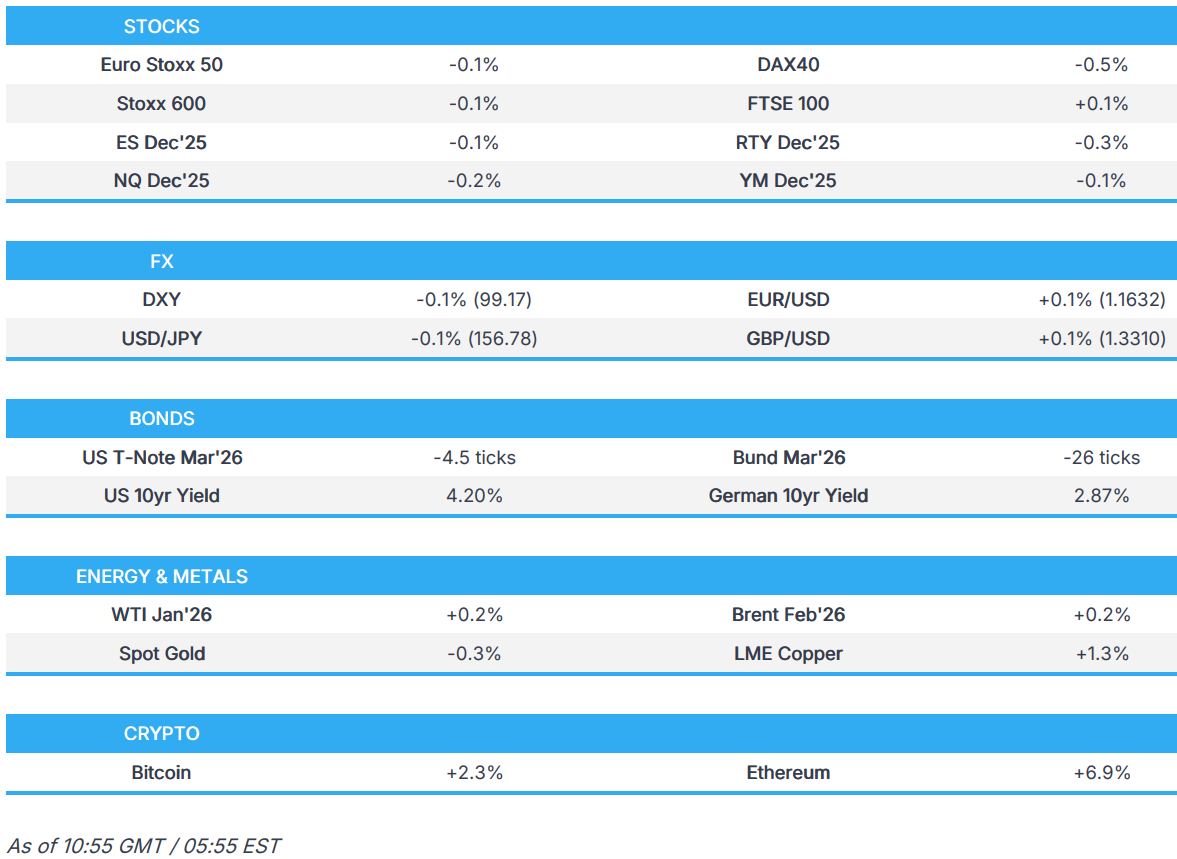

US equity futures lower, DXY flat going into key rate announcements - Newsquawk US Market Open

- US Trade Representative Greer said China's rare earths continue to flow and expects to sign more trade deals over the coming weeks.

- US President Trump is to kick off the final round of Fed Chair interviews this week, while senior administration officials said Kevin Hassett remains in pole position to succeed Powell as Fed Chair, according to the FT.

- European bourses are broadly lower, with US equity futures mildly in the red as markets await the FOMC; The Information reported that China is weighing NVIDIA chip purchases in an emergency meeting.

- USD is essentially flat and holds around the 99.20 mark, with G10s also broadly unchanged.

- Global bonds are lower, OATs fail to benefit after the French National Assembly passed the social security budget.

- Crude rangebound, XAU subdued ahead of FOMC rate decision; Copper holding onto earlier gains.

