US equities set to rebound following Wednesday's tech-led selloff; Markets await US CPI and rate announcements by the BoE and ECB - Newsquawk US Market Open

- US President Trump said he will soon announce the next Fed chair and that the new Fed chair will believe in lowering interest rates by a lot.

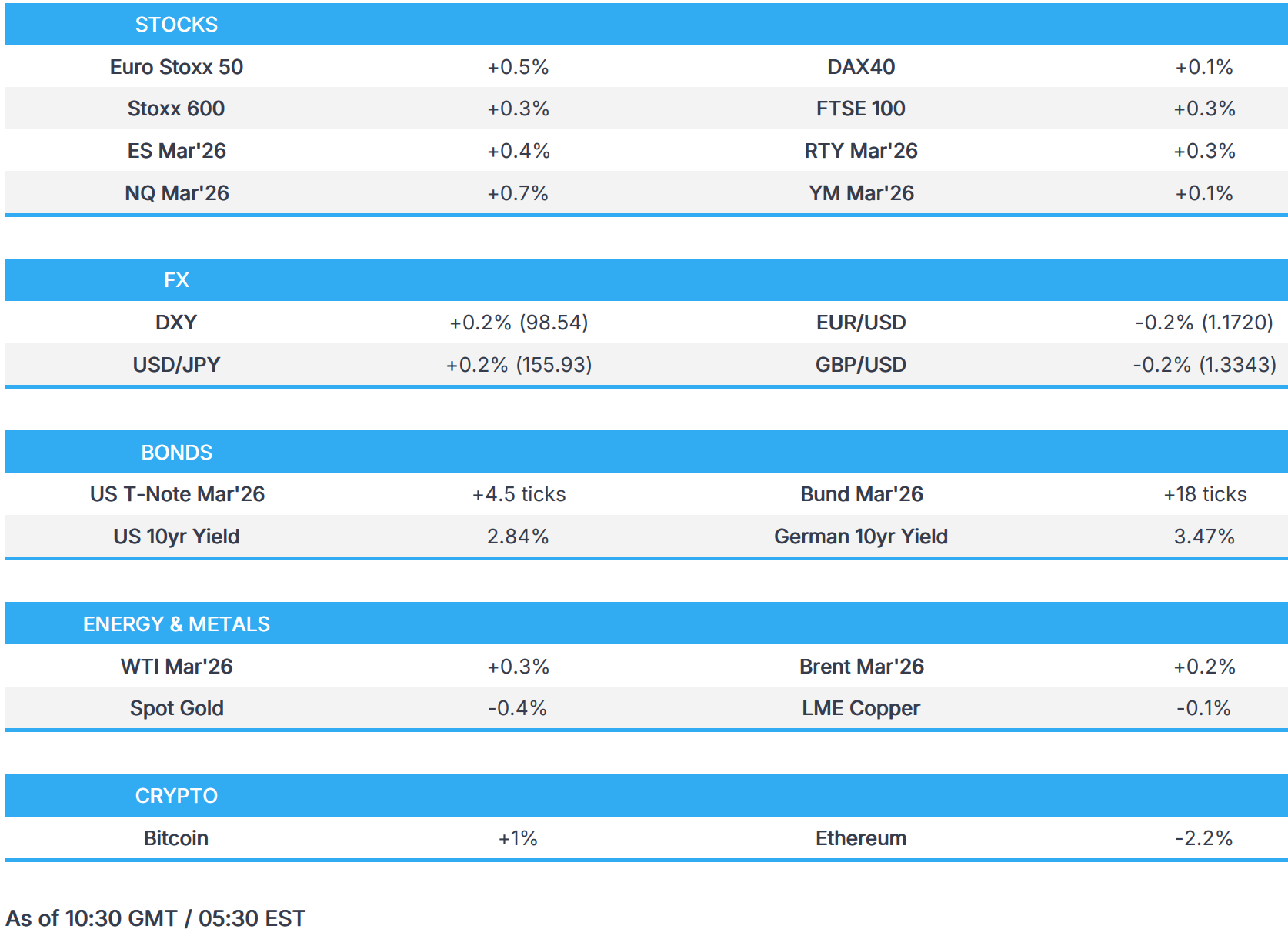

- European bourses are mostly firmer; US equity futures also gain, with mild outperformance in the NQ.

