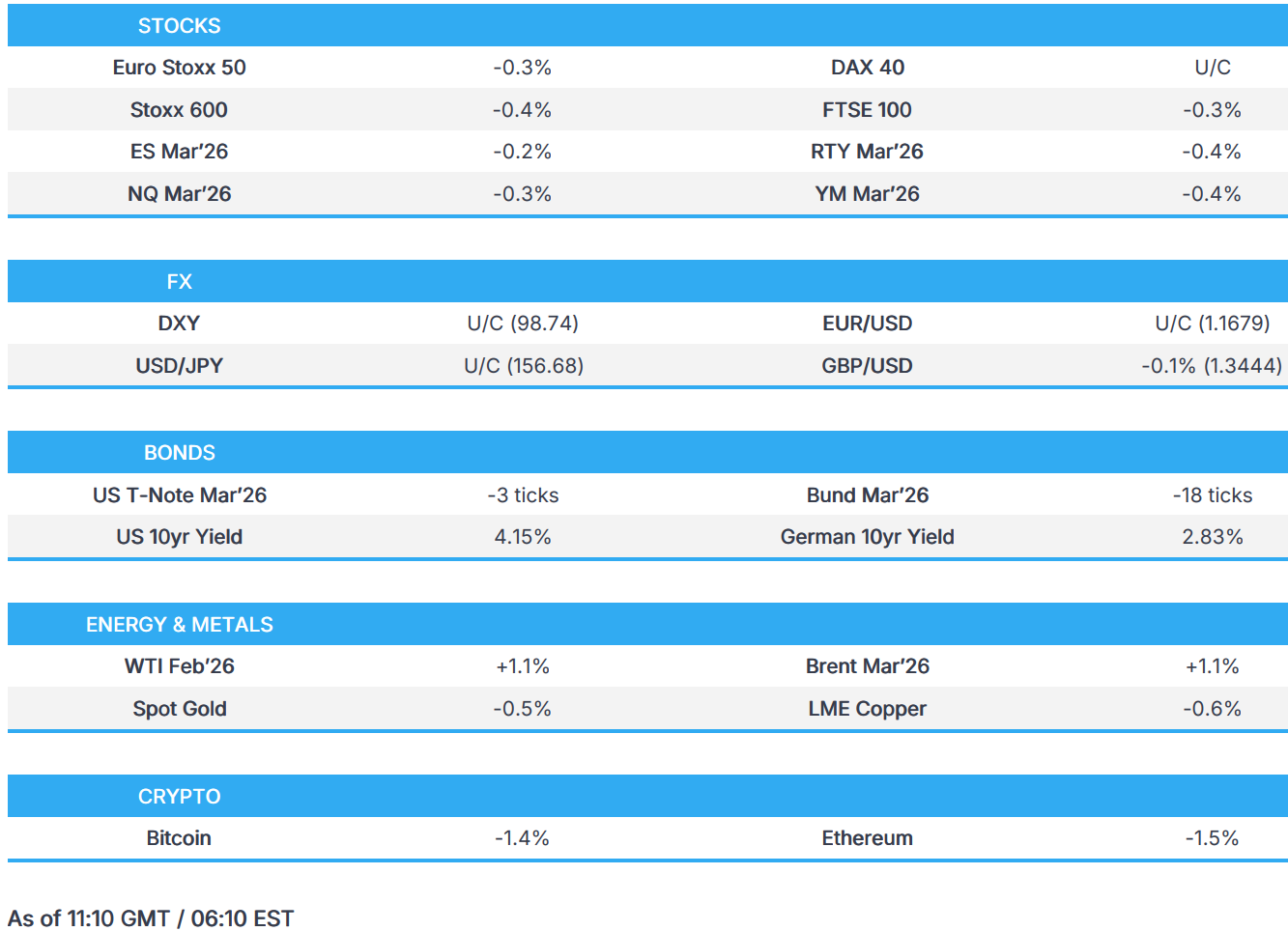

US equity futures on the backfoot; DXY awaits US jobs data - Newsquawk US Opening News

- US President Trump's team is working up a sweeping plan to control Venezuelan oil for years to come, according to WSJ.

