US equity futures entirely in the red as markets await Trump's announcement of the next Fed Chair; Warsh emerges as frontrunner - Newsquawk US Market Open

- US President Trump says he will announce his Fed pick on Friday. Reports suggest the administration is leaning towards Warsh.

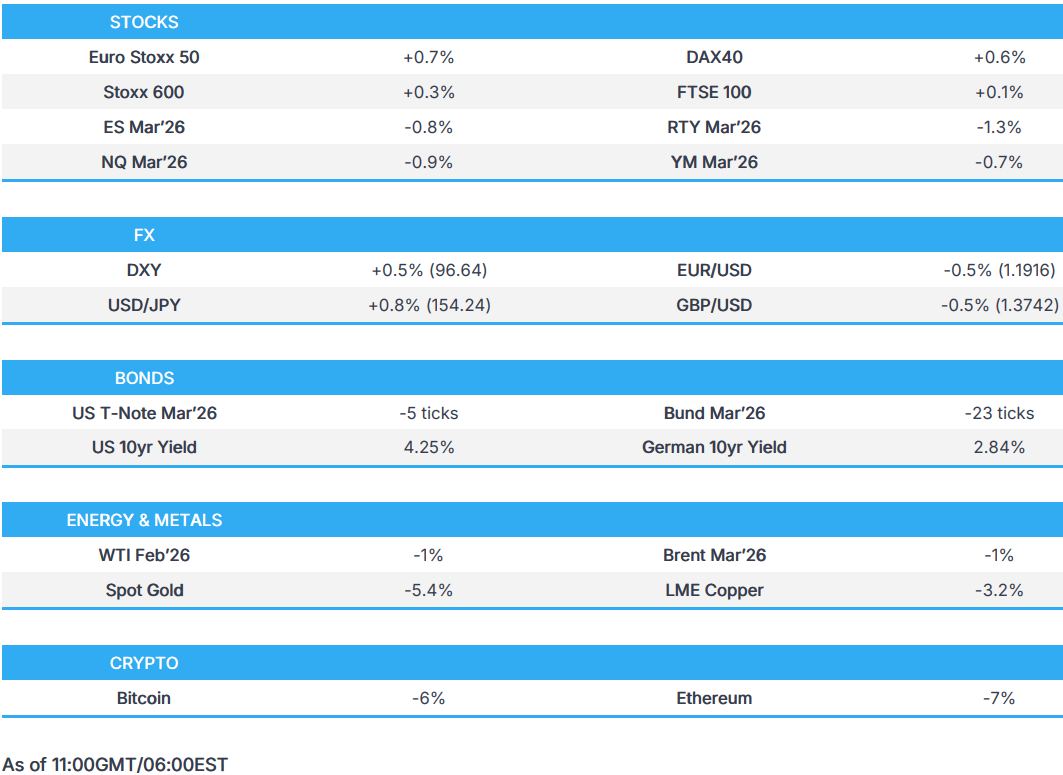

- DXY bid, USTs lower with the yield curve steeper and US equity futures down (ES -0.8%) amid the Warsh speculation.

- XAU lost the USD 5k/oz handle and XAG below USD 100/oz in a pullback from recent highs and amid USD strength.

- Crude curtailed by the USD, and as Trump plans to meet with Iranian officials

- AUD hit on metal action, JPY digests Tokyo CPI, EUR unaffected by German state CPIs and EZ GDP

- Looking ahead, highlights include German HICP (Jan), Canadian GDP (Dec), US PPI (Dec), Speakers including Fed's Musalem, Bowman, Miran, Waller.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 +0.3%) have opened mostly on a firmer footing. Strength comes amid a rebound in the DAX 40 (+0.7%) after yesterday's SAP-induced pressure, a narrative added to by strong Adidas (+5.2%) earnings.

