US equity futures point to a higher open going into the Christmas holiday; Global geopols in focus - Newsquawk US Market Open

- US Coast Guard officials over the weekend tracked two oil tankers in international waters close to Venezuela, marking three tankers within the past week.

- Russia’s Kremlin said changes made by Ukrainians and Europeans to peace proposals did not bring agreements closer or add anything positive, IFAX reported.

- Israeli PM Netanyahu reportedly plans to brief US President Trump on possible new Iran strikes, according to NBC News.

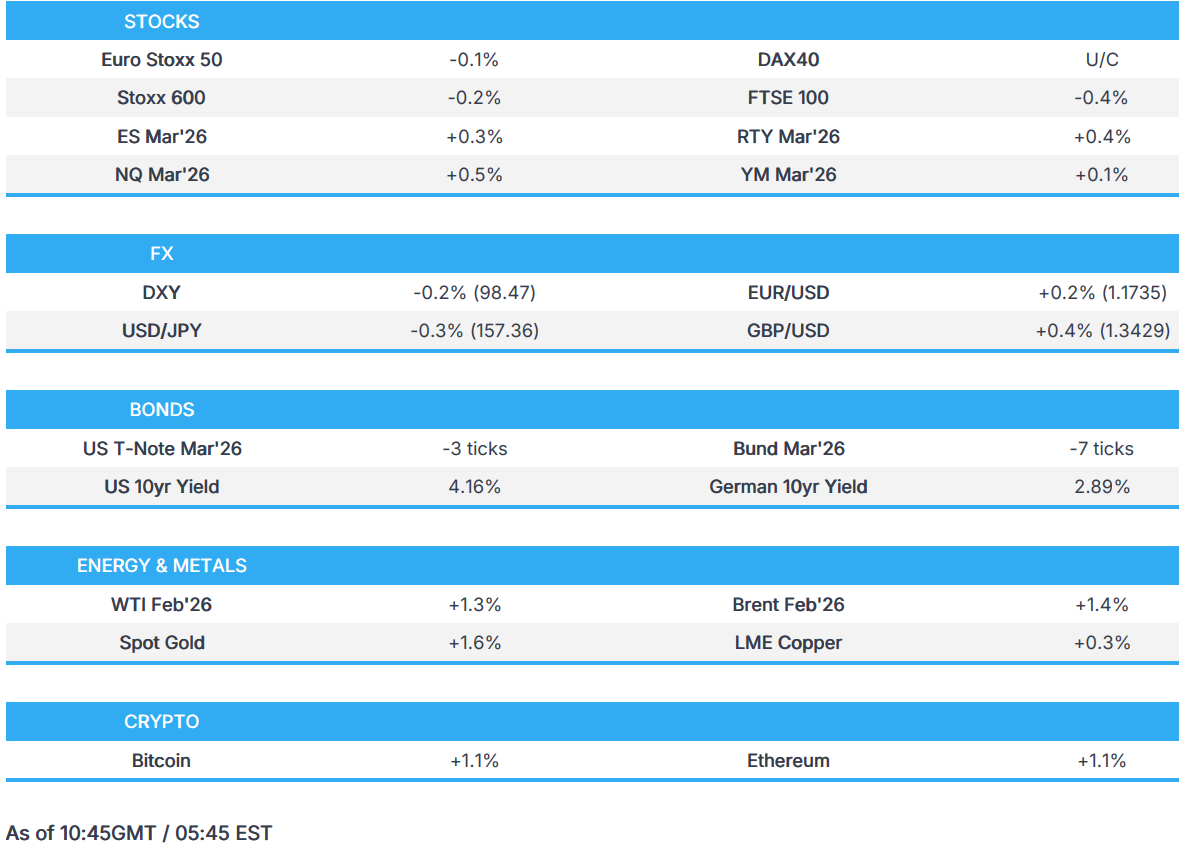

- European bourses are broadly unchanged in quiet trade; US equity futures are firmer, with mild outperformance in the NQ.

- USD is slightly lower vs G10 peers; Antipodeans outperform on strength in metals prices.

- USTs are slightly lower but with price action contained, awaiting a 2yr auction.

- WTI and Brent are boosted by rising geopolitical tensions, spot gold surges to ATHs above USD 4.4k/oz.