- US President Trump posted that Venezuela is going to be purchasing only American-made products with the money received from the new oil deal with the US.

- European and US equity futures are broadly on the backfoot; China is to reportedly approve some NVIDIA H200 purchases as soon as this quarter.

- DXY incrementally firmer awaiting further jobs data after an early Challenger Layoffs release; Antipodeans lag.

- Fixed income faltered as risk sentiment saw a fleeting recovery; Spain and France auctions passed without issue.

- Crude rebounds following after recent losses with newsflow quiet; Precious metals on the backfoot once again in quiet newsflow.

- Looking ahead, highlights include US Initial Jobless Claims, RevelioLabs Total US Nonfarm Employment Data, Comments from Fed's Miran.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TRADE/TARIFFS

- China is to reportedly approve some NVIDIA (NVDA) H200 purchases as soon as this quarter, according to sources cited by Bloomberg; China to bar H200 from state bodies and critical infrastructure; Beijing is said to allow commercial use of H200 AI chip. Alibaba (BABA) and Bytedance have both reportedly informed NVIDIA that they are interested in ordering in excess of 200k units each of the H200, according to sources.

- India's Foreign Ministry reportedly intends to remove restrictions on Chinese firms bidding for government contracts, according to sources.

- US President Trump posted "I have just been informed that Venezuela is going to be purchasing ONLY American Made Products, with the money they receive from our new Oil Deal". Full Post: "I have just been informed that Venezuela is going to be purchasing ONLY American Made Products, with the money they receive from our new Oil Deal. These purchases will include, among other things, American Agricultural Products, and American Made Medicines, Medical Devices, and Equipment to improve Venezuela’s Electric Grid and Energy Facilities. In other words, Venezuela is committing to doing business with the United States of America as their principal partner – A wise choice, and a very good thing for the people of Venezuela, and the United States. Thank you for your attention to this matter!".

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.4%) are mostly lower, following the negative tone seen in APAC trade. The DAX 40 (U/C) did initially buck the negative mood, with upside facilitated by strength in Rheinmetall (+3%) after President Trump called for a 50% increase in US defence spending by 2027.

- European sectors have opened mostly in the red. Leading sectors are Banks (+0.4%), Insurance (+0.2%) and Food Beverage & Tobacco (+0.2%). The banking sector has been underpinned by gains in BNP Paribas (+2.0%) after the Co. said that the judge's decision to certify the verdict in Sudan clears the path for the bank to pursue an appeal, otherwise newsflow has been light for the other outperforming sectors. To the downside, Basic Resources is weighed on by downside across underlying metals.

- US equity futures are lower as sentiment continued to be pinned down following yesterday's session when Trump said he is immediately taking steps to ban large institutional investors from buying more single-family homes. Some pick-up in sentiment was seen on a Bloomberg report which suggested that China is to reportedly approve some NVIDIA H200 purchases as soon as this quarter. However, the upside was short-lived with indices broadly still in the red.

- Mass production of HBM4 has been delayed to no earlier than end-Q1 following NVIDIA (NVDA) raising the required pin-per speed and strong demand for prev.-gen Blackwell products, TrendForce reported. SK Hynix (000660 KS), Samsung (005930 KS) and Micron (MU) have resubmitted HBM4 samples and continue to refine their designs; vs peers, Samsung has taken an early lead by taking a 1cnm process and utilising in-house foundry technology. Points that position Samsung as the most likely supplier to qualify first. Though, SK Hynix has already secured HBM contracts and is expected to retain a dominant share in 2026.

- NVIDIA (NVDA) is said to be requiring full upfront payment from Chinese customers seeking H200 chips, hedging it against ongoing uncertainty over China's approval of the shipments.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is essentially flat/incrementally firmer and trades above its 100 DMA within a fairly narrow 98.67 to 98.82 range; further upside for the Dollar could see the test of its 200 DMA at 98.87, the round 99.00 mark and then the 50 DMA at 99.08. G10s are mixed against the Dollar, with some underperformance in the Antipodeans which have been weighed on by the risk-tone and pressure in the metals complex.

