"Uninvestable": Trump's $100 Billion Venezuela Gamble Meets Oil Industry Reality

President Donald Trump’s push for U.S. oil companies to commit at least $100 billion toward rebuilding Venezuela’s energy industry is meeting significant resistance from the very executives he is courting, according to Bloomberg.

Although the White House projects confidence, industry leaders are warning that Venezuela remains too unstable for major investment, with Exxon Mobil CEO Darren Woods describing the country bluntly as “uninvestable.”

At a closed-door meeting Friday with roughly 20 energy executives, Trump said he expected an agreement “today or very shortly thereafter” to restart large-scale drilling in Venezuela following the removal of Nicolás Maduro. He applied direct pressure, telling the group, “If you don’t want to go in, just let me know, because I’ve got 25 people that aren’t here today that are willing to take your place.”

Publicly, many executives praised the opportunity. Privately and in their remarks, they expressed deep concern about risk, governance, and long-term returns. Woods delivered the strongest warning, pointing to Venezuela’s unstable business environment and past expropriations. “If we look at the legal and commercial constructs and frameworks in place today in Venezuela today, it’s uninvestable,” he said, noting Exxon’s assets there had already been seized twice. He questioned whether any future protections would hold: “How durable are the protections from a financial standpoint? What will the returns look like? What are the commercial arrangements, the legal frameworks?” Even so, he added that Exxon would be willing “to put a team on the ground” if invited and given proper security guarantees.

Other executives struck a cautious tone. Continental Resources founder Harold Hamm said the prospect “excites me as an explorationist,” but emphasized the scale of the task ahead: “There’s a huge investment that needs to be done — we’ve all agreed on that, and certainly we need time to see that through.”

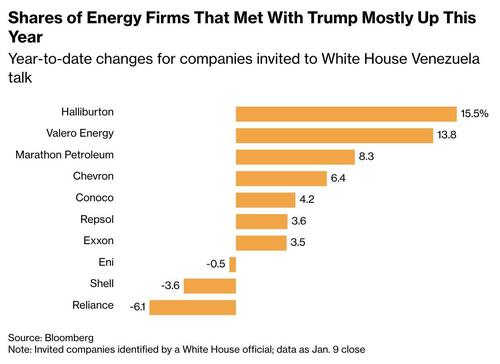

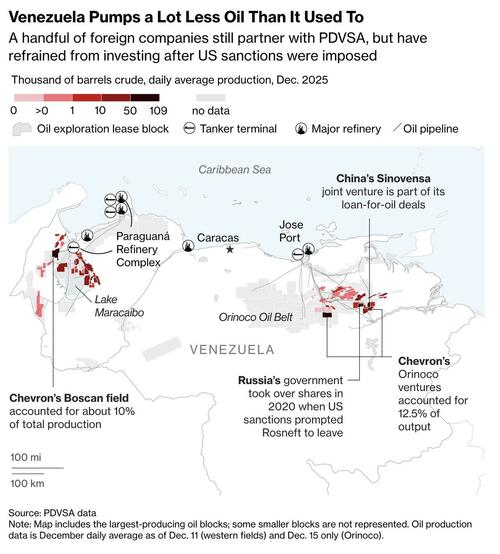

Bloomberg writes that Trump, however, left the meeting projecting momentum. “We sort of formed a deal,” he told reporters, predicting companies would soon be investing “hundreds of billions of dollars in drilling oil.” Yet when pressed for specifics, Energy Secretary Chris Wright acknowledged that Chevron — the only U.S. major still operating in Venezuela — was the only firm to make a concrete pledge. Chevron Vice Chairman Mark Nelson said production, now about 240,000 barrels per day, could rise by roughly 50% within 18 to 24 months.

Trump sought to ease investor fears by promising sweeping protections: “You have total safety, total security,” he said. “You’re dealing with us directly — you’re not dealing with Venezuela or we don’t want you to deal with Venezuela.” Wright later said the administration’s priority is to “change the behavior of the government in Venezuela” and “drive better business conditions.”

The meeting included moments of levity over massive past losses. When ConocoPhillips CEO Ryan Lance said his company had absorbed a $12 billion hit in Venezuela, Trump replied, “Good write-off,” prompting Lance to respond, “It’s already been written off.”

Some executives were openly eager. Repsol’s CEO told Trump his company was “ready to invest more in Venezuela today,” and Armstrong Oil & Gas CEO Bill Armstrong said, “We are ready to go to Venezuela… it is prime real estate… kind of like West Palm about 50 years ago: very ripe.”

Still, many industry figures are uneasy about the optics and risks of the administration’s strategy, which critics argue amounts to an aggressive grab for Venezuela’s vast oil reserves. Trump defended the move bluntly: “If we didn’t do this, China or Russia would have done it.”

Despite the uncertainty, Wright predicted Venezuela’s output would “hopefully” begin rising by summer and said, “They are going to ramp up investment immediately in the next few weeks… Can we achieve $100 billion investment over next 10 years? I think absolutely.”

Venezuela holds the world’s largest proven oil reserves, but decades of neglect, sanctions, and infrastructure collapse have pushed production below one million barrels per day. Rebuilding even a fraction of its former output will require years of work and tens of billions of dollars to repair abandoned rigs, corroded pipelines, and heavily damaged facilities.