US equity futures hold onto Monday's gains; US weekly ADP and retail sales ahead - Newsquawk US Market Open

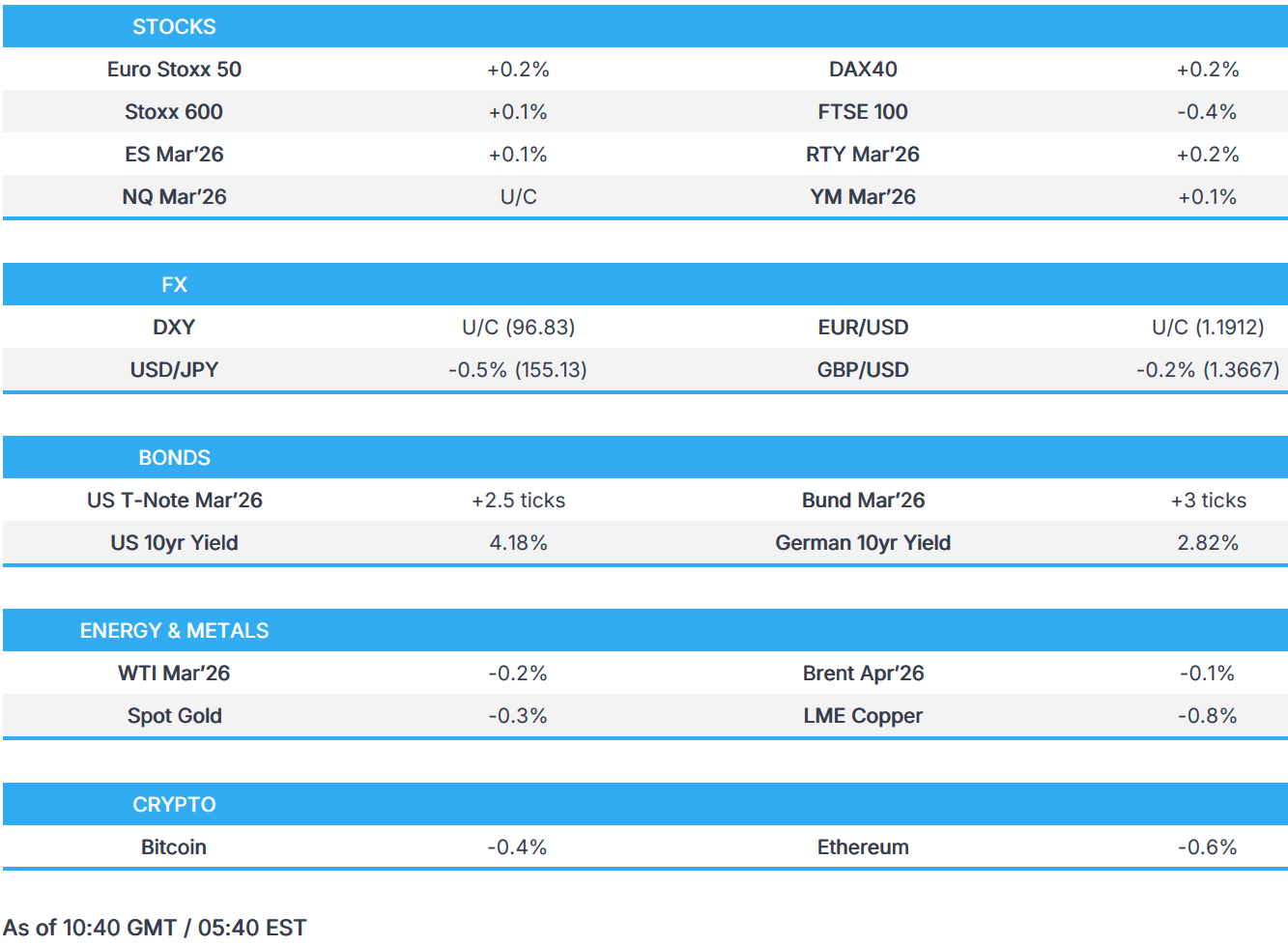

- European bourses are mostly firmer, US equity futures are flat/incrementally higher.

