US equity futures are weaker across the board in pre-market trade as Tech continues to lag on valuation concerns - Newsquawk US Market Open

- European equities opened broadly lower, with all major indices in the red as sentiment soured following weakness in APAC trade; FTSE 100 lags.

- US equity futures are weaker across the board in pre-market trade as Tech continues to lag on valuation concerns.

- GBP/USD is in focus this session following reports that Chancellor Reeves has scrapped plans for an income tax rate hike, a move seen as increasing fiscal risks ahead of the November 26th budget.

- Gilts experienced a volatile session, with the benchmark plunging from 93.37 to 92.07, but has since rebounded modestly on reports around UK forecasts.

- UKMTO notes of incident off the coast of UAE's Khor Fakkan [near the Strait of Hormuz], believed to be state activity; Vessel is transiting towards Iranian territorial waters.

- Looking ahead, speakers include ECBʼs Cipollone & Lane, Fedʼs Bostic, Schmid & Logan.

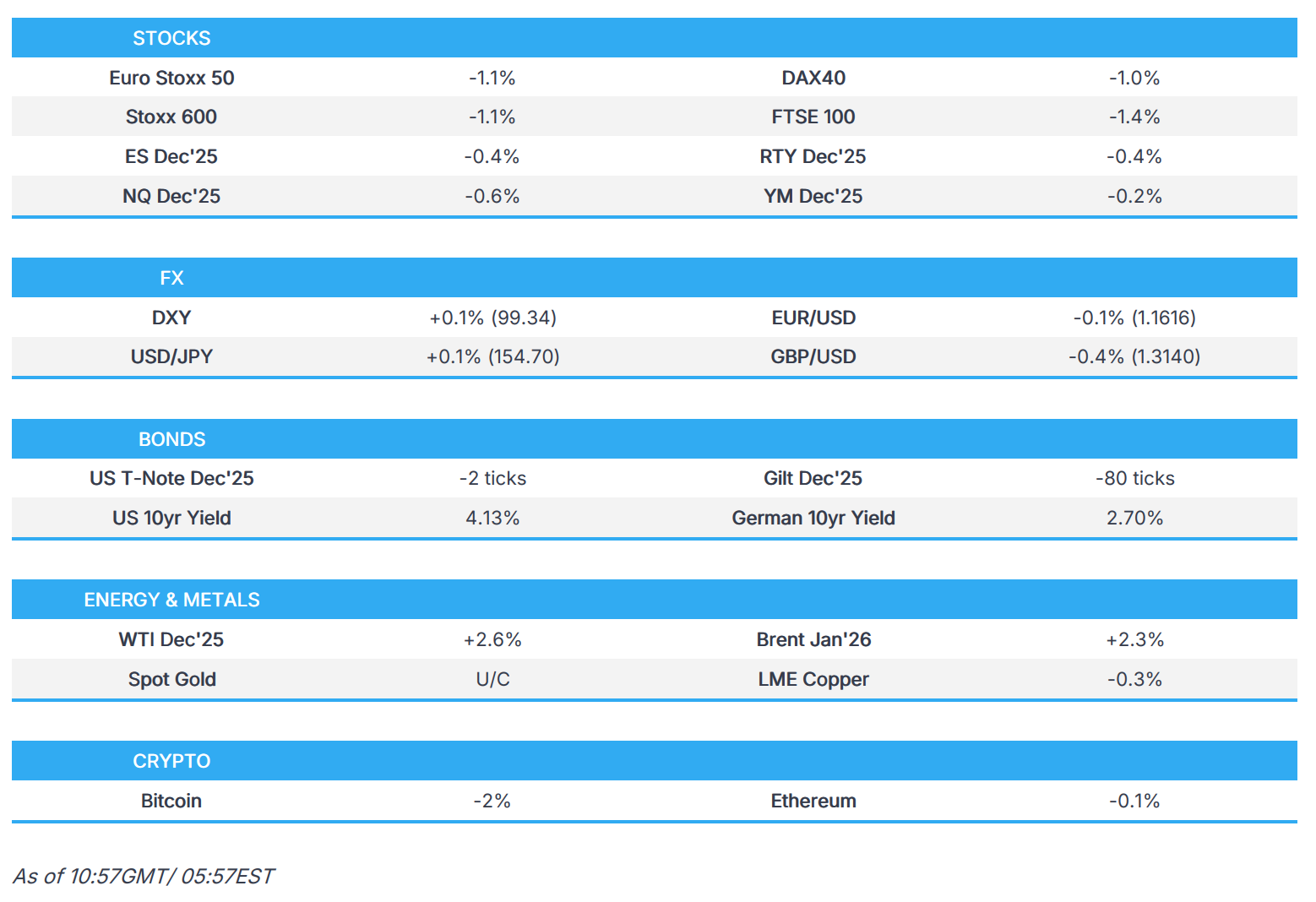

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump's administration is preparing tariff exemptions in a bid to lower food prices, according to NYT

