US equity futures gain with the NQ outperforming; precious metals rebound amid geopols updates - Newsquawk US Opening News

- US President Trump warned that the US will “rescue” Iranian protestors if they are shot; the US is “locked and loaded and ready to go”.

- Ukrainian President Zelensky said they are 10% away from a deal to end the war with Russia but not ‘at any cost’, according to The Independent.

- Ukrainian authorities in Zaporizhzhia on January 2nd noted of over 700 Russian attacks on the territory of the province "in the past hours", according to Al Jazeera.

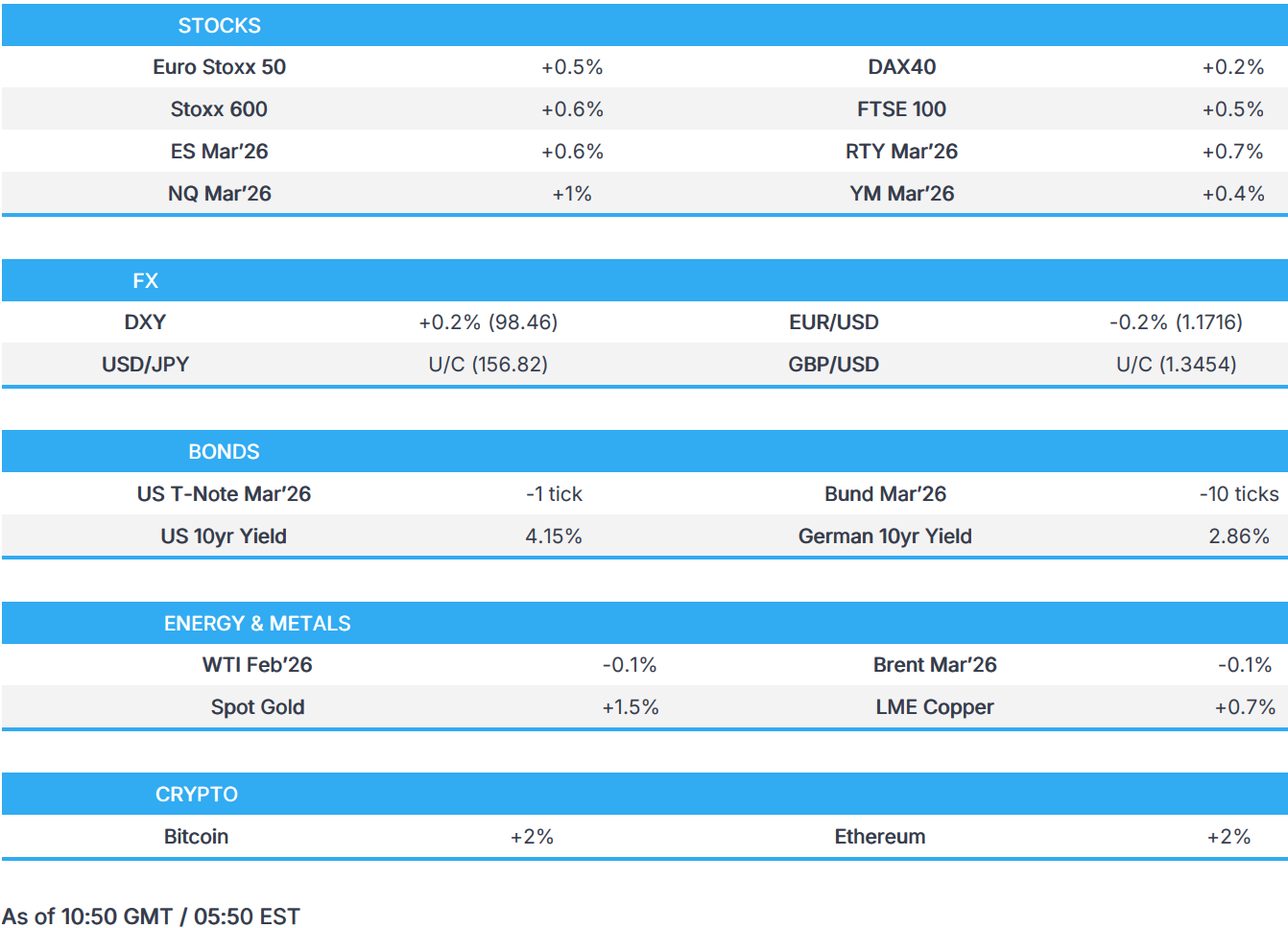

- European bourses were boosted for most of the European morning, but have come off best levels in recent trade; US equity futures gain, with outperformance in the NQ.

- DXY is slightly firmer, Antipodeans lead whilst the EUR is pressured a touch.

- Fixed benchmarks are broadly lower, but are off worst levels in quiet trade.