- DXY is flat awaiting Retail Sales/ECI, JPY bid alongside JGB stabilisation whilst NOK gains post-inflation.

- Fixed rebounds from Monday's pressure into data & supply; Gilts outperform as PM Starmer pushed back on calls to resign.

- WTI and Brent mildly lower, XAU remains above USD 5k/oz; Copper muted heading into Chinese festive period.

- Looking ahead, highlights include US NFIB (Jan), Weekly ADP, ECI (Q4), Retail Sales (Dec) & EIA STEO. Speakers include Fed’s Hammack & Logan, Supply from the US. Earnings from Coca-Cola, S&P, Gilead, Robinhood, Welltower, Duke Energy, Datadog, Ford, AIG, Xylem, Spotify.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.1%) are mostly firmer, but with slight underperformance in the FTSE 100 (-0.4%), which has been pressured by post-earning losses in BP (-5%) and as precious metals move lower.

- European sectors are mixed. Chemicals leads followed by Consumer Products whilst Travel & Leisure is found towards the bottom of the pile. For Luxury, Kering (+10%) is boosted by strong earnings, where the Co. highlighted it expects to return to growth and improve margins in 2026. Travel & Leisure has been pressured by TUI (-6%), which highlighted weaker markets and airline trading.

- US equity futures (ES +0.1%, NQ U/C, RTY +0.2%) are trading incrementally firmer/flat, as traders await Retail Sales/ECI and then the NFP report on Wednesday.

- In terms of US specifics, the region plans a tariff carve-out for hyperscalers; TSMC’s January sales printed at the fastest in months; ON Semiconductor slips on a mixed outlook; OpenAI rolls out adverts; Amazon plans an AI content marketplace.

- Barclays (BARC LN) Q4 (GBP) Revenue 7.08bln (prev. 6.96bln Y/Y), PBT 1.86bln (exp. 1.76bln); announces share buyback of GBP 1bln.

- BP (BP/ LN) Q4 2025 (USD): Adj. EPS 0.10 (exp. 0.099), Adj. Net 1.5bln (exp. 1.53bln), Board has decided to suspend share buybacks; Net Debt 22.18bln (exp. 23.04bln); Dividend per share 8.32c (exp. 8.29c); Operating Cash Flow 7.6bln (exp. 7.4bln).

- AstraZeneca (AZN LN) - Q4 (USD): Core EPS 2.12 (exp. 2.14), Revenue 15.5bln (exp. 15.46bln), guides initial FY26 revenue up by mid-to-high single digit and core EPS up by double-digit percentage.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is flat and trades within a 96.79-97.00 range, taking a breather following the losses seen in the prior session. USD-specific newsflow has been lacking this morning, but will pick up later following the release of US Retail Sales and the Employment Cost Index; Fed speak is also due. On the trade front, Politico reported that US President Trump and Chinese President Xi’s summit is reportedly set for the first week of April – though the White House clarified that nothing is set in stone. ING opines that the index could trade within a 96.50-97.50 range over the next few days.

- JPY is the outperformer this morning, in the aftermath of the LDP landslide victory on Sunday. As mentioned in the coverage on Monday, investors are seemingly deriving confidence from the renewed political stability, and trust recent vows by PM Takaichi that she aims to adhere to fiscal responsibility. Moreover, on the monetary policy side of things, markets are increasing their bets of faster BoJ normalisation. JGB pressure also subsided overnight (albeit were already within recent ranges), and the continued strength in the Nikkei will also push JPY bears away. ING, citing local brokers, expects JPY 10tln to enter Japanese equities over the next 3 months – which could see USD/JPY break below 155.00. The pair currently trades around 155.30, and within a 155.08-156.29 range.

- G10s are mixed against the USD; as mentioned, JPY outperforms (+0.3%) whilst the Aussie is the slight laggard, as precious metals pull back a touch. The GBP remains on the backfoot, despite comments from PM Starmer who reiterated that he is to remain in his position – pushing back calls for him to resign. EUR is currently flat; earlier, ECB’s de Guindos failed to move the single currency, as his comments were largely in fitting with the Bank’s latest policy announcement. He stated that the ECB would need to be very vigilant if Chinese exports to Europe increase, via Econostream.