- US Secretary of State Rubio met with Brazil's Foreign Minister and discussed a reciprocal framework for the US-Brazil trade relationship, according to the State Department

- US senior official said agreements with Argentina, Ecuador, El Salvador and Guatemala open markets to US agricultural and industrial products, expects full agreements with most of these countries to be finalised within the next two weeks, in which the four countries agreed not to impose digital service taxes. Furthermore, the tariff rates will remain for these countries, but framework agreements will provide relief in certain areas, including bananas.

- US senior official said talks with Switzerland on Thursday were very positive, and if the deal is accepted by US President Trump, we would see a reduction of tariffs on Swiss imports. The official also commented that they have made a lot of advances with Taiwan.

- South Korea announced the factsheet with the US was finalised and President Lee said that US President Trump made a rational decision for the factsheet, while Lee added they agreed that investment in the US will be limited to commercially viable projects and that South Korea and the US will build a new partnership for shipbuilding, AI and the nuclear industry. Lee stated that the sides agreed on South Korea building a nuclear-powered submarine, and South Korea will strengthen ties with companies like NVIDIA.

- South Korean Presidential Adviser said the US will give South Korea chip tariff terms that are no less favourable than Taiwan’s, while it was agreed with the US that forex market stability needs to be ensured and that the amount and timing of fund supply to the US can be adjusted if needed for forex stability.

- White House said the US and South Korea deal includes USD 150bln of Korean investment in the shipbuilding sector approved by the US and USD 200bln of additional Korean investment committed pursuant to an MOU on strategic investments, while the US has given approval for South Korea to build nuclear-powered attack submarines. US said it will reduce its Section 232 sectoral tariffs on automobiles, auto parts, timber, lumber and wood derivatives of South Korea to 15%, and for any Section 232 tariffs imposed on pharmaceuticals, the US intends to apply a tariff rate no greater than 15% to originating goods of South Korea. Furthermore, South Korea is committed to spending USD 25bln on US military equipment purchases by 2030 and shared its plan to provide comprehensive support for US Forces Korea amounting to USD 33bln in accordance with South Korean legal requirements, while the US agreed that South Korea will pay USD 20bln annual phased instalments as part of the trade deal.

EUROPEAN TRADE

EQUITIES

- European Equities – Opened broadly lower, with all major indices in the red as sentiment soured following weakness in APAC trade, where tech underperformed on valuation and China AI concerns. Recent hawkish Fed rhetoric and mixed Chinese data also weighed. UK headlines dominated the morning, with reports that PM Starmer and Chancellor Reeves will scrap plans to raise income tax, further pressuring the FTSE 100 (-1.2%). EZ GDP and employment data were largely shrugged off, while attention now turns to ECB’s Buch, Elderson, and Lane.

- European sectors - Opened mostly lower, with only Energy (+1.0%) and Consumer Products & Services (+0.7%) in positive territory. The latter was lifted by Richemont (+8.0%) after stronger-than-expected H1 revenue and profit, while Energy gained on elevated crude prices following a Ukrainian drone strike on Russia’s Novorossiysk oil depot and upbeat results from Siemens Energy (+9.9%), which raised 2026 guidance. Laggards include Technology (-2.7%), Banks (-2.0%), and Basic Resources (-2.0%). Tech mirrored US weakness amid renewed US–China AI race concerns, while softer Chinese industrial output weighed on resources. Banks underperformed on UK political turbulence, with HSBC (-2.8%), Lloyds (-3.4%), and Barclays (-2.8%) all lower.