- European sectors are mostly in the green, leading are Banks, Travel & Leisure and Technology. The former have been underpinned by reports that Kevin Warsh is likely to be the next Fed Chair, which has bolstered global yields. Furthermore, the sector benefits from gains in Caixabank (+4.0%) after the Co. announced that it expects NII to grow in 2026. To the downside, Basic Resources has been weighed down by pressure in metal prices, whilst energy has been pinned down by crude as the complex gives back gains.

- US equity futures are lower across the board (ES -0.7%, NQ -0.9%, RTY -1.2%), with clear underperformance in the economy-linked RTY, as the odds of the relatively "more hawkish" Chair candidate, Warsh, replacing Chair Powell increase.

- Apple Inc. (AAPL) Q1 2026 (USD): EPS 2.84 (exp. 2.67), Revenue 143.8bln (exp. 138.36bln). iPhone had unprecedented demand for iPhone in quarter. Dividend 0.26/shr. Wearables, Home and Accessories net sales 11.49bln (exp. 12.04bln). Mac net sales 8.39bln (exp. 8.95bln). iPad net sales 8.60bln (exp. 8.13bln). iPhone net sales 85.27bln (exp. 78.65bln). Greater China net sales 25.53bln (exp. 21.32bln). Services net sales 30.01bln (exp. 30.07bln). -0.6% in pre-market trade, ended after-hours trade roughly flat

- Sandisk (SNDK) Q2 2026 (USD): Adj. EPS 6.20 (exp. 3.62), Revenue 3.03bln (exp. 2.69bln). Kioxia and Sandisk continue Yokkaichi JV agreement through 2034, whereby Sandisk will pay Kioxia USD 1.165bln.Q3 outlook. Adj. EPS 12-14 (exp. 4.62). Revenue 4.4-4.8bln (exp. 2.84bln). +19.5% in pre-market trade

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is on a firmer footing today, following reports that the US administration is leaning towards Kevin Warsh to replace Fed Chair Powell – President Trump said he will make the announcement on Friday. Further details surrounding specific timing is currently light, aside from a couple of appearances towards the later part of the day. As it stands, Warsh’s odds have risen to ~94% (prev. 34% pre-report), whilst Rieder has fallen to ~4% (prev. 34.6% pre-report). DXY currently at the upper end of a 96.16-96.76 range.

- G10s are entirely losing against the firmer Dollar, with clear underperformance in the Aussie as it takes a hit from the pressure seen across underlying metals prices. JPY also towards the bottom of the pile, with USD/JPY currently trading at the upper end of a 152.86-154.38 range. Two factors for the JPY today; a) widening yield differentials as traders weigh a potential Warsh pick, b) softer-than-expected Tokyo CPI, better-than-expected Industrial Production and weak Retail Sales.

- EUR has had a slew of EZ data to digest throughout the day. French GDP contracted a touch from the prior, whilst Spanish, Italy and Germany was a little more upbeat. The German figure itself spurred some minor pressure in the single currency at the time, with the pair then trundling lower as the morning progressed. No move to the EZ GDP metrics, which topped exp. but contracted a touch from the prior. At the same time was the release of several German State CPIs, which on balance was more-or-less in-line with what is expected from the mainland figure due at 13:00 GMT. One point to note is that the NRW state held a bit more of a hawkish skew (0.1% M/M vs prev. 0.0%; mainland expects 0.0%). Currently trades in a 1.1894-1.1974 range.

FIXED INCOME

- USTs on the backfoot as Kevin Warsh will reportedly be nominated by President Trump later today for the Fed Chair position. Reaction occurring as while Warsh has called for immediate rate cuts, his policy stance is net-hawkish vs the other options available to Trump. While Warsh will likely call for lower policy rates, given his recent commentary and the clear pressure from the administration, the main point of focus will be on the balance sheet, as Warsh has long been critical of QE and a large balance sheet. USTs at a 111-17+ low, a tick above Thursday's base, which itself is a tick above the WTD 111-15+ low. Amidst this, yields are firmer across the curve, which itself is steeper with action led by the long-end, as while Warsh is a hawkish pick vs the other options, he ultimately will still try to push rates lower in the near term, which may drive inflation and by extension rates higher on a longer horizon.

