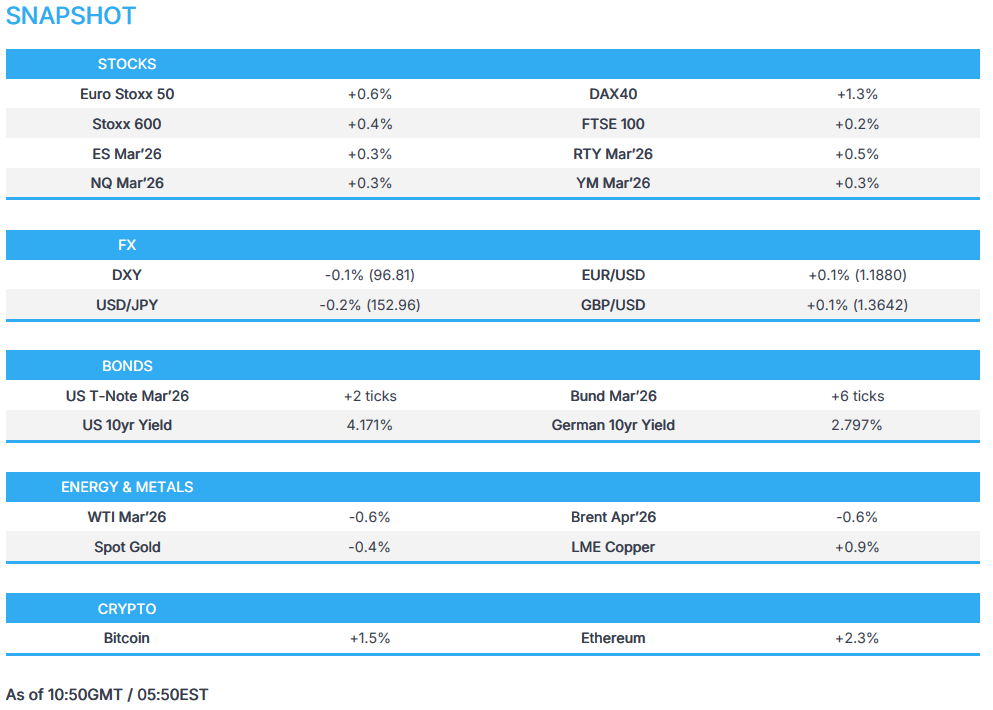

US equity futures broadly in the green; China's MOFCOM announces a tariff of up to 11.7% (prev. 42.7%) on EU dairy products - Newsquawk US Opening News

- China's Commerce Ministry announces a tariff of up to 11.7% (prev. 42.7%) on EU dairy products; effective from February 13th.

- European equities broadly in the green; Financials lead as Schroders (+28.5%) gets acquired by Nuveen; US equity futures are entirely in the green.

- G10s mostly firmer against the USD; AUD takes a slight breather.

- Gilts lead after soft GDP though BoE pricing largely unaffected; USTs tread water ahead of Friday's CPI.

- WTI and Brent trade slightly lower as geopolitics remain quiet; IEA cut 2026 global oil demand growth and nudged lower supply growth forecasts.

- Looking ahead, highlights include US Weekly/Continuing Claims, Existing Home Sales (Jan), EU Informal Leaders Retreat, Speakers including ECBʼs Lane & Nagel, BoCʼs Rogers, Supply from the US, Earnings from Applied Materials, Arista Networks, Vertex Pharmaceuticals, Howmet Aerospace, Coinbase & American Electric Power.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.5%) are entirely in the green, with the DAX 40 (+1.2%) leading gains and CAC 40 (+0.9%) following closely behind. On the other hand, the Dutch AEX (-0.5%) lags, weighed by Adyen and Magnum earnings.

- Sectors hold a mostly positive bias with Financials (+1.3%) and Telecommunications (+1.0%) leading the pack. Schroders (+28.5%) leads in financials after Nuveen agreed to purchase the company for GBP 9.9bln. Deutsche Boerse (+2.0%) is also higher, after acquiring a further 20% stake in ISS STOXX, which is expected to be accretive to cash EPS in the first full year.

- Movers include Siemens (+5.7%), Hermes (+1.3%) and Mercedes-Benz (-2.0%). Siemens missed top-line expectations but raised its FY EPS guidance helping shares higher. Hermes posted earnings that beat estimates and highlighted that 2026 prices increases would be lower than it was in 2025. For Mercedes Benz, the Co. guided its Adj. ROS below market consensus.

