US equity futures entirely in the green, despite AMZN -7.7% pre-market; Informal US-Iran talks are underway - Newsquawk US Market Open

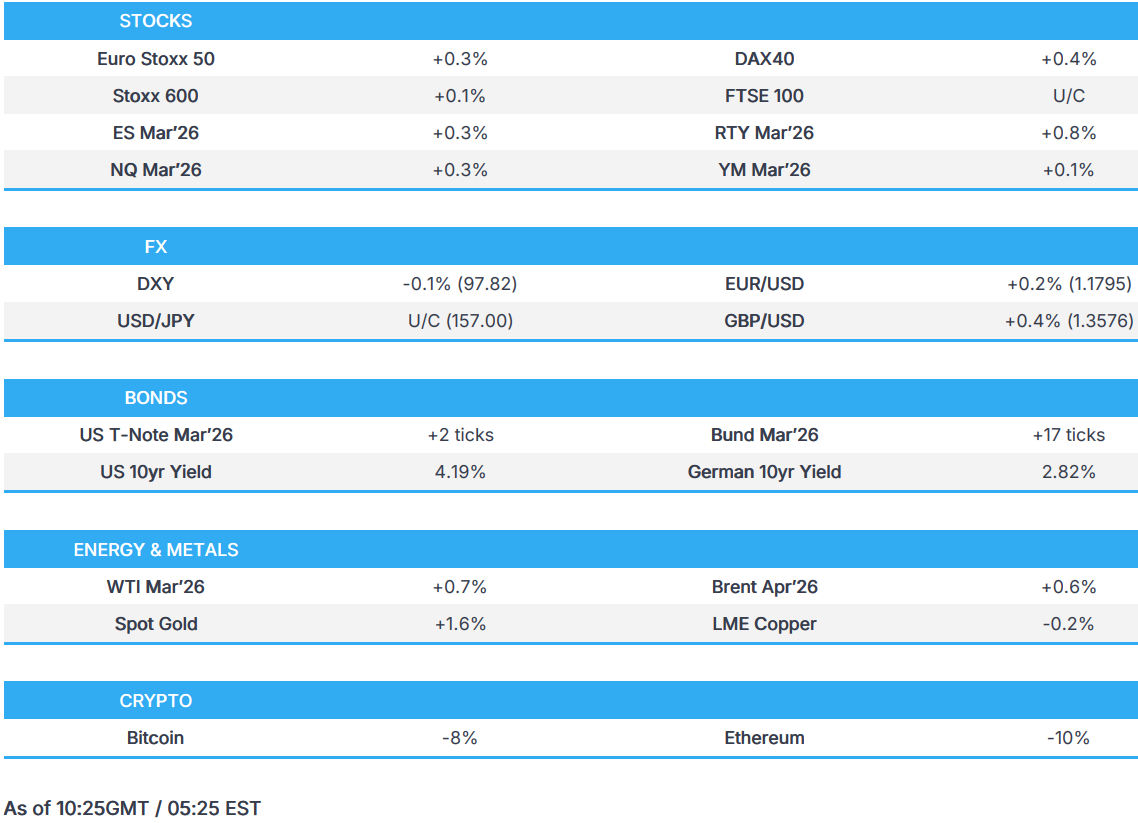

- European bourses were initially lower, but now mixed whilst US equity futures are firmer; AMZN -7.7% pre-market.

- DXY is mildly lower, G10s are broadly firmer across the board with outperformance in the Antipodeans.

- USTs hold onto recent gains, Bunds digest ECB speak whilst Gilts take a breather.

- Crude prices dip as US and Iran informal talks enter the second round; Metals pare back earlier losses as high volatility continues.

- Looking ahead, Canadian Jobs Report (Jan), US Prelim. Michigan (Feb), Speakers include BoEʼs Pill & Fed's Jefferson.

- Earnings from Biogen, Under Armour, Carlyle Group, Philip Morris International.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.1%) broadly opened on the backfoot but have gradually moved higher as the morning progressed.

- European sectors opened with a clear negative bias but are now mixed. Construction leads, boosted by upside in Vinci (+6.5%). To the downside, Autos has been hit by significant pressure in Stellantis (-22.3%). The Co. noted it is to take a EUR 22bln charge as it resets its business and scales back on its recent EV push.