- US Equity Futures - Weaker across the board in pre-market trade as Tech continues to lag on valuation concerns. Overnight, US officials described talks with Switzerland as “very positive,” noting that if approved by President Trump, the deal would see reduced tariffs on Swiss imports. The White House also announced a South Korea investment deal, including USD 150bln in approved shipbuilding investment and USD 200bln in additional strategic commitments under an MOU. Today’s US calendar is light, with Fed speakers Schmid (’25, hawkish), Logan (’26), and Bostic (’27) on deck.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD - DXY is little changed after a subdued overnight session, following yesterday’s weakness when USD-denominated assets came under pressure amid a broader risk-off tone. With the government now reopened, focus shifts to the release of delayed economic data, though no official schedule has been confirmed — one could, however, be announced as early as today. In early European trade, DXY continues to hold within a narrow 99.109–99.336 range, well within Thursday's 98.991-99.591 range.

- EUR - EUR/USD is trading slightly softer in early European hours after holding onto the prior day’s gains during APAC trade, remaining above the 1.1600 handle amid ongoing dollar pressure. Newsflow for the Eurozone is light, with the pair contained within a 1.1618–1.1648 intraday range and well within yesterday’s 1.1579–1.1656 parameters. The 50DMA and 100DMA sit just above at 1.1660 and 1.1662, respectively.

- GBP - GBP/USD is in focus this session following reports that Chancellor Reeves has scrapped plans for an income tax rate hike, a move seen as increasing fiscal risks ahead of the November 26th budget. Gilts slipped at the open, with the pound underperforming into European trade. Price action later reversed modestly after Bloomberg sources suggested that improved UK forecasts had prompted Reeves to drop the planned tax rise (see Fixed Income section for details). GBP/USD spiked from 1.3121 to 1.3200 on the Bloomberg headlines before easing back toward 1.3150, with trade contained within a 1.3109–1.3200 intraday range and inside yesterday’s broader 1.3100–1.3215 parameters.

- JPY - USD/JPY is struggling for clear direction after recent choppy trade and amid a lack of fresh domestic catalysts, while Japanese press highlights growing scepticism among market participants over the government’s ability to support the yen through direct intervention. The JPY is showing limited reaction to the broader risk-averse tone, with sentiment further dampened by sharp remarks from China’s Defence Ministry, which warned that Japan “will only suffer a crushing defeat” should it “dare to take a risk.” The comments followed Japanese PM Takaichi’s statement that a conflict over Taiwan could constitute a “survival-threatening situation” for Tokyo. USD/JPY trades within a 154.32–154.74 intraday range, contained inside yesterday’s 154.13–155.02 parameters.

- Antipodeans - The Antipodeans are mixed with NZD leading gains despite limited fresh catalysts, after the RBNZ confirmed it will proceed with easing mortgage loan-to-value ratio restrictions as previously announced last month. AUD/USD briefly moved above its 100DMA (0.6540) before pulling back, while NZD/USD recovered strongly from yesterday’s losses. The AUD/NZD cross meanwhile slipped from a 1.1558 high to a 1.1487 low.

- PBoC set USD/CNY mid-point at 7.0825 vs exp. 7.0964 (Prev. 7.0865).

- Click for a detailed summary

FIXED INCOME

- Gilts - A volatile session, with the benchmark plunging from 93.37 to 92.07 at the lows (down 130 ticks) before rebounding to trade around 92.60, still lower by ~77 ticks. Yields briefly spiked to 4.57% (10yr) and 5.37% (30yr). The initial selloff followed FT reports that Chancellor Reeves plans to scrap the manifesto-breaching income tax rate hike, opting instead for threshold cuts and smaller levies — moves seen as undermining fiscal credibility. The reversal prompted renewed concerns over the government’s fiscal stability and added political pressure on PM Starmer. Gilts later pared losses after Bloomberg reported the U-turn was driven by improved UK growth and wage forecasts, lifting the benchmark nearly 50 ticks. ITV’s Peston added that the new plan includes a two-year extension of threshold freezes and lower entry points for the 40p/45p bands, underpinned by stronger wage-driven revenue projections. Despite partial recovery, markets remain uneasy over the handling of communications and credibility risks. The yield swing trimmed the odds of a December BoE cut to under 75% (from ~85% earlier in the week), particularly as higher wage growth reinforces inflation concerns within the MPC’s divided board.

- USTs - Softer in early Europe, with the benchmark slipping to a 112-19 low before stabilising near 112-22, down around 2+ ticks, as US futures found support amid improved chip-sector sentiment. Newsflow was light, with focus on US government bureaus resuming operations and expected to release updated data schedules—potentially as soon as today—setting up a catch-up-heavy week ahead. Attention remains on the December Fed meeting, where markets are split roughly 50/50 on a rate cut, leaving upcoming delayed data pivotal for near-term policy expectations.