- Looking ahead, highlights include US Employment Costs (Q3), BoC/FOMC/BCB Rate Announcement. Speakers include BoC's Macklem & Fed's Powell. Earnings from Oracle, Adobe & Synopsys.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US Manufacturers are reportedly pulling back "harder" on orders of parts and raw materials due to uncertainty on the US Administration's tariff policy and SCOTUS ruling, according to WSJ, citing a survey.

- US President Trump said they have taken in hundreds of billions of dollars from tariffs, but added shortly after that it is actually trillions.

- US-Indonesia trade deal is at risk of collapse as USTR Greer believes Indonesia is backtracking on several commitments it made, while Indonesian officials have told Greer that Jakarta cannot agree to some binding commitments in the deal, according to FT. However, an Indonesian government source said Indonesia's tariff negotiation with the US is on track as per the leaders' joint statement, while an official also said that the trade negotiation with the US is still ongoing, with no specific issues arising during the negotiations.

- US Trade Representative Greer said the Trump administration has made it clear to South Africa that they need to address trade barriers if they want a better tariff situation with the US, while he is open to different treatment and possible exclusion of South Africa if the US renews the African Growth and Opportunity Act.

- US Trade Representative Greer said China's rare earths continue to flow and expects to sign more trade deals over the coming weeks.

- China added domestic AI chips to its official procurement list for the first time, according to FT.

NOTABLE US HEADLINES

- US President Trump is to kick off the final round of Fed Chair interviews this week, while senior administration officials said Kevin Hassett remains in pole position to succeed Powell as Fed Chair, according to FT. Trump later confirmed that he will be meeting with a couple of people for the Fed chair job and separately commented that he hears that Autopen might have signed the appointment of some of the Democrats on the Fed Board of Governors.

- White House Economic Adviser Hassett said as Fed chair, he would be apolitical, according to a Fox Business interview.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.1%) slipped at the open, with all major European indices in negative territory amidst a lack of "good" macro news, an unfavourable yield environment and key risk events ahead.

- European sectors continue to hold the negative bias they opened with. At the top of the pile is Basic resources, as the copper rally, which stalled on Tuesday, gains legs once again. Media also does well with WPP +3.2% extending on recent gains after receiving a significant government contract. To the downside, Autos underperforms with the largest constituent Ferrari -2.5% after being initiated Equal Weight at Morgan Stanley.

- US equity futures (ES NQ RTY) were initially trading around the unchanged mark, before recently moving lower without a fresh catalyst. For equity specifics, ORCL, ADBE and SNPS are to announce quarterly results after the US market closes. On the macro front, the FOMC and BoC announce interest rate decisions. The latter is expected to keep rates unchanged, while the FOMC is likely going to reduce its key rate by 25bps to 3.50–3.75% in hawkish fashion. Ahead of the decision, the US Q3 employment cost index is due for release.

- China reportedly weighs NVIDIA (NVDA) chip purchase in an emergency meeting, according to The Information

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY has been choppy within a 99.017-99.258 range with focus now on today’s FOMC meeting; the central bank is expected to announce a 25bps rate cut, though dissent from several policymakers is anticipated. A full preview is available in the Newsquawk Research Suite. Overnight attention has centred on trade developments, with CNBC noting that China has resumed purchases of US soybeans, though it remains behind the targets outlined in the Trump trade deal. On the Fed front, the FT reported that President Trump is set to begin the final round of interviews for the next Fed Chair, with senior officials still viewing White House NEC Director Hassett as the leading candidate.

- G10s have been moving in tandem with the USD. EUR was unreactive to earlier remarks from ECB’s Villeroy and Simkus, with Villeroy concentrating on the French economy, while Simkus indicated that further rate cuts are unnecessary — a view echoed by market pricing, which suggests rates will remain unchanged through 2026. Further for the EUR, on Tuesday, the French National Assembly approved the social security budget in a narrow vote, passing by just 13 votes — a close outcome in line with analysts’ expectations. Notably, all of President Macron’s Renaissance lawmakers backed the bill, while Les Républicains showed a more divided stance. For GBP, recent BoE commentary has offered little new for UK rates. EUR/USD is choppy within a 1.1622-1.1658 range, with GBP/USD in a 1.3296-1.3327 band.

