US equity futures lower; US-Iran talks underway, Iran reportedly announced its readiness to reduce uranium enrichment - Newsquawk US Opening News

- US-Iran talks have gotten underway; the latest is that the nuclear negotiations have entered the stage of discussing technical issues, Al Jazeera reports citing Iranian TV.

- Iran announced its readiness to reduce uranium enrichment, Al Hadath reports citing Iran's ambassador in Cairo; added "The contradiction of the US statements is proof of its lack of seriousness in the negotiations"

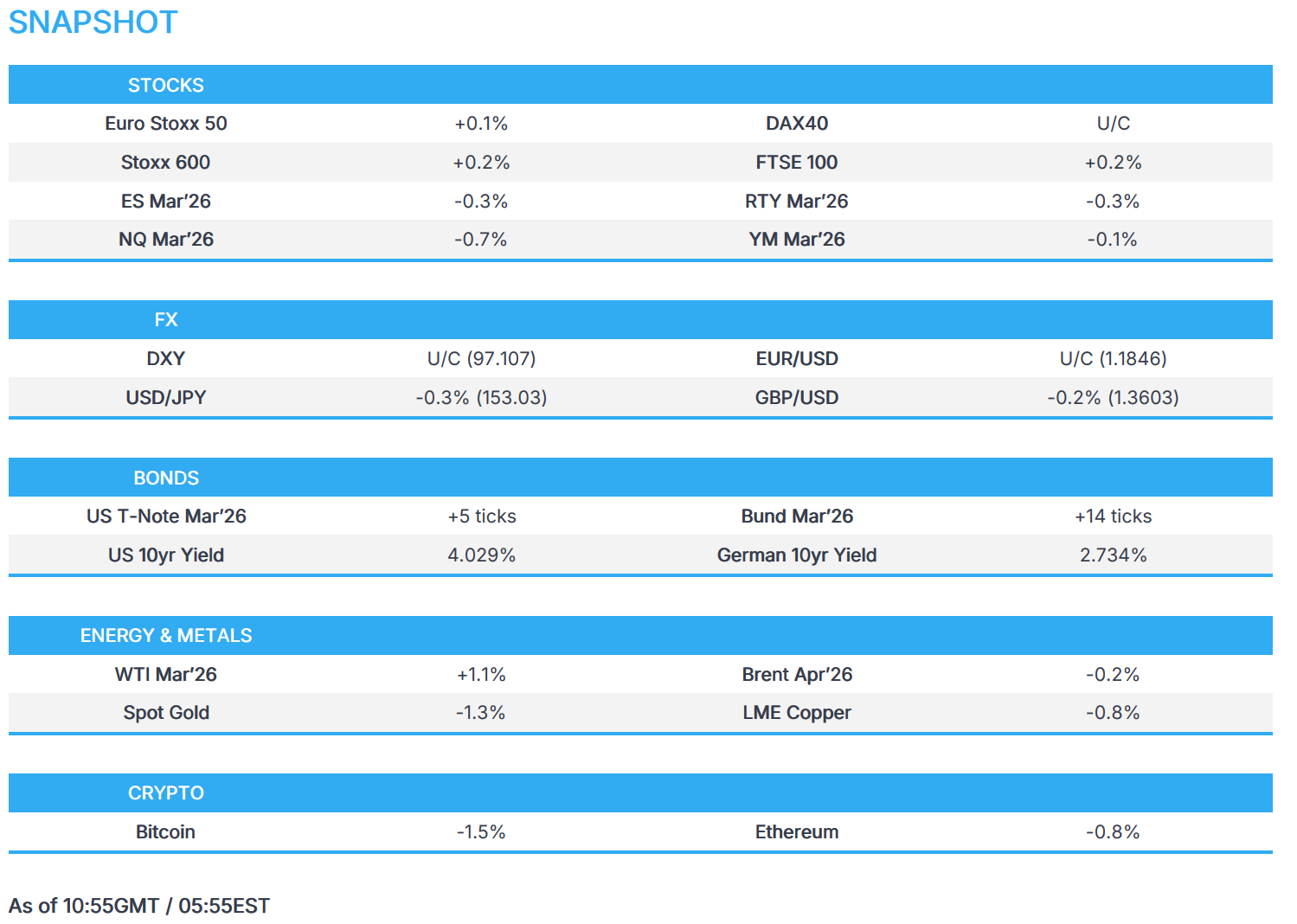

- European stocks are broadly in the green; Basic Resources weighed on by metals prices; US equity futures lower as US traders return from holiday.