- Bunds - Weaker, down around 23 ticks at 128.69, trading between USTs and Gilts in relative terms. The benchmark fell to a 128.63 low (off 29 ticks at worst) after Germany’s defence ministry unveiled its 2026 Bundeswehr funding plan, followed by the Bundestag fiscal committee’s approval of a total package roughly EUR 4bln above the prior figure. Reports indicate net new borrowing for 2026 at EUR 98bln (vs EUR 89.8bln in the draft), explaining Bunds’ mild underperformance versus Treasuries. The full Bundestag vote is scheduled for November 28th.

- Click for a detailed summary

COMMODITIES

- Crude Oil - Firmer after prices surged in APAC trade on reports of a Ukrainian strike on a Russian oil depot and Kyiv confirming active air defences amid a large-scale attack. WTI and Brent spiked around USD 2/bbl to peaks of USD 60.65 and USD 64.86, before easing to USD 59.26 and USD 63.56 respectively. Later, the UKMTO reported an incident off UAE’s Khor Fakkan, believed linked to state activity, shortly after Reuters cited sources saying an Iranian force redirected a Talara tanker toward its coast near the Strait of Hormuz, prompting a fresh USD 1/bbl uptick. Separately, Sky News Arabia reported the IDF preparing a limited offensive in Lebanon against Hezbollah.

- Precious Metals - Mixed, with XAU unchanged and XAG +1.0%. Spot gold held in a USD 4159–4211/oz range through APAC and early Europe, consolidating after several Fed officials suggested limited scope for further cuts, while Kashkari said he did not support the latest move. The simultaneous drop in equities and gold on Thursday has raised concern that the metal’s safe-haven appeal is fading, with investors noting that gold’s strong correlation with risk aversion — which helped drive it to record highs in recent months — has weakened lately.

- Base Metals - Softer, with 3M LME Copper -0.3%, extending Thursday’s risk-off tone. The red metal held within a USD 10.86k–10.91k/t range through APAC before dipping to a USD 10.83k/t low amid continued caution in broader markets. It has since bounced modestly from session lows as sentiment stabilises.

- US President Trump administration revoked Biden-era limits on Alaska oil drilling.

- Qatar raised the January term premium for Al-Shaheen oil to USD 0.84 per barrel above Dubai quotes.

- Click for a detailed summary

CRYPTO

- Crypto markets remain subdued with Bitcoin firmly under USD 100,000 and trading on either side of USD 97,000.

NOTABLE DATA RECAP

- EU GDP Flash Estimate YY (Q3) 1.4% vs. Exp. 1.3% (Prev. 1.3%, Rev. 1.5%)

- EU GDP Flash Estimate QQ (Q3) 0.2% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.1%)

- EU Eurostat Trade NSA, EUR (Sep) 19.4B (Prev. 1.0B, Rev. 1.9B)

- EU Employment Flash QQ (Q3) 0.1% vs. Exp. 0.1% (Prev. 0.1%)

- EU Employment Flash YY (Q3) 0.5% vs. Exp. 0.5% (Prev. 0.6%)

- French CPI (EU Norm) Final YY (Oct) 0.8% vs. Exp. 0.9% (Prev. 0.9%); MM 0.1% vs. Exp. 0.1% (Prev. 0.1%)

- Spanish HICP Final YY (Oct) 3.2% vs. Exp. 3.2% (Prev. 3.2%); MM (Oct) 0.5% vs. Exp. 0.5% (Prev. 0.5%)

- Italian Global Trade Balance (Sep) 2.852B EU (Prev. 2.05B EU).

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer and Chancellor Reeves reportedly ditched budget plans to increase income tax rates, according to FT. Since, improved UK forecasts reportedly led Chancellor Reeves to drop the Income Tax hike, via Bloomberg citing sources.

- ITV's Peston posts the UK Chancellor "is NOT going to take greater risks with the public finances, which is what investors quite understandably fear is happening". Peston, citing sources, writes that the Chancellor will increase the headroom from the GBP 9bln at the last budget to GBP 15bln or more; "that will happen". Expects Reeves and/or PM Starmer to make it clear today that they will not weaken their commitment to the fiscal rules and increasing headroom. Changes are due to the Treasury receiving improved data on current/expected future wage growth, which has increased tax revenue forecasts; reducing the need to increase tax rates re. Income Tax. New "tax masterplan": extend the Income Tax threshold increase by another two years; look at reducing the threshold where 40p and 45p tax bands kick in.

