US equity futures higher, JPY gains on reports of a BoJ hike as early as April - Newsquawk US Opening News

- A White House Official said the chip announcement on Wednesday was 'phase one' action and there could be other announcements, pending ongoing negotiations with other countries and companies.

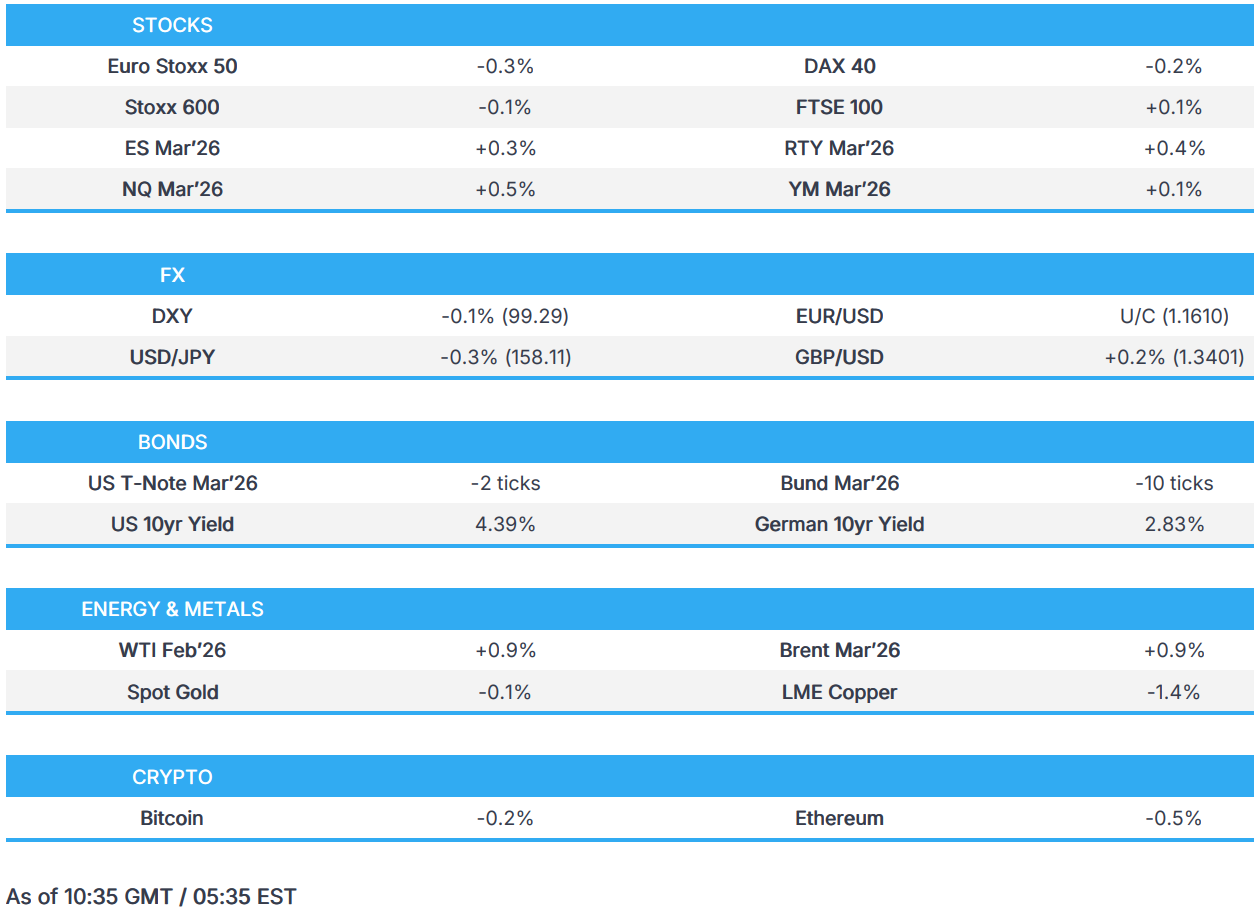

- European bourses are mostly lower; US equity futures gain, with mild outperformance in the NQ.

- DXY is flat/slightly lower, JPY gains on reports of a BoJ hike as soon as April and further jawboning.

- Bearish start for fixed into data and speakers; OATs underperform amid ongoing political uncertainty.

- Crude climbs but is towards the low-end of the week's range, TTF leads, metals tarnished.

- Looking ahead, US Industrial Production (Dec), Speakers include Fed's Collins, Jefferson, Bowman. Earnings from State Street, PNC Financial Services.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 -0.1%) are trading mostly softer, contrary to APAC which traded mostly in the green. Not much on a macro newsflow to explain broader weakened sentiment seen in European.

- European sectors are trading mostly in the red. At the bottom of the pile are Basic Resources (1.5%), Automobiles & Parts (-1.4%) and Consumer Product & Services (-1.3%). Sentiment around the Basic Resources sector has been pinned down by lower metal prices with copper especially pressured by China’s crack down on high-frequency trading. On the upside, Utilities (+0.3%), Health Care (+0.3%) and Energy (+0.2%) are the slight outperformers.