- US equity futures are entirely in the green (NQ +0.4%, ES +0.3%, RTY +0.5%), continuing to hold onto Wednesday's gains post-NFP. The tech-heavy NQ has been led higher by gains across storage-related names such as SanDisk (+7%) and Micron (+4%).

- Hermes (RMS FP) FY 2025 (EUR) Revenue 16bln (exp. 16bln), Op. Income 6.56bln (prev. 6.15bln Y/Y); noted that 2026 price increases would be around 5-6%, down from around 6-7% rate in 2025.

- Unilever (ULVR LN) Q4 2025 (EUR): Revenue 12.6bln (exp. 12.47bln), Underlying Sales +4.2% (exp. +3.97%); New EUR 1.5bln share buyback announced.

- Siemens (SIE GY) Q1 (EUR): Net income 2.2bln (prev. 3.90bln Y/Y), Revenue 19.1bln (exp. 22.4bln), Orders 21.37bln (exp. 20.85bln), raises FY EPS pre-PPA 10.70-11.10 (prev. guided 10.40-11.00).

- Mercedes-Benz Group (MBG GY) FY25 (EUR): Net 5.33bln (exp. 4.9bln), Revenue 132.2bln (exp. 132.8bln), EBIT 1.76bln (exp. 1.73bln); sees 2026 Adj. ROS between 3-5% (exp. 5.79%).

- Cisco Systems Inc. (CSCO) Q2 2026 (USD) Adj. EPS 1.04 (exp. 1.02), Revenue 15.30bln (exp. 15.11bln).

- McDonald's Corporation (MCD) Q4 2025 (USD): Adj. EPS 3.12 (exp. 3.04), Revenue 7.01bln (exp. 6.83bln).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- G10s are mostly firmer against the USD. Kiwi leads, followed by the GBP, whilst the Aussie lags a touch; the latter seemingly paring back recent strength.

- DXY is incrementally lower today. As a reminder, the index was choppy in the prior session following a strong NFP report and as markets continue to digest reports that President Trump is looking exit the North American trade pact. Currently, the index resides towards the lower end of a 96.77-97.07 range, and further pressure could see a test of the prior day’s low at 96.49. Focus today will be on the US Jobless Claims, and then an appearance from the POTUS.

- GBP is slightly firmer this morning, largely attributed to the slight USD weakness. Earlier, a mixed GDP report spurred two-way action in Cable; in brief, December’s M/M figure printed in-line with expectations, whilst the Y/Y component and Q4 prelims metrics came in softer than expected. GBP/USD fell from 1.3617 to 1.3607 before paring, and then strengthening as the morning progressed. ING opines that, given recent seasonality-related factors, it expects the economy to “bounce back” a bit in Q1. On monetary policy, the bank believes that if recent growth and labour market weakness persist alongside falling wage growth, then a March cut is “highly likely”. As it stands, Cable currently sits at the upper end of a 1.3604-1.3654 range.

- JPY is currently moving at the whim of the USD, with USD/JPY towards the midpoint of a 152.26-153.54 range. Further pressure in the pair could see a test of the lows seen in late January, when Jiji reported that Japan asked the US to conduct USD/JPY rate checks. In terms of the environment for JPY, markets are continuing to increase bets of faster BoJ normalisation. Mizuho’s Koshimizu, speaking to Reuters, highlighted that improved growth prospects, clearer policy strategy and inflation continuing to remain above the BoJ’s target, may allow the Bank to deliver three rate hikes this year – suggesting that a hike could come as early as March or April. Markets currently price in a 60% chance of a hike in March, 92% chance in June and fully priced in for July.

FIXED INCOME

- A contained start for most benchmarks.

- Gilts are the relative outperformers after soft GDP data. The benchmark opened higher by 18 ticks before climbing another nine to a 91.30 peak and notching a fresh WTD high. Weighing on the UK's 10yr yield to a 4.47% trough. For the BoE, the data works in favour of the doves who wanted to cut last week and somewhat skews the narrative towards a March cut vs current pricing for April. However, pricing didn't really move as we await next week's CPI and employment/wage metrics; furthermore, while the series was weak, the economy was still resilient during a tumultuous Q4, a finding that tempers the otherwise dovish impulse.

- JGBs returned from Wednesday's holiday lower, reacting to the US NFP print and bearish UST action. Pressure that proved fleeting as the benchmark lifted to a 132.02 peak with gains of just over 10 ticks at best. However, that upside faded across the APAC session to a 131.52 trough. Drivers for this include a Reuters interview with Mizuho's Kozhimizu, who expects as many as three hikes by the BoJ in 2026, and a move as soon as March or April is entirely possible. As it stands, just 3.5bps of tightening is implied in March, 14bps in April and 23.6bps in June, with a move not fully priced until July, where 30bps is implied.