- JPY gains ground on yield differentials and some haven flows while GBP lags after the UK jobs report; DXY flat.

- Gilts and JGBs lead; pricing remains in favour of a BoE cut in April, but March has inched higher into Wednesday's CPI post-unemployment/wages; USTs bid alongside global benchmarks.

- WTI and Brent rangebound with geopols in focus.

- Looking ahead, highlights include US ADP Weekly, NY Fed (Feb), Canadian CPI (Jan), Japanese Balance of Trade (Jan), US-Iran talks. Speakers include Fed’s Barr & Daly. Earnings from Medtronic, Leidos, Palo Alto, Cadence Design Systems, Republic Services, Vulcan Materials, Kenvue.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.2%) initially started on the backfoot but have reversed earlier losses and are now trading mostly in the green. The SMI (+0.7%) leads, while the AEX (+0.2%) lags, weighted on by losses in ASML (-1.3%). FTSE 100 (+0.5%) sits near the top of the pile, aided by softer-than-expected jobs and wages data, increasing the likelihood of BoE rate cuts.

- European sectors are mostly firmer. Utilities (+1.3%) and Insurance (+1.2%) reside near the top, with insurance names helped by a broker upgrade for AXA (+1.8%, initiated with outperform at RBC) and a sector perform rating for Allianz. Basic Resources (-1.4%) is the clear underperformer, weighed on by metal prices (XAU -1.3%, XAG -2.4%).

- US equity futures (ES/RTY -0.3%, NQ -0.7%) are entirely in the red as US traders get set to re-enter from their holiday break.

- Antofagasta (ANTO LN) FY25 (USD): Revenue 8.62bln (exp. 8.50bln), EBITDA 5.20bln (exp. 5.15bln), Pretax profit 3.16bln (exp. 3.19bln), EBITDA margin 60.3% (exp. 61.2%), Dividend/shr 64.6c (prev. 31.4c Y/Y), Recommended final dividend of 48.0c.

- BHP (BHP AT) H1 (USD) net rose 28% Y/Y to 5.64bln, underlying profit rose 22% Y/Y to 6.2bln (exp. 6.03bln), rev. rose 11% Y/Y to 27.9bln, Co. will pay interim dividend of USD 0.73/shr, inks silver streaming agreement with Wheaton Precious Metals.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY trades flat intraday but at the lower end of a tight 97.072-97.247 range as US participants gear up to return from the long weekend. Focus has been on geopolitics as US-Iran talks look to continue through to the afternoon, whilst US-Ukraine-Russia trilateral talks have now been moved to tomorrow. On the data front for the day ahead, weekly ADP jobs data are due (prev. showed an average of +6.5k/week over the four-week period). Elsewhere, the Empire State Manufacturing Index for February, and the NAHB housing market index for February are scheduled.

- JPY gained as risk sentiment in Japan deteriorated shortly after the open, while there were some recent comments from former BoJ board member Adachi, who sees a likelihood that the BoJ will hike rates by 25bps in April. During European hours, the JPY remains the outperformer as US yields fall, but overall, the pair remains within the ranges of the last four trading sessions, with today's current parameters between 152.70 and 153.75. Note, JPY could also be seeing some haven flows against the backdrop of the US-Iran talks today.