- Looking ahead, highlights include Canadian Producer Prices (Nov), and supply from the US.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 -0.2%) are trading lower/flat this morning, with price action fairly rangebound in light newsflow.

- European sectors are trading with a mostly negative bias. Basic Resources (+1.1%) leads on firmer metal prices, followed by Tech (+0.4%) on positive spillover from the strong Nasdaq close, and Energy (+0.3%) on higher crude amid ongoing geopolitical tensions between Russia-Ukraine and US-Venezuela. On the downside, Utilities (-0.9%), Optimised Personal Care (-0.9%) and Food Beverage and Tobacco (-0.9%) lag.

- US equity futures are firmer across the board. The NQ (+0.4%) continues to outperform from Friday’s session, helped by gains from tech Co’s like Oracle and CoreWeave. Not much to look ahead to in the equity space in the US, however, all eyes will be on the geopolitical development between the US and Venezuela following news over the weekend that US Coast Guard officials over the weekend tracked two oil tankers in international waters close to Venezuela, marking three tankers within the past week.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is a little lower and trades at the lower end of a 98.45 to 98.69 range. Price action this morning incredibly lacklustre, given holiday-thinned newsflow. In recent action the USD weakness has extended a little, to the benefit of the EUR, which currently resides towards highs of 1.1738.

- G10s are stronger against the USD to varying degrees; the Antipodeans lead, benefiting from strength in underlying metals prices, whilst the JPY is found at the bottom of the G10 pile.

- GBP is slightly firmer vs the USD, currently in a 1.3375 to 1.3435 range; UK GDP (Q3) remained unrevised, spurring little action in the GBP.

- Really not anything pertinent from an FX perspective scheduled for the remainder of the day; ECB's Kazimir provided some comments, and overall highlighted that the Bank remains flexible. Elsewhere, in domestic politics, French President Macron will watch as PM Lecornu presents a bill that needs to pass before the Christmas break to ensure the continuity of basic public services.

- Click for NY OpEx Details

FIXED INCOME

- Fixed pressured overnight as JGBs continued to falter from the c. 50 ticks of downside seen on Friday amidst the BoJ. Overnight, JGBs continued to fall with downside of c. 60 ticks at most to a 132.21 low.

- USTs and Bunds followed suit, down to lows of 112-11+ and 126.75, respectively, posting losses of 6+ and 40 ticks. Thereafter, Bunds lifted off lows in an early doors volume spike, to a 127.16 peak and while they touched the unchanged mark, they failed to return to the green. Specifics for that move light, but the earlier news around a Russian General being killed in a Moscow explosion potentially factored.

- USTs are also off lows, but are still in the red. The docket ahead features Fed's Miran at 13:30GMT on Bloomberg TV. Thereafter, a 2yr Note auction is due.

- Gilts softer in-fitting with peers this morning. UK specifics near non-existent, no follow-through from an unrevised read of Q3 GDP.

COMMODITIES

- WTI and Brent are in the green, with the complex boosted by ongoing geopolitical tensions, which have been rising on multiple fronts; 1) US-Venezuela, where most recently US Coast guard officials tracked two Venezuelan oil tankers, 2) Ukraine-Russia, Kremlin suggested that peace proposals did not bring the pair any closer to peace, 3) Israel-Iran, the former reportedly briefed the POTUS on potential strikes on Iran. Brent Feb’26 currently sits off peaks, with price action fairly rangebound since the European cash open; as it stands, within a USD 60.53-61.31/oz range.

- Spot gold opened flat, and then gradually firmed throughout the overnight session, taking the yellow-metal up to a record high beyond the USD 4.4k/oz mark. Spot gold has since scaled a touch off those highs, to a current USD 4,413/oz vs current ATH of USD 4,420/oz. Precious metals across the board are bid, with spot silver also printing a record high above the USD 69/oz mark. Upside potentially facilitated by the aforementioned rising geopolitical tensions.

- Base metals hold a positive bias, with upside facilitated by the positive risk tone seen in overnight trade. 3M LME copper currently higher by around 0.4% and towards the upper end of a USD 11,877-11,996.18/t range.

- Iraq’s state oil firm reaffirmed its commitment to the Kurdistan oil agreement, under which international oil companies in the region were required to hand over their output to the state. An official at Iraq’s state oil firm said the oil export deal between Baghdad and Erbil would continue without issues, Rudaw reported.