- USD/JPY is flat after Tuesday’s rise to just below the 157.00 level, which prompted the usual round of verbal intervention from Japanese officials. Meanwhile, PPI figures overnight came in as expected and had minimal effect on the currency. USD/JPY trades in a narrow 156.56-156.94 range vs Tuesday's 156.96 high.

- Antipodeans trade in tandem with the USD in a quiet FX session, with overall risk sentiment muted ahead of the Fed decision. Chinese inflation data overnight were mixed — CPI rose to its fastest pace in nearly two years, while a softer-than-expected PPI reading pointed to deeper deflation at the factory gate.

- Click for FX OpEx Details

FIXED INCOME

- USTs started the European session flat, but have since slipped marginally into the red, alongside global peers. Currently trading at the bottom end of a 111-30 to 112-04+ range – the trough marks a new weekly low and is now trading at levels not seen since early September. From a yield perspective, rates are higher across the curve, with the belly leading. Focus overnight has been on trade developments, with CNBC reporting that China is buying US soybeans again, but is reportedly falling short of the goal set by the Trump trade agreement. Turning to the Fed, the FT reported that President Trump will begin the final round of Fed Chair interviews – but senior officials still expect the White House NEC Director Hassett as the frontrunner. Now attention turns to the FOMC later today.

- Bunds are also on the back foot and underperforming vs peers, but nothing really behind the underperformance in EGBs. Bunds Mar’26 is currently trading towards the lower end of a 127.05 to 127.49 range, with the trough marking a contract low. Earlier, there was some commentary via ECB’s Villeroy and Simkus, where the former focused on the French economy, whilst the latter suggested that the policy rate does not need to be lowered further – a move also concurred by market pricing, which sees rates steady through 2026. Elsewhere, Gilts also hold a negative bias and hold at the bottom end of a 90.71 to 91.04 range. Recent BoE speak has been non-incremental for UK paper.

- OATs are also in the red, and to a similar magnitude as peers. French political developments on Tuesday saw the National Assembly approve the social security budget. The bill narrowly passed with 13 votes, with analysts expecting a tight decision; interestingly, all of President Macron’s Renaissance voted in favour, whilst the Les Republicans were a little more mixed. OATs have not really celebrated the approval, with price action near enough following peers, not all too surprising as traders now turn their attention to the state budget.

- UK sells GBP 4.5bln 4.75% 2035 Gilt: b/c 3.05x (prev. 2.84x), average yield 4.613% (prev. 4.608%), tail 0.3bps (prev. 0.6bps)

COMMODITIES

- Crude benchmarks trade in tight ranges as the European session gets underway, following the selloff in Tuesday's session. WTI and Brent oscillate in a USD 58.08-58.47/bbl and USD 61.76-62.16/bbl band as markets await a clear catalyst to drive oil prices.

- Spot XAU remains mid-range of the wider USD 4163-4265/oz band that has been forming over the past 8 days as markets await a Fed rate decision. A view of price action so far in today's session shows a peak of USD 4219/oz in the early hours of the APAC session before gradually dipping back below USD 4200/oz as the European session gets underway. Newsflow has been light ahead of the FOMC rate announcement.

- 3M LME Copper started the APAC session on the front foot has continued to hold onto earlier gains as the European session gets underway, despite cooler-than-expected Chinese CPI and PPI. The red metal drove higher straight from the open from USD 11.5k/t to a peak of 11.64k/t, before pulling back to a low of USD 11.58k/t. 3M LME Copper still remains within parameters set earlier in the day but is currently crawling back to session highs.

- Iraq's Oil Minister said 13mln oil barrels have been exported from Kurdistan region via the Iraqi-Turkish pipeline so far.

NOTABLE DATA RECAP

- Norwegian Consumer Price Index YY (Nov) 3.0% vs. Exp. 2.7% (Prev. 3.1%); MM (Nov) 0.1% (Prev. 0.1%)

- Italian Industrial Output YY WDA (Oct) -0.3% vs. Exp. 0.2% (Prev. 1.5%, Rev. 1.4%); MM SA (Oct) -1.0% vs. Exp. -0.3% (Prev. 2.8%, Rev. 2.7%)

NOTABLE EUROPEAN HEADLINES

- ECB's Villeroy said he is in favour of a 4.8% budget deficit for 2026, but it will not be reached. Suspending pension reforms does not solve of financing pensions issue. The Bank of France will upgrade France's GDP forecasts. It would be wise to maintain ECB rates at the current level.