- GBP fell in the aftermath of a dovish jobs report: unemployment unexpectedly rose to 5.2%, just below the BoE’s 5.3% peak forecast (raised in February), while wage growth slowed across both measures, especially including bonuses. GBP/USD have recovered off its worst levels with the pair currently around the middle of a 1.3552-1.3633 intraday range at the time of writing.

- EUR marginally trickled lower, but with price action kept within tight parameters near the 1.1850 level amid light newsflow from the bloc and the recent mixed EU Industrial Production data. Some risk was taken out for the EUR (for today) as the US-Ukraine-Russia trilateral meeting has been pushed back to tomorrow. A modest four-pip immediate dip was seen as German ZEW disappointed, with EUR/USD currently in a 1.1828-1.1852 range.

FIXED INCOME

- USTs move higher this morning by around 7 ticks, currently trading within a 113-03 to 113-14 range. From a yield perspective, the 10yr is now eyeing the 4% mark (currently 4.025%), and trading at lows not seen since late Nov’25. Much of the upside can seemingly be attributed to the muted risk tone, in an environment clouded by geopolitical uncertainty, with US-Iran and US-Ukraine-Russia talks taking place. The former arguably holds added risk, given there is some chance that the US could strike Iran if talks break down – though analysts believe that the most likely outcome is not a full deal today but a decision to keep talks alive. (Full analysis piece can be found on the Newsquawk feed)

- Bunds follow the global fixed income complex higher. In reaction to the UK’s jobs/wages data, Bunds spiked higher from 129.30 to 129.41. Currently trading higher by around 15 ticks and at the upper end of a 129.13 to 129.36 range – the 10yr yield is trading well outside recent ranges, around 2.733%. Further pressure could see the 10yr test 2.70%, which happens to be the trough from the 1st of December 2025. Following the softer-than-expected ZEW series, Bunds rose from 129.37 to 129.41 - the peak for the day. Demand for German debt remains tepid, with the 2yr Schatz demand sub-2x b/c.

- Gilts gapped higher by 38 ticks before climbing another two to a 92.32 peak, in reaction to the latest unemployment and wage data. If the move continues, resistance comes into view at 92.51, 92.56 and 92.95. Upside spurred in a dovish reaction to a report that showed a further deterioration in the labour market, as the unemployment rate ticked up to 5.2% and is just a tenth shy of the BoE's 5.3% peak forecast (a view that was increased in the February MPR). Furthermore, wage data showed a moderation from the prior for both metrics and markedly so for the measure incl. bonuses. Sparking a dovish reaction in BoE pricing, however, the next cut remains priced for April, but March is now up to -21bps (-20.3bps pre-release) while the timing for a second 2026 cut has been brought forward to November from December.

- JGBs firmer, with upside of just over 50 ticks at best, hitting a 132.60 peak. Upside was a function of the negative risk tone in Japan overnight, where conditions were very limited due to numerous APAC closures. Furthermore, participants continue to digest the policy implications of recent weak GDP data. Note, there was fleeting JGB pressure to a broadly in-line 5yr auction.

- Germany sells EUR 4.59bln vs exp. EUR 6bln 2.10% 2028 Schatz: b/c 1.77x (prev. 2.1x), average yield 2.02% (prev. 2.14%), retention 23.5% (prev. 22.8%).

- UK sells GBP 500mln 0.125% 2028 Gilt via Tender: b/c 4.05x (prev. 3.77x), average yield 3.336% (prev. 3.443%), tail 0.7bps (prev. 0.6bps).

- Japan sold JPY 1.9tln 5yr JGBs; b/c 3.10x (prev. 3.08x), average yield 1.640% (prev. 1.639%).

COMMODITIES

- WTI Mar'26 and Brent Apr'26 are trading around the lower range of USD 62.84-63.87/bbl and USD 67.85-68.62/bbl, respectively. Focus for oil traders is on meetings between the US and Iran and the trilateral talks between Russia, US and Ukraine. At the time of writing, the trilateral talks have concluded, with talks set to resume tomorrow. Much of the action this morning has been spurred by Iran-related commentary; some pressure in the complex on reports that Iran approved IAEA visit to nuclear facilities, but soon reversed after hawkish commentary from Iranian Supreme Leader Khamenei, who suggested that the US army needs to be "slapped" so hard it cannot get up. Most recently, reports suggest that Iran announced its readiness to reduce uranium enrichment, and are now at the stage of discussing technical issues. Ultimately, very choppy action given the mixed newsflow.

