US equity futures hold steady, DXY slightly firmer and USTs rangebound heading into US CPI - Newsquawk US Opening News

- US President Trump plans to roll back tariffs on metal and aluminium goods, according to FT.

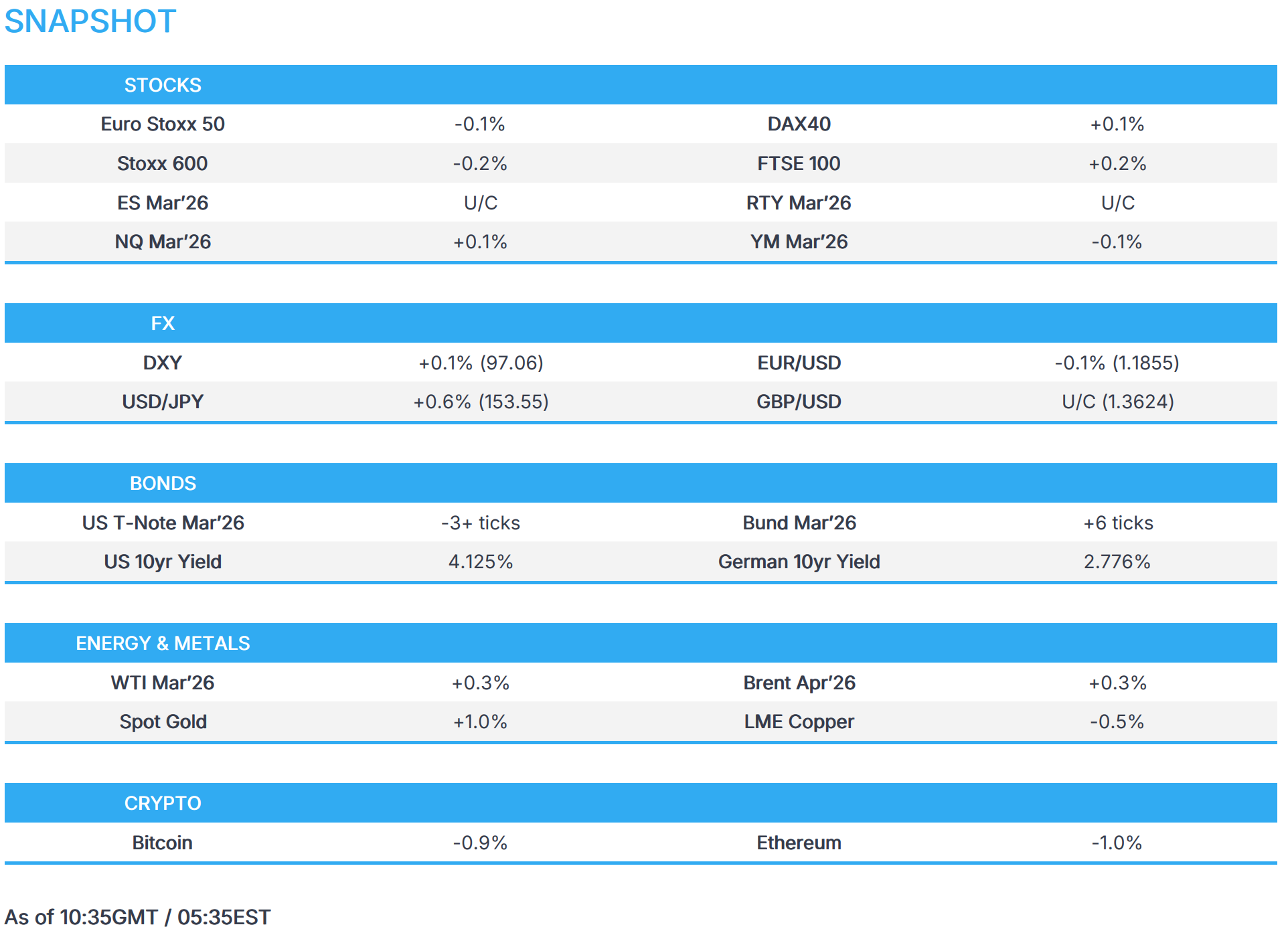

- European equities shrug off the selloff seen stateside; Tech rebounds while Basic Resources lag; US equity futures hold steady.