- NOK is stronger this morning after the region’s inflation metrics topped expectations. In brief, Core Y/Y printed at 3.4% (exp. 3%), with the headline metrics also printing above forecasts. Norges Bank has longed reiterated the line that “the policy rate will be reduced further in the course of the year”. Some had seen a cut as early as March/May, whilst SEB saw a cut in June pre-release; following the data the firm said, “we will not change our forecast for a June cut based on this one inflation release, but risks for a later cut have increased". EUR/NOK is currently lower by 0.4%, and trades at the lower end of a 11.3468-11.4254 range.

FIXED INCOME

- Benchmarks bounce this morning with JGBs firmer overnight, having picked up off post-election lows, USTs rebounding from the pressure after the China diversification report. JGBs firmer by near 30 ticks at best, back to the week's 131.60 opening level.

- Gilts have also rebounded, as the immediate pressure on PM Starmer eased slightly after the Cabinet backed him yesterday and no fresh revelations emerged overnight. As such, the benchmark gapped higher by 23 ticks before climbing to a 90.88 peak, firmer by 37 ticks on the day. However, Starmer's situation remains fraught into the end-February by-election, May local elections and amidst that any fresh revelations about his dealings with Mandelson. On that point, the Mail on Sunday's Hodges reports that Starmer appears to be planning to limit what is published re. Mandelson, and the Cabinet Office have asked Ministers not to publish their personal messages with Mandelson, after Wes Streeting made his available. No move to the 2031 Gilt auction, which was strong.

- Limited newsflow for EGBs thus far. As such, the benchmark is firmer given the bias from above, but with magnitudes more modest as EGBs were not hit directly by the China-UST report or the Starmer situation on Monday. Bunds moved a touch lower heading into a 2031 Bobl outing, which overall follows an improving trend of German outings, but still remains soft; EGBs remain firmer by a handful of ticks.

- Back to USTs, the benchmark is firmer by a handful of ticks at a 112-10 high, looking to last week's 112-16+ peak. The docket is headlined by data (weekly ADP, Retail Sales & ECI) before Wednesday's Payrolls & Friday's CPI; additionally, 3yr supply is scheduled just after 2026 voters Hammack and Logan.

- Germany sells EUR 3.811bln vs exp. EUR 5bln 2.50% 2031 Bobl: b/c 1.65x (prev. 1.41x), average yield 2.40% (prev. 2.47%), retention 23.8% (prev. 23.38%)

- UK sold GBP 3.75bln 4.125% 2031 Gilt: b/c 3.94x (prev. 3.50x), average yield 4.001% (prev. 3.980%), tail 0.2bps (prev. 0.2bps).

- Netherlands sold EUR 1.845bln vs exp. EUR 1.5–2bln 3.25% 2044 Green DSL: average yield 3.388% (prev. 3.176%).

- Alphabet (GOOGL) launches its first GBP debt sale with a 100-year note. To also sell GBP-denominated 3-year, 6-year, 15-year and 32-year bonds.

- Japan sold JPY 250bln 10yr I/L JGB; b/c 3.38x, (prev. 3.46x), yield at lowest accepted price 0.458% (prev. 0.113%). Lowest accepted price 96.05 (prev. 99.00).

- Alphabet (GOOGL) launches its first CHF debt sale, according to Bloomberg.

COMMODITIES

- Crude benchmarks have held onto the majority of Monday's gains, with WTI holding above USD 64/bbl while Brent regains the USD 69/bbl mark. Geopolitical risk premium continues to be priced into the oil market, despite US-Iran tensions easing somewhat following their indirect talks in Oman.

- Nat gas futures have continued to pull back from the surge higher following the Arctic storm, due to warmer weather forecasts in the US. Henry Hub futures continue to near USD 3/MMBtu while Dutch TTF holds below EUR 35/MWh.