- DXY is slightly firmer as traders await US CPI; GBP underperforms a touch ahead of the BoE, EUR awaits the ECB.

- Fixed income grinds higher; Bunds saw some modest downticks after Germany's DFA announced their 2026 issuance plan, which came in slightly above analyst expectations.

- Crude complex was initially firmer but now hovering just above the unchanged mark, as Trump avoided mentioning Venezuela/Russia in his primetime address.

- Looking ahead, highlights include US CPI (Nov), Jobless Claims (w/e 13 Dec), Philly Fed (Dec), Japanese CPI (Nov), NZ Trade Balance (Nov), ECB Announcement, BoE Announcement, CNB Announcement, Banxico Announcement. Speakers include ECB’s Lagarde & BoE’s Bailey, Supply from US, Earnings from Carnival, Nike & FedEx.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EQUITIES

- European bourses are broadly in the green, in contrast to a mostly subdued APAC session as markets await policy decisions from the BoE and the ECB.

- European sectors are trading mixed. Retail (+1.0%), Financial Services (+0.4%) and Real Estate (+0.4%) lead. Retail has been underpinned by gains in Curry's (+8.6%) after Co. posted strong half year growth. At the other end of the spectrum, Autos (-0.6%), Banks (-0.5%) and Travel & Leisure (-0.3%) lag.

- US equity futures are mostly firmer, with gains across the major indices, although the YM is lagging and trading flat. There has been limited macro newsflow so far this morning; however, one key overnight development was comments from US President Trump, who said he will announce the next Fed chair and that the appointee will favour lowering interest rates.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY resides on a firmer footing, now back above 98.50 following yesterday's choppy trade, which saw the index close in the middle of a 98.175-98.639 parameter. Analysts at ING acknowledge the dovish tilt to Wednesday's remarks from Fed's Waller, but suggested he was in no rush to lower rates. January pricing for a 25bps cut resides at around 27% at the time of writing. ING favour a cut in March, currently priced at near-60%. The desk also believes the USD will be largely unfazed by the weekly claims today (barring a spike), whilst the delayed US CPI is unlikely to trigger a major Fed repricing.

- EUR is subdued against the USD but slightly firmer vs the GBP in the run-up to the ECB confab, which, all in all, should be frictionless and focus on the new macroeconomic projections, though recent commentary has moderated the focus from the 2028 view. Nonetheless, the forecasts will help to inform the discussion around whether the next move is a cut or a hike (full Newsquawk preview available). Also for the EUR, EU leaders are to hold strategic debates on Ukraine, where focus from a macro perspective largely centres around the possible funding options for Ukraine, European defence, and thereafter Russia's response and any implications on peace efforts (Full Newsquawk primer available). EUR/USD remains within yesterday's 1.1703-1.1758 parameter.

- GBP is also pressured by the USD and lower against the EUR in the run-up to the BoE announcement, where a 25bps cut is widely expected, but eyes will be on the vote split, particularly following the latest GDP and CPI metrics. Thereafter, focus on the forward guidance and any hints around the terminal (full Newsquawk preview available). GBP/USD remains tucked within yesterday's 1.3312-1.3427 range at the time of writing.

- SEK was unreactive to the Riksbank leaving its rates unchanged at 1.75% as expected, in which it reiterated rate is expected to remain at this level for some time to come. Meanwhile, Norges Bank maintained its Key Policy Rate at 4.00% as expected, and suggested if the economy evolves broadly as currently projected, the policy rate will be reduced further in the course of the coming year. NOK saw mild strength, facilitated by the unwinding of some bets that the updated Norges Bank MPR would signal earlier easing.

- PBoC set USD/CNY mid-point at 7.0583 vs exp. 7.0403 (Prev. 7.0573).