- Precious metals rebound amid geopolitical updates, Crude focuses on oversupply pre-OPEC.

- Looking ahead, highlights include, Canadian & US Final Manufacturing PMIs.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EQUITIES

- European bourses (STOXX 600 +0.6%) began the session around the unchanged mark before rising to session highs soon after the cash open, without a clear driver. Since, indices have dipped off best levels, paring some of the earlier upside.

- European sectors hold a positive bias, led by Basic Resources (+1.7%), Technology (+1.8%), and Energy (+1.7%). The former is supported by higher metal prices, with gains in gold and copper. On the downside, Food Beverage & Tobacco (-0.3%), Real Estate (-0.3%) and Construction (-0.1%) lag.

- US equity futures (ES +0.6% NQ +1% RTY +0.7%) are firmer with upside in all major indices, with the NQ (+0.9%) outperforming.

- Tesla (TSLA) delivery consensus, figures due c. 14:00GMT/09:00ET on 2nd January.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY resides closer to the upper end of a tight 98.14-98.42 in early European hours, following a rather subdued APAC session.

- In terms of today's trade, price action has been relatively muted as volume returns to the market from the holiday period. AUD and NZD outperform amid the broader risk-on sentiment, with the AUD also underpinned by a rebound in gold amid a myriad of geopolitical factors, including US President Trump's warning to Iran this morning that the US is "locked and loaded and ready" to rescue peaceful protesters if Iran opens fire on them. Elsewhere, JPY is flat in a narrow 156.77-157.00 intraday range. Meanwhile, EUR and GBP saw little immediate move from their respective final Manufacturing PMIs.

- 2025 recap: 2025 proved a tough year for the index, which saw its sharpest annual drop in eight years, whilst most majors rallied. The JPY saw gains of under 1% over 2025, in a year rattled by political instability, fiscal woes, BoJ hawkish bias and haven flows. Antipodeans saw the AUD climb nearly 8% over 2025 (best since 2020) and the NZD gained almost 3% to snap a three-year losing streak. The EUR was up 13.5% in 2025 and GBP +7.7% (both their strongest yearly gains since 2017).

- Click for NY OpEx Details

FIXED INCOME

- A softer start for fixed benchmarks.

- Bunds and USTs lower by 20 and a tick, respectively. Specifics are fairly light aside from Final PMIs which, thus far, have not had any real impact. USTs in the red but at the upper-end of a 112-05 to 112-13 band. If a move into the green occurs, resistance factors at 112-25. A similar picture for Bunds, in the red but just off highs in 127.08-49 parameters. Resistance at 127.57 and 127.83.

- For Gilts, a softer open but the benchmark has since climbed off lows and is, as above, towards highs in 90.74-91.33 parameters. 91.37 would take Gilts back to unchanged on the day, thereafter resistance at 91.47.

COMMODITIES

- WTI and Brent trades slightly lower, with prices towards the lower ends of USD 57.08-57.93/bbl and USD 60.51-61.38/bbl, respectively. Focus for the complex lies more on oversupply risks as opposed to any geopolitical risks from the above, with traders also setting sights on this weekend's OPEC+ confab. OPEC+ is expected to reaffirm its production pause through Q1, maintaining the halt to further supply increases, according to Bloomberg sources. The stance reflects concerns over a looming global oversupply backdrop, with crude prices sharply lower over 2025 and forecasters warning of a potential glut in 2026. Delegates indicate little appetite to resume hikes at this stage, according to reports. Recent Saudi–UAE geopolitical tensions have generated headlines, but are widely viewed as noise rather than a threat to OPEC unity, with no expectation that they will spill over into production policy.

- Spot Gold kicked off 2026 on the front foot, with spot prices currently +1.5% intraday towards the upper end of a 4,326.28-4,397.84/oz range at the time of writing. The yellow metal printed a record high at ~USD 4,550/oz on Dec 26th before declining in the subsequent three sessions to a USD 4,274.03/oz trough on 31st Dec, with a near-USD 250/oz drop seen on Dec 29th.

- Geopolitical updates have kept the precious metals complex underpinned, with US President Trump's warning to Iran this morning that the US is "locked and loaded and ready" to rescue peaceful protesters if Iran opens fire on them. Further, tensions flared between OPEC members Saudi Arabia and the UAE, primarily due to an open military and diplomatic confrontation in Yemen, with the two nations now actively backing rival factions and engaging in direct hostilities. In terms of Russia-Ukraine, Ukrainian President Zelensky said they are 10% away from a deal to end the war with Russia, but not at any cost, according to The Independent. That being said, Ukrainian authorities in Zaporizhzhia on the morning of January 2nd noted over 700 Russian attacks on the territory of the province.

- North Sea Buzzard oil field recommenced production on 1st January 2026, according to CNOOC.

- Rail line in Australia used by Glencore (GLEN LN) requires a significant repair job.