- US equity futures are firmer across the board and gradually picked up alongside strength across European equities. In pre-market trade: Amazon (-7.7%) sinks as it prepares for a USD 200bln AI spending boost, offsetting a Q4 revenue beat.

- Strategy (MSTR) Q4 2025 (USD): Revenue 123mln (exp. 119mln); holds 713,502 BTC.

- Amazon.com Inc. (AMZN) Q4 2025 (USD): EPS 1.95 (exp. 1.96), Revenue 213.4bln (exp. 211.42bln). AWS net sales 35.60bln (exp. 34.88bln). AWS net sales ex-FX +24% (exp. 21%). North America net sales 127.08bln (exp. 127.21bln). Physical stores net sales 5.86bln (exp. 5.88bln). Operating income 25bln (exp. 24.8bln). Operating margin 11.7% (exp. 11.7%). Outlook. Guidance assumes no additional restructuring. Q1 operating income 16.5-21.5bln (exp. 22.2bln). Q1 sales 173.5-178.5bln (exp. 175.6bln). 2026 capex about 200bln (exp. 146.11bln).

- Stellantis (STLAM IM/STLAP FP) to incur a charge of EUR 22.2bln, in relation to a business reset which aims to support profitable growth.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY marginally pulled back since the start of the APAC session after gaining against its peers yesterday amid haven appeal and as the buck continued to nurse some of its YTD weakness, with momentum following the Warsh Fed Chair nomination remaining intact yesterday, despite the slew of weaker-than-expected labour market metrics. The European morning has seen trade within tight parameters as traders look ahead to the University of Michigan prelim survey and comments from Fed's Jefferson. DXY resides in a 97.75-97.97 range after finding support near 98.00 once again after printing a 97.60-97.98 parameter yesterday.

- EUR/USD ekes mild gains and retested the 1.1800 level, albeit with price action contained following the uneventful ECB policy announcement yesterday, with several ECB speakers offering commentary today, albeit with no obvious impact on EUR assets. Further, the ECB Survey of Professional Forecasters suggested headline and core HICP inflation expectations unchanged across all horizons, while Real GDP growth expectations unchanged except for a slight upward revision for 2026. EUR/USD currently trades within a 1.1765-1.1801, versus Thursday's 1.1775-1.1822 range.

- GBP/USD regained some composure after the prior day's underperformance, which was caused by the BoE's dovish vote split and UK political woes and calls grow for UK PM Starmer to resign. GBP/USD trades between 1.3508-1.3581 compared to yesterday's wide 1.3518-1.3654 parameter.

- USD/JPY declined overnight but trimmed losses to trade flat at the time of writing, but with price action choppy ahead of the election on Sunday and following disappointing Household Spending data from Japan, while BoJ's Masu reiterated that the central bank will raise rates if the economy and prices are in line with the BoJ's outlook.

- Antipodeans outperform across the G10 space, rebounding from a weekly trough as the early sell-off in metals and stocks gradually stabilised and then reversed.

FIXED INCOME

- USTs are firmer by a handful of ticks, remaining at the elevated levels seen in the prior session. As a reminder, the strength seen on Thursday was attributed to: a) risk-off sentiment, b) poor US jobs data, c) a dovish hold at the BoE. Newsflow is lacking this morning, aside from the recommencement of US-Iran talks in Oman – the key risk is that talks break down, leading to a potential US strike on Iran. Geopols aside, focus will be on the US data slate, which includes the UoM survey. Currently within a 112-06+ to 112-16+ range.

- Bunds are also firmer this morning, following peers; currently firmer by around 15 ticks and trading within a 128.31-128.58 range. Earlier, German Exports rose more than expected with Imports also topping expectations – promising data from the region, though more focus was on the Industrial Production. The metric fell sharply in December, which highlights the uncertain nature of Germany’s recovery. Following this data, Bunds rose from 128.37 to a high of 128.46, before scaling back to just under the 128.40 mark where the benchmark currently resides. Several ECB speakers have appeared throughout the day, Kazaks highlighted risks of the stronger EUR, whilst Rehn suggested that there's a real risk of lower-than-expected inflation.

