US equity futures are flat heading into US data; DXY weighed on by strength in the Yen and Antipodeans - Newsquawk US Market Open

- US President Trump said US will keep ships and oil seized near Venezuela.

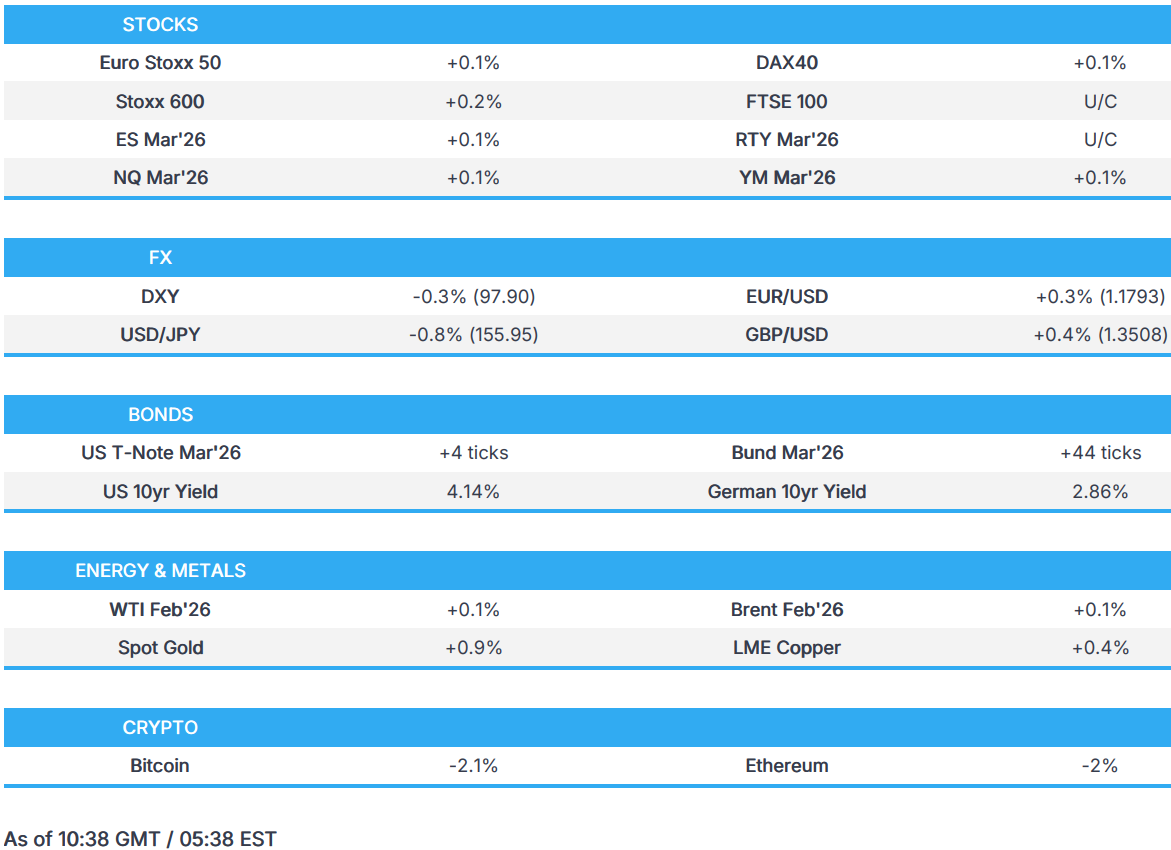

- European bourses are mixed on either side of the unchanged mark, US equity futures are mostly incrementally firmer ahead of US data.

- DXY is under pressure whilst the JPY continues to strengthen; Antipodeans benefit from strength in metals prices.

- JGBs lead global fixed income higher after PM Takaichi rejected any "irresponsible bond issuance or tax cuts", via a Nikkei interview.

- Crude benchmarks trade rangebound, whilst spot gold eyes USD 4.5k/oz to the upside.

- Looking ahead, highlights include US Richmond Fed (Dec), Durable Goods (Oct), GDP Advance (Oct), PCE Prices (Q3), Industrial Production, Consumer Confidence, Canadian GDP, BoC Minutes (Dec Meeting), Supply from US.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses are mixed, with macro newsflow light. On the micro side, Novo Nordisk (+6.7%) said its oral Wegovy pill has been approved in the US for weight management after showing 16.6% weight loss in the OASIS 4 trial, and it plans a US launch in January 2026.

- European sectors have opened mixed with a slight positive bias. Health Care (+1.1%), to no surprise, leads due to gains in Novo Nordisk (+6.7%) after US approval of its weight-management drug. Utilities (+0.4%) and Food, Beverage and Tobacco (+0.4%) are also near the top, however, this is likely a rebound from yesterday’s underperformance. Banks (-0.3%), Consumer Products & Services (-0.3%) and Construction (-0.2%) lag, with little fresh newsflow driving moves.