- Click for NY OpEx Details

FIXED INCOME

- Gilts are trading slightly firmer, in line with global peers, ahead of the highly-anticipated BoE rate decision at 12:00GMT. The Bank is expected to cut interest rates by 25bps to 3.75%, but traders will be keeping an eye on the vote split. See headline feed for an in-depth preview.

- Bunds are trading with modest gains, but newsflow remains light going into the ECB rate announcement at 13:15GMT. German debt benchmarks opened at 127.50 and traded muted in low liquidity as the European pre-cash session got underway. Bunds grinded higher to a peak of 127.62 just as Germany's DFA announced their 2026 issuance plan. Bunds fell 6 ticks to a trough of 127.52 as the figure came in slightly above analyst expectations (EUR 512bln vs exp. 500bln) but the move has been completely pared back. The ECB is expected to hold its deposit facility rate at 2%. Investors will be closely watching the updated projections, which includes a new 2028 inflation forecast.

- USTs have continued the grind higher seen in Wednesday’s session as the tech-led risk off sentiment drove global markets. T-notes traded rangebound during APAC trade as JGBs remained muted before treading higher, in line with European peers. A major catalyst for USTs will be the November CPI report released by the BLS. Markets are expecting headline inflation to rise slightly to 3.1% from 3.0%, while core CPI to remain at 3%.

- German Finance Agency said it plans to sell record EUR 512bln in debt in 2026; 20yr Federal bond will be issued for the first time "in light of demand". To raise EUR 176bln on money markets in 2026. Plans to issue green securities in the volume of EUR 16-19bln in 2026.

COMMODITIES

- WTI and Brent are incrementally firmer this morning, but are significantly off the highs seen in overnight trade. Initial upside was facilitated by the ongoing US-Venezuelan developments, and with traders continuing to digest the Bloomberg report, which suggested that US energy sanctions on Russia were in the works, should Russia reject a peace plan. For reference, ING opines that the blockade on Venezuela could put around 600k bpd of oil exports at risk. Thereafter, the complex then waned off best levels as markets digested US President Trump's primetime address to the nation, given that there was no mention of the Venezuelan blockade or Russian sanctions. This led Brent to slip from a peak of USD 60.67/bbl to a trough of USD 59.72/bbl over an hour, where it currently resides.

- Precious metals are softer across the board and giving back some of the prior day's gains as the Dollar continues to edge higher in early European hours, with traders focusing on a myriad of scheduled macro events alongside European geopolitical and trade talks in the background. From a data perspective, the delayed US CPI is in focus but is unlikely to shift the dial for the Fed, whilst ING expects the Dollar to be unfazed by jobless claims data, assuming no surge. Spot gold currently trades in a USD 4,321.06-4,343.10/oz intraday range, well within yesterday's USD 4,302.41-4,349.28/oz parameter. Spot silver takes a breather after notching another record high yesterday, at USD 66.90/oz, with the precious metal now meandering around the USD 66/oz mark.

- Base metals are similarly subdued by the firmer Dollar and despite risk appetite across equities tilting higher. Copper prices post shallower losses vs the open, having retreated overnight amid the subdued risk appetite and with pressure seen as Chinese commodities trade got underway. Trade thus far is tentative ahead of risk events, 3M LME copper in a USD 11,664.00-11,739.00/t range (within recent parameters) at the time of writing.

- Dubai set official crude differential to GME Oman for March at USD 0.10/bbl discount.

- Qatar lowers February term price for Al Shaheen oil to USD 0.53/bbl above Dubai, according to sources cited by Reuters.

- US President Trump's administration is asking the US oil industry if they would return to Venezuela if Maduro is gone, according to POLITICO.

- Venezuela is running out of oil storage space amid tanker curbs, via Bloomberg. Venezuela's main oil storage and tankers sitting at its terminals are quickly filling up and may be at maximum capacity in about 10 days. If that happens, state-owned Petróleos de Venezuela SA, whose production is close to 1mln bpd a day, could be forced to shut-in wells.