- Spot gold continues to hold above the USD 5k/oz, with Monday's session managing to close above the level for the first time since the selloff on January 30th. The yellow metal sold off modestly at the start of the APAC session but has since clawed back earlier losses and is only seeing modest losses of 0.2%, at the time of writing.

- 3M LME Copper trades muted and in tight ranges, as the Chinese New Year holiday looms. Buying of the red metal is expected to be light going into, and throughout, the holiday period, with buying expected to resume when the festive period ends.

- Bank of China (3988 HK) is to increase margin requirements for gold deferred contracts, effective from the 11th of February.

- Venezuela's largest refinery, Amuay, is out of service after a power blackout, according sources.

TRADE/TARIFFS

- India is reportedly in talks with France, Netherlands, Brazil and Canada over a deal on critical minerals.

- Japanese Trade Minister Akazawa said plan to visit US between February 11th to 14th to discuss Japan's investment plan.

- US President Trump posted Canada is building a massive bridge between Ontario and Michigan which Canada will own and built it with virtually no US content, adds " I will not allow this bridge to open until the United States is fully compensated...".

NOTABLE EUROPEAN HEADLINES

- UK Cabinet Office has asked all Ministers not to follow Wes Streeting in publishing their messages with Peter Mandelson.

- Mail on Sunday's Hodges reported that his understanding is that UK PM Starmer "is planning some sort of fresh attempt to limit what gets published over the Mandelson saga.".

- French President Macron said the bloc should not be lulled into a false sense of security that tensions with the US over Greenland, technology and trade are over. said:Reiterated called for the EU to raise common debt to raise in AI and quantum computing, energy transition and defence.

NOTABLE EUROPEAN DATA RECAP

- Swedish Industrial Production MoM (Dec) M/M 1.6% (Prev. -0.1%).

- Swedish Household Consumption YoY (Dec) Y/Y 0.50% (Prev. 3.50%, Rev. From 3.5%).

- Swedish Construction Output YoY (Dec) Y/Y 1.6% (Prev. 1%).

- Swedish New Orders YoY (Dec) Y/Y 6.8% (Prev. 19.4%, Rev. From 23%).

- Swedish Household Consumption MoM (Dec) M/M -3.70% (Prev. 1.00%, Rev. From 1%).

- Swedish Industrial Production YoY (Dec) Y/Y 4.2% (Prev. 4.2%).

- French Unemployment Rate (Q4) 7.9% vs. Exp. 7.8% (Prev. 7.7%, Low. 7.7%, High. 7.8%).

- UK BRC Retail Sales Monitor YoY (Jan) Y/Y 2.3% vs. Exp. 1.2% (Prev. 1.0%, Rev. From 1%).

- Norwegian Core Inflation Rate YoY (Jan) Y/Y 3.4% vs. Exp. 3% (Prev. 3.1%).

- Norwegian Inflation Rate YoY (Jan) Y/Y 3.6% vs. Exp. 3.1% (Prev. 3.2%).

- Norwegian Core Inflation Rate MoM (Jan) M/M 0.3% vs. Exp. -0.1% (Prev. 0.1%).

- Norwegian Inflation Rate MoM (Jan) M/M 0.6% (Prev. 0.1%).

CENTRAL BANKS

- US President Trump said he doesn't know if the Powell probe is worth holding up Warsh, adds Powell is incompetent, but the question is if he's corrupt.

- Fed's Miran (Voter, Dove) said no significant tariff-driven inflation seen so far, and interest rates should be much lower than current levels.

- US President Trump said in a Fox Business taped interview that the US economy can grow at 15% if Fed nominee Walsh does a job that he's capable of.

- BoJ is to submit nominee to replace board member Noguchi on February 25th.

- ECB's de Guindos said the ECB would need to be very vigilant if Chinese exports to Europe increases, describes the economy as more resilient and inflation is moving towards target, via Econostream. Reiterates the current level of rates are appropriate. Recent euro strength is fully consistent with the assumptions included in the ECB's projections.

- Monetary Authority of Singapore chief economist said monetary policy stance remains appropriate.