- DXY slightly firmer and USTs rangebound heading into US CPI; JPY underperforms.

- Precious metals recover following Thursday's slump, whilst Copper lags on the back of weaker risk sentiment; Crude flat.

- Looking ahead, highlights include US CPI (Jan), Speakers including ECBʼs de Guindos, BoEʼs Pill, Earnings from Moderna.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.1%) are trading mixed as the end of the week nears. SMI (+0.6%) leads its European peers, closely followed by the AEX (+0.5%). On the other hand, the CAC 40 (-0.2%) is the slight laggard following a mixed bag of earnings coming out of France.

- European sectors are mixed. Technology (+1.3%) sits comfortably at the top of the pile, followed by Insurance (+0.6%) and Industrial Goods and Services (+0.5%). Upside in Tech follows on from the earnings by Applied Materials, which posted positive earnings and Q2 forecasts. Sitting at the bottom lies Basic Resources (-1.3%), as miners react to the selloff in metals prices. Consumer Products and Services (-0.7%) is weighed on by L'Oreal (-3.5%) post-earnings.

- US equity futures (NQ +0.1%, ES & RTY U/C) steady following Thursday's selloff caused by further worries of AI disruption, this time in the logistics sector (CH Robinson Worldwide -14.5% by market close). Markets await US CPI.

- NatWest (NWG LN) - Q4 (GBP): Pretax Profit 1.94bln (exp. 1.72bln), Revenue 4.32bln (prev. 3.83bln Y/Y), NII 3.44bln (exp. 3.33bln); intends to commence a GBP 750mln share buyback programme in H1'26.

- Capgemini (CAP FP) - FY 2025 (EUR): Revenue 22.5bln (prev. 22.1bln Y/Y), Operating profit 2.2bln (prev. 2.4bln Y/Y); guides initial FY26 at 6.5-8.5%.

- Safran (SAF FP) FY25 (EUR): Revenue 31.3bln (prev. 27.3bln Y/Y), Operating profit 4.72bln (prev. 4.13bln Y/Y), sees FY26 revenue higher in the low to mid-teens and operating income between 6.1-6.2bln.

- Applied Materials Inc. (AMAT) Q1 2026 (USD): Adj. EPS 2.38 (exp. 2.21), Revenue 7.01bln (exp. 6.87bln), Adj. net income 1.9bln (exp. 1.75bln). Guidance: Q2 revenue 7.15-8.15bln (exp. 7bln). Q2 adj. EPS 2.44-2.84 (exp. 2.28).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is currently trading with very mild gains and trades at the midpoint of a 96.89-97.15 range. Really not much driving things for the index this morning, with traders awaiting the US CPI report later. On that, the headline is expected to rise +0.3% M/M (prev. 0.3%), and core rising at a rate of 0.3% M/M (prev. 0.2%). UBS said easing inflation should keep the Fed on track for rate cuts despite strong jobs data, forecasting two 25bps reductions in June and September, while FOMC projections indicate one additional cut this year. In terms of recent price action, ING notes that there has been a strong inclination to sell USD rallies this week, as such, analysts “struggle to see the dollar recover substantially from here”.

- G10s are mixed against the USD, with the NZD and CAD holding around the unchanged mark, whilst the CHF, AUD and JPY hold towards the foot of the pile, with the latter the clear underperformer. EUR was little moved by the EZ GDP 2nd estimates and Employment change, which printed more-or-less in-line with expectations.

- Really not much driving things for the JPY this morning, with the weakness potentially a slight paring of a four-day winning streak seen following PM Takaichi’s landslide victory. Focus has been on Takaichi’s remarks that she will adhere to fiscal responsibility, with attention also on comments via FinMin Katayama, who noted that the foodstuff tax cut could be funded by foreign reserves. On the monetary policy side of things, markets now see the chance of faster BoJ normalisation; on that, BoJ’s Tamura (Hawk) suggested inflation is becoming “sticky”, and flagged the chance of a rate hike “this spring”. On the neutral rate, he suggested that the policy rate is “very distant” from the neutral rate. USD/JPY was little moved by his comments, and currently trades at the upper end of a 152.63-153.66 range.