- Australia sold AUD 800mln 1.00% December 2030 bonds, b/c 4.14, avg. yield 4.3641%.

COMMODITIES

- WTI and Brent briefly dipped below USD 63/bbl and USD 67/bbl, respectively at the start of the Asia-Pac session, before steadily bidding higher as European trade gets underway. The key event traders will be looking out for today is any reporting following the US-Iran nuclear talks in Oman. As of writing, the meeting has gotten underway but there have been reports that a convoy carrying US officials has left the site where the talks have been taking place.

- Spot gold is trading stronger today and currently at the upper end of a USD 4,655.23-4,903.40/oz range, and just above its 21 DMA (USD 4,848/oz). Focus remains on geopolitical updates out of Oman as the US and Iran remain in meetings.

- Base metals hold a negative bias this morning but have gradually picked up off worst levels as the risk tone improves. 3M LME Copper currently trades in a USD 12,540-12,896.78/t range.

- China's National Gold Group to constrain precious metals repurchase business from the 7th of February.

- China's Shanghai Gold Exchange to increase margin ratios, price limits for some gold and silver contracts from the 9th of February closing settlement.

- Weekly SHFE warehouse stocks change (W/W): Copper +6.8%, Aluminium +13.1%, Zinc +8.5%, Lead +56.4%.

- Iraq's SOMO Director said they are planning to boost oil export from the south by 120k BPD.

- Thailand's TFEX announces the temporary trading halt of silver online futures.

- Mexico reportedly evaluating how to send fuel to Cuba while avoiding US tariffs.

TRADE/TARIFFS

- Japan and US 1st round of investment to include gas power, ports and artificial diamond, totalling JPY 6-7tln, Nikkei reported.

- Chinese Commerce Ministry said they will lead policy measures to promote travel service exports and boost inbound consumption.

- French President Macron to visit Japan at the end of March, via Nikkei.

- South Africa Trade Minister said they signed a framework economic partnership with China, while the agreement will be followed by an early harvest agreement by end of March 2026, which will then see China provide duty-free access to South African exports.

- South Korea Foreign Minister said South Korea is not intentionally delaying US investment.

- Venezuela and Qatar review bilateral agenda to strengthen cooperation.

NOTABLE EUROPEAN HEADLINES

- Russian Ambassador said the UK and France should participate if there is a serious talk multilateral nuclear disarmament.

- UK and China working group will work towards an MOU between the PBoC and BoE.

- ECB's Escriva said there is always room for changes in monetary policy; inflation is at target and expectations are anchored.

NOTABLE EUROPEAN DATA RECAP

- UK BBA Mortgage Rate (Jan) 6.62% (Prev. 6.77%).

- UK Halifax House Price Index MoM (Jan) M/M 0.7% vs. Exp. 0.1% (Prev. -0.5%, Rev. From -0.6%).

- UK Halifax House Price Index YoY (Jan) Y/Y 1.0% (Prev. 0.4%, Rev. From 0.3%).

- Spanish Industrial Production YoY (Dec) Y/Y -0.3% (Prev. 4.6%, Rev. From 4.5%).

- French Exports (Dec) 53.1B (Prev. 52.2B, Rev. From 52.2B).

- French Current Account (Dec) -0.60B (Prev. -0.30B, Rev. From -0.8B).

- French Balance of Trade (Dec) -4.8B vs. Exp. -4.1B (Prev. -4.0B, Rev. From -4.2B).

- French Imports (Dec) 57.9B (Prev. 56.2B, Rev. From 56.4B).

- Swedish CPIF MoM Prel (Jan) M/M 0.2% vs. Exp. 0.3% (Prev. 0.1%).

- Swedish CPIF YoY Prel (Jan) Y/Y 2% vs. Exp. 2.1% (Prev. 2.1%).

- Swedish Inflation Rate MoM Prel (Jan) M/M 0.1% vs. Exp. 0.4% (Prev. 0%).

- Swedish Inflation Rate YoY Prel (Jan) Y/Y 0.4% vs. Exp. 0.6% (Prev. 0.3%).