NOTABLE US HEADLINES

- US IT sector downgraded to Neutral from Attractive from UBS.

- US Department of Health and Human Services is to cut USD 600mln in public health grants to blue states, according to Bloomberg.

- White House said the Trump-Xi meeting has not been finalised.

- White House eyes data center agreements amid energy price spikes, while a draft pact seeks to help ensure data centres do not raise household electricity prices and strain water resources or undermine grid reliability.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin announce that they have no clear date for the next round of discussion with Ukraine.

MIDDLE EAST

- Iran warns of destructive influence on diplomacy ahead of Israeli's PM Netanyahu's trip to the US.

- White House officials said US President Trump does not support Israel annexing the West Bank, adds stable West Bank is key to Israel's security and align with the administration's peace goals.

OTHERS

- EU Defence Commissioner Kubilius said the EU needs to take responsibility for its defence and that replacing US strategic enablers with European ones should be a priority.

- China holds 2026 work conference on Taiwan affairs, while Chairman of the Chinese People's Political Consultative Conference Wang Huning said will resolutely crack down on Taiwan independence, according to Xinhua.

- China’s embassy in London said it has consistently opposed UK interference in China’s internal affairs, including the BNO issue. said:Urges British side to follow the general trend and cease political interference, while it accused Britain of resorting to tricks and described its behaviour as contemptible.

- Philippines ambassador to Washington said China seems ready to find ways to ease South China Sea tensions through cooperation.

- US military said it carried out a strike on a vessel in the eastern Pacific, killing two and leaving one survivor.

- US Interior Secretary Burgum said Greenland deal is moving forward with progress.

CRYPTO

- Bitcoin is a little lower and trades around USD 69k whilst Ethereum holds above USD 2k.

APAC TRADE

- APAC stocks were mostly higher as the region took impetus from the gains on Wall Street, where the S&P 500 approached closer towards its record levels, and the Nasdaq outperformed as the tech rebound persisted.

- ASX 200 marginally gained amid continued outperformance in tech, but with advances in the index limited by underperformance in the top-weighted financial sector and weakness in some defensives.

- Nikkei 225 rallied to a fresh record high near the 58,000 level amid the Takaichi trade and expectations of incoming stimulus, while SoftBank was among the biggest gainers due to its heavy semiconductor exposure.

- Hang Seng and Shanghai Comp lagged behind their regional counterparts in somewhat mixed trade, with the Hong Kong benchmark led higher by pharmaceuticals, while the mainland was flat amid little fresh drivers.

NOTABLE ASIA-PAC HEADLINES

- China NPC Standing Committee will hold 21st session on February 25th-26th in Beijing.

- Japanese Finance Minister Katayama said discussions on using entire surplus are planned, but no position has been taken. Indicates that a proposed cut in food sales tax would serve as a temporary solution ahead of the implementation of a new tax credit system.

- China released a white paper on Hong Kong's practice of safeguarding national security, according to Xinhua.

- TSMC (2330 TT) January (TWD) rev. rose 37% Y/Y to 401.3bln (prev. 335.0bln M/M).

- TSMC (2330 TT / TSM) board has approved the issuance of corporate bonds in Taiwan, of up to TWD 60bln in size.

NOTABLE APAC DATA RECAP

- Japanese Machine Tool Orders YY (Jan P) 25.3% (Prev. 10.9%).

- Japanese Money Supply M2 YY (Jan) 1.6% (Prev. 1.7%).

- Australian Private House Approvals YY Final (Dec) 0.4% (Prelim. 0.4%).

- Australian Building Permits YoY Final (Dec) Y/Y 0.4% (Prev. 19.4%).

- Australian Building Permits MoM Final (Dec) M/M -14.9% (Prelim. -14.9%).

- Australian NAB Business Confidence (Jan) 3 (Prev. 3).

- Australian NAB Business Conditions (Jan) 7 (prev. 9).

- Australian Westpac Consumer Confidence Change (Feb) -2.6% (Prev. -1.7%).

- Australian Westpac Consumer Confidence Index (Feb) 90.5 (Prev. 92.9).