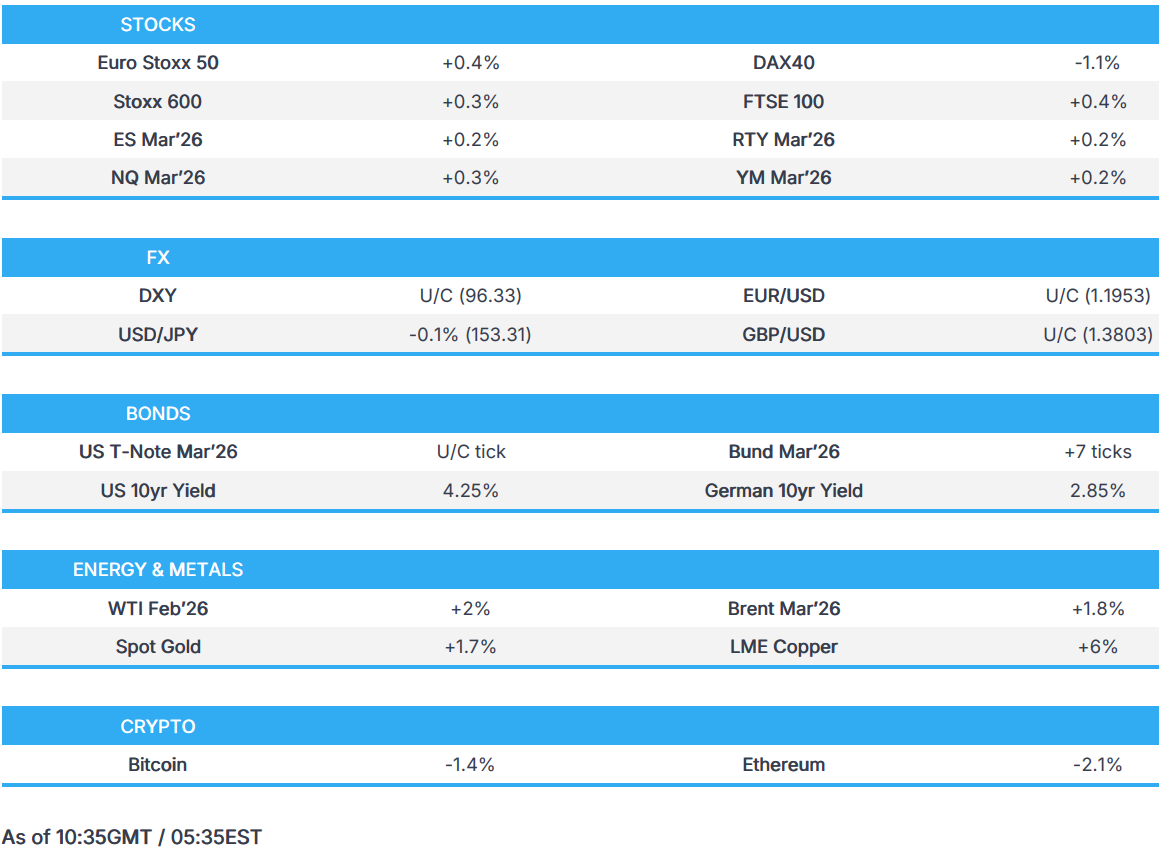

US equity futures are entirely in the green, helped by META and TSLA earnings; Brent topped at USD 69/bbl on possible US strikes on Iran - Newsquawk US Market Open

- US Senate Majority Leader Thune sees a possibility to avoid a shutdown by week’s end after Senate Minority Leader Schumer laid out Democrats' demands on ICE, CNN reported.

- European bourses are broadly firmer though DAX 40 has been pressured by losses in SAP, after disappointing cloud backlogs.

- In the pre-market: Microsoft (-6.4%, strong results, though AI spending and disappointing cloud growth weigh), Meta (+7.5%, posts record sales), and Tesla (+2%, annual revenue falls for the first time, but aims to pivot further to AI).

- AUD outpaces on gold and copper; G10s flat/firmer vs USD.

- US yields remain bid post-FOMC, supply in focus for the near-term

- Spot XAU nears USD 5600/oz while copper prices surge beyond USD 14k/t on greater AI demand; Crude climbs to new four-month highs as Trump reportedly considers a new strike on Iran.

- Looking ahead, US Jobless Claims, Chicago Fed Labour Market Indicators (Jan), Japanese Industrial Production (Dec), Retail Sales (Dec) & Tokyo Core CPI (Jan), SARB Policy Announcement. Speakers include ECB's Cipollone. Supply from the US.