- Norwegian Manufacturing Production MoM (Dec) M/M -0.1% (Prev. 2.4%).

- German Balance of Trade (Dec) 17.1B vs. Exp. 14.1B (Prev. 13.1B, Rev. From 13.1B).

- German Exports MoM (Dec) M/M 4.0% vs. Exp. 1% (Prev. -2.5%).

- German Industrial Production MoM (Dec) M/M -1.9% vs. Exp. -0.3% (Prev. 0.8%).

- German Imports MoM (Dec) M/M 1.4% vs. Exp. 0.2% (Prev. 0.8%).

CENTRAL BANKS

- BoJ's Masu said he does not think the BoJ is behind the curve and need to monitor the impact of FX on inflation. Timing of rate hikes to neutral is not predetermined. Not suggesting food price moves need immediate action. Watching food inflation beyond rice prices. Policy should be carefully guided to keep underlying inflation around 2%. True that Japan's negative real interest rate is likely behind rises in property prices. Past pace of rate hikes will not be any guide to the future pace of hikes.

- BoJ's Masu said the central bank is closely watching FX market moves and their impact on the economy and prices, also noted that appropriate and timely rate hike is needed. said:. BoJ will raise rates if the economy and prices are in line with the BoJ's outlook. Cause of inflation also warrants close attention, in terms of whether inflation is truly caused by supply-side factors alone or by a combination of both demand- and supply-side factors. Real interest rate remains at a significantly negative level in Japan. Convinced that continuing with further policy interest rate hikes will be needed to complete the normalisation of monetary policy in Japan.

- BofA expects ECB to hold rates in 2026 (prev. 25bp cut in March), sees 25bps cuts in March and June 2027.

- ECB Survey of Professional Forecasters: Headline and core HICP inflation expectations unchanged across all horizons; Real GDP growth expectations unchanged except for a slight upward revision for 2026. Unemployment rate expectations unchanged for 2026 and 2027 but slightly lower thereafter.

- ECB's Muller said December's outlook still good for basic decision making.

- ECB's Rehn on their next meeting in March said they will be receiving new data and updates for ECB's forecast, allowing them to refine their assessment of the Euro area's growth momentum and inflation dynamic. Any changes in the key interest rates in the future, if justified and not executed. Highlights that there's a real risk of lower than expected inflation.

- ECB's Kazaks said that rapid EUR strengthening may trigger a response from the ECB.

- ECB's Villeroy said downside risks are probably more significant; the ECB has no FX target.

- ECB's Stournaras said "we are monitoring exchange rates"; have strong confidence in the economic outlook. ECB is monitoring the FX rate, but euro increase has not been dramatic. FX rate levels are not a primary focus. January inflation data should be viewed in context. Meeting-by-meeting approach has been good practice. Judges that risks are balanced. Do not think we have to take any action now.

- RBA Governor Bullock said RBA board is not happy with inflation and the prospects of getting it down.

- RBA Governor Bullock said much of the recent increase in inflation is judged to be temporary, but some of it seems to be persistent, adds Board will be monitoring closely the extent to which the strong inflation we have observed is persistent or temporary. said:Labour market is still doing very well, calling it good news.

- RBI maintains Repurchase Rate at 5.25%, as expected, via unanimous decision and maintains neutral policy stance.

NOTABLE US HEADLINES

- South Korean official said US is taking necessary steps regarding the issue of South Korea being on sensitive country lists, according to Yonhap.

GEOPOLITICS

RUSSIA-UKRAINE

- Russian Ambassador said the UK and France should participate if there is a serious talk multilateral nuclear disarmament.

- Russia's Kremlin said Abu Dhabi talks will continue; on nuclear talks, said Russia and the US realise the need to begin talks soon.

- Deputy Head of Russian Military intelligence shot in Moscow, sources report.

MIDDLE EAST

- Iranian media reported that the second round of Muscat talks does not signify the start of negotiations, and these initial sessions have been held for each party to coordinate with the Omani mediator.

- Second round of nuclear negotiations between the US and Iran have gotten underway.

- An Iranian diplomatic person said the presence of CENTCOM or any military officials can jeopardise indirect nuclear talks between the US and Iran.