- US equity futures (ES +0.2%, NQ +0.5%, RTY +0.4%) are mostly firmer in the premarket. Newsflow has been light thus far to explain the uptick in US equities. Looking ahead, Fed’s Collins, Bowman and Jefferson are scheduled to speak later.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is flat/incrementally lower this morning and currently within a narrow 99.26-99.40 range, which is towards the upper end of Thursday’s bands. Overnight, a White House Official suggested that the latest chip announcement was “phase one” and more could be put out following negotiations. That aside, not really much US specific newsflow, but focus will turn to a few Fed speakers and Industrial Production later.

- G10s are mixed, with the Kiwi and JPY topping the pile whilst the Loonie is mildly pressured. The JPY was boosted overnight after a Reuters report suggested that the BoJ could hike as soon as April, with some members fearing a weak currency could lead to a resurgence in inflation. In the midst of all this, Finance Minister Katayama has continued to provide some jawboning, which also helped the JPY. USD/JPY currently trades at the lower end of a 157.97-158.70 range vs Monday’s open of 158.07.

- Politics remains the main theme for Japan, as attention now turns to the 22nd of January, when PM Takaichi is expected to dissolve the Diet. UBS believes that the LDP will be able to secure a half majority, improving the party's position. Interestingly, Nippon TV ran the numbers following the CDP-Komeito tie-up and calculated that LDP "would retain only 60 of the 132 single‑member districts it won in 2024". Though this is only a mathematical calculation, and does not account for Takaichi's high approval rating of more than 70%.

- Japanese Finance Minister said the statement between Japan and the US can be viewed as saying intervention to counter FX moves out of line with fundamentals is permitted. Not sure when JPY-carry trades peak out as Japan-US interest rate differentials are set to narrow further.

FIXED INCOME

- A contained start for fixed income benchmarks, though the bias is increasingly bearish.

- Newsflow has been light. USTs in a very thin sub-five tick range just above the 112-00 mark into an afternoon once again dictated by, on paper at least, data and Fed speak.

- Bunds under increasing pressure into the morning, pressure that has emerged without a clear or overt fundamental driver. Down to a 128.26 base with downside of 17 ticks at most. No reaction to unrevised inflation from Germany and Italy, while the European docket ahead is light today before picking up next week with several key ECB speakers at the Davos WEF, including President Lagarde.

- OATs lag in Europe, down by 20 ticks at worst to a 121.01 base. Action that has lifted the OAT-Bund 10yr yield spread above 68bps, though the above Bund pressure is stemming the downside. Slight underperformance that is likely a function of the French Government electing to suspend the National Assembly budget debate last night, meaning that the deliberations of the budget and likely conclusion of it will not occur today. As such, the pencilled-in date of a Monday vote on the revenue draft is off the table.

- Gilts opened on the backfoot, with losses of six ticks and have since extended to a 92.27 low, -21 ticks at most. Pressure that is a function of catch-up to the bearish action that was seen in the latter part of Thursday's US session, the morning's bearish bias, and reports that the ONS might be delaying the new labour data by six months.

COMMODITIES

- Crude benchmarks are firmer this morning, and while they are set to end the week in the green with upside of c. USD 0.80/bbl for WTI and USD 1.0/bbl for Brent, they are towards the lower-end of the week's c. USD 4.00/bbl parameters. Continuing with energy but away from crude, gas benchmarks remain alight and at highs. Drivers remain the same as discussed in recent sessions, including: Iran supply, European cold spell, Asian demand, and expectations for a cold spell in APAC next week. Dutch TTF briefly surmounted the EUR 35/MWh mark this morning

- Spot gold is under modest pressure. Hovering around the USD 4.6k/oz handle despite a contained USD, but hit as the risk tone stateside is constructive and geopolitics, as discussed, hasn't escalated. Further pressure is also potentially stemming from the firmer global yield environment.

- Base peers were softer overnight, hit by China cracking down on high-frequency trading via the removal of servers from some data centres. Action that pushed 3M LME Copper below the USD 13k/t handle early doors and since to a USD 12.77k/t trough, lower by over USD 300/t on the session.

- Heavy rainfall in northeast Australia has triggered floods that are hampering mine operations, with some coal miners declaring force majeure on portions of their shipments or potential delays to customers.

TRADE/TARIFFS

- Canadian PM Carney said the relationship with China is more predictable than the one Canada has with the US.

- Canadian PM Carney announces that they will allow as many as 49k Chinese EVs into the Canadian market, with a most-favoured-nation tariff of 6.1%. In return, Canada anticipates that by March 1st China will reduce tariffs on Canola seed to a c. 15% combined rate. In addition to a resolution to other trade obstacles.

- A White House Official said the chip announcement on Wednesday was 'phase one' action and there could be other announcements, pending ongoing negotiations with other countries and companies.