- BofA said if WTI prices averages USD 57/bbl in 2026, in line with its forecasts, US Shale oil production may fall by 70k bpd or 1% Y/Y.

TRADE/TARIFFS

- French President Macron said numbers on Mercosur trade deal does not add up right now and talks are not yet over.

- Chinese Commerce Ministry, on talks with the EU on EV tariffs, said they are still being negotiated.

- Chinese Commerce Ministry, on EU rare earth export licenses, said some Chinese licence applications have been approved.

- Chinese Commerce Ministry, on EU's FRS (Foreign Subsidies Regulation) Investigation, said it has severely impacted Chinese firms business and investment operations in the EU.

- China's Commerce Ministry, on steel licences, said it involves some 300 products; designed to strengthen monitoring and tracking of exports.

- US President Trump said they used to have the worst trade deals anywhere in the world and were laughed at, but they're not laughing anymore. said:. Much of the success has been due to tariffs. One year ago, the country was dead and ready to fail, and now its the hottest anywhere in the world.

- Japan government said consultation committee for the USD 550bln US-bound investment package held its meeting on Thursday.

NOTABLE EUROPEAN DATA RECAP

- Polish Corp. Sector Wages YY (Nov) 7.1% vs. Exp. 6.2% (Prev. 6.6%).

- Polish PPI YY (Nov) -2.4% vs. Exp. -2.5% (Prev. -2.2%).

- Polish Industrial Output YY (Nov) -1.1% vs. Exp. 2.7% (Prev. 3.2%, Rev. 3.3%).

- Polish Employment YY (Nov) -0.8% vs. Exp. -0.9% (Prev. -0.8%).

- French Business Climate Mfg (Dec) 102.0 vs. Exp. 98.0 (Prev. 98.0).

- Dutch Unem Rate Monthly SA (Nov) 4.0% (Prev. 4.0%).

CENTRAL BANKS

- Norges Bank maintains its Key Policy Rate at 4.00% as expected; if the economy evolves broadly as currently projected, the policy rate will be reduced further in the course of the coming year. If the policy rate is lowered too quickly, inflation could remain above target for too long. With a gradual decline in wage growth ahead, inflation is projected to move down and be close to 2 percent in 2028. Sees 2026 Key Policy Rate at 3.9% (prev. forecast 3.9%). Sees 2027 Key Policy Rate at 3.4% (prev. forecast 3.5%).

- Norges Bank's Bache said NOK is weaker than previously assumed, raising inflation prospects slightly.

- Riksbank maintains its rate at 1.75% as expected; reiterates rate is expected to remain at this level for some time to come. Although inflation has varied somewhat from month to month, it has overall developed in line with the Riksbank's forecast in September and approached 2 per cent. Indicators continue to support the view of inflationary pressures in line with the target going forward.

- Riksbank's Thedeen said policy rate will stay at this level at some time going forward, with this view covering the horizon for the Bank's rate path.

- China Securities Times reported PBoC rate cut room shrinks amid shift of focus to policy mix, and noted aggressive RRR cuts are less needed.

NOTABLE US HEADLINES

- US President Trump said will soon announce the next Fed chair and will announce aggressive housing reforms in the new year, said new Fed chair will believe lower interest rates by a lot.

- US President Trump said more than a million service members will get a special dividend of USD 1,776 before Christmas.

- US President Trump said from day one, he stopped the 'invasion' from the southern border.

- US House passes Republican health care bill without extension of ACA subsidy.

- White House official said US President Trump is expected to address marijuana rescheduling on Thursday.

- US President Trump was told by his former lawyer that the Constitution is ambiguous regarding the question of a third term, according to WSJ.

- US aims to strip more naturalized Americans of citizenship, according to NYT.

GEOPOLITICS

- Ukraine's President Zelensky said European representatives could take part in talks in the US; there are no final aligned peace proposals for now; he is not ready to withdraw troops from Donbas.