- Really not much driving things for the Dollar this morning, but with some focus on an early release of the US Challenger Layoffs (Dec), which fell to 35.55k (prev. 71.3k). The inner report highlighted that “while December is typically slow, this coupled with higher hiring plans, is a positive sign after a year of high job cutting plans”. A constructive picture for the labour market, which follows on from a rebound in the ADP in the prior session (albeit that printed shy of expectations). Ahead, a couple more labour market metrics in the form of jobless claims and RevelioLabs Employment data.

- EUR is also flat and currently at the lower end of a narrow 1.1668-1.1682 range. A strong German Factory Orders print had little impact on the single currency this morning. Focus has been on regional geopolitics in the past couple of days; on one front, positive mood music out of Ukraine with President Zelenskiy suggesting that the war could end in H1’26. Elsewhere, Trump’s continued verbal assault on Greenland will keep NATO and allies on their toes.

- Click for NY OpEx Details

FIXED INCOME

- A contained start for fixed benchmarks with newsflow somewhat light early doors aside from ongoing digestion of updates regarding Venezuela. But have gradually slipped from best levels as the morning progressed.

- USTs got to a 112-21 peak, firmer by three ticks, and Bunds to a 128.15 high with gains of 10 ticks at most early doors. Thereafter, the benchmarks began to gradually trim as the risk tone lifted off lows into the morning, with assistance coming via reporting regarding NVIDIA. For USTs, an early release of December's Challenger Jobs series spurred no move, headline printed at 35.55k (prev. 71.3k).

- Supply this morning came from Spain (fine, but softer than is usually the case) and France (strong overall), but neither outing spurred any significant move.

- Gilts opened near-enough unchanged just above 92.00 before extending to 92.16 and then falling to a 91.88 low, in-fitting with action in peers. No move to the latest DMP survey.

- Spain sold EUR 6.28bln vs exp. EUR 5.5-6.5bln 2.70% 2030, 3.00% 2033, 3.45% 2043 Bono & EUR 0.726bln vs exp. EUR 0.25-0.75bln 1.15% 2036 I/L Bono. EUR 2.8bln 2.70% 2030: b/c 2.21x (prev. 1.97x); average yield 2.51% (prev. 2.471%). EUR 2.01bln 3.00% 2033: b/c 2.08x (prev. 2.34x); average yield 2.94% (prev. 2.88%). EUR 1.46bln 3.45% 2043: b/c 1.87x; average yield 3.8%. 1.15% 2036 I/L: b/c 1.9x (prev. 2.63x); yield 1.51% (prev. 1.469%).

- France sold EUR 13.5bln vs exp. EUR 11.5-13.5bln 3.50% 2035, 0.50% 2040, 3.60% 2042 & 3.75% 2056 OAT. 3.50% 2035: b/c 1.98x (prev. 2.147x); average yield 3.53% (prev. 3.43%). 0.50% 2040: b/c 2.37x (prev. 2.272x); average yield 3.95% (prev. 3.898%). 3.60% 2042: b/c 2.12x (prev. 2.922x); average yield 4.05% (prev. 3.92%). 3.75% 2056: b/c 3.4x; average yield 4.46%.

- Japan sold JPY 524.9bln 30-yr JGBs; b/c 3.14x (prev. 4.04x), and average yield 3.447% (prev. 3.427%). Lowest accepted price 99.15 vs prev. 96.55. Average accepted price 99.30 vs prev. 96.64. Tail in price 0.15 vs prev. 0.09.

COMMODITIES

- WTI and Brent front-month futures post mild upside as the contracts rebound after two consecutive sessions of losses and after the US’ effective seizure of Venezuela’s crude, which promises more barrels in the market and a likely move away from Canadian oil for the US. WTI Feb resides in a USD 55.97-56.51/bbl range whilst Brent Mar sits in a USD 59.96-60.48/bbl band.