- US equity futures are incrementally firmer to flat, in a quiet session - but the session may pick-up surrounding the US GDP Advance/PCE (Q3) metrics.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is lower and trades at the bottom end of a 97.88 to 98.23 range; really not much driving things for the USD recently, with newsflow exceptionally light, but perhaps facilitated by a strong JPY (see below). Nonetheless, traders will keep a keen eye out for Q3 GDP Advance/PCE, as well as Durable Goods (Oct), due at the same time.

- JPY is amongst the outperformers, with the strength seemingly a continuation of the price action seen following fresh jawboning from Finance Minister Katayama; as a reminder, she said that they have a “free hand” to take bold action in the FX market if needed. USD/JPY drifted lower from an overnight high of 157.07, down below the 156.00 mark, where the pair currently resides.

- Antipodeans also gained throughout overnight trade and into the European session, boosted by ongoing strength in metals prices (XAU now eyeing USD 4.5k/oz to the upside). Earlier, the Aussie showed little reaction to the RBA minutes, which indicated the Board debated whether a rate increase might be required at some point in 2026. Elsewhere, for the Kiwi specifically, NZD/USD breached 0.58 to the upside, which allowed the pair extend beyond the level, which can explain some of the outperformance this morning.

- The GBP and EUR are steady vs the broadly weaker USD. Really not much driving things for either at the moment; the single currency really only has geopolitical updates to digest heading into the Christmas holidays. For Cable, the pair extended beyond the 1.3500 mark to make a peak of 1.3518; the next level to the upside includes the October 1 high at 1.3527.

- PBoC set USD/CNY mid-point at 7.0523 vs exp. 7.0267 (Prev. 7.0572); strongest fix since Sept 30 2024.

FIXED INCOME

- 10yr JGB futures outperformed, firmer by over 40 ticks at best, while the yen simultaneously reversed its early-week weakness following verbal jawboning from Japanese Finance Minister Katayama. JGB futures then rose further after Japanese PM Takaichi said Japan's national debt is still high, and rejected any "irresponsible bond issuance or tax cuts", via a Nikkei interview.

- USTs follow JGBs higher, with a lack of domestic newsflow helping things for the benchmark. Currently trading higher by a handful of ticks, and towards the upper end of a 112-11+ to 112-15+ range. Ahead, focus turns to some key US data points, which include US GDP Advance/PCE (Q3) and Durable Goods.

- Bunds, Gilts and OATs also follow suit. For the latter, OATs remain in focus after yesterday's cabinet meeting made the use of Article 49.3 more likely. For the near-term fiscal needs, the Assembly and Senate are set to finish debating and then adopt text to allow the government to continue financing basic public services into early-2026, despite the absence of a 2026 budget deal. A point that has contributed to OAT strength, as the benchmark marginally outmuscles Bunds, causing the OAT-Bund 10yr yield spread to probe 70bps to the downside.

- China's Finance Ministry expects aggregate government bond issuance to remain "elevated" in 2026, according to Reuters citing sources.

COMMODITIES

- WTI and Brent chop around USD 58/bbl and USD 62/bbl, respectively, in tight ranges as crude benchmarks consolidate following Monday’s bid higher. Geopolitics has resurfaced in recent sessions as the near-term driver for crude prices, with tensions between the US and Venezuela rising and a potential escalation between Israel and Iran. However, a lack of updates throughout the APAC session has led to a muted start to Tuesday’s session.

- Spot XAU has followed on from Monday's trend, peaking just shy of USD 4500/oz as the European morning gets underway, with rising geopolitical tensions acting as a new driver for the yellow metal. The recent US-Venezuela developments, specifically the blockaded oil tankers, have urged investors to look for safer places to place their investments.

- 3M LME Copper traded muted in a tight c. USD 60/t band throughout APAC trade, seemingly not benefiting from the further extension in gold and silver prices. As the European session gets underway, the red metal lifted as the positive risk tone in equities fed through into copper. Thus far, 3M LME Copper trades just shy of the ATH formed in Monday’s session, currently at USD 11.98k/t.

- China crude steel output in November 69.6mln tonnes, -10.9% Y/Y; global crude steel output in November 140.1mln tonnes, -4.6% Y/Y, via WorldSteel.

- Thai Central Bank Chief said there will be a set maximum trading volumes per major gold trader.

- Thailand's Finance Minister is looking to implement a tax on gold trading online.

TRADE/TARIFFS

- Japan's Chief Trade Negotiator Akazawa said JPY 1.8tln has been requested to support Nippon Export and Investment Insurance for US investments.

NOTABLE EUROPEAN HEADLINES

- EU is preparing checks on imported plastics and other measures to shore up its recycling industry, according to FT.