- Precious metals have stalled following prior day gains, with the yellow metal slipping below the USD 5,000/oz mark and silver falling by 4.5%, though off worst levels seen during the APAC session. Analysts note that liquidity remains thin, particularly across metals. Focus now turns to US ADP employment figures, which could trigger volatility. Weaker jobs data could trigger a weaker USD, spurring the yellow metal and vice versa.

- Copper prices remain subdued, largely amid the mixed global risk tone and the closure of the Chinese market due to the Chinese holiday. 3M LME Copper currently trades in a narrow range of USD 12,695.08-12,849k/t.

NOTABLE EUROPEAN HEADLINES

- The German Chamber of Industry and Commerce raises its 2026 GDP growth forecast from 0.7% to 1.0%.

- Swedish Finance Minister said they are not expecting to join the Euro in the coming years.

- UK government quietly shelved a programme to build a frictionless post-Brexit trade border, after spending GBP 110mln on a contract with Deloitte and IBM for the project, according to FT.

- EU officials held a constructive meeting to strengthen the international role of the euro on Monday, according to EU's Dombrovskis.

NOTABLE EUROPEAN DATA RECAP

- German ZEW Economic Sentiment Index (Feb) 58.3 vs. Exp. 65 (Prev. 59.6, Low. 59, High. 74.3).

- German ZEW Current Conditions (Feb) -65.9 vs. Exp. -65.7 (Prev. -72.7, Low. -71.1, High. -65).

- EU ZEW Economic Sentiment Index (Feb) 39.4 vs. Exp. 45.2 (Prev. 40.8).

- UK Labour Productivity QoQ (Q4) Q/Q -0.6% vs. Exp. -0.6% (Prev. 0.6%, Rev. From 0.7%).

- UK Employment Change (Dec) 52K (Prev. 82K).

- UK Unemployment Rate (Dec) 5.2% vs. Exp. 5.1% (Prev. 5.1%, Low. 5.1%, High. 5.2%).

- UK Claimant Count Change (Jan) 28.6K vs. Exp. 22.8K (Prev. 2.7K, Rev. From 17.9K).

- UK HMRC Payrolls Change (Jan) -11K (Prev. -6K, Rev. From -43K).

- UK Average Earnings excl. Bonus (3Mo/Yr) (Dec) 4.2% vs. Exp. 4.2% (Prev. 4.4%, Rev. From 4.5%, Low. 4.2%, High. 4.6%).

- UK Average Earnings incl. Bonus (3Mo/Yr) (Dec) 4.2% vs. Exp. 4.6% (Prev. 4.6%, Rev. From 4.7%, Low. 4.4%, High. 4.8%).

- German Inflation Rate MoM Final (Jan) M/M 0.1% vs. Exp. 0.1% (Prev. 0.0%, Low. 0.1%, High. 0.1%).

- German Inflation Rate YoY Final (Jan) Y/Y 2.1% vs. Exp. 2.1% (Prev. 1.8%, Low. 2.1%, High. 2.1%).

CENTRAL BANKS

- RBA Minutes from February meeting stated that members agreed that prevailing uncertainties meant it was not possible to have a high degree of confidence in any particular path for the cash rate. Board concluded inflation would stay stubbornly high if it had not hiked interest rates as it did this month. Members agreed that the data received since the previous meeting had strengthened their concern that without a policy response, inflation would remain persistently above target for too long.

- NBP Member Dabrowski says April would be safer to cut rates than in March, a policy rate of 3.5% in 2026 is achievable.