- Bunds firmer, but contained, in narrow 128.62-76 parameters. Specifics for the bloc light, no move to a handful of ECB remarks, which stuck to the script.

- A similar story for USTs, rangebound in APAC hours towards the mid-point of the post-NFP drop. Holding at 112-11+ in thin parameters that are well within Wednesday's 112-00 to 112-20 bound. Today, the US docket is comparatively light, with supply and weekly jobs the highlights. Barring a surprise on those, it may be a bit of a filler day into Friday's CPI.

- Italy sells EUR 6.25bln vs exp. EUR 5-6.25bln 2.40% 2029, 3.15% 2033, 3.25% 2032 BTP.

- Australia sold AUD 150mln in 2035 indexed bonds, b/c 3.97, avg. yield 2.4127%.

COMMODITIES

- WTI and Brent are mildly lower this morning and currently trade within a USD 64.18-65.10/bbl and USD 68.86-69.85/bbl range, respectively. Really not much driving things for the complex this morning; action seemingly a paring back of some of the geopolitically-driven strength in the prior session, where reports suggested that the Pentagon was preparing a second aircraft carrier to deploy to the Middle East. It is worth noting a bout of pressure was seen in early European trade, though this lacked a clear driver. Elsewhere, the IEA OMR cut its 2026 global oil demand and supply growth forecast.

- Spot gold has been lacklustre thus far throughout the European morning, with the yellow metal trading around the USD 5,075/oz mark at the time of writing, still within yesterday's USD 5,019.71-5,119.35/oz range, with fresh catalysts on the lighter side. Alongside news flow, the Dollar remains relatively muted following yesterday's NFP-driven volatility, which proved to be short-lived. Both the Dollar and XAU have been moving sideways since awaiting the US CPI tomorrow.

- Copper prices were indecisive during the APAC session, reflecting mixed sentiment in China, with the Hang Seng and Shanghai Composite diverging overnight. However, early positive sentiment from Europe keeps prices underpinned, and offsets some of the weakness from the APAC session, providing support to the red metal. 3M LME Copper is currently trading around USD 13.3k/t in a narrow 13,2k-13.339k/t range.

- Vitol CEO said Russia and Iran's oil buyers are reaching for Western supply.

- IEA cuts 2026 global oil demand growth forecast to 850k BPD (prev. 930k BPD); cuts 2026 global oil supply growth forecast to 2.4mln BPD (prev. 2.5mln BPD). Lowers 2026 forecast for non-OPEC+ supply growth to 1.2mln BPD (prev. 1.3mln BPD). Escalating geopolitical tensions, snowstorms and extreme temperatures in North America, and Kazakh supply disruptions sparked the reversal to a bullish market.

- Goldman Sachs sees a boost to mine supply growth slowing considerably in 2027/28 which would the ex-China market into deficit.

- Saudi crude oil supply to China is set to rise to at least 53mln barrels in March, according to sources.

- US Energy Secretary Wright states Venezuela oil quarantine is essentially over, calling it a historic pivot, but noted political prisoners remain an issue.

- US President Trump directs Department of Energy to issue funds to coal plants in states including West Virginia and Ohio.

- Venezuela's interim President Rodriguez said hopes relationship with US progresses without obstacles; talked with US Energy Secretary about deals on oil, gas, power, and mining; look forward to move forward as fast as possible.

- South African Mining Production YoY (Dec) Y/Y 2.5% (Prev. -2.7%).

- South African Gold Production YoY (Dec) Y/Y 1.1% (Prev. -6.0%, Rev. From -6%).

TRADE/TARIFFS

- Chinese buyers are reportedly buying around 1mln tonnes per month of Australian barley due to a local feed supply shortage, traders report. Chinese buyers are reportedly booked near 2.5mln tonnes of US sorghum over the past three months to replenish domestic feed grain shortfall, traders report.

- Indian Trade Minister said textiles will receive no duties if raw material is from the US.

- China's Commerce Ministry announced a tariff of up to 11.7% (prev. 42.7%) on EU dairy products; effective from the 13th of February.

- China's Commerce Ministry, on Canada canola anti-dumping tariffs, said investigation period extended to March 9th.

- China's Commerce Minister said China and the US are to maintain close communication at all levels through trade and economic consultation mechanisms.

- China's chief trade negotiator Li Chenggang met with Mexico's deputy economy minister in Beijing.

- China's top trade negotiator met with Westinghouse Electric Company CEO on Tuesday.

- Taiwan and the US are reportedly to sign a reciprocal trade agreement on February 13th.