- Earnings from Apple, SanDisk, Visa, Western Digital, Mastercard, Caterpillar, Nasdaq, Blackstone, Lockheed Martin.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.4%) are broadly firmer, but with clear underperformance in the DAX 40 (-1.2%), which has been dragged down by post-earnings losses in SAP (-14%). The software giant disappointed on cloud revenue and poor cloud backlog metrics.

- European sectors are mixed; Basic Resources is the clear outperformer, boosted by continued strength in underlying metals prices and following Glencore (+3%) and Antofagasta (+6%) releasing their FY26 copper production guidance, with both companies indicating strong production throughout the year. Among underperformers, Chemicals has been pressured by Givaudan (-6%) post-earnings, followed closely by Tech, dragged lower by losses in SAP.

- US equity futures (ES +0.2%, NQ +0.2%, RTY +0.1%) are modestly firmer across the board in the aftermath of three US mega-cap earnings releases on Wednesday. In the pre-market: Microsoft (-6.4%, strong results, though AI spending and disappointing cloud growth weigh), Meta (+7.5%, posts record sales), and Tesla (+2%, annual revenue falls for the first time, but aims to pivot further to AI).

- Tesla Inc. (TSLA) Q4 2025 (USD): Adj. EPS 0.50 (exp. 0.45), Revenue 24.9bln (exp. 24.77bln). Gross margin 20.1% (exp. 17.1%). Operating income 1.41bln (exp. 1.32bln). Free cash flow 1.42bln (exp. 1.59bln). In Q1 of this year, we plan to unveil the Gen 3 version of Optimus. Plan to begin megapack 3 and megablock production at megafactory Houston in 2026. On Jan 16, agreed to invest ~2B to acquire shares of Series E Preferred stock of xAI. Shares +3% pre-market

- Microsoft Corporation (MSFT) Q2 2025 (USD): EPS 5.16 (exp. 3.92), Revenue 81.3bln (exp. 80.28bln). said net gains from OpenAI investments totaled USD 7.6bln, which resulted in an increase in diluted earnings per share of USD 1.02/shr. Operating income 38.3bln (exp. 32.9bln). SEGMENTS:. Q2 Azure and other Cloud services revenue increased 39% (exp. 38.8%). Productivity and Business +16% at USD 34.1bln (exp. 33.5bln). More Personal Computing: USD 14.3bln (exp. 14.33bln). Cloud revenue +26% to USD 51.5bln. Intelligent cloud revenue USD 32.9bln. Commercial RPO +110% to USD 625bln. Shares -6.4% pre-market

- Meta Platforms Inc (META) Q4 2025 (USD) EPS 8.88 (exp. 8.19), Revenue 59.9bln (exp. 58.38bln). Sees Q1 rev. USD 53.5bln-56.5bln (exp. 51.3bln). Sees 2026 capex USD 115bln-135bln (exp. 110.6bln). Shares +7.9% pre-market

- International Business Machines Corporation (IBM) Q4 (USD) Adj. EPS 4.52 (exp. 4.33), Revenue 19.7bln (exp. 19.21bln). Sees FY constant currency rev. growth of over 5%. Sees FY2026 revenue USD 70.14bln (exp. 70.16bln). Sees FY free cash flow to increase by about USD 1bln. Shares +8.2% pre-market

- SAP (SAP GY) Q4 2025 (EUR): Adj. oper. profit 2.83bln (exp. 2.75bln), Revenue 9.68bln (exp. 9.74bln), Cloud Revenue 5.61bln (exp. 5.64bln), Cloud/Software Revenue 8.62bln (exp. 8.68bln); announced up to EUR 10bln buyback, to start Feb 2026. Shares -14%

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY resides in a current 96.01–96.35 range, well within yesterday’s 95.859–96.787 parameter, with little movement seen following the FOMC decision and press conference yesterday. There was a lack of major surprises or fireworks from the meeting and presser, although Powell noted that rates are at the higher end of the neutral range, and that if the tariff effect on goods pricing is seen to peak this year, it would signal to the Fed that it can loosen policy. Looking ahead stateside, US initial jobless claims for the week of 24 January are expected at 205k (prev. 200k), while continuing claims (week of 17 January, coinciding with the BLS’ traditional survey window for the January jobs report) are seen at 1.86mln (prev. 1.849mln). The Chicago Fed’s Labour Market Indicators are also due today. Final Q3 unit labour costs data are also scheduled, alongside US trade data for November and factory orders for November.