- Australia's Energy Minister Bowen announces plans for Australian gas reservation policy.

TRADE/TARIFFS

- China's Commerce Ministry is to impose levies of up to 42.2% on EU dairy products, effective 23rd December, following its anti-subsidy probe.

- New Zealand concludes free trade agreement with India; deal set to be signed in H1 2026. India and New Zealand are confident of doubling bilateral trade over the next five years.

NOTABLE EUROPEAN HEADLINES

- German Ifo survey finds that 26% of firms expect business to deteriorate in 2026, 59% expect no change, 15% forecast an improvement.

NOTABLE EUROPEAN DATA RECAP

- Italian Producer Prices YY (Nov) -0.2% (Prev. 0.1%).

- Italian Producer Prices MM (Nov) 1.0% (Prev. -0.2%).

- UK Business Invest QQ (Q3) 1.5% (Prev. -0.3%, Rev. -1.7%).

- UK Business invest YY (Q3) 2.7% (Prev. 0.7%, Rev. 3.2%).

- UK Current Acc GBP (Q3) -12.067B vs. Exp. -21.26B (Prev. -28.939B, Rev. -21.154B).

- UK GDP YY (Q3) 1.3% vs. Exp. 1.3% (Prev. 1.3%).

- UK GDP QQ (Q3) 0.1% vs. Exp. 0.1% (Prev. 0.1%).

CENTRAL BANKS

- ECB's Kazmir said that the ECB remains flexible and will be ready to step in if needed. He is concerned about the long term growth prospect of the Eurozone.

- Fed’s Hammack (2026 voter) said rates should be held steady into the spring after recent cuts, warning she was inflation-wary, noting November’s 2.7% CPI likely understated 12-month price growth due to data distortions, and suggesting the neutral interest rate was higher than commonly believed, the WSJ reported.

- Former BoJ member Sakurai said the first hike to 1.0% could come around June or July and that the BoJ likely sees the neutral rate sitting somewhere around 1.75%.

- Chinese Loan Prime Rate 5Y (Dec) 3.50% vs. Exp. 3.50% (Prev. 3.50%).

- Chinese Loan Prime Rate 1Y (Dec) 3.00% vs. Exp. 3.00% (Prev. 3.00%).

NOTABLE US HEADLINES

- US President Trump on Friday said he would call a meeting of insurance companies in the coming weeks to push them to cut prices and stay in the system.

- US President Trump on Friday announced deals with nine pharmaceutical companies to cut prices on most drugs sold through Medicaid and lower cash-pay prices, while committing to most-favoured-nation pricing for future drugs, according to Reuters. The companies also pledged more than USD 150bln in US manufacturing and R&D investment, agreed to remit some foreign revenues to offset US costs, and received relief from US tariffs in return.

GEOPOLITICS

US-Venezuela

- US Coast Guard officials over the weekend tracked two oil tankers in international waters close to Venezuela, marking three tankers within the past week. An official suggested that the tanker is subject to sanctions, according to several media reports.

- The Venezuelan government rejected the seizure of a new vessel transporting oil, it said in a statement.

RUSSIA-UKRAINE

- US Special Envoy Witkoff said the Ukrainian delegation held productive meetings over three days in Florida with US and European partners, including a separate US–Ukraine meeting, with discussions focused on timelines and sequencing of next steps.

- Ukrainian President Zelensky said broader consultations with European partners should follow recent talks in the US.

- Ukrainian President Zelensky said allies had started to slow supplies of air defence missiles and said Kyiv should stand by the US as mediator on talks with Russia, commenting on French President Macron’s proposal.

- Ukrainian President Zelensky said the situation in the Odesa region was harsh after Russian strikes and said Russia was trying to restrict Ukraine’s access to the sea.

- The Kremlin said changes made by Ukrainians and Europeans to peace proposals did not bring agreements closer or add anything positive, IFAX reported. It said Dmitriev was still in Miami meeting with Americans and would report on the results upon his return to Moscow. Kremlin aide said a trilateral Russia–US–Ukraine meeting was not being discussed.

- Ukrainian President Zelensky said elections could not be held in Russian-occupied parts of Ukraine, could only take place once security was guaranteed, and said Kyiv was working with the US on a stable peace while preparing voting infrastructure for Ukrainians abroad, Reuters reported.