- That aside, the morning's stronger-than-expected German Q4 GDP sent Bunds to a 128.07 low with losses of 26 ticks at most. In proximity, we saw the German state CPIs hit ahead of the 13:00GMT mainland figure, the M/M skew was broadly in-line with the mainland consensus, while the Y/Y skew was a hawkish one. For reference, German CPI is expected at 2.0% Y/Y (prev. 1.8%) and 0.0% M/M (prev. 0.0%).

- Gilts gapped lower by 26 ticks before slipping further to a 90.59 trough, given the bias from USTs. Since, the benchmark has rebounded a touch and is holding around 90.90, some 10 ticks above opening levels, but still in the red by c. 15 ticks.

- Japan sold JPY 2.2tln in 2-year JGBs; b/c 3.88x (prev. 3.26x); average yield 1.253% (prev. 1.129%). Lowest accepted price 100.080 vs. prev. 99.920. Weighted average price 100.090 vs prev. 99.942. Tail in price 0.010 vs prev. 0.022.

- Australia sold AUD 1bln 4.25% March 2036 bonds, b/c 3.34, avg. yield 4.8039%.

- IBM (IBM) raises nearly USD 7.5bln via cross-border bond sale.

COMMODITIES

- Crude benchmarks started the Asia-Pac session on the backfoot, partially driven by the stronger greenback, but primarily by comments from President Trump, who said he plans to have talks with Tehran and hopes the US do not have to use the big, powerful ships. WTI dropped to a trough of USD 64.30/bbl following the potential Fed Chair announcement reports re. Warsh, before immediately paring back the entirety of the move. Around 30 minutes later, on the Trump comments, prices steadily dropped, and WTI hit a low of USD 63.65/bbl. Benchmarks have since consolidated in a broad c. USD 1.00/bbl range.

- Precious metals slide as European trade continues, with spot XAU currently trading at USD 5090/oz, nearly USD 500/oz lower from the ATH made in Thursday's session. The yellow metal briefly lost USD 5k/oz, slipping to a USD 4941/oz trough before rebounding.

- Spot silver has slipped even further and has wiped out the entirety of this week's gains, to sub-100/oz. This comes following the recent strength in the greenback as Kevin Warsh emerges as the frontrunner for the Fed Chair role, with markets suggesting that he is more hawkish than other candidates such as Rick Rieder. President Trump is set to announce the pick later today.

- Alongside precious metals, base metals have been hit by the stronger dollar, with 3M LME Copper briefly tagging USD 13.1k/t before slightly paring back losses but remaining below USD 13.5k/t. For context, the red metal was trading at USD 14.53k/t just 18 hours ago.

- OPEC+ likely to keep its pause on oil output increases for March at Sunday meeting, according to sources.

- ArcelorMittal (MT NA) and Liberia sign a new long-term mineral development agreement. "The expansion project, which is nearing completion, will see iron ore shipments increase from historic levels of approximately 5 million tonnes per annum (mtpa) to 20 mtpa in 2026 alongside improvements in product quality to higher grade, higher value ore.". "The Company is also undertaking feasibility studies for further expansion of its iron ore asset beyond 20 mtpa.".

- Explosion reported in an oil refinery at northwestern Turkish province of Kocaeli, while causes of the explosion at the oil refinery are unknown, according to Al-Arabiya.

- LME trading has now opened following a delay due to technical issues.

- White House clarifies that US sanctions relief for Venezuela covers refining and other downstream activities, but not upstream production and White House official said more announcements on Venezuela sanctions easing are expected.

- London Metal Exchange delays market opening due to technical issues, according to Bloomberg.

TRADE/TARIFFS

- China is to lower tariffs on whisky imports to 5% from February 2nd.

- US President Trump said it is ‘very dangerous’ for the UK to get into business with China and even more dangerous for Canada to get into business with China.