- EUR/USD remains sub-1.2000 after finding some resistance at 1.1996 overnight, while still remaining within yesterday’s 1.1896–1.2045 range. There has been little of note for the EUR as participants gear up for next week’s ECB meeting, with some focus on Governing Council commentary. Aside from that, price action this morning has been largely USD-driven. GBP/USD found resistance near yesterday’s high (1.3846) before waning, with the pair remaining within yesterday’s parameter.

- USD/JPY is softer and back below its 100-DMA (153.71), trading within a 152.76–153.46 band, with price action largely in tandem with the USD in the absence of fresh macro drivers. Traders will be keeping an eye on the geopolitical landscape amid further punchy rhetoric from both Iran and the US. Domestically, a Nikkei poll showed that Japanese PM Takaichi’s party is expected to gain a Lower House majority.

- Antipodeans outperform, with AUD outpacing peers as the commodity-linked currency benefits from the surge in spot gold and copper prices, despite a lack of obvious drivers for the magnitude of gains seen. Data from Australia also showed firmer export and import prices.

- Click for NY OpEx Details

FIXED INCOME

- USTs are, once again, near enough flat, holding off lows in the 111-16+ to 111-26 range. Post-FOMC updates have been light. In brief, the Fed held policy in a decision that saw two dovish dissenters (Miran and Waller), while the statement outlined a more optimistic outlook on the economy and labour market. Overall, the statement and presser left the Fed narrative largely unchanged, although the omission of the line referring to “downside risks to employment” lent a slight hawkish tint to the statement—a point reflected at the time in upside pressure at the short end of the yield curve. This morning, yields are bid across the curve, which is marginally steeper, with the 10yr back above 4.25%, though still shy of last week’s JGB-induced 4.31% YTD peak.

- EGBs were flat this morning, but have gradually edged higher to a peak around the 128.13 area, with gains of up to 10 ticks. Earnings are once again dominating the European newsflow, with the DAX 40 underperforming on account of SAP, though Bunds themselves do not appear to be reacting.

- Gilts gapped lower by just over 10 ticks before slipping to a 90.48 trough, catching up with the modest pressure seen in peers overnight. In the UK, the PM’s meeting with Chinese President Xi generated mixed commentary. A 2028 tender auction attracted strong demand, but had little impact on UK paper.

- Italy sold EUR 6.5bln vs exp. EUR 6-6.5bln 2.85% 2031, 3.45% 2036 BTP & EUR 2.0bln vs exp. EUR 1.5-2.0bln 1.468% 2035 CCTeu.

- UK sold GBP 1.25bln 0.125% 2028 Gilt auction via Tender: b/c 3.77x (prev. 3.84x), average yield 3.443% (prev. 3.783%).

- South Korea to issue KRW 18.0tln in government bonds in February.

COMMODITIES

- Crude benchmarks have steadily moved higher and reached new four-month highs, with Brent Apr’26 climbing above USD 69/bbl as the probability of a US strike on Iran rises. CNN reported late on Wednesday, citing sources, that US President Trump is considering a new large-scale attack on Iran due to a lack of progress on a nuclear deal. More recently, Kpler’s Bakr reported that Trump is not looking for a war, but instead wants a diplomatic win or an “organic” internal uprising.

- Worries over oil and gas production due to the Arctic storm have subsided for now, with Henry Hub futures consolidating below USD 4/MMBtu after peaking at USD 7.43/MMBtu earlier in the week.

- Precious metals continue their surge higher, with spot XAU topping out just shy of USD 5,600/oz, aided by a weaker dollar following the FOMC policy announcement. Alongside gold, spot silver also peaked at a new ATH of USD 120.43/oz but is currently underperforming the yellow metal. This runs contrary to recent trends, where spot silver has typically led gains. UBS notes that reduced inflows into ETFs and net speculative futures positioning on the US COMEX exchange hint at a possible end to the rally in XAG.

- Copper prices surged at the start of Asia-Pac trade, with 3M LME copper breaking its prior ATH of USD 13.41k/t to reach a new peak of USD 14.12k/t. Despite the lack of a clear near-term driver, expectations for stronger US growth and increased build-out of AI infrastructure remain key supports for the red metal. This move also comes ahead of China’s Lunar New Year holiday, prompting the usual front-loading of copper and other metals ahead of the festive period.