- ECB's Simkus said interest rates do not need to be lowered further, via Bloomberg.

- ECB President Lagarde says we remain in a good place and may upgrade projections again in December.

- UK Chancellor Reeves said she can rule out capital gains tax on primary residences in this parliament. Can rule out scrapping the pension triple lock in this parliament.

- Morgan Stanley no longer expects the BoE to cut rates in March 2026; continues to see a cut in February, April and June to take the terminal rate to 3%.

GEOPOLITICS

RUSSIA-UKRAINE

- Ukraine President Zelensky sees leader-level talks with the US next week, and said Ukraine is ready for an energy ceasefire if Russia agrees, while he wants to discuss restoration of Ukraine as part of peace plan preparation with the US. Zelensky also said they are ready to hold elections and ask US and European partners to guarantee security during the process, as well as noted that if security is guaranteed, elections could be held in the next 60-90 days.

- Russia's Foreign Minister Lavrov said Russia has no intention of fighting a war with Europe, via Al Arabiya; adds that Russia will respond if European forces are deployed in Ukraine. Agree to work on a settlement in Ukraine with the US. The efforts from US President Trump are appreciated to resolve the crisis in Ukraine.

OTHER

- US President Trump said he will have to make a call on Wednesday about Thailand and Cambodia, while he commented that the two countries are at it again.

- Japanese Defence Minister Koizumi said there is no truth that Japan also aimed radar at Chinese aircraft, while he added that China did not provide specific details about naval training exercises in communication with Japan's Maritime Self-Defense Force. Furthermore, he said Japan demands that China prevent the recurrence of dangerous acts which exceed the necessary range for safe aircraft operations.

CRYPTO

- Bitcoin is a little firmer and trades just above USD 92k whilst Ethereum outperforms and heads back above USD 3.3k.

APAC TRADE

- APAC stocks were mostly subdued amid cautiousness ahead of today's Fed policy decision and dot plots, while the region also digested the latest Chinese inflation data.

- ASX 200 was flat as weakness in tech, industrials, energy, health care and financials was counterbalanced by resilience in miners, materials and resources.

- Nikkei 225 initially rallied to above the 51,000 level following recent currency weakness, but then reversed course as yields briefly edged higher on BoJ rate hike risks.

- Hang Seng and Shanghai Comp retreated following mixed inflation data, which showed CPI Y/Y accelerated to its highest in almost two years, but PPI was softer-than-expected and showed a worsening deflation in factory gate prices. There were also several trade-related dampeners, including reports that China's US soybean purchases are falling short of targets, while it was also reported that China is set to limit access to NVIDIA's H200 chips despite export approval from US President Trump, and that chips exported to China will undergo a special security review.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi said they are closely watching market moves when asked about rising yields. Takaichi also commented that it is important for currencies to move in a stable manner reflecting fundamentals and will take appropriate action for excessive and disorderly FX moves, while she added that a weak yen has both merits and demerits. The Government are working closely with the BoJ, expects the BoJ to conduct appropriate monetary policy to achieve a stable 2% price target

- RBNZ Governor Breman said the RBNZ has achieved a great deal towards the delivery of its mandated functions, while she added they are keeping a close look at data, including inflation and GDP. Breman also said there is no preset course for monetary policy and will adjust if they see the outlook for inflation change.

- Japan's Government is considering expanding the tax bracket for the ultra-rich to increase tax revenues, according to NHK.

DATA RECAP

- Chinese CPI MM (Nov) -0.1% vs. Exp. 0.2% (Prev. 0.2%)

- Chinese CPI YY (Nov) 0.7% vs. Exp. 0.7% (Prev. 0.2%)

- Chinese PPI YY (Nov) -2.2% vs. Exp. -2.0% (Prev. -2.1%)

- Japanese Corp Goods Price MM (Nov) 0.3% vs. Exp. 0.3% (Prev. 0.4%, Rev. 0.5%)

- Japanese Corp Goods Price YY (Nov) 2.7% vs. Exp. 2.7% (Prev. 2.7%)