- US President Trump posted "Canada has taken advantage of the United States on Trade for many years. They are among the worst in the World to deal with, especially as it relates to our Northern Border".

- US President Trump posted "Any Republican, in the House or the Senate, that votes against TARIFFS will seriously suffer the consequences come Election time, and that includes Primaries!".

- US House majority backs resolution to eliminate Trump's tariffs on Canada.

- US President Trump and Chinese President Xi are poised to extend trade truce by up to a year during April meeting in Beijing, according to SCMP citing people familiar with discussions.

NOTABLE EUROPEAN HEADLINES

- EU Court Advisor said they should stop the release of c. EUR 10bln in funds for Hungary.

- UK Chancellor Reeves is to limit the deregulatory drive as she seeks closer UK relations with the EU, according to FT.

NOTABLE EUROPEAN DATA RECAP

- UK GDP MoM (Dec) M/M 0.1% vs. Exp. 0.1% (Prev. 0.2%, Rev. From 0.3%, Low. -0.1%, High. 0.3%).

- UK GDP Growth Rate QoQ Prel (Q4) Q/Q 0.1% vs. Exp. 0.2% (Prev. 0.1%, Low. 0.0%, High. 0.2%).

- UK GDP Growth Rate YoY Prel (Q4) Y/Y 1.0% vs. Exp. 1.2% (Prev. 1.2%, Rev. From 1.3%, Low. 1.2%, High. 1.2%).

- UK GDP YoY (Dec) Y/Y 0.7% vs. Exp. 1.1% (Prev. 1.2%, Rev. From 1.4%, Low. 1.0%, High. 1.2%).

- UK GDP 3-Month Avg (Dec) 0.1% vs. Exp. 0.2% (Prev. -0.1%, Rev. From 0.1%, Low. 0.1%, High. 0.2%).

- UK Goods Trade Balance (Dec) -22.72B vs. Exp. -22.7B (Prev. -23.58B, Rev. From -23.71B).

- UK Goods Trade Balance Non-EU (Dec) -10.99B (Prev. -11.33B, Rev. From -11.46B).

- UK Balance of Trade (Dec) -4.340B (Prev. -6.116B).

- UK RICS House Price Balance (Jan) -10% vs. Exp. -11% (Prev. -14%).

- Hungarian Core Inflation Rate YoY (Jan) Y/Y 2.7% vs. Exp. 2.8% (Prev. 3.8%).

- Hungarian Inflation Rate MoM (Jan) M/M 0.3% (Prev. 0.1%).

- Hungarian Inflation Rate YoY (Jan) Y/Y 2.1% vs. Exp. 2.4% (Prev. 3.3%).

CENTRAL BANKS

- Fed's Hammack (2026 voter) said unemployment rate looks like it's stabilising, adds we have the labour market broadly in balance but noted inflation is still too high. Consumer spending holding in driven by upper incomes. Important for Fed to get inflation back to 2%. Current Fed Funds Rate is right around neutral. Local contacts say growth is picking up. Good for the Fed to stay on hold right now and doesn't need to fine-tune rate policy.

- Fed Governor Miran said Wednesday's NFP report does not mean the Fed can't lower rates. Think if you increase supply then you get a decline in inflation. If you blame supply chain failures for higher inflation, stands to reason pushing supply out lowers inflation. Deregulation opens up an output gap. I'd be very Happy to stay, but not up to me. What happens later this year will depend on choices the President and the Senate make.

- ECB's Makhlouf said that the ECB is in a good place, adding that inflation is currently on target.

- ECB's Cipollone said preserving monetary sovereignty has been a key objective of our single currency.

- ECB's Villeroy said expected France's economic growth in Q1 to be between 0.2-0.3%, and in line with the 1% annual growth expected in 2026.

- BoE's Breeden said it is reasonable to expect rate cuts across the next couple of meetings if the economy evolves as expected.

- RBA Assistant Governor Hunter said need to assess extent to which recent rise in inflation is temporary, adds labour market has stabilised recently, but remains a bit tight; expects labour markets to remain tight and inflation above target for some time.

- RBA Governor Bullock said economy performing reasonably well, labour market a positive development, adds the Bank will monitor data and act if inflation becomes entrenched, warning that further rate hikes may be needed. She further added that the board decided inflation at around 3-point something was unacceptable.

- CBRT raises its end-2026 inflation forecast to 15-21% (prev. 13-19%).

NOTABLE US HEADLINES

- US Treasury Secretary Bessent agreed with the suggestion that the Senate Banking Committee could investigate Fed Chair Powell, instead of the Department of Justice, Semafor reports citing sources.