- CHF is slightly lower this morning, in the aftermath of the region’s inflation data; the Y/Y metric printed in-line with the consensus, whilst the M/M metric was a touch below the prior and surprisingly fell into negative territory. The CHF initially weakened on the report, before scaling back much of the pressure thereafter. It is worth reminding that SNB’s Schlegel suggested that the Bank is willing “look through negative months of inflation”, adding that the bar to negative rates is high.

FIXED INCOME

- Another contained start for fixed income into US CPI and before Monday's US holiday, which coincides with the Chinese New Year holiday period.

- USTs on the backfoot, but only marginally, going into US CPI to round off a packed week of data. Currently, at the low-end of a 112-21 to 112-28 band, and while in the red as it stands, the upper-end of that band is a new marginal WTD peak.

- Bunds are also contained, though the benchmark finds itself firmer by a handful of ticks, but off best in 128.93 to 129.12 confines. The firmer APAC bias came from gains towards the end of the European day after German Chancellor Merz said he is not in favour of joint eurobonds, in addition to the read-across from a strong US 30yr auction.

- Gilts opened higher by nine ticks, catching up to the strength seen on that US auction. Since, the benchmark has retreated into the red with losses of c. five ticks in 91.34 to 91.51 parameters. Ahead of US CPI today but, more pertinently for the UK, next week's packed data docket that will likely determine if the BoE cuts in April as markets currently forecast, or if March comes into consideration.

- JGBs came under pressure to a 131.52 low after BoJ's Tamura said even if they tighten, monetary conditions will remain accommodative.

- Japan sold JPY 649.5bln in 10yr, 20yr and 30yr JGBs in enhanced liquidity auction; b/c 2.95 vs. Prev. 2.58. Highest accepted spread -0.014% vs. Prev. +0.018%. Allotment of bids at highest spread 2.5490% vs. Prev. 86.2119%.

- PBoC is to issue CNY 30bln in 3-month and 1-year bills in Hong Kong.

- Australia sold AUD 1bln 2.50% May 2034 bonds, b/c 3.44, avg. yield 4.2898%.

COMMODITIES

- Crude benchmarks are trading relatively flat following yesterday’s slump after dollar strength and weak risk sentiment, sparked by AI disruption woes. Adding to further downside pressure were comments from US President Trump yesterday evening that the US must make a deal with Iran and that they could reach a deal over the next month. Not much in terms of fresh catalysts thus far in the European session, as traders await US CPI. WTI and Brent are trading at the lower end range of USD 62.54-63.17/bbl and USD 67.22-67.89/bbl, respectively.

- Precious metals are rebounding after yesterday’s decline, which was driven by a stronger US dollar following strong jobs data surpassing market expectation. There is no fresh catalyst behind today’s recovery, though some analysts attribute the move to dip-buying after the recent sell-off. Spot gold is currently trading near the upper end of USD 4,885.89–4,997.53/oz range, while silver is holding at the upper range of USD 73.745–79.085/oz.

- Copper trades slightly lower triggered by downbeat sentiment in Wall Street and APAC, although Europe fares somewhat better. The red metal trades at the lower end range of 12,800-13,021/t. Other relevant news in the metal space includes the Shanghai Weekly updating their Warehouse changes before the Chinese holiday: Copper +9.47%, Nickel +2.29%, Aluminium +21.3%.

- Indonesia's Mining Minister said we are studying a plan to ban exports on a number of raw materials next year, which includes tin.

- India's Reliance has reportedly been awarded general authorisation from the US to buy Venezuelan Oil.

- Three people reportedly burnt at Exxon's (XOM) Beaumont facility.

- Shanghai Weekly Warehouse Changes: Copper +9.47%, Nickel +2.29%, Aluminium +21.3%.