- US President Trump threatens to charge Canada a 50% tariff on any and all aircraft sold to the US.

- White House noted that US President Trump signed an executive order declaring a national emergency and establishing a process to impose tariffs on goods from countries that sell or otherwise provide oil to Cuba.

NOTABLE EUROPEAN HEADLINES

- UK and China weigh a cross-border asset management scheme to deepen market ties, according to SCMP.

- US Treasury said semi-annual currency report concluded no major US trading partners manipulated currency to gain unfair trade advantage during four quarters through June 2025.

NOTABLE EUROPEAN DATA RECAP

- EU GDP Growth Rate YoY Flash (Q4) Y/Y 1.3% vs. Exp. 1.2% (Prev. 1.4%).

- EU GDP Growth Rate QoQ Flash (Q4) Q/Q 0.3% vs. Exp. 0.2% (Prev. 0.3%).

- EU Unemployment Rate (Dec) 6.2% vs. Exp. 6.3% (Prev. 6.3%).

- Italian Unemployment Rate (Dec) 5.6% vs. Exp. 5.8% (Prev. 5.6%, Rev. From 5.7%).

- Italian GDP Growth Rate YoY Adv (Q4) Y/Y 0.8% vs. Exp. 0.5% (Prev. 0.6%).

- Italian GDP Growth Rate QoQ Adv (Q4) Q/Q 0.3% vs. Exp. 0.2% (Prev. 0.1%).

- UK BoE Consumer Credit (Dec) 1.524B vs. Exp. 1.7B (Prev. 2.143B, Rev. From 2.077B, Low. 1.7B, High. 1.9B).

- UK Net Lending to Individuals MoM (Dec) M/M 6.1B vs. Exp. 6.1B (Prev. 6.6B, Low. 64B, High. 66B).

- UK Mortgage Lending (Dec) 4.60B vs. Exp. 4.5B (Prev. 4.59B, Rev. From 4.49B, Low. 4.2B, High. 4.8B).

- UK Lloyds Business Barometer (Jan) 44 (Prev. 47).

- German GDP Growth Rate QoQ Flash (Q4) Q/Q 0.3% vs. Exp. 0.2% (Prev. 0.0%, Low. 0.1%, High. 0.4%).

- German GDP Growth Rate YoY Flash (Q4) Y/Y 0.4% vs. Exp. 0.3% (Prev. 0.3%, Low. 0.2%, High. 0.5%).

- German North Rhine Westphalia CPI YoY (Jan) Y/Y 2.0% (Prev. 1.8%).

- German North Rhine Westphalia CPI MoM (Jan) M/M 0.1% (Prev. 0%).

- German Unemployment Change (Jan) 0K vs. Exp. 4K (Prev. 3K).

- German Unemployed Persons (Jan) 2.976M (Prev. 2.977M).

- German Unemployment Rate (Jan) 6.3% vs. Exp. 6.3% (Prev. 6.3%, Low. 6.3%, High. 6.4%).

- German Import Prices YoY (Dec) Y/Y -2.3% vs. Exp. -2.6% (Prev. -1.9%).

- German Import Prices MoM (Dec) M/M -0.1% vs. Exp. -0.4% (Prev. 0.5%).

- Spanish Inflation Rate YoY Prel (Jan) Y/Y 2.4% vs. Exp. 2.3% (Prev. 2.9%).

- Spanish GDP Growth Rate YoY Flash (Q4) Y/Y 2.6% vs. Exp. 2.7% (Prev. 2.8%).

- Spanish GDP Growth Rate QoQ Flash (Q4) Q/Q 0.8% vs. Exp. 0.6% (Prev. 0.6%).

- Spanish Inflation Rate MoM Prel (Jan) M/M -0.4% vs. Exp. -0.3% (Prev. 0.3%).

- Spanish Core Inflation Rate YoY Prel (Jan) Y/Y 2.6% (Prev. 2.6%).