NOTABLE EUROPEAN HEADLINES

- The ONS has drawn up contingency plans to delay the launch of its new labour market survey by 6 months, Bloomberg reported citing people familiar with the matter. Another scenario under consideration is to launch the survey in May 2027. ONS plans to decide in the summer whether to stick to the November roll-out date.

NOTABLE EUROPEAN DATA RECAP

- Italian Inflation Rate YoY Final (Dec) Y/Y 1.2% vs. Exp. 1.2% (Prev. 1.1%).

- Italian Inflation Rate MoM Final (Dec) M/M 0.2% vs. Exp. 0.2% (Prev. -0.2%).

- German Inflation Rate MoM Final (Dec) M/M 0.0% vs. Exp. 0% (Prev. -0.2% ).

- German Inflation Rate YoY Final (Dec) Y/Y 1.8% vs. Exp. 1.8% (Prev. 2.3%).

CENTRAL BANKS

- BoJ: abolish the "Amount of Cash Collateral for Lending of ETFs" today, given that the new lending of ETFs has been ceased and the outstanding balance of ETF lending has reached zero.

- BoJ is seen as likely to raise its FY26 economic and inflation forecasts, Reuters reported citing sources; the report adds that some BoJ policymakers see scope to raise interest rates as soon as April due to the inflationary effect of a weaker JPY.

- ECB's Lane said that there is no immediate debate on interest rates if current conditions persist and that that current rates set to establish baseline for years ahead.

- NBP Governor Kotecki, in a Bloomberg interview, said it is becoming increasingly clear that there is room for further rapid interest rate cuts. Assumes that in February, the MPC will resume its activities from last year. The inflation outlook is increasingly optimistic.

NOTABLE US HEADLINES

- Japanese Finance Minister Katayama said FX intervention is a potential option under the US-Japan agreement and expresses readiness to take decisive action while keeping all options on the table.

- US President Trump, via Truth Social, said the US has never done better and said tariffs are the main reason, hundreds of billions of dollars have been taken with virtually no inflation and national security has never been as strong as today.

- US Senator Schumer just met with President Trump at the White House, NewsNation reported citing senior White House official.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia announces plans to increase defence capabilities in the Arctic region as tensions around Greenland heighten.

- Russia's President Putin and Israeli Prime Minister Netanyahu are on a phone call together, according to Tass.

- The European Commission is drafting a proposal to replace the EU accession system with a two-tier model that could fast-track Ukraine's entry in any peace deal to end Russia's invasion, the FT reported.

MIDDLE EAST

- US Special Envoy Witkoff said we hope to reach a diplomatic solution with Iran.

- US President Trump said that, with support from Egypt, Turkey and Qatar, he is pushing for a comprehensive demilitarisation deal requiring Hamas to surrender all weapons and dismantle all tunnels. He warned Hamas to immediately meet its commitments, including returning the final body to Israel, or face severe consequences.

- Iran's Deputy UN Envoy said Iran seeks neither escalation nor confrontation; warns that any form of aggression, whether direct or indirect, will prompt a strong and lawful response.

- At least one US aircraft carrier is moving to the Middle East, Fox News reported citing military sources; the US military is preparing a range of options regarding Iran.

- At least one US aircraft carrier is moving to the Middle East, Fox News reported citing military sources; the US military is preparing a range of options regarding Iran.

OTHERS

- Russia announces plans to increase defence capabilities in the Arctic region as tensions around Greenland heighten.

- Saudi Arabia is reportedly finalising an agreement on a military coalition with Egypt and Somalia, Bloomberg reported citing sources. Designed to create more strategic collaboration on Red Sea security.

- The US State Department said the US made it clear to the Mexican Foreign Minister that incremental progress in facing border security challenges is unacceptable.

- Japan and the US are to discuss raising interceptor missile output, Kyodo reported.

CRYPTO

- Bitcoin is a little lower and trades around USD 95.5k. Ethereum is also on the backfoot but stays above USD 3.3k.

APAC TRADE

- APAC stocks traded mostly in the green, supported by strength in the tech sector after strong TSMC earnings lifted sentiment across the region.

- ASX 200 opened with slight gains and is on track for its biggest weekly advance in seven weeks, led by IT and financials. Positive US bank earnings from Morgan Stanley and Goldman Sachs also helped improve sentiment.

- Nikkei 225 traded middle-of-the-pack, chopping around 54,000 amid continued uncertainty surrounding the new opposition party. Additional pressure came from JPY strength after Bloomberg highlighted concerns about the economic impact of a weaker yen.

- KOSPI outperformed and is set for a third consecutive weekly gain, buoyed by the renewed AI-driven tech rally. TSMC’s results fed through to major Korean names, with Samsung (+3.1%) and LG Electronics (+4.0%) among the standout movers.

- Hang Seng and Shanghai Comp initially posted gains of up to 0.5% but later pared back, with the indices slipping into negative territory.

NOTABLE APAC DATA RECAP

- Japanese Stock Investment by Foreigners (Jan/10) 1.14tln (Prev. 124.9bln).