GEOPOLITICS

RUSSIA-UKRAINE

- Ukraine's Air Force warns of a likely launch of Russian intermediate-range ballistic missile.

- An oil refinery has reportedly caught fire in Russia's Komi due to a drone attack, RIA reported.

- Russia warns it will retaliate if Europe tries to create military capabilities against it, according to Al Arabiya.

- Witnesses reported explosions in Ukraine's capital of Kyiv.

MIDDLE EAST

- Turkish top diplomat said US and Iran are showing flexibility on a nuclear deal, according to FT.

OTHERS

- South Korean MPs say North Korea is accelerating its program to develop and manufacture drones based on experience from the Russia-Ukraine battlefield, citing the spy agency.

- North Korea is said to be developing a submarine that can carry 10 submarine-launched ballistic missile, according to an MP citing South Korea's spy agency. North Korea-Russia collaboration excludes modern tech and nuclear programs. North Korea seeks to improve relations despite dissatisfaction with China.

- Sounds of explosions at the US base in the countryside of Al-Hasakah, Syria, due to the explosion of mines, Al Arabiya reported citing sources; details light.

- US Energy Secretary Wright said US wants no conflict and no military action for the Americas. US is working seven days a week to issue new licenses.

CRYPTO

- Bitcoin rebounds slightly, holding above USD 67k. Ethereum nears USD 2k.

- Standard Chartered projects Bitcoin to fall to USD 50k, and Ethereum to fall to USD 1.4k in the "next few months"; cuts its year-end forecast to USD 100k (prev. saw 150k), year-end Ethereum forecast to USD 4k (prev. USD 7.5k).

APAC TRADE

- APAC stocks were ultimately mixed with a slightly positive bias amongst the major indices as the region reflected on earnings releases and the better-than-expected US jobs data, while Japan's benchmark hit a fresh record high on return from holiday, before fading the gains.

- ASX 200 was led higher by strength in utilities and financials after shares in Origin Energy and ANZ Group rallied post-earnings, but with upside in the broader market capped by hawkish rhetoric from RBA Governor Bullock.

- Nikkei 225 swung between gains and losses, in which the index initially climbed to above the 58,000 level for the first time, but then briefly wiped out all of its gains as currency strength persisted.

- Hang Seng and Shanghai Comp were mixed with the Hong Kong benchmark dragged lower by underperformance in the likes of Budweiser and NetEase following their earnings releases, with the latter also weighed by tech/AI-related headwinds, which dragged other large tech names lower such as Tencent, Baidu and Meituan, while AI startup Zhipu shares surged around 36% after the release of its new model. Conversely, the mainland treaded water following another firm liquidity operation by the PBoC and after China's State Council held a session on boosting AI use, with Premier Li urging to promote the use of AI in various sectors, while there are also expectations for the US and China to extend the trade truce by up to a year during the expected Trump-Xi meeting in April.

NOTABLE ASIA-PAC HEADLINES

- Japan is said to have requested US Fed/NY Fed JPY rate check back in January.

- Japan's top currency diplomat Mimura won't comment on FX levels and said closely watching markets with a high sense of urgency, also said they are not lowering our guard and are in contact with US authorities.

- Japanese Finance Minister Katayama discussed with PM Takaichi about how to proceed with tax credits for benefits and sales tax cut on food, while she did not discuss forex with the PM, according to Jiji.

- Softbank (9984 JT) CFO Goto said nothing has been decided about an additional funding round for OpenAI.

NOTABLE APAC DATA RECAP

- Australian Consumer Inflation Expectations (Feb) 5.0% (Prev. 4.6%).

- Japanese PPI YoY (Jan) Y/Y 2.3% vs. Exp. 2.3% (Prev. 2.4%, Low. 2.0%, High. 2.5%).

- Japanese PPI MoM (Jan) M/M 0.2% vs. Exp. 0.2% (Prev. 0.1%, Low. -0.1%, High. 0.4%).

NOTABLE APAC EQUITY HEADLINES

- Nissan Motor (7201 JT) 9-month (JPY): Net income -250.22bln (prev. 5.15bln Y/Y), Revenue 8.58tln (prev. 9.14tln Y/Y). Raises its FY revenue forecast to 11.90tln (prev. 11.70tln) and sees narrower FY operating loss at 60bln.

- Softbank (9984 JT) Q3 (JPY): Net Income 248.59bln (exp. 857.01bln), Net Sales 1.98tln (exp. 1.96tln).

- Lenovo (992 HK) Q3 (USD) net 546mln (prev. 693mln Y/Y), pre-tax profit rose 48% Y/Y to 803mln, rev. 22.2bln (prev. 18.8bln Y/Y).