- French PPI MoM (Dec) M/M 0.2% (Prev. 2.8%, Rev. From 1.1%).

- French Private Non Farm Payrolls QoQ Prel (Q4) Q/Q -0.1% (Prev. 0.0%, Rev. From -0.1%).

- French PPI YoY (Dec) Y/Y -2.00% (Prev. -1.50%, Rev. From -3.3%).

- French Household Consumption MoM (Dec) M/M -0.6% vs. Exp. -0.4% (Prev. -0.3%).

- French GDP Growth Rate YoY Prel (Q4) Y/Y 1.1% vs. Exp. 1.2% (Prev. 0.9%).

- French GDP Growth Rate QoQ Prel (Q4) Q/Q 0.2% vs. Exp. 0.2% (Prev. 0.5%).

CENTRAL BANKS

- Trump administration is said to be preparing a Warsh Fed nomination, according to Bloomberg.

- Former Fed Governor Warsh had met with US President Trump at the White House on Thursday, according to Reuters citing a source familiar with the matter.

- US journalist Rachael Bade posted on X "Trump met 2day with his two finalists for Fed Reserve chair -- and is leaning toward KEVIN WARSH to replace Jerome Powell, I'm told". said: "Nothing is official I'm told. But 1 source close to Trump said Warsh basically has the wink & the nod." "KEVIN HASSETT is out. RICK RIEDER was also at the WH today & is the other finalist.".

- US President Trump said he will announce Fed pick tomorrow morning and he has chosen a very good person to lead the Fed. said:. Pick is someone very well-known to the financial world. He will know tonight what happens with the shutdown.

- US Fed Balance Sheet (Jan/28) 6.59T (Prev. 6.59T).

- BoJ keeps its JGB purchasing plan unchanged for February.

- Japanese JPY 2.8tln 2-year JGB Auction 0.7516% (Prev. 1.129%).

- ECB Consumer Expectations Survey (Dec):. Inflation:. 1-year CPI expectations 2.8% vs exp. 2.7% (prev. 2.8%). 3-year CPI expectations 2.6% vs exp. 2.4% (prev. 2.5%). 5-year CPI expectations 2.4% vs (prev. 2.2%). Growth:1-year expectations -1.1% (prev. -1.3%).

- EU ECB Consumer Inflation Expectations (Dec) 2.8% (Prev. 2.8%).

- SNB said they have acknowledged the US Treasury Department's latest report; not engaging in CHF manipulation. Welcomes ongoing discussion as part of macroeconomic dialogue. Neither seeks to prevent balance of payments adjustment nor to gain unfair competitive advantages for the Swiss economy.

- SARB MPC member Loewald is to retire on March 1st.

NOTABLE US HEADLINES

- Large US companies are set to lay off at least 52,000 workers as the jobs market cools, according to FT.

- White House said President Trump will sign executive orders at 11:00EST/16:00GMT and is participating in a policy meeting at 14:00EST/19:00GMT.

- US Senator Graham said Senate will not vote tonight on the spending deal.

- US President Trump and Democrats say a deal is reached to avert a shutdown in which the Senate would move quickly to pass five of the six spending bills that have cleared the House, according to WSJ.

- US President Trump sues the IRS and Treasury for USD 10bln over tax return leaks.

- US House Speaker Johnson said he's not confident that a government shutdown will be avoided.

- US President Trump confirms he's signing a historic executive order to combat the scourge of addiction and substance abuse.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin said US President Trump personally asked Russian President Putin to halt strikes on Kyiv until Feb 1 and create favourable conditions for negotiations.

- Ukraine's President Zelensky said the compromise on territory has not yet been reached; Ukraine will not strike Russian energy infrastructure if Russia halts its attacks on Ukraine's energy infrastructure. Halting strikes on energy targets is a US initiative and a personal proposal of US President Trump. said he is inviting Putin to Kyiv if Putin "dares". No official ceasefire agreement on energy target exists between both countries. Reiterates readiness for leaders summit in any format, but not in Moscow or Belarus.