- US Treasury Secretary Bessent said increased Venezuelan crude oil supply means lower fuel prices and proceeds from the sale of Venezuelan oil will return to Venezuelans.

- US is handing over a seized oil tanker to Venezuela, according to US officials.

TRADE/TARIFFS

- China's MOFCOM spokesperson, when asked about a potential round of US-China trade talks, said China is willing to work with the US side to jointly uphold and implement the important consensus of the two heads of state, Global Times reported.

- Chinese President Xi said they are willing to consider implementing a unilateral visa-free system for British nationals.

NOTABLE EUROPEAN HEADLINES

- Germany's Chancellor Merz said they are now seeing the first signs of recovery in the German economy.

- French Finance Minister Lescure said recent FX moves reflect fundamentals.

- Chinese President Xi said to UK PM Starmer that the UK-China relationship in recent years had seen “twists and turns that did not serve the interests of our countries”. said:. China stands ready to develop with the UK a long-term and consistent strategic partnership . More dialogue between the UK and China was “imperative”.

NOTABLE EUROPEAN DATA RECAP

- EU Consumer Confidence Final (Jan) -12.4 vs. Exp. -12.4 (Prev. -13.1).

- EU Consumer Inflation Expectations (Jan) 24.1 (Prev. 26.7).

- EU Selling Price Expectations (Jan) 10.0 (Prev. 10.8, Rev. From 10.9).

- EU Economic Sentiment (Jan) 99.4 vs. Exp. 97 (Prev. 97.2, Rev. From 96.7).

- EU Industrial Sentiment (Jan) -6.8 vs. Exp. -8.1 (Prev. -8.5, Rev. From -9.0, Low. -9, High. -7).

- EU Services Sentiment (Jan) 7.2 vs. Exp. 6 (Prev. 5.8, Rev. From 5.6, Low. 5.0, High. 9.8).

- EU M3 Money Supply YoY (Dec) Y/Y 2.8% vs. Exp. 3% (Prev. 3.0%, Rev. From 3%).

- EU Loans to Households YoY (Dec) Y/Y 3% vs. Exp. 2.9% (Prev. 2.9%).

- EU Loans to Companies YoY (Dec) Y/Y 3.0% (Prev. 3.1%).

- Italian Industrial Sales MoM (Nov) M/M -0.10% (Prev. -0.50%, Rev. From -0.5%).

- Italian Industrial Sales YoY (Nov) Y/Y 0% (Prev. 1.7%).

- Swedish GDP MoM (Dec) M/M -0.6% (Prev. 0.5%, Rev. From 0.9%).

- Swedish GDP Growth Rate QoQ Flash (Q4) Q/Q 0.2% vs. Exp. 0.6% (Prev. 1.1%).

- Swedish GDP Growth Rate YoY Flash (Q4) Y/Y 1.8% vs. Exp. 2.2% (Prev. 2.6%).

- Swedish Household Lending Growth YoY (Dec) Y/Y 2.9% (Prev. 2.8%).

- Spanish Retail Sales YoY (Dec) Y/Y 2.9% (Prev. 6.0%, Rev. From 6%).

- Spanish Retail Sales MoM (Dec) M/M -0.8% (Prev. 1%).

CENTRAL BANKS

- Riksbank leaves its policy rate unchanged at 1.75% as expected; reiterates that the policy rate is expected to remain at this level for some time to come, in line with the forecast in December.

- BoK said uncertainty surrounding US monetary policy is likely to persist and it reiterated it will closely monitor financial markets.

- HKMA maintains its base rate at 4.00%, as expected.

- Monetary Authority of Singapore kept the prevailing rate of appreciation of the SGD NEER policy band, as well as made no change to the width and level the band is centred, as expected. said:. Output gap will be positive for the year as a whole. Growth this year is expected to remain resilient. Expects 2026 GDP growth to ease Y/Y.

- Brazilian BCB Policy Announcement 15% vs. Exp. 15.00% (Prev. 15.00%); said it will start cutting rates next meeting.

NOTABLE US HEADLINES

- US President Trump and Senate Minority Leader Schumer move towards a possible deal to avert a shutdown, according to New York Times. - Trump and Schumer were discussing an agreement to split off homeland security funding from a broader spending package and negotiate new limits on immigration agents.

- Chairman of a US House of Representatives committee said in a letter that NVIDIA (NVDA) helped DeepSeek hone AI models later used in China's military, according to Reuters.

- US Senate Majority Leader Thune sees a possibility to avoid a shutdown by week’s end after Senate Minority Leader Schumer lays out Democrats' demands on ICE, according to CNN's Manu Raju.