- A convoy reportedly carrying American officials leaves the site of the US-Iran talks in Oman, the AP reported; details light.

- US envoy Kushner is also attending US-Iran talks, according to Iranian state TV.

- Iran and US commence nuclear talks in Oman, Iranian media reported.

- Iran's Foreign Minister said they are fully prepared to defend Iran's sovereignty and security against any transgressions.

- US-Iran talks are reportedly delayed by a few hours.

- Israeli media reported that Israeli PM Netanyahu said in closed sessions of the Knesset that political, military and economic factors brought Iran closer to a critical point, although he did not consider the fall of the government to be certain. He warned that any Iranian attack would be met with a "strong response".

- US President Trump posted "Rather than extend “NEW START” (A badly negotiated deal by the United States that, aside from everything else, is being grossly violated), we should have our Nuclear Experts work on a new, improved, and modernized Treaty". Full post: "The United States is the most powerful Country in the World. I completely rebuilt its Military in my First Term, including new and many refurbished nuclear weapons. I also added Space Force and now, continue to rebuild our Military at levels never seen before. We are even adding Battleships, which are 100 times more powerful than the ones that roamed the Seas during World War II — The Iowa, Missouri, Alabama, and others. I have stopped Nuclear Wars from breaking out across the World between Pakistan and India, Iran and Israel, and Russia and Ukraine. Rather than extend “NEW START” (A badly negotiated deal by the United States that, aside from everything else, is being grossly violated), we should have our Nuclear Experts work on a new, improved, and modernized Treaty that can last long into the future. Thank you for your attention to this matter! PRESIDENT DONALD J. TRUMP".

OTHERS

- US to resume aid to North Korea whilst outreach stalls, via the WSJ. According to a US official, the decision isn't an act of gesture but rather as a de facto block on aid to North Korea.

- Senior South Korea official said expects progress in a few days regarding the North Korea issue, according to Yonhap.

CRYPTO

- Bitcoin is on the backfoot and trades around USD 66k; Ethereum follows suit and now down towards USD 1.9k.

APAC TRADE

- APAC stocks were ultimately mixed after the global market rout rolled over into the region following the continued tech woes stateside and weak US labour market data. Nonetheless, most of the regional benchmark indices are well off their worst levels, as the early sell-off gradually stabilised.

- ASX 200 was among the underperformers with the index dragged lower by heavy tech losses, and with sentiment also not helped by M&A-related disappointment after the proposed Rio Tinto-Glencore merger fell through, while there were comments from RBA Governor Bullock, who noted the RBA board is not happy with inflation and the prospects of getting it down.

- Nikkei 225 initially declined amid the broad risk-off mood and disappointing Household Spending data, but then recovered as sentiment improved and with participants awaiting the snap election on Sunday, where the ruling bloc is widely anticipated to achieve a landslide victory.

- Hang Seng and Shanghai Comp were mixed amid a lack of fresh pertinent catalysts and with the mainland clawing back all of its early losses following another two-pronged liquidity operation by the PBoC utilising both 7-day and 14-day reverse repos.

NOTABLE ASIA-PAC HEADLINES

- Indonesian President said they signed a security treaty with Australia.

- Former Bank of China (3988 HK) Vice President was expelled from the China Communist Party for serious violations of discipline and law.

- China's Ministry of Agriculture issues implementation plan to advance rural revitalisation and agricultural modernisation.

- Japan ruling parties expected to win over 300 seats out of the 465 seats in the lower house election, according to Nikkei.

NOTABLE APAC DATA RECAP

- Japanese Leading Economic Index Prel (Dec) 110.2 vs. Exp. 109.8 (Prev. 109.9).

- Japanese Coincident Index Prel (Dec) 114.5 (Prev. 114.9).

- Japanese Foreign Exchange Reserves (Jan) 1.39T (Prev. 1.37T).

- Japanese Household Spending YoY (Dec) Y/Y -2.6% vs. Exp. 0% (Prev. 2.9%, Low. -3.7%, High. 1.0%).

- Japanese Household Spending MoM (Dec) M/M -2.9% vs. Exp. -1.3% (Prev. 6.2%, Low. -3.5%, High. 0.1%).