MIDDLE EAST

- US President Trump said he plans to have talks with Tehran and there are big, powerful ships going to Iran, he hopes they don't have to use them. said:He told the Iranians 'no' to nuclear weapons, stop killing protesters, and that they have to do something.

- US President Trump said have a team headed to Iran.

CRYPTO

- Bitcoin is on the backfoot and trades just above USD 82k whilst Ethereum also extends losses, now around USD 2.7k.

APAC TRADE

- APAC stocks were pressured heading into month-end, as the Apple-related euphoria following record iPhone sales, was dampened as yields gained and the dollar strengthened on reports that the Trump administration is preparing for the nomination of Kevin Warsh as the next Fed Chair.

- ASX 200 was dragged lower by underperformance in miners and resources stocks as metal prices took a hit.

- Nikkei 225 swung between gains and losses following a slew of data releases, including softer-than-expected Tokyo CPI, better-than-expected Industrial Production and weak Retail Sales, but with the downside in the index cushioned by a weaker currency.

- Hang Seng and Shanghai Comp underperformed with little fresh drivers and indirect pressure from US President Trump, who warned of dangers for the UK and Canada regarding getting into business with China, while CK Hutchison shares were hit after reports that the Panama Supreme Court ruled the Co.'s ports contract is unconstitutional.

NOTABLE ASIA-PAC HEADLINES

- The probe into the Air India crash leans toward deliberate pilot action, Bloomberg reported.

NOTABLE APAC DATA RECAP

- Australian Housing Credit MoM (Dec) M/M 0.7% (Prev. 0.6%).

- Australian PPI QoQ (Q4) Q/Q 0.8% (Prev. 1.0%).

- Australian Private Sector Credit YoY (Dec) Y/Y 7.7% (Prev. 7.4%).

- Australian Private Sector Credit MoM (Dec) M/M 0.8% vs. Exp. 0.6% (Prev. 0.6%).

- Australian PPI YoY (Q4) Y/Y 3.5% (Prev. 3.5%).

- Japanese Industrial Production YoY Prel (Dec) Y/Y 2.6% (Prev. -2.2%).

- Japanese Retail Sales MoM (Dec) M/M -2.0% (Prev. 0.6%).

- Japanese Industrial Production MoM Prel (Dec) M/M -0.1% vs. Exp. -0.4% (Prev. -2.7%, Low. -1.5%, High. 0.3%).

- Japanese Tokyo Core CPI YoY (Jan) Y/Y 2.0% vs. Exp. 2.2% (Prev. 2.3%, Low. 2.1%, High. 2.3%).

- Japanese Jobs/applications ratio (Dec) 1.19 vs. Exp. 1.18 (Prev. 1.18, Low. 1.17, High. 1.19).

- Japanese Tokyo CPI Ex Food and Energy YoY (Jan) Y/Y 2% (Prev. 2.3%, Rev. From 2.6%).

- Japanese Unemployment Rate (Dec) 2.6% vs. Exp. 2.6% (Prev. 2.6%, Low. 2.5%, High. 2.6%).

- Japanese Tokyo CPI YoY (Jan) Y/Y 1.5% (Prev. 2.0%, Rev. From 2%).

- Tokyo CPY YY (Jan) 1.5% vs Exp. 1.8% (Prev. 2.0%).

- Tokyo CPY Ex. Fresh Food YY (Jan) 2.0% vs Exp. 2.2% (Prev. 2.3%).

- Tokyo CPY Ex. Fresh Food & Energy YY (Jan) 2.4% vs Exp. 2.6% (Prev. 2.6%).

NOTABLE APAC EQUITY HEADLINES

- Hitachi (6501 JT) is reportedly seeking a buyers for its data storage business, according to Bloomberg.

- LG Electronics (066570 KS) final Q4 (KRW) loss 828bln, oper. loss 109bln (prelim. loss 109bln), rev. 23.9tln (prelim. 23.9tln).