- Ukraine’s deputy prime minister said Russia attacked the Pivdennyi port and was deliberately targeting civilian logistics in the Odesa region.

- Russia’s Defence Ministry said Russian troops had captured Vysoke in Ukraine’s Sumy region and Svitlie in the Donetsk region, according to IFAX and TASS.

- Russia's Kremlin said Envoy Dmitriev will report to President Putin on the US proposals for a possible Ukraine settlement. Adds the US intelligence perception of Putin's aims are mistaken following the Reuters report.

- Russian General Sarvarov was injured in a car explosion in Moscow, via Unn; subsequently, the Russian Investigative Committee said the general was killed in the explosion.

- "TASS: [Russian President] Putin's envoy is likely to hold the next meeting with the US delegation in Moscow", via Al Arabiya.

- Two vessels and two piers were damaged in Russia’s Krasnodar after a Ukrainian drone attack, regional authorities said; damage to piers led to a large fire in the area.

- US Special Envoy Witkoff said weekend meetings between US and Russian delegation were productive and constructive; Russia remains fully committed to achieving peace in Ukraine.

MIDDLE EAST

- Israeli PM Netanyahu reportedly plans to brief US President Trump on possible new Iran strikes, according to NBC News. Israeli officials believe Iran is expanding its ballistic missile program. They are preparing to make the case during an upcoming meeting with Trump that it poses a new threat. Israeli officials have announced a Dec. 29 meeting.

- Sources said the biggest risk is a war between Israel and Iran will break as a result of a miscalculation with each side thinking the other plans to attack and try to preempt it, according to Axios.

- Israeli officials warned the Trump administration over the weekend that an Iranian IRGC missile exercise could be preparations for a strike on Israel, according to Axios sources.

CRYPTO

- Bitcoin is a little firmer and trades just shy of the USD 90k mark; Ethereum returns back above USD 3k.

APAC TRADE

- APAC stocks kicked off the week with gains across the board as the region coat-tailed on the strength seen stateside. Tech outperformance continued across the region.

- ASX 200 edged higher as miners tracked gains in gold prices, with the yellow metal buoyed by a weekend packed with geopolitics

- Nikkei 225 was the clear outperformer as it topped 50.5k as the index cheered the post-BoJ JPY weakness on Friday alongside the global tech rally, whilst simultaneously overlooking the continuing rise in JGB yields.

- KOSPI was underpinned by its tech sector and following a month-to-date rise in exports.

- Hang Seng and Shanghai Comp conformed to the risk tone but with upside shallower than the above peers, with the PBoC LPR left unchanged as expected, whilst reports on Friday suggested US lawmakers urged the Pentagon to add DeepSeek and Xiaomi to the list of firms allegedly aiding the Chinese military.

NOTABLE ASIA-PAC HEADLINES

- Japanese Chief Cabinet Secretary Kihara said will not comment on the forex market; recently seeing one-sided, rapid moves; important for currencies to move in a stable manner reflecting fundamentals; will take appropriate action against excessive moves. Closely watching the impact of higher interest rates while cooperating with the BoJ.

- Japanese Top Currency Diplomat Mimura said he is recently seeing one-sided, rapid moves; will take appropriate action against excessive moves; concerned about forex moves.

NOTABLE APAC DATA RECAP

- Hong Kong Consumer Price Index (Nov) 1.2% vs. Exp. 1.3% (Prev. 1.2%).

- South Korea Dec 1–20 trade balance at provisional USD +3.82bln, customs agency said; exports +6.8% Y/Y; imports +0.7% Y/Y.

NOTABLE APAC EQUITY HEADLINES

- China Vanke (2202 HK) bondholders approve the decision on a vote for 30-day extension of CNY 2bln bond, however rejecting one-year extension for 15th Dec CNY 2bln bond, via Reuters sources.

- Goldman Sachs expect Chinese stocks to continue advancing in 2026, citing easing geopolitical tensions and as investors household savings begin flowing to equities as interest rates fall. Analyst Kinger Lau writes that "we expect the bull run to continue, but at a slower pace". Though the firm highlights some main risks to the upside, including; global recession, AI exuberance, US-China tensions and disinflation. Finally, analysts suggest that the macro / equity-market policies remain in effect which should shift the expected fair value of Chinese stocks upward.