envoy to UN said US will impose and enforce sanctions to deprive Venezuela's Maduro of resources to fund Cartel de Los Soles, including oil profits.

- The US moved a large number of special-operations aircraft and multiple cargo planes filled with troops and equipment into the Caribbean area this week, giving the US additional options for possible military action in the region, via WSJ citing officials.

- Venezuela assembly approves law allowing up to 20-year sentences for promoting piracy or blockades amid U.S. oil ship interceptions.

EU/UK

NOTABLE EUROPEAN EQUITY HEADLINES

- BP (BP/ LN) reportedly nears sale of Castrol lubricants unit stake to Stonepeak at a USD 10bln valuation, according to the WSJ; BP set to receive around USD 6bln in proceeds from the sale of a 65% stake.