TRADE/TARIFFS

- US President Trump signed a New Year’s Eve proclamation titled “AMENDMENTS TO ADJUSTING IMPORTS OF TIMBER, LUMBER, AND THEIR DERIVATIVE PRODUCTS INTO THE UNITED STATES”. This included a delay in tariff increases on upholstered furniture, kitchen cabinets and vanities for a year, which keeps the tariff levels for the aforementioned goods at 25%, instead of raising it to 30% for upholstered furniture and 50% for kitchen cabinets and vanities, citing ongoing trade talks, according to Associated Press.

- Italy's Foreign Ministry announced on Thursday that the US sharply lowered the proposed duties on several Italian pasta makers from the additional 92% duty proposed in October, with the tariff for La Molisana set to 2.26% and for Garofalo set to 13.98%, while 11 other producers will face tariffs of 9.09%.

- US granted TSMC (2330 TT) an annual licence to import US chipmaking tools for its facilities in China's Nanjing.

- China’s Ministry of Commerce called the EU’s carbon border tax unfair and discriminatory, while it vowed to take countermeasures to defend the country’s interests, according to a statement on Thursday cited by Bloomberg.

- China set quotas on beef imports as it seeks to protect domestic farmers and producers, in a blow to Brazil and other major shippers, including Australia and Argentina, while shipments exceeding the limits will be subject to a 55% duty, according to the Ministry of Commerce.

- India extended tariffs on steel imports for three years with import levies of 11%-12% proposed for some products, according to Bloomberg. It was also reported that India imposed anti-dumping duties of USD 60.89-130.66/ton on low-ash met coke imports for six months.

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer promised to "defeat the decline and division offered by others" in his new year message and insisted that people would feel a "positive change" in their lives in 2026, according to BBC.

- French President Macron called for unity, strength and hope during his New Year's Eve address, while he pledged to work until the 'last second' of his mandate and guard the 2027 presidential election from foreign interference.

NOTABLE EUROPEAN DATA RECAP

- UK S&P Global Manufacturing PMI (Dec) 50.6 vs. Exp. 51.2 (Prev. 51.2).

- EU HCOB Manufacturing Final PMI (Dec) 48.8 vs. Exp. 49.2 (Prev. 49.2).

- German HCOB Manufacturing PMI (Dec) 47 vs. Exp. 47.7 (Prev. 47.7).

- French HCOB Manufacturing PMI (Dec) 50.7 vs. Exp. 50.6 (Prev. 50.6).

- Italian HCOB Manufacturing PMI (Dec) 47.9 vs. Exp. 50.0 (Prev. 50.6).

- Spanish HCOB Manufacturing PMI (Dec) 49.6 vs. Exp. 51 (Prev. 51.5).

- Swedish PMI Manufacturing Sect (Dec) 55.3 (Prev. 54.6).

- UK Nationwide house price yy (Dec) 0.6% vs. Exp. 1.2% (Prev. 1.8%).

- UK Nationwide house price mm (Dec) -0.4% vs. Exp. 0.1% (Prev. 0.3%).

- EU Money-M3 Annual Grwth (Nov) 3.0% vs. Exp. 2.7% (Prev. 2.8%).

- EU Loans to Non-Fin (Nov) 3.1% (Prev. 2.9%).

- EU Loans to Households (Nov) 2.9% (Prev. 2.8%).

GEOPOLITICS

RUSSIA-UKRAINE

- Ukrainian President Zelensky said they are 10% away from a deal to end the war with Russia but not ‘at any cost’, according to The Independent. Zelensky also announced that a meeting with national security advisors “focused on peace” will be held on January 3rd, and there will be meeting with the military chiefs of general staff on January 5th where the main issue is security guarantees for Ukraine, while he said there will be a meeting with European leaders and the leaders of the Coalition of the Willing on January 6th.

- Ukrainian President Zelensky denied allegations made by Russia that Ukraine launched a drone attack on one of Russian President Putin's residences last Sunday, and accused Moscow of trying to derail peace talks. Furthermore, Russia recently handed over to the US what it claimed was proof of the attempted strike on Putin’s residence, although it was separately reported that US officials determined that the Russian allegation that Ukraine targeted Putin in a drone strike is false, according to WSJ.

- Ukraine's military said on Thursday that it struck Russia's Ilsky oil refinery and the Almetevskaya oil preparation facility, while Ukraine also announced that a Russian drone attack damaged power infrastructure, according to Reuters.

- Russian-installed governor of Ukraine’s Kherson region said at least 24 were killed and over 50 were injured from a Ukrainian drone strike on a hotel and cafe during New Year celebrations, according to Reuters.

- US envoy Witkoff said on Wednesday that he held a “productive call” with European allies on the next steps in the peace process, while he said they “also spent time on the prosperity package for Ukraine – how to continue defining, refining and advancing these concepts, so Ukraine can be successful, resilient and truly thrive once the war is over”.