- ANZ revises gold price forecast, now sees gold hitting USD 5,800/oz in Q2 vs. previous forecast of USD 5,400/oz.

- Qatar hikes April term price for Al Shaheen oil to USD 0.87/bbl over Dubai quotes, according sources.

- Shenzhen financial regulator issues public notice to further standardise gold market operations.

TRADE/TARIFFS

- China and the US held an anti-drug intelligence exchange meeting on February 10th-12th, Xinhua reported; both sides agreed to promote healthy and practical anti-drug cooperation.

- China's Ministry of Commerce holds a roundtable with German firms; hopes that German companies can increase investment in China.

- US President Trump plans to roll back tariffs on metal and aluminium goods, according to FT.

- Japan's Trade Minister Akazawa engaged with US Commerce Secretary Lutnick on US-bound investment initiatives and confirmed progress on talks to launch the USD 550bln investment.

- Taiwan President Lai said trade deal with US marks a pivotal moment for Taiwan's economy and industries, adds we secured significant benefits for Taiwan's industries and overall economy, and we solidified the Taiwan-US high-tech strategic partnership.

- US Department of Commerce increases duties on Chinese battery-grade graphite to 160% related to Novonix (NVX).

- US and Taiwan sign a reciprocal trade agreement with Taiwan to eliminate or reduce 99% of tariff barriers on US goods, while US confirms 15% tariff rate on Taiwanese goods.

- US and North Macedonia agreed to a trade framework with the US to impose 15% tariff on North Macedonian goods, while North Macedonia is to eliminate all tariffs on US goods.

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer is set to call for multinational defence initiative to cut costs of rearmament, according to FT.

NOTABLE EUROPEAN DATA RECAP

- EU Employment Change QoQ Prel (Q4) Q/Q 0.2% vs. Exp. 0.1% (Prev. 0.2%, Low. 0.0%, High. 0.2%).

- EU Employment Change YoY Prel (Q4) Y/Y 0.6% vs. Exp. 0.6% (Prev. 0.6%, Low. 0.4%, High. 0.7%).

- EU Balance of Trade (Dec) 12.6 (Prev. 9.3, Rev. From 9.9).

- EU GDP Growth Rate QoQ 2nd Est (Q4) Q/Q 0.3% vs. Exp. 0.3% (Prev. 0.3%, Low. 0.3%, High. 0.3%).

- EU GDP Growth Rate YoY 2nd Est (Q4) Y/Y 1.4% vs. Exp. 1.3% (Prev. 1.4%, Low. 1.3%, High. 1.3%).

- Spanish Core Inflation Rate YoY Final (Jan) Y/Y 2.6% vs. Exp. 2.6% (Prev. 2.6%).

- Spanish Inflation Rate YoY Final (Jan) Y/Y 2.3% vs. Exp. 2.4% (Prev. 2.9%).

- Spanish Inflation Rate MoM Final (Jan) M/M -0.4% vs. Exp. -0.4% (Prev. 0.3%).

- Swiss Inflation Rate YoY (Jan) Y/Y 0.1% vs. Exp. 0.1% (Prev. 0.1%, Low. 0.0%, High. 0.1%).

- Swiss Inflation Rate MoM (Jan) M/M -0.1% vs. Exp. 0% (Prev. 0.0%, Rev. From 0%, Low. -0.1%, High. 0.0%).

- German Wholesale Prices MoM (Jan) M/M 0.9% vs. Exp. 0.1% (Prev. -0.2%).

- German Wholesale Prices YoY (Jan) Y/Y 1.2% (Prev. 1.2%).

CENTRAL BANKS

- Fed's Miran (voter) said some of the concern he has on labour markets is a little less than he had before, adds a range of policies are pushing out the supply of the economy and will increase economic growth in a non-inflationary way. said:. Fed is one of the biggest risks to growth. Monetary policy has passively tightened. We may be underestimating how restrictive monetary policy actually is.

- BoJ's Tamura said he feels Japan's recent inflation is becoming sticky and reiterates will keep raising rates if outlook is met, adds we may be able to judge that BoJ's price goal has been achieved as early as this spring. Added that even if the BoJ raises the policy rate further, monetary conditions will remain accommodative.