- Belgian PM De Wever said there is no precedent for the proposal to use the immobilised Russian assets. Guarantees thus far do not meet Belgium demands. Want binding guarantees in writing from other EU member states. Other nations with immobilized Russian assets need to take the same responsibility as Belgium. Nations outside of the EZ and EU should be prepared to take the same action if we use immobilized assets. The most probable option is to use the headroom in the EU budget, which could include an opt-out for countries; other options are technically complicated. Using headroom would be cheaper and safer.

- Ukrainian attack damages ship in southern Russian port of Rostov-on-Don, while there are deaths among the crew, according to the regional governor.

- Iranian President Pezeshkian said they do not seek nuclear weapons and are ready for dialogue

CRYPTO

- Bitcoin is a little firmer this morning and trades around USD 87k whilst Ethereum moves lower down to USD 2.8k

APAC TRADE

- APAC stocks were mostly lower following on from the tech-led selling stateside and ahead of US inflation data and a slew of upcoming central bank decisions.

- ASX 200 was flat with the index constrained by weakness in energy, gold miners and industrials.

- Nikkei 225 briefly dipped beneath the 49,000 level amid tech woes and anticipation of a BoJ rate hike when the central bank concludes its 2-day policy meeting tomorrow.

- Hang Seng and Shanghai Comp were mixed as tech-related headwinds dampened risk sentiment in Hong Kong, although the mainland kept afloat after the PBoC's open market operations, in which it opted to utilise both 7- and 14-day reverse repos.

NOTABLE ASIA-PAC HEADLINES

- Japan's Chief Cabinet Secretary Kihara said watching market moves, including long-term rates closely.

- South Korea's Finance Minister said concerned of FX volatility widening, adds closely monitoring impacts from diverging monetary policies abroad on local markets.

- South Korea Vice Finance Minister sees herd behaviour in markets, adds KRW declines seem more excessive compared to the economy's fundamentals.

NOTABLE APAC DATA RECAP

- Australian MI Inflation Gauge MM (Nov) 4.7% (Prev. 4.5%).

- Japanese Foreign Invest JP Stock w/e 528.3B (Prev. 96.8B, Rev. 132.8B).

- Japanese Foreign Bond Investment w/e 356.4B (Prev. 452.9B, Rev. 456.3B).

- New Zealand GDP Prod Based, Ann Avg (Q3) -0.5% vs. Exp. -0.3% (Prev. -1.1%, Rev. -1.2%).

- New Zealand GDP Prod Based QQ, SA (Q3) 1.1% vs. Exp. 0.9% (Prev. -0.9%, Rev. -1.0%). NZD/USD immediately moved higher by 7 pips to 0.5784 from 0.5777.

- New Zealand GDP Prod Based YY, SA (Q3) 1.3% vs. Exp. 1.3% (Prev. -0.6%, Rev. -1.1%).

- New Zealand GDP Exp Based QQ, SA (Q3) 1.3% vs. Exp. 0.9% (Prev. -0.9%, Rev. -0.8%).

NOTABLE APAC EQUITY HEADLINES

- TSMC (2330 TT) is to install cutting edge 3nm chip tools in Arizona plant next summer, according to Nikkei.

- Qube (QUB AT) announced sale of interest in Beveridge property and receives AUD 111mln from the sale.

- Austal (ASB AT) secured a AUD 1.03bln design-and-build contract for landing craft.

- ValueAct raises stake in Takara Holdings (2531 JT) to 12.44% from 9.84%.

NOTABLE GLOBAL EQUITY HEADLINES

- Yann LeCun is in early talks to raise EUR 500mln for his AI start-up Nabla, via FT citing sources; valuing it at c. EUR 3bln.

- UK is to water down rules for financial benchmarks with most index providers to be exempt from UK regulations under a scaled-back regime, according to FT.

- SK Hynix (000660 KS) becomes first to complete Intel (INTC) data centre certification for 32GB die-based 256GB server DDR5 RDIMM.

- Woodside Energy (WDS AT) CEO Meg O'Neill resigns to join BP (BP/ LN) as CEO effective 1st April 2026, and Liz Westcott was appointed as acting CEO of Woodside Energy, while BP CEO Auchincloss steps down.