- Nat Gas, meanwhile, is on a firmer footing once again after Dutch TTF settled over 2.5% higher, albeit off best levels, with traders citing the current cold snap across some of Europe. ING suggests that EU gas storage is now 58% full vs a 5-year average of 72%.

- Spot gold resides closer to the bottom end of a USD 4,415.40-4,466.48/oz range, but is still holding onto a long-term upward trend.

- Base metals succumb to the modestly firmer dollar and overall weaker risk, with 3M LME copper dipping back under USD 13k/t before finding some support at USD 12,687/t. Newsflow overall remains light, but traders are also cognizant of the SCOTUS update tomorrow, which could provide a ruling on President Trump’s Liberation Day and some targeted tariffs (possible, not guaranteed).

- HSBC forecasts gold to hit USD 5000/oz in H1'26 due to geopolitical risk and increasing fiscal debt; High volatility trading level likely.

- ICE plans 22-hour trade for European and UK gas and power by February 23rd.

- US President Trump's team works up a sweeping plan to control Venezuelan oil for years to come, while Trump believes his efforts could help lower oil prices to his favoured level of USD 50/bbl, according to WSJ.

- US oil companies warn they will need guarantees to invest in Venezuela, according to FT.

- Chevron is in talks with US government to expand Venezuela license and seeks authorisation to supply Venezuelan oil to other buyers, according to industry sources. US government also wants other US companies involved in oil exports from Venezuela.

- US Vice President Vance said Venezuela can only sell its oil if it serves US national interests, and the way we control Venezuela is to control the purse strings.

NOTABLE EUROPEAN HEADLINES

- EU plans to pursue a special rulebook for corporates outside national law, which would create a voluntary ‘28th regime’ for companies to operate across EU, according to FT.

NOTABLE EUROPEAN DATA RECAP

- EU Unemployment Rate (Nov) 6.3% vs. Exp. 6.4% (Prev. 6.4%).

- EU PPI YoY (Nov) Y/Y -1.7% vs. Exp. -1.9% (Prev. -0.5%).

- EU PPI MoM (Nov) M/M 0.5% vs. Exp. 0.2% (Prev. 0.1%).

- EU Services Sentiment (Dec) 5.6 vs. Exp. 5.9 (Prev. 5.8, Rev. 5.7); Consumer Confidence Final (Dec) -13.1 vs. Exp. -14.6 (Prev. -14.2); Industrial Sentiment (Dec) -9.0 vs. Exp. -9.1 (Prev. -9.3); Economic Sentiment (Dec) 96.7 vs. Exp. 97 (Prev. 97.1, Rev. 97); Consumer Inflation Expectations (Dec) 26.7 vs. Exp. 23.6 (Prev. 24.3, Rev. 23.1); Selling Price Expectations (Dec) 10.9 vs. Exp. 10.4 (Prev. 9.9).

- UK BBA Mortgage Rate (Dec) 6.77% vs. Exp. 6.6% (Prev. 6.81%).

- UK Halifax House Price Index YoY (Dec) Y/Y 0.3% vs. Exp. 1.1% (Prev. 0.6%, Rev. 0.7%).

- UK Halifax House Price Index MoM (Dec) M/M -0.6% vs. Exp. 0.2% (Prev. -0.1%, Rev. 0%).

- Italian Unemployment Rate (Nov) 5.7% vs. Exp. 6% (Prev. 5.8%, Rev. 6%).

- French Balance of Trade (Nov) -4.2B vs. Exp. -4.2B (Prev. -3.5B, Rev. -3.9B); Exports (Nov) 52.2B vs. Exp. 52.5B (Prev. 51.8B, Rev. 51.7B); Imports (Nov) 56.4B vs. Exp. 55.9B (Prev. 55.3B, Rev. 55.7B).

- French Foreign Exchange Reserves (Dec) 362.743B vs. Exp. 361.0B (Prev. 359.393B).

- French Current Account (Nov) -0.80B vs. Exp. 1.4B (Prev. 1.40B, Rev. 1.1B).