- Japan's PM Takaichi is to meet with BoJ Governor Ueda on February 16th at 17:00JST / 08:00GMT.

- Japanese PM Takaichi's advisor Honda suggests the BoJ may consider raising interest rates later this year, but noted the unlikelihood of a hike in March.

- ECB's Kazaks said the ECB has yet to see full impact of EUR appreciation; he worries strong EUR reflects dollar weakness; said now is not the time for ECB to move interest rates; said ECB officials are on monitoring mode on EUR strength.

- PBoC's new emphasis on overnight money market rate has reportedly sparked speculation it could become the main policy target.

- Riksbank's Jansson said January inflation confirmed the picture of downside risks to inflation. Figures for GDP and consumption have been a little weaker recently.

- Russian Federation Interest Rate Decision 15.50% vs. Exp. 16% (Prev. 16.00%).

NOTABLE US HEADLINES

- Tech and banking trade groups are among others that are urging the Trump administration to not change the federal framework they have been using to safely deploy AI, Axios reported citing a letter.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin said that new round of peace talks with Ukraine will take place next week; adds that its unlikely that discussions will move beyond talks before the conflict in Ukraine is settled.

- US, Russia and Ukraine are planning to meet again next week, possibly in Miami or Abu Dhabi, POLITICO reported.

MIDDLE EAST

- US aircraft carrier U.S.S Gerald R. Ford will be sent to the Middle East from Venezuela, according to officials cited by NYT.

OTHERS

- Russia's Deputy Foreign Minister Ryabkov said Russia will provide Cuba with material assistance, TASS reported.

- Russia's Kremlin said they did not decide to stop using the dollar but that the US imposed restrictions, dollar will have to compete with other currencies if the US lifts restrictions.

- Japan seizes a Chinese fishing boat off the Nagasaki coast, according to Japanese press.

CRYPTO

- Bitcoin nears USD 67,000 while Ethereum rebounds from Thursday's USD 1,900 trough.

APAC TRADE

- APAC stocks were mostly lower as the region took its cue from the losses stateside, where tech underperformed as AI-disruption concerns re-emerged, and logistics/industrials stocks were also pressured after Algorhythm Holdings (RIME) released its AI freight scaling tool.

- ASX 200 was dragged lower by losses in tech stocks, and as participants also digested earnings releases.

- Nikkei 225 retreated at the open after recent currency strength and with focus also on earnings reports, including from SoftBank, which returned to profit in Q3 but missed expectations, while its shares were also not helped by its AI exposure.

- Hang Seng and Shanghai Comp suffered alongside the broad downbeat mood in the region, and despite reports that President Trump paused some China tech bans ahead of his summit with Xi in April, while it is also the last trading day in the mainland before the Lunar New Year and Spring Festival holiday closures.

NOTABLE APAC DATA RECAP

- Chinese New Yuan Loans (Jan) 4710B vs. Exp. 5000B (Prev. 910B).

- Chinese M2 Money Supply YoY (Jan) Y/Y 9% vs. Exp. 8.4% (Prev. 8.5%).

- Chinese Total Social Financing (Jan) 7220B vs. Exp. 7050B (Prev. 2210B).

- Chinese Outstanding Loan Growth YoY (Jan) Y/Y 6.1% vs. Exp. 6.2% (Prev. 6.4%).

- Chinese House Price Index MM (Jan) Y/Y -0.4% (Prev. -0.4%).

- Chinese House Price Index YoY (Jan) Y/Y -3.1% (Prev. -2.7%).

- New Zealand 1yr Inflation Expectation (Q1) 2.6% (Prev. 2.4%).

- New Zealand 2yr Inflation Expectation (Q1) 2.4% (Prev. 2.6%).

- Japanese Stock Investment by Foreigners (Feb/07) 543.2B (Prev. 494.6B).

- Japanese Foreign Bond Investment (Feb/07) -365.7B (Prev. 713.7B, Rev. From 713.7B).