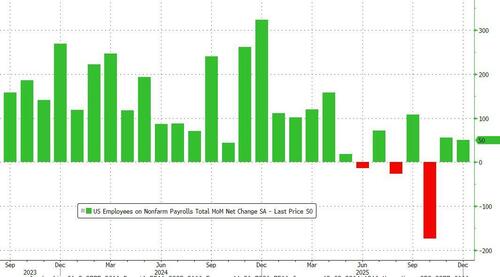

US Adds Only 50K Jobs In December, Missing Estimates, But Unemployment Rate Drops To 4.4%

Ahead of today's jobs report, expectations were that the NFP number would show another rebound from the terrible Sept/Oct prints, but remain muted (or else spark fears about reheating and an end to the Fed's easing cycle). Well, that's precisely what we got moments ago when the BLS reported that in December the US gained 50K jobs, a modest miss to estimates of 50K, but smack in the middle of JPM's sweet spot range of 35K-75K (as previewed earlier) which would be best for the market.

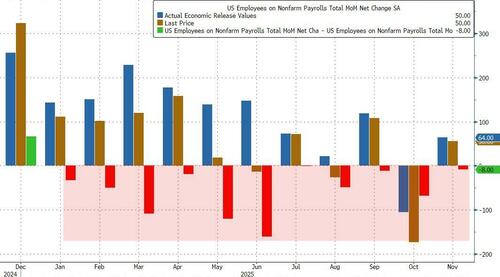

The change in total nonfarm payroll employment for October was revised down by 68,000, from -105,000 to -173,000, and the change for November was revised down by 8,000, from +64,000 to +56,000. With these revisions, employment in October and November combined is 76,000 lower than previously reported. Notably, as shown in the chart below, the initial NFP print has now been revised lower in every single month of 2025.

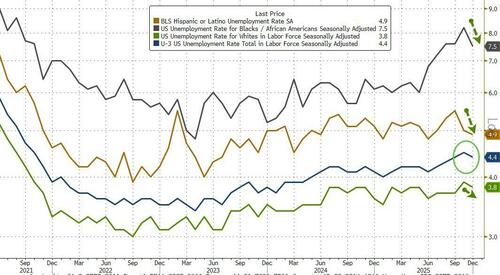

While there was NFP print was on the weak side, there was a modest improvement in the unemployment rate, which dipped from a downward revised 4.5% (was 4.6% originally) to 4.4%, which still is the highest since 2021, save for Nov 2025. Among the major worker groups, the unemployment rates for adult men was 3.9%, adult women 3.9%, teenagers 15.7%, Whites 3.8%, Blacks 7.5%, Asians 3.6%, and Hispanics 4.9%.

Labor force participation dipped fractionally from 62.5% to 62.4%, in line with estimates. The employment-population ratio, at 59.7%, was also unchanged in December. These measures have shown little change over the year.

While jobs came on the cool side, hourly earnings came slightly hot: rising 0.3% MoM, up from 0.2% in November (and in line with estimates), this translates to a 3.8% increase YoY, up from 3.6% and above the 3.6% expected.

Some more details from the report:

- The number of people jobless less than 5 weeks edged down to 2.3 million in December. The number of long-term unemployed (those jobless for 27 weeks or more) changed little over the month at 1.9 million but is up by 397,000 over the year. The long-term unemployed accounted for 26.0 percent of all unemployed people in December.

- The number of people employed part time for economic reasons, at 5.3 million, changed little in December but is up by 980,000 over the year. These individuals would have preferred full-time employment but were working part time because their hours had been reduced or they were unable to find full-time jobs.

- The number of people not in the labor force who currently want a job was little changed at 6.2 million in December but is up by 684,000 over the year. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of people marginally attached to the labor force changed little at 1.8 million in December. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, decreased by 183,000 in December to 461,000.

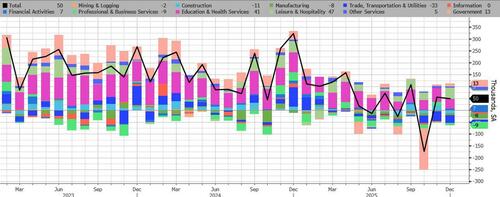

Taking a closer look at the Establishment survey, we find that employment continued to trend up in food services and drinking places, health care, and social assistance. Retail trade lost jobs. Payroll employment rose by 584,000 in 2025 (an average monthly gain of 49,000), less than the increase of 2.0 million in 2024 (an average monthly gain of 168,000). Here is the breakdown:

- Employment in food services and drinking places continued to trend up in December (+27,000). Food services and drinking places added an average of 12,000 jobs per month in 2025, similar to the average increase of 11,000 jobs per month in 2024.

- Health care employment continued its upward trend in December (+21,000), with a gain of 16,000 jobs in hospitals. Health care employment rose by an average of 34,000 per month in 2025, less than the average monthly gain of 56,000 in 2024.

- In December, employment in social assistance continued to trend up (+17,000), mostly in individual and family services (+13,000).

- Retail trade lost 25,000 jobs in December. Over the month, employment declined in warehouse clubs, supercenters, and other general merchandise retailers (-19,000) and in food and beverage retailers (-9,000). Electronics and appliance retailers added 5,000 jobs. Retail trade employment showed little net change in both 2024 and 2025.

- Federal government employment was little changed in December (+2,000). Since reaching a peak in January, federal government employment is down by 277,000, or 9.2 percent. (Employees on paid leave or receiving ongoing severance pay are counted as employed in the establishment survey.)

- Employment showed little or no change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; transportation and warehousing; information; financial activities; professional and business services; and other services.

And the visual breakdown:

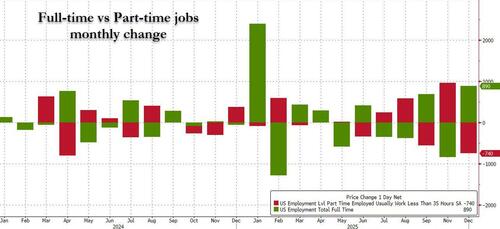

Elsewhere, there were some notable improvements in other qualitative metrics we track, including the full/part-time breakdown, where last month's ugly push to Part-Time jobs was almost entirely reversed as full-time jobs rose 890K to 135.215MM, offset by a 740K plunge in part-time jobs -740K to 28.712MM...

... while the number of multiple jobholders slumped by 444K - the second biggest drop since Covid - to 8.848MM.

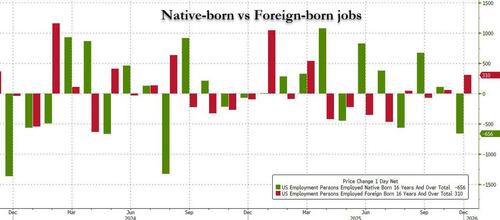

And one red flag: the number of native-born workers dropped by 656K to 132.6 million, while foreign-born workers rose by 310K to 32.426 million, a modest reversal of the trends observed in 2025.

Commenting on the data, TradeStation's head of market strategy, David Russell said that "the labor market has reached an equilibrium after a year of policy shocks. There are no red flags compelling the Fed to cut now. Inflation is a bigger factor on rates than employment, which focuses attention on next week’s CPI. Investors may see less impact from macro-level data in the next few months and more impact from company-level events like earnings."

Overall, this was a goldilocks report: neither too hot (with NFP missing) nor too cold (as unemp rate dropped), which leaves the Fed on autopilot and likely to cut at least 2 more times this year, absent any major changes.