NOTABLE EUROPEAN DATA RECAP

- Italian Flash Trd Bal Non-EU (Nov) 6.92B (Prev. 5.32B).

- Spanish GDP YY (Q3) 2.8% vs. Exp. 2.8% (Prev. 2.8%).

- Spanish GDP Final QQ (Q3) 0.6% vs. Exp. 0.6% (Prev. 0.6%).

- Swedish PPI MM (Nov) 1.2% (Prev. 0.4%).

- Swedish PPI YY (Nov) -1.4% (Prev. 0.4%).

- German Import Prices MM (Nov) 0.5% vs. Exp. 0.1% (Prev. 0.2%).

- German Import Prices YY (Nov) -1.9% vs. Exp. -2.2% (Prev. -1.4%).

NOTABLE EUROPEAN EQUITY HEADLINES

- European Car Sales +2.4% to 1.08mln vehicles in November, according to Bloomberg citing ACEA.

- Novo Nordisk (NOVOB DC) said Wegovy pill is approved in the US as the first oral GLP-1 treatment for weight management after showing 16.6% weight loss in the Oasis 4 trial, and said it plans to launch the drug in the US in January 2026. US-listed NOVO shares +5% after market. Eli Lilly -1.2% after market.

- US President Trump said he told French President Macron that France has to raise its drug prices.

CENTRAL BANKS

- RBA Minutes: Board discussed whether a rate increase might be needed at some point in 2026; holding the cash rate steady for some time could be sufficient to keep the economy in balance. October CPI suggested a risk that Q4 inflation could also be higher than forecast. The board discussed whether a rate increase might be needed at some point in 2026. Recent data suggested risks to inflation had lifted to the upside. The board judged it was too early to know whether the rise in inflation would prove persistent. The board said it would take a little longer to assess the persistence of inflation. Holding the cash rate steady for some time could be sufficient to keep the economy in balance. Policy would be assessed at future meetings, with Q4 inflation data available before the February meeting. Some board members felt conditions were no longer restrictive, while others felt they were a little restrictive. The impact of the recent rise in bond yields on financial conditions needed to be assessed. The economy was operating with excess demand and it was not clear if financial conditions were tight enough. The labour market was judged to still be a little tight, with the output gap positive. The full impact of policy easing earlier in the year was yet to be felt. Measures of capacity utilisation pointed to supply constraints. Little immediate action in AUD or ASX 200.

NOTABLE US HEADLINES

- US President Trump is reportedly mulling giving 775 acres of federal wildlife refuge to SpaceX, via NYT.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Ryabkov said Russia and US held new round of talks on 'Irritants'; main issues remain unresolved, via IFX. New round of contacts may take place in early spring.

- Polish Armed Forces said they have scrambled jets following Russian strikes on Ukraine.

- Russia is again attacking Ukraine’s energy infrastructure, according to Ukraine’s energy ministry.

- Russia conducts airstrikes on Ukrainian capital Kyiv, according to Ukraine's military.

- Ukrainian President Zelensky said "Negotiations to end the war are "close to achieving a result", according to Sky News Arabia.

- Russia's Kremlin states Ukraine peace talks over the weekend did not achieve breakthrough.

- Russia needs to understand to what extent the US work with Ukraine and Europe on peace plan corresponds to spirit of earlier Putin-Trump Alaska summit, via TASS.

- Odesa regional governor said Russian forces launch new evening drone attack on Ukraine's Odesa, damaging port facilities and civilian ship.

MIDDLE EAST

- "Israel's Channel 12: Israel fears miscalculation with Iran, assures Washington that it will not take risks", via Sky News Arabia.

CRYPTO

- Bitcoin is a little lower and trades around USD 87k with Ethereum once again dipping below USD 3k.

APAC TRADE

- APAC stocks eventually traded mixed after initially taking their cue from Wall Street, although volumes and news flow remained subdued as markets wound down for the holiday period.

- ASX 200 was underpinned by strength in gold miners after the yellow metal printed a fresh all-time high near USD 4,500/oz, supported by a softer USD and ongoing geopolitical tensions.

- Nikkei 225 initially saw shallower gains than peers as a firmer yen, following official jawboning, capped upside for the index, whilst further gains in the JPY later took the index into the red.

- KOSPI extended its tech-led rally, with Samsung Electronics shares pushing toward near all-time highs.

- Hang Seng and Shanghai Comp initially tracked the broader risk tone, while fresh region-specific catalysts remained scarce. Hang Seng later gave up earlier gains.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Katayama declines to comment on forex levels or interest rates, and said Japan will take appropriate action and reiterates they have a "free hand" to respond to excessive moves in the JPY. FX moves after the BoJ press conference are speculative and not reflecting fundamentals. The market has stabilised somewhat since yesterday.