- German Budget Committee approved the 2026 budget, which clears the path to parliamentary approval, while the budget has total spending of EUR 524.5bln and includes investments of EUR 58.3bln and borrowing of EUR 97.9bln.

- German 2026 net new borrowing to rise to EUR 98bln (vs. 89.8bln in the draft), via Bloomberg citing a document.

- ECB's Elderson says he favours easier rules and fewer requirements for small banks.

NOTABLE US HEADLINES

- NEC Director Hassett said he expects to see 60k job losses due to the government shutdown, while he responded that the numbers they have are consistent with more rate cuts, when asked about inflation.

GEOPOLITICS

IRAN

- Talara crude oil tanker taken towards Iranian coast by revolutionary guards based on initial assessment according to Reuters sources.

- Thereafter, UKMTO notes of incident off the coast of UAE's Khor Fakkan, believed to be state activity; Vessel is transiting towards Iranian territorial waters

RUSSIA-UKRAINE

- Ukrainian drone attack damages apartment buildings and oil depot in Russian Black Sea port of Novorossiysk.

- Ukrainian air defence units were engaged in Kyiv against what the mayor described as a massive Russian attack.

- US Coast Guard detected and monitored a Russian military vessel operating near US territorial waters approximately 15 nautical miles south of Oahu on October 29th, according to the US Coast Guard.

OTHER

- US senior military officials on Wednesday presented President Trump with updated options for potential operations in Venezuela, including strikes, according to sources cited by CBS News.

- US Defense Secretary Hegseth announces Operation Southern Spear to remove narco-terrorists from the Western Hemisphere.

- China summoned Japan’s envoy over Japanese PM Takaichi's remarks on Taiwan and said the remarks were extremely dangerous.

APAC TRADE

- APAC stocks were pressured following the sell-off stateside, where tech was hit on valuation and China AI race concerns, while sentiment was also not helped by recent hawkish-leaning Fed rhetoric and mixed Chinese activity data.

- ASX 200 was dragged lower by weakness in tech and with nearly all sectors in the red aside from energy.

- Nikkei 225 dipped beneath the 51,000 level and was among the worst performers amid earnings results and tech woes.

- Hang Seng and Shanghai Comp declined with participants digested the recent data releases, including mixed activity data in which Industrial Production disappointed and Retail Sales marginally topped estimates, but both showed a slowdown from the previous, while Chinese House Prices continued to contract. Nonetheless, the downside in the mainland was somewhat cushioned with China pledging to expand domestic demand and stabilise trade.

NOTABLE ASIA-PAC HEADLINES

- China stats bureau spokesperson said the economy was generally stable in October, but pressure to adjust the domestic economic structure remains high and stabilisation faces some challenges, while China is to improve the effectiveness of macro policies and to pursue higher-quality economic growth. China will also expand domestic demand on all fronts and will further spur private investment vitality. Furthermore, the spokesperson said China’s investment space and potential remain huge and that China will stabilise trade and help trade firms that have been heavily hit.

- South Korean Finance Minister said they are to prepare measures to stabilise the FX market with the pension fund, while he is concerned about increasing uncertainty in the FX market and noted it is necessary to address imbalances in FX supply and demand.

- Chinese Defence Ministry says the Japanese side "will only suffer a crushing defeat" should it dare to take a risk.

- Hong Kong revises its 2025 GDP forecast to 3.2% (prev. 2-3%).

- Japan's automobile union (JAW) says there are no plans to scale back the wage demand for next year, despite a hit from US tariffs. Wage hikes are key to attaining a demand driven economy.

DATA RECAP

- Chinese Industrial Production YY (Oct) 4.9% vs. Exp. 5.5% (Prev. 6.5%)

- Chinese Retail Sales YY (Oct) 2.9% vs. Exp. 2.8% (Prev. 3.0%)

- Chinese Urban Investment YTD YY (Oct) -1.7% vs. Exp. -0.8% (Prev. -0.5%)

- Chinese Unemployment Rate Urban Area (Oct) 5.1% (Prev. 5.2%)

- Chinese China House Prices MM (Oct) -0.5% (Prev. -0.4%); YY (Oct) -2.2% (Prev. -2.2%)