- Swedish Inflation Rate MoM Prel (Dec) M/M 0% vs. Exp. 0.2% (Prev. -0.4%); Inflation Rate YoY Prel (Dec) Y/Y 0.3% vs. Exp. 0.5% (Prev. 0.3%).

- Swedish CPIF YoY Prel (Dec) Y/Y 2.1% vs. Exp. 2.5% (Prev. 2.3%).; CPIF MoM Prel (Dec) M/M 0.1% vs. Exp. 0.1% (Prev. -0.2%).

- German Factory Orders MoM (Nov) M/M 5.6% vs. Exp. -1% (Prev. 1.5%).

- Swiss Inflation Rate YoY (Dec) Y/Y 0.1% vs. Exp. 0.1% (Prev. 0.0%, Rev. 0%).

- Swiss Inflation Rate MoM (Dec) M/M 0.0% vs. Exp. -0.1% (Prev. -0.2%).

CENTRAL BANKS

- BoJ's Nagoya region branch manager said US trade policy is having negative impact in the region, but is not dealing a severe blow to region's economy. Some firms in the region see China's export curb as potentially having an impact on their businesses.

- BoJ maintains its assessment on all Japan's 9 regions in its quarterly regional report.

- ECB Consumer Expectations Survey (Nov 2025 vs Oct 2025): median consumer perceptions of inflation over the previous 12 months remained unchanged, as did median inflation expectations for the next 12 months, for three years ahead and for five years ahead. 1-year: 2.8% (prev. 2.8%). 3-year: 2.5% (prev. 2.5%). 5-year: 2.2% (prev. 2.2%).

- ECB's de Guindos said the ECB is at inflation target, but uncertainty remains very high.

- BoE DMP (Dec): 1yr ahead CPI expectations maintained at 3.4%; 3yr ahead maintained at 2.9%. Wage Growth1yr ahead: 3.7% (prev. 3.8%).

- RBA Deputy Governor Hauser said likely seen the last rate cut in the cycle and the likelihood of near term rate cuts is very low, also noted November CPI data was helpful, but largely as expected, according to ABC interview.

- SNB Minutes: Governing Board confirmed that it remains willing to be active in the foreign exchange market as necessary; Board will continue to monitor the situation closely and adjust monetary policy if necessary.

NOTABLE US HEADLINES

- US President Trump said our military budget for the year 2027 should not be USD 1tln, but rather USD 1.5tln."

- US President Trump is scheduled to participate in a policy meeting at 17.30EST/22:30GMT on Thursday, according to his public schedule.

- US House votes to advance Democrats' bill to extend expired healthcare subsidies.

- US President Trump signs a Presidential Memorandum directing withdrawal of US from participation in 66 international organisations.

- Punchbowl reported that the State of the Union date of February 24th is firm, which US President Trump will deliver.

- US bipartisan Senate group believes it is on the verge of a deal, regarding health care and a Obamacare subsidies extension, Punchbowl reports; however, the Hyde language is "now viewed more acutely as an insurmountable problem."

GEOPOLITICS

RUSSIA-UKRAINE

- US VP Vance said seized oil tanker was a fake Russian tanker, while he stated the US had a legitimate indictment for Maduro and that President Trump will make a determination on Greenland.

- US Republican Senator Graham said after meeting Wednesday with US President Trump, that he has greenlit the bipartisan Russia sanctions bill, while Graham looks forward to a vote as early as next week.

MIDDLE EAST

- Israel considers Lebanon's efforts to disarm Hezbollah 'totally insufficient', Sky News Arabia reports

- Iranian Foreign Minister said "We are ready for any situation and we do not want war, but we are ready for it and we are also ready to negotiate", Al Jazeera reported. "We are ready to negotiate with the United States on the basis of mutual respect and mutual interests".

OTHERS

- US President Trump said the US would be extracting Venezuelan oil for years; "the oil will take a while in Venezuela"; said US oversight of Venezuela could last for years.

- US President Trump's administration draws up new legal justification for Maduro operation with DoJ's opinion expected to say that it was lawful because it was part of a law enforcement action, according to WSJ.