NOTABLE US HEADLINES

- Spanish PM Sanchez said the Council of Ministers will invoke Article 8 to ask the Public Prosecutor to investigate Meta (META), X and TikTok.

- EU privacy watchdog opens probe into X over sexualised AI images, according to FT.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin said the three-way talk with US and Ukraine in Geneva will continue tomorrow with no news expected today.

- Russian Defence Ministry said Russia carried out a massive strike on military targets in Ukraine, IFX reported.

- Russian President Putin advisor Patrushev said Russia is preparing measures to respond to seizures of its trading vessels, IFX reported.

- Ukrainian long-range drones hit the Ilsky Oil Refinery in the Krasnodar Krai region of Russia and the refinery is on fire, according to Visegrad 24.

MIDDLE EAST

- Iran is ready to stay for days and weeks in Geneva in order to reach an agreement, Al Jazeera reports citing the Iranian Foreign Ministry spokesman.

- US-Iran nuclear negotiations in Geneva have entered the stage of discussing technical issues, Al Jazeera reports citing Iranian TV.

- Iran announced its readiness to reduce uranium enrichment, Al Hadath reports citing Iran's ambassador in Cairo; adds "The contradiction of the US statements is proof of its lack of seriousness in the negotiations."

- Iran's IRGC are holding military exercises in the Strait of Hormuz and the Sea of Oman at the same time as US-Iran nuclear talks, Iran International reports.

- Iranian Supreme Leader Khamenei says, in relation to the US, "The strongest army in the world may sometimes be slapped so hard that it cannot get up."

- Indirect talks between the US and Iran have begun with a message exchange process, according to reported.

- Senior Iranian Official said Iran's approach to US talks are positive and serious, but holds no preconception about the outcome.

- "Iran approves IAEA visit to nuclear facilities", Al Arabiya reported.

- Russian President's Aide said Russia, Iran and China sent ships to the Strait of Hormuz to participate in the "Security Belt 2026" exercise, Al Jazeera reported (as expected).

- US officials say they expect Iran to come to Geneva talks today with concrete concessions regarding its nuclear program, according to Axios.

- US President Trump said he will be involved in the Iran talks indirectly and that Iran wants to make a deal. Iran are bad negotiators and he hopes they will be more reasonable in talks.

- US delegation led by Special Envoy Witkoff leaves for Geneva for talks with Iran.

- Palestinian media reported Israeli army conducts bombing operations in deployment areas within Beit Lahiyah and the Northern Gaza Strip, according to Al Qahera.

OTHERS

- US President Trump said Secretary of State Rubio is talking to Cuba right now and that they want to make a deal, adds will see how it all turns out with Cuba and the US talking.

CRYPTO

- Bitcoin hovers around USD 68,000, while Ethereum struggles to hold above USD 2,000.

APAC TRADE

- APAC stocks traded mixed amid the extremely thinned conditions due to the Lunar New Year holiday and in the absence of a lead from the US, where markets were closed for Washington's Birthday/Presidents' Day.

- ASX 200 was led higher by outperformance in miners as BHP shares surged after the mining giant reported a 28% jump in H1 net, although gains in the broader market were capped by weakness in tech and real estate.

- Nikkei 225 retreated shortly after the open with SoftBank and heavy industry stocks leading the declines, as the post-election euphoria petered out following the recent underwhelming GDP data.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi to unveil a sweeping budgeting reform, placing strategic investments under a ringfenced multi-year framework to enhance predictability and attract private capital, Nikkei reports citing a draft

- Japan PM Takaichi considers multi-year budget for growth and crisis management, according to Nikkei citing her draft policy speech for Friday.

- Japanese Finance Ministry estimate indicates annual bond issuance could rise 28% three years from now amid increasing debt financing costs, according to Reuters.

- Indian Government Minister said we are discussing age-based social media ban with firms.

NOTABLE APAC DATA RECAP

- Japanese Tertiary Industry Index MoM (Dec) M/M -0.5% vs. Exp. -0.2% (Prev. -0.2%).