GEOPOLITICS

RUSSIA-UKRAINE

- Russian Kremlin spokesperson Peskov does not comment on reported of a energy infrastructure ceasefire between Russia and Ukraine.

- Russia's Kremlin said they're still waiting for the US response on Putin's offer to extend limits in expiring nuclear treaty.

MIDDLE EAST

- Kpler's Bakr, on Iran, writes "What I’m hearing: Trump isn’t looking for war. He wants a diplomatic win, or an “organic” internal uprising that forces change from within.".

- Sources from Arab TV report that disputes are still ongoing between Egypt and Israel regarding the number of people crossing through the Rafah in both direction on a daily basis.

- EU's top diplomat said the EU will likely agree on placing sanctions on Iran's IRGC, AP's Gambrell reported.

- Iran's representative to the UN said Iran informs the Council it faces a clear US threat to use force against it, while the Iranian envoy said Washington will bear responsibility for any uncontrolled consequences resulting from any acts of aggression.

- CNN sources say US President Trump is considering a new large-scale strike on Iran as no progress has been made in nuclear talks, although he has not yet made a final decision on a new major military strike against Iran. Trump's military options include airstrikes and targeting of Iranian leaders and security officials.

- BofA card spending, week to January 24th: +6.6% Y/Y (prev. 4.6% Y/Y). Spending growth grew in groceries and general merchandise, indicative of stockpiling before the Winter storm.

- Turkey said it has foiled an Iranian intelligence plot at US' Incirlik base.

OTHERS

- Sources from Arab TV report that disputes are still ongoing between Egypt and Israel regarding the number of people crossing through the Rafah in both direction on a daily basis.

- Denmark's Foreign Minister after his meeting in Washington said he's more optimistic on Greenland compared to a week ago. Plan to hold further meetings. Back on track with the US on Greenland.

CRYPTO

- Bitcoin is a little lower and trades around USD 88k; Ethereum underperforms a touch.

APAC TRADE

- APAC stocks were mostly subdued with sentiment in the region clouded following a lack of fireworks at the FOMC, where the Fed kept rates unchanged at 3.50%-3.75%, as expected, while top- and bottom-line earnings beats from the likes of Meta, Microsoft and Tesla also failed to spur the broader risk appetite.

- ASX 200 marginally declined amid underperformance in telecoms and miners, while a surge in exports and import prices added to the inflationary risks and the case for an RBA rate hike next week.

- Nikkei 225 swung between gains and losses amid currency-related headwinds and earnings results.

- KOSPI saw two-way price action amid fluctuations in tech heavyweights Samsung Electronics and SK Hynix despite both companies posting stellar earnings results.

- Hang Seng and Shanghai Comp were mixed with price action relatively flat amid a lack of fresh pertinent macro catalysts for China, although property names were supported after reports that several developers are no longer required to submit the monthly “three red lines” indicators, which are debt metrics introduced in 2021 to curb builders' financial leverage.

NOTABLE ASIA-PAC HEADLINES

- India's Economic Survey has FY27 growth in a 6.8-7.2% range. Weaker INR causes investors to pause.

- China market liquidity will remain ample in February, according to analysts cited by China Securities Times.

- Google (GOOG) took action against a Chinese company linked to a massive cyber weapon.

NOTABLE APAC DATA RECAP

- Japanese Consumer Confidence (Jan) 37.9 vs. Exp. 38 (Prev. 37.2).

- Japanese Stock Investment by Foreigners (Jan/24) 328.1 (Prev. 878.9, Rev. From 874).

- Japanese Foreign Bond Investment (Jan/24) 177.6 (Prev. -361.1, Rev. From -361.4).

- Australian Import Prices QoQ (Q4) Q/Q 0.9% vs. Exp. -0.2% (Prev. -0.4%).

- Australian Export Prices QoQ (Q4) Q/Q 3.2% (Prev. -0.9%).

- New Zealand ANZ Activity Outlook (Jan) 51.6 (Prev. 60.9).

- New Zealand ANZ Business Confidence (Jan) 64.1 (Prev. 73.6).

- New Zealand Imports (Dec) 7.60 (Prev. 7.15, Rev. From 7.15).

- New Zealand Balance of Trade (Dec) 52B vs. Exp. 0.03B (Prev. -335B, Rev. From -0.163B).

- New Zealand Exports (Dec) 7.65 (Prev. 6.81, Rev. From 6.99).