- US VP Vance said seized oil tanker was a fake Russian tanker, while he stated the US had a legitimate indictment for Maduro and that President Trump will make a determination on Greenland.

- China hacked email systems of US Congressional Committee staff with Beijing intelligence said to have used Salt Typhoon to access communications used by top panels in US Congress, while the intrusions were detected in December, FT reported.

- US President Trump comments it was a great honour to speak with Colombia's President, who called to explain the situation of drugs and other disagreements that we have had, Trump said he appreciates his call and tone and looks forward to meeting him. Full post: "It was a Great Honor to speak with the President of Colombia, Gustavo Petro, who called to explain the situation of drugs and other disagreements that we have had. I appreciated his call and tone, and look forward to meeting him in the near future. Arrangements are being made between Secretary of State Marco Rubio and the Foreign Minister of Colombia. The meeting will take place in the White House in Washington, D.C.".

- US Republican Senator Graham said after meeting Wednesday with US President Trump, that he has greenlit the bipartisan Russia sanctions bill, while Graham looks forward to a vote as early as next week.

- UK PM Starmer spoke with US President Trump this evening and set out his position on Greenland.

CRYPTO

- Bitcoin is on the backfoot and once again back below the USD 90k mark.

APAC TRADE

- APAC stocks eventually traded mostly negative following a similar handover from Wall Street, where the S&P 500 and DJIA pulled back from record highs.

- ASX 200 traded marginally higher as strength in health care, tech, consumer stocks, energy and financials, offset the losses in mining and materials, with mild tailwinds seen amid a softer yield environment in Australia.

- Nikkei 225 extended its decline beneath the 52,000 level amid soft wages data from Japan and further frictions with China after MOFCOM yesterday announced an anti-dumping probe into Japan's dichlorosilane imports, which is a key chipmaking chemical, while Japan protested China's operation of mobile drilling rigs in waters on the Chinese side of the Japan-China median line in the East China Sea.

- Hang Seng and Shanghai Comp eventually traded negative with the Hong Kong benchmark pressured amid tech-related weakness and with some early pressure seen in China’s OpenAI rival Knowledge Atlas Technology a.k.a. Zhipu, during its Hong Kong debut. The mainland eventually gave up the modest gains that were seen as the PBoC conducted a CNY 1.1tln outright reverse repo operation to maintain ample liquidity in the banking system.

NOTABLE ASIA-PAC HEADLINES

- China's Ambassador rejects Japan's export controls negotiations.

- PBoC announced on Wednesday it will conduct a CNY 1.1tln outright reverse repo operation on Thursday to maintain ample liquidity in the banking system.

- Fast Retailing (9983 JT) Q1 (JPY): Revenue 1.03tln (prev. 0.895tln), PBT 226.7bln (prev. 196.6bln), Net 147.5bln (prev. 131.9bln).

NOTABLE APAC DATA RECAP

- Japanese Consumer Confidence (Dec) 37.2 vs. Exp. 37.8 (Prev. 37.5).

- Japanese 30-Year JGB Auction 3.447% (Prev. 3.427% ).

- Japanese Foreign Bond Investment (Dec/27) -223.6 (Prev. 103.0, Rev. 103).

- Japanese Stock Investment by Foreigners (Dec/27) 124.9, (Prev. -1,, Rev. -1234.8,).

- Japanese Real Cash Earnings YY (Nov) -2.8% vs Exp. -1.2% (Prev. -0.7%, Rev. -0.8%).

- Japanese Overtime Pay YoY (Nov) Y/Y 1.20% vs. Exp. 1.4% (Prev. 2.10%, Rev. 1.5%).

- Japanese Average Cash Earnings YoY (Nov) Y/Y 0.5% vs. Exp. 2.3% (Prev. 2.5%, Rev. 2.6%).

- Australian Balance of Trade (Nov) 2.936B vs. Exp. 4.9B (Prev. 4.385B ).

- Australian Exports MoM (Nov) M/M -2.9% (Prev. 3.4%).

- Australian Imports MoM (Nov) M/M 0.2% (Prev. 2.0%).