- Ukrainian authorities in Zaporizhzhia on January 2nd noted of over 700 Russian attacks on the territory of the province "in the past hours", according to Al Jazeera.

MIDDLE EAST

- US President Trump posted "If Iran shots and violently kills peaceful protesters, which is their custom, the United States of America will come to their rescue. We are locked and loaded and ready to go. Thank you for your attention to this matter!".

- Israeli Defence Minister Katz urged the IDF to be ready for a potential ‘Oct.7-style’ mass attack on West Bank settlements and called for the reestablishment of northern West Bank military bases which were evacuated as part of a US-backed deal, according to Times of Israel.

- Iran’s defence export agency offered to sell ballistic missiles, drones and other advanced weapons systems to foreign governments in exchange for cryptocurrency and barter, according to FT.

- UAE announced on Tuesday that it was pulling out its remaining forces in Yemen, after Saudi Arabia bombed the Yemeni port city of Mukalla following accusations that two ships from the UAE had delivered weapons and combat vehicles to separatist forces. It was separately reported that Yemen’s government imposed restrictions on flights between Yemen and the UAE to mitigate the ongoing escalation in the country, according to a Saudi source cited by Reuters.

OTHERS

- US Treasury Department announced new sanctions related to Venezuela, targeting crude oil tankers.

- Russia requested that the US stop pursuing an oil tanker identified as Bella 1, which was headed to Venezuela and was fleeing the US Coast Guard in the Atlantic Ocean, according to The New York Times on Thursday.

- Taiwanese President Lai vowed to defend the nation’s sovereignty in his New Year’s speech days after China fired dozens rockets towards the island and deployed warships and aircraft near Taiwan as part of military drills and a show of force, while he stated that 2026 is a very critical year for Taiwan and that they must stand shoulder to shoulder with democratic countries.

- China's Taiwan Affairs Office said Lai’s New Year's address was riddled with 'falsehoods and reckless assertions, hostility and malice', while it was also reported that China's Defence Ministry said the PLA's drills are completely justified and necessary.

CRYPTO

- Bitcoin is on a firmer footing and holds just short of the USD 90k mark, with Ethereum also posting gains above the USD 3k mark.

APAC TRADE

- ASX 200 posted mild gains of 0.2% in quiet trade, with hefty losses in gold miners hampering the gains from Energy and Financials.

- KOSPI jumped about 2% to a fresh record high, helped by a roughly 6% rise in Samsung Electronics, after reports said customers praised its HBM (high memory bandwidth) chips.

- Hang Seng surged ~2.6%, with gains led by education stocks, while AI chip designer Shanghai Biren gained in excess of 100% following a HKD 5.58bln Hong Kong IPO, which was said to be heavily oversubscribed.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi said in his annual New Year’s Eve speech that the year 2025 marked the completion of China's 14th Five-Year Plan for economic and social development, while he added that they have pressed ahead with enterprise and fortitude, and overcome many difficulties and challenges. Xi added that they met the targets in the Plan and made solid advances on the new journey of Chinese modernisation, as well as noted that economic output has crossed thresholds one after another, and is expected to reach CNY 140tln for the year. Furthermore, he said their economic strength, scientific and technological abilities, defence capabilities, and composite national strength all reached new heights, while he also vowed to reunify China and Taiwan.

- China’s State Council said it studied measures for facilitating cross-border trade, while it will promote green and cross-border e-commerce. Furthermore, it will speed up the review and approval of breakthrough therapeutic drugs, as well as boost investment in water network projects.

- China’s industrial hubs are to lower power prices to support the economic recovery, with the eastern province of Jiangsu, which surrounds Shanghai, to cut rates by 17% vs 2025, while the southern province of Guangdong had recently announced to reduce power prices by 5%.

- Chinese automakers’ market share of Europe’s electric-vehicle market in November reached a record 12.8%, despite the cost of European Union tariffs, according to Bloomberg.

- South Korean President Lee plans to discuss economic ties and peace efforts in the Korean Peninsula during his upcoming summit talks with Chinese President Xi scheduled for early next week.

- Japanese PM Takaichi and US President Trump may hold talks, via telephone on Friday night at earliest, according to Kyodo News citing sources.

NOTABLE APAC DATA RECAP

- Chinese Manufacturing PMI (Dec) 50.1 vs Exp. 49.2 (Prev. 49.2)

- Chinese Non-Manufacturing PMI (Dec) 50.2 vs Exp. 49.6 (Prev. 49.5)

- Chinese Composite PMI (Dec) 50.7 (Prev. 49.7)

- Chinese RatingDog Manufacturing PMI (Dec) 50.1 vs Exp. 49